As inflation continues to shape the economic landscape in 2025, homeowners are searching for financial tools to protect their wealth. HELOCs (Home Equity Lines of Credit) have emerged as a potential hedge against rising prices and eroding purchasing power.

At HELOC360, we’ve analyzed the relationship between HELOCs and inflation to help you make informed decisions about leveraging your home equity. In this post, we’ll explore whether HELOCs can truly be considered inflation-proof and how they might fit into your financial strategy during these uncertain times.

How HELOCs Function in the Current Economy

Understanding HELOCs

A Home Equity Line of Credit (HELOC) allows homeowners to borrow against their property’s equity. It functions similarly to a credit card, secured by your home, with your available credit determined by your home’s value minus your mortgage balance.

HELOCs operate in two phases:

- Draw period (typically 5-10 years): Borrow up to your credit limit, paying interest only on the amount used.

- Repayment phase: Pay back both principal and interest.

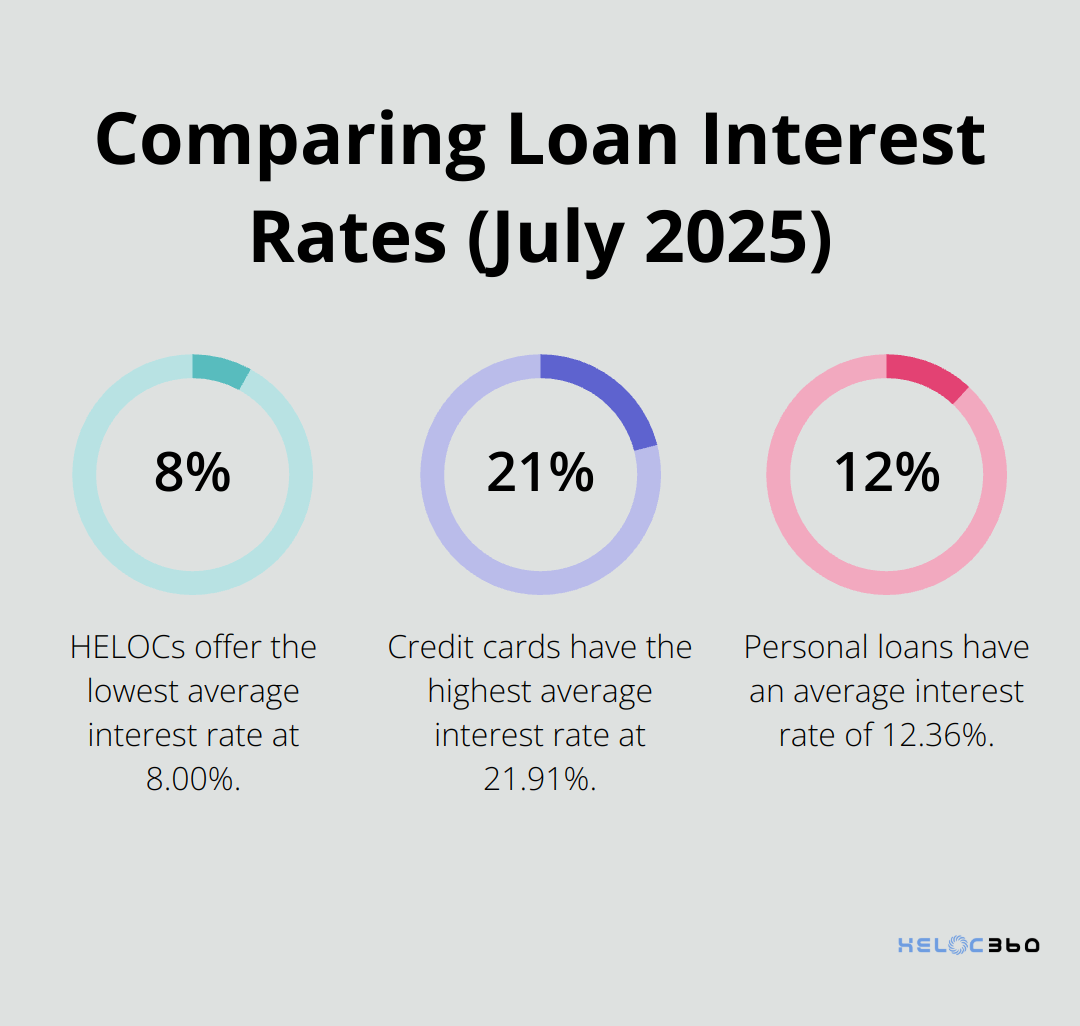

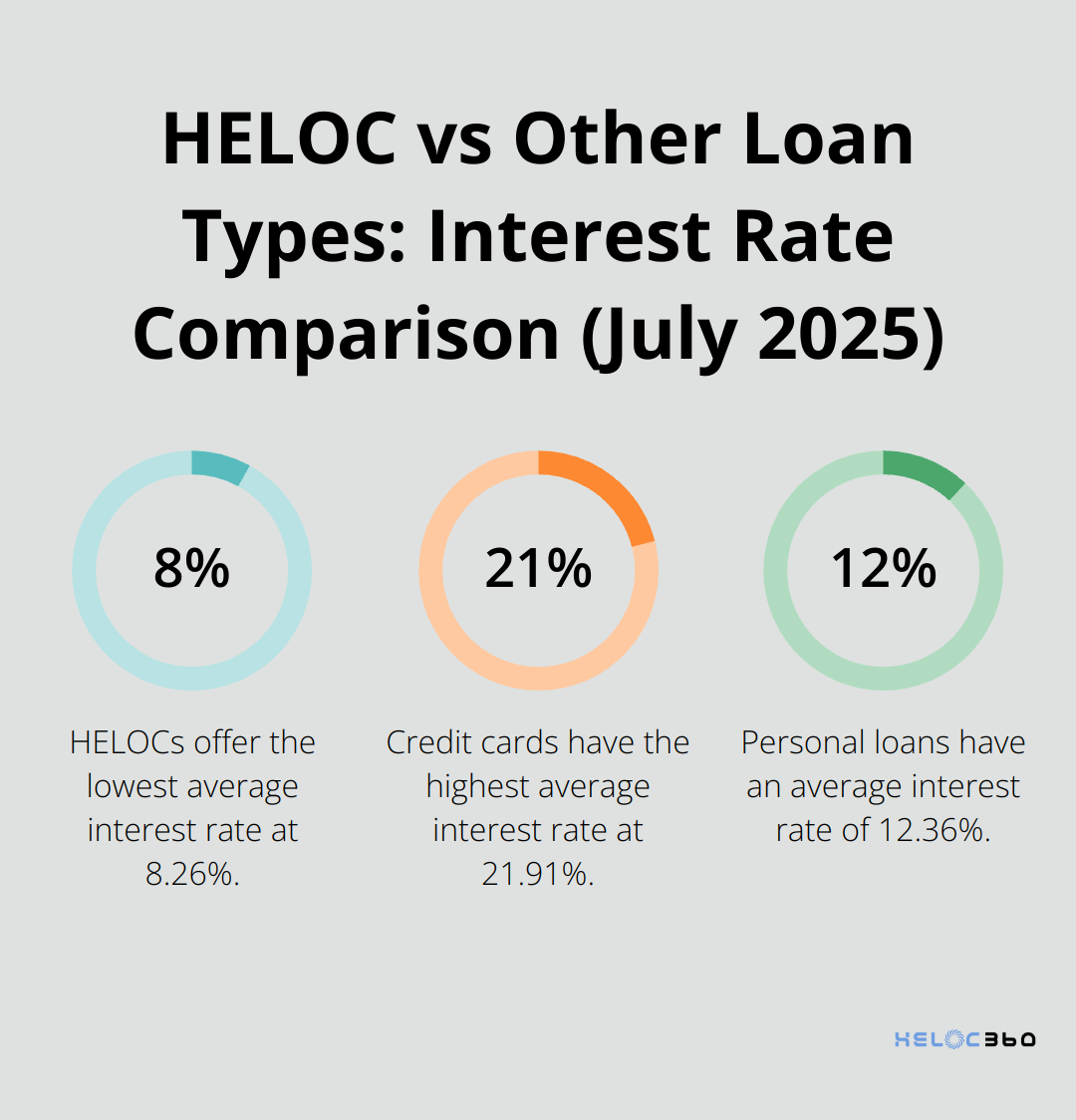

As of July 2025, HELOC rates average around 8.00%, which compares favorably to credit card rates (21.91%) and personal loan rates (12.36%). This makes HELOCs an attractive option for many homeowners seeking to access funds.

The Inflation Landscape in 2025

U.S. inflation has become a central economic concern. The trend significantly affects HELOC borrowers as it influences interest rates. When inflation eases, the Federal Reserve becomes more likely to cut rates, potentially leading to lower HELOC interest rates.

For instance, HELOC rates have been relatively stable recently. This sensitivity to inflation changes directly impacts borrowers’ monthly payments.

Effects on Borrowing and Lending

The inflationary environment has increased HELOC popularity. As of March 2025, outstanding total HELOC balances were $381.3 billion, a 9.7% gain from the same time last year, according to Equifax.

HELOCs appeal to those funding expenses like home renovations or education. However, while HELOC rates have decreased, they remain higher than in previous years.

Lenders have adopted more cautious practices in the current economic climate. They scrutinize factors such as:

- Debt-to-income ratios (usually 43% or less)

- Credit scores (minimum between 580 and 680)

- Home appraisals

Navigating HELOCs in an Inflationary Environment

While HELOCs offer advantages, understanding their terms, monitoring rate changes, and considering long-term financial strategies remain essential. The relationship between HELOCs and inflation creates both opportunities and challenges for homeowners. Let’s explore how this relationship impacts home values and borrowing costs in the next section.

How Inflation Shapes Your HELOC Experience

The Interplay of Inflation and Home Values

Inflation and HELOCs share a complex relationship that significantly impacts homeowners. As inflation rises, property values often follow suit. The Joint Center for Housing Studies of Harvard University reported that the average homeowner’s equity reached approximately $400,000 in Q4 2024. This increase in home values can benefit HELOC borrowers by potentially expanding their borrowing capacity.

Consider this scenario: Your home, valued at $300,000 last year, now appraises at $330,000 due to inflationary pressures. This $30,000 increase in equity translates to additional borrowing power through your HELOC. This expanded financial cushion can help offset rising costs in other areas of your budget.

Interest Rates: A Balancing Act

While rising home values can advantage HELOC borrowers, the impact of inflation on interest rates presents a more nuanced picture. The Federal Reserve often responds to increased inflation by raising interest rates to cool the economy. This action can result in higher HELOC rates, as most HELOCs feature variable interest rates tied to the prime rate.

HELOC rates have experienced significant fluctuations over the past year. However, these rates can change rapidly. If inflation continues its upward trend, HELOC rates might increase again, potentially diminishing the benefits of the line of credit.

Maximizing HELOCs in Inflationary Periods

Despite challenges, HELOCs offer several advantages during inflationary times. They provide access to substantial funds at interest rates significantly lower than credit cards or personal loans. This feature proves particularly useful for consolidating high-interest debt or funding large expenses like home improvements.

In an environment where money’s value decreases, borrowing now to invest in inflation-appreciating assets can prove a smart strategy. For instance, using a HELOC to purchase rental properties in high-demand markets could potentially generate returns that outpace inflation.

As your home’s value increases with inflation, your HELOC’s credit limit may also rise, offering even more financial flexibility. Some lenders provide automatic credit limit increases as your home appreciates, though this varies by institution.

Strategic Use of HELOCs in Inflationary Times

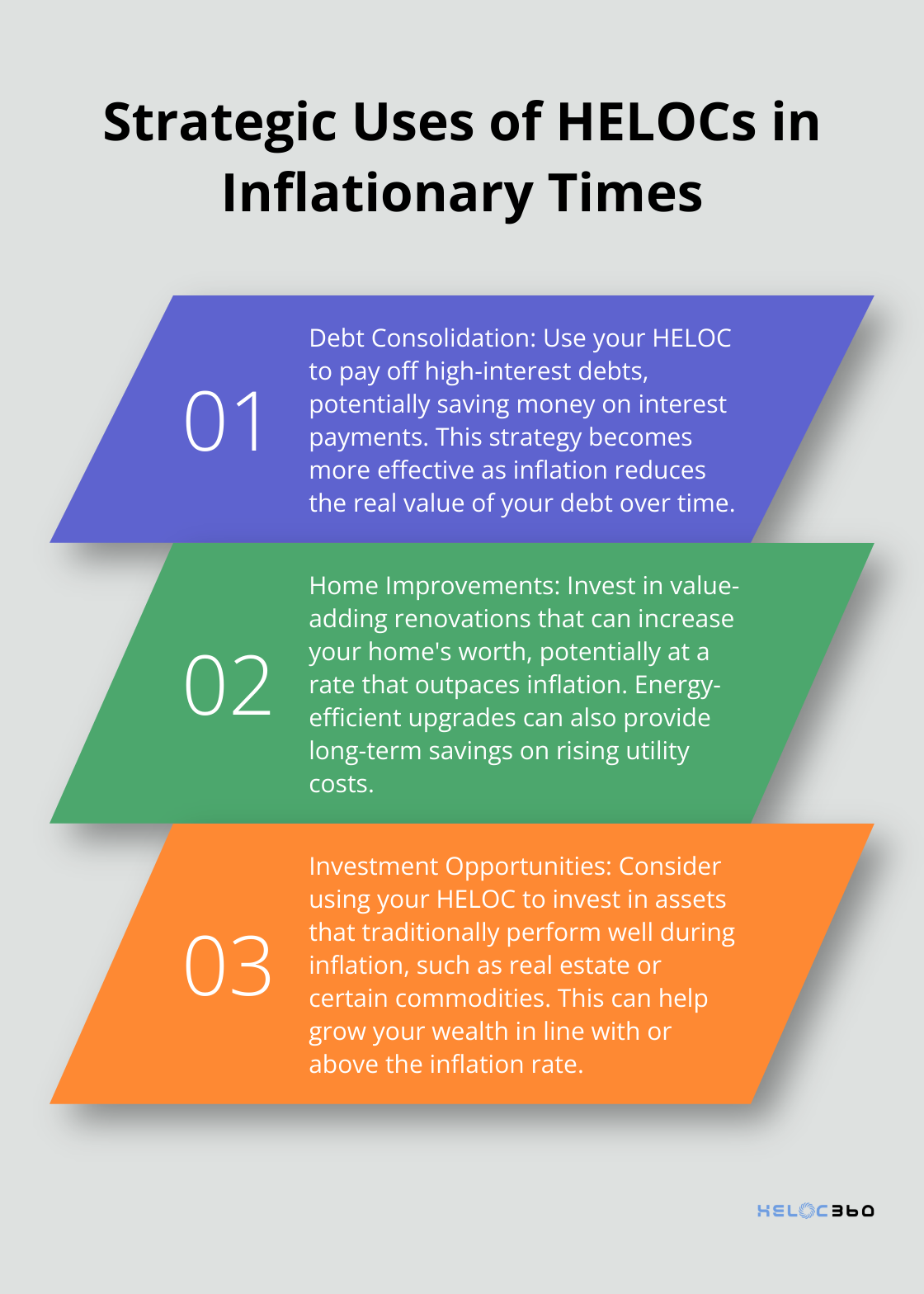

To make the most of your HELOC during inflationary periods, consider these strategies:

While HELOCs aren’t entirely inflation-proof, they do offer unique advantages in an inflationary environment. The key lies in understanding how inflation affects your HELOC and using this knowledge to make strategic financial decisions. As we move forward, let’s explore specific strategies for leveraging HELOCs to combat inflation and maximize your financial potential.

How to Leverage HELOCs Against Inflation

Invest in Inflation-Resistant Assets

One effective way to use your HELOC during inflationary periods is to invest in assets that traditionally perform well when prices rise. Real estate often tops this list. You could use HELOC funds to purchase a rental property in a high-demand area. With current rental rates in many markets outpacing inflation, this strategy could provide a steady income stream that grows with rising prices.

The housing market remains sensitive to interest rate changes, which affects both buyer and seller behavior. This dynamic creates opportunities for savvy investors to find undervalued properties with strong potential for appreciation.

Another option is to invest in your own home through strategic renovations. Upgrades that increase energy efficiency (such as solar panels or improved insulation) can provide long-term savings on utility bills that typically rise with inflation. Energy-efficient home improvements can lead to significant savings on home energy bills.

Strategic Debt Consolidation

Using a HELOC for debt consolidation can be particularly beneficial in a high-inflation environment. With HELOC rates averaging around 8.26% as of July 2025, they offer a significantly lower interest rate compared to credit cards (21.91%) and personal loans (12.36%).

You can potentially save thousands in interest payments over time by consolidating high-interest debts into a lower-rate HELOC. This strategy becomes even more powerful when you consider that inflation effectively reduces the real value of your debt over time, while your home’s value (and thus your equity) is likely to increase.

Time Your HELOC Usage Wisely

The timing of when you draw from and repay your HELOC can significantly impact its effectiveness as an inflation-fighting tool. In periods of rising inflation, it may be advantageous to borrow sooner rather than later, as the purchasing power of the borrowed funds will likely decrease over time.

However, it’s important to have a solid repayment plan. Try to make more than the minimum payments during the draw period. This approach can help you build equity faster and reduce the impact of potential interest rate increases in the future.

Keep a close eye on inflation trends and interest rate forecasts. The Federal Reserve’s actions in response to inflation can directly affect HELOC rates. If rate cuts are expected, it might be wise to wait before making large draws from your HELOC.

Manage Your HELOC Actively

Homeowners who actively manage their HELOCs, adjusting their usage based on economic conditions, tend to see better outcomes. Stay informed about market trends and make timely decisions to maximize the benefits of your HELOC.

While HELOCs can be powerful financial tools, they also come with risks. Your home serves as collateral, so it’s important to borrow responsibly and have a solid plan for using and repaying the funds. Always consult with a financial advisor to ensure your HELOC strategy aligns with your overall financial goals and risk tolerance. When navigating variable HELOC rates, it’s crucial to obtain multiple quotes from different lenders to get a clear market picture and leverage your position.

Final Thoughts

HELOCs offer unique advantages during inflationary periods, tapping into rising home values and providing competitive interest rates compared to other credit forms. The effectiveness of HELOCs against inflation depends on strategic use, such as investing in appreciating assets or consolidating high-interest debts. Careful timing and active management of HELOC funds can maximize benefits, but homeowners must consider potential rate fluctuations and their long-term financial goals.

HELOC360 provides comprehensive guidance and solutions for those exploring HELOC options and seeking to make informed decisions about leveraging their home equity. Our platform helps you navigate the complexities of HELOCs and inflation, ensuring you have the tools and knowledge to make the most of your home’s value. HELOCs can serve as powerful financial instruments when used responsibly, potentially helping homeowners stay ahead in an inflationary environment.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.