HELOCs can be a powerful financial tool, but they come with hidden risks. Many homeowners are unaware of the potential HELOC penalties that could derail their financial plans.

At HELOC360, we’ve seen firsthand how these unexpected costs can impact our clients. This post will shed light on the most common hidden HELOC penalties and show you how to protect your finances.

The Early Termination Fee Trap: A Hidden HELOC Penalty

Understanding Early Termination Fees

Early termination fees represent a significant hidden cost in Home Equity Lines of Credit (HELOCs). These charges apply when borrowers close their HELOC before a specified period, typically within the first few years of opening the account. Lenders impose these fees to recover the costs associated with setting up and maintaining your HELOC.

The Consumer Financial Protection Bureau (CFPB) provides information about early termination fees and other closing costs associated with HELOCs.

Calculation Methods for Early Termination Fees

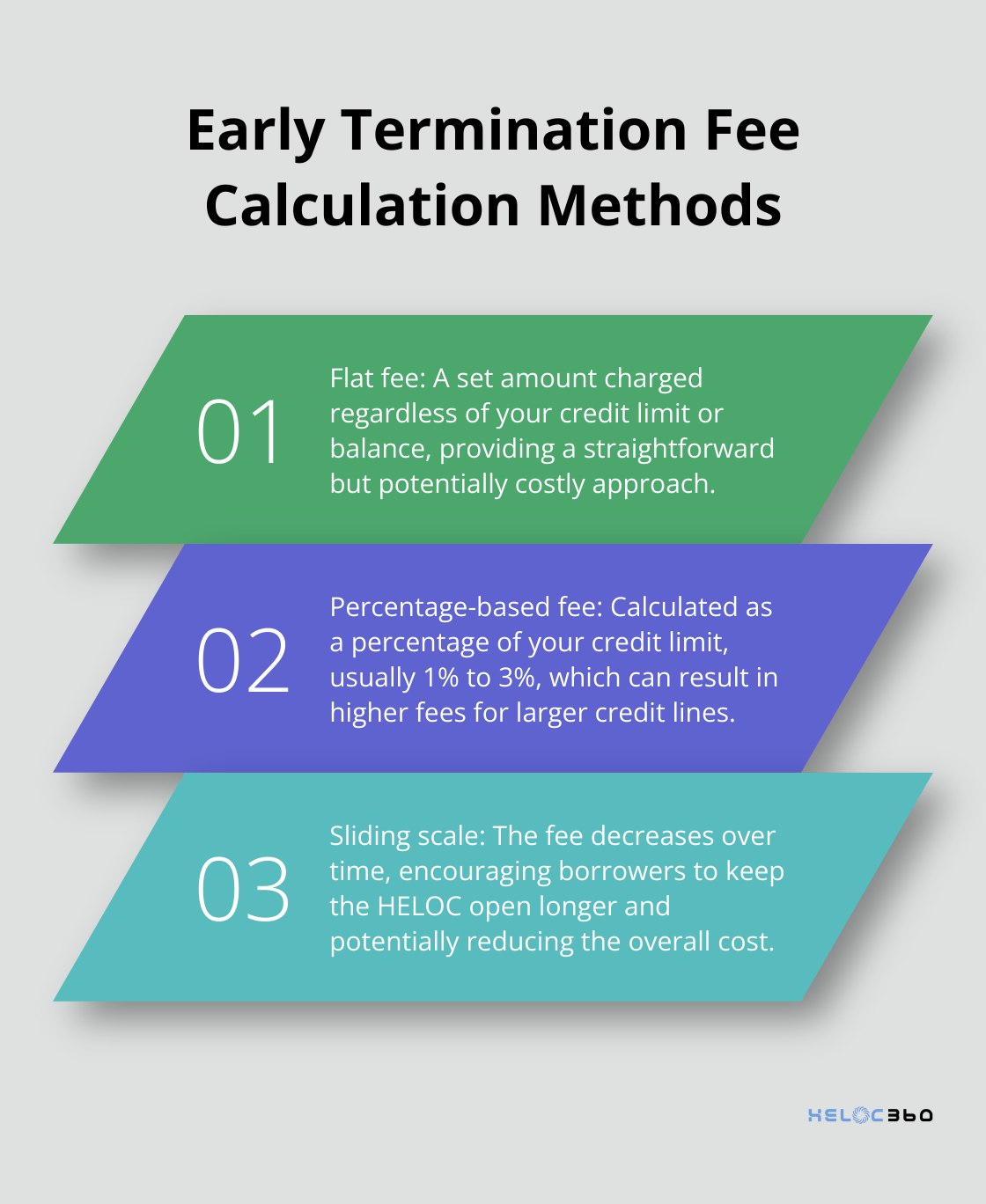

Lenders employ various approaches to calculate early termination fees:

- Flat fee: A set amount, regardless of your credit limit or balance.

- Percentage-based fee: A percentage of your credit limit (usually 1% to 3%).

- Sliding scale: The fee decreases over time, encouraging you to keep the HELOC open longer.

For instance, Bank of America charges a $450 fee if you close your HELOC within 36 months of opening it. Wells Fargo uses a sliding scale, charging up to $500 if you close within the first year, decreasing to $100 if you close in the third year.

Financial Impact on Borrowers

Early termination fees can significantly affect your finances. Consider this scenario: You open a HELOC with a $100,000 credit limit and decide to close it after 18 months due to improved financial circumstances. If your lender charges a 2% early termination fee, you’d owe $2,000 – a substantial sum that could negate any benefits you’ve gained from the HELOC.

Protecting Yourself from Early Termination Fees

- Read the fine print: Review your HELOC agreement thoroughly before signing. Pay special attention to the sections on fees and penalties.

- Negotiate: Some lenders may waive or reduce early termination fees, especially if you have a good relationship with them. Don’t hesitate to ask.

- Plan ahead: Consider your long-term financial goals when contemplating a HELOC. Determine if you’ll need the credit line for several years or if it’s a short-term solution.

The Importance of Transparency in HELOC Agreements

Transparency in HELOC agreements proves essential for borrowers to make informed decisions. Some lenders (like HELOC360) prioritize clear communication about potential fees associated with HELOCs and work with lenders who offer fair and reasonable terms.

As we move forward, it’s important to consider another hidden aspect of HELOCs that can impact your finances: rate caps and floors. These features can significantly affect your borrowing costs over time.

How HELOC Rate Caps and Floors Impact Your Borrowing Costs

Understanding HELOC Rate Structures

HELOCs typically offer variable interest rates, but many lenders implement rate caps and floors to protect both themselves and borrowers from extreme market fluctuations. These features play a significant role in managing your HELOC effectively.

Defining Rate Caps and Floors

Rate caps limit the maximum increase in your interest rate over a specific period or the life of the loan. For instance, a HELOC might have a 2% annual cap and a 5% lifetime cap. This structure prevents your rate from increasing by more than 2% in any given year and ensures it never exceeds 5% above your initial rate.

Floors set a minimum interest rate for your HELOC. Even if market rates plummet, your HELOC rate won’t drop below this floor. The national average HELOC interest rate is 8.27% as of July 16, 2025, according to Bankrate’s latest survey of the nation’s largest home equity lenders.

The Hidden Costs of Rate Structures

While rate caps protect you from drastic increases, they can lead to unexpected costs. If market rates rise rapidly, your HELOC rate might hit the cap and remain there, even if rates later decline. This scenario unfolded during recent interest rate hikes, catching many HELOC borrowers off guard.

Floors can be equally problematic. In low-rate environments, you might pay more than current market rates. For example, if your HELOC has a 4% floor and market rates drop to 3%, you’ll still pay 4%.

Comparing HELOC Rates to Other Loan Types

HELOCs with caps and floors offer less predictability compared to fixed-rate loans. A 30-year fixed mortgage maintains the same rate throughout its term. However, HELOCs often provide lower initial rates than personal loans or credit cards, making them attractive for short-term borrowing.

Strategies to Mitigate Rate Risks

- Choose HELOCs with lower lifetime caps, even if they come with slightly higher initial rates.

- Convert part of your HELOC balance to a fixed-rate option if your lender offers this feature.

- Monitor market trends and prepare to refinance if rates become unfavorable.

Understanding rate caps and floors proves essential for HELOC borrowers. These features significantly impact your long-term costs and warrant careful consideration when selecting a HELOC provider. As we explore further, let’s examine another often-overlooked aspect of HELOCs: inactivity fees and their potential impact on your finances.

Are Inactivity Fees Draining Your HELOC?

The Hidden Cost of Dormant HELOCs

Inactivity fees represent a lesser-known but potentially costly aspect of Home Equity Lines of Credit (HELOCs). Some lenders impose these charges to penalize borrowers who do not use their credit line. These fees can catch homeowners off guard, transforming a seemingly beneficial financial tool into an unexpected burden.

Inactivity fees typically range from $50 to $100 annually, though some lenders charge as much as $300 per year. HELOCs often have ongoing expenses, charging annual fees or inactivity fees. Lenders justify these charges as a way to offset the costs of maintaining open credit lines and to encourage borrowers to use their HELOCs actively.

Consider this scenario: You open a HELOC for emergency purposes but don’t draw from it for several years. You could end up paying hundreds of dollars in fees without ever using the credit line. This situation occurs more frequently than one might expect. A HELOC can function like a savings account, with funds right at your fingertips, and interest rates on HELOCs may be lower than other financial options.

Strategies to Avoid Inactivity Fees

- Make regular, small withdrawals: Withdraw small amounts from your HELOC periodically, even if you don’t need the funds immediately. You can repay these amounts quickly to avoid interest charges while keeping your account active.

- Negotiate with your lender: Some lenders may waive inactivity fees if you maintain other accounts with them or have a strong credit history. Don’t hesitate to ask about fee waivers or reductions.

- Look for fee-free HELOCs: Not all lenders charge inactivity fees. Try to find lenders who prioritize transparency and minimal fees to help you avoid these hidden costs.

Alternatives for Unused HELOCs

If you consistently don’t use your HELOC, consider these alternatives:

- Convert to a fixed-rate home equity loan: This option provides a lump sum with a fixed interest rate, eliminating concerns about inactivity fees or variable rates.

- Cash-out refinance: If you have significant equity and need a large sum, this could prove more cost-effective, especially if current mortgage rates are lower than your original mortgage rate.

- Close the HELOC: If you’re past any early termination fee period and don’t foresee needing the credit line, closing the HELOC might be the most economical choice.

The Importance of Staying Informed

The key to avoiding inactivity fees lies in staying informed and proactive. Always read the fine print in your HELOC agreement and ask your lender about all potential fees. Understanding these hidden costs and exploring alternatives will help ensure your HELOC remains a valuable financial tool rather than a drain on your resources.

Final Thoughts

HELOC penalties can significantly impact your financial health. Early termination fees, rate caps and floors, and inactivity fees often catch borrowers off guard. Thorough research and asking the right questions will help you avoid these pitfalls and make informed decisions that align with your financial goals.

HELOC360 simplifies the process of navigating HELOCs. We offer expert guidance and connect you with lenders that fit your unique needs. Our platform aims to empower clients with the knowledge they need to make smart financial decisions.

You can unlock the full potential of your home equity while avoiding common pitfalls. HELOC360 provides the expertise and resources to help you achieve your financial aspirations. Take control of your home equity journey today and turn your HELOC into a powerful financial tool.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.