A HELOC draw period is a critical phase in your home equity line of credit. It’s the time when you can access funds and use them for various purposes.

At HELOC360, we understand the importance of making the most of this opportunity. This guide will show you how to maximize your HELOC draw period, avoid common pitfalls, and set yourself up for financial success.

What Is a HELOC Draw Period?

Definition and Duration

A HELOC draw period represents the timeframe when you can access funds from your home equity line of credit. The draw period typically lasts up to 10 years. During this time, you have the flexibility to borrow against your home’s equity as needed, up to your approved credit limit.

Mechanics of Draw Periods

When you receive approval for a HELOC, your lender assigns a credit limit based on factors such as your home’s value, credit score, and income. The draw period functions similarly to a credit card, allowing you to withdraw funds multiple times. You only pay interest on the amount you borrow, not on your entire credit limit.

Payment Options

During this window, you can take out money up to the limit as often as you’d like. Most lenders offer interest-only payments during the draw period. This option can result in lower monthly payments, as you don’t have to pay down the principal. However, making principal payments during this time can reduce your overall interest costs and prepare you for the repayment period.

The Transition to Repayment

Once the draw period ends, the repayment phase begins. This phase usually lasts 10 to 20 years. During repayment, you can no longer withdraw funds, and your payments will include both principal and interest. Your monthly payments will likely increase significantly during this phase.

Importance of Awareness

A 2023 Federal Reserve study revealed that many HELOC borrowers were unaware of the exact date their draw period would end. This lack of awareness can lead to financial stress when the repayment period begins. Mark your calendar and plan ahead to avoid surprises.

As we move forward, let’s explore strategies to maximize your HELOC draw period and make the most of this financial tool.

How to Maximize Your HELOC Draw Period

Create a Comprehensive Spending Plan

Before you withdraw funds, you should create a detailed plan for your HELOC usage. Focus on projects or expenses that will provide long-term value. For home improvements, concentrate on those with the highest return on investment (ROI). The 2021 Cost vs. Value Report finds that exterior improvement projects continue a multiyear trend of providing the greatest return on investment (ROI) for homeowners.

Invest in High-Value Home Improvements

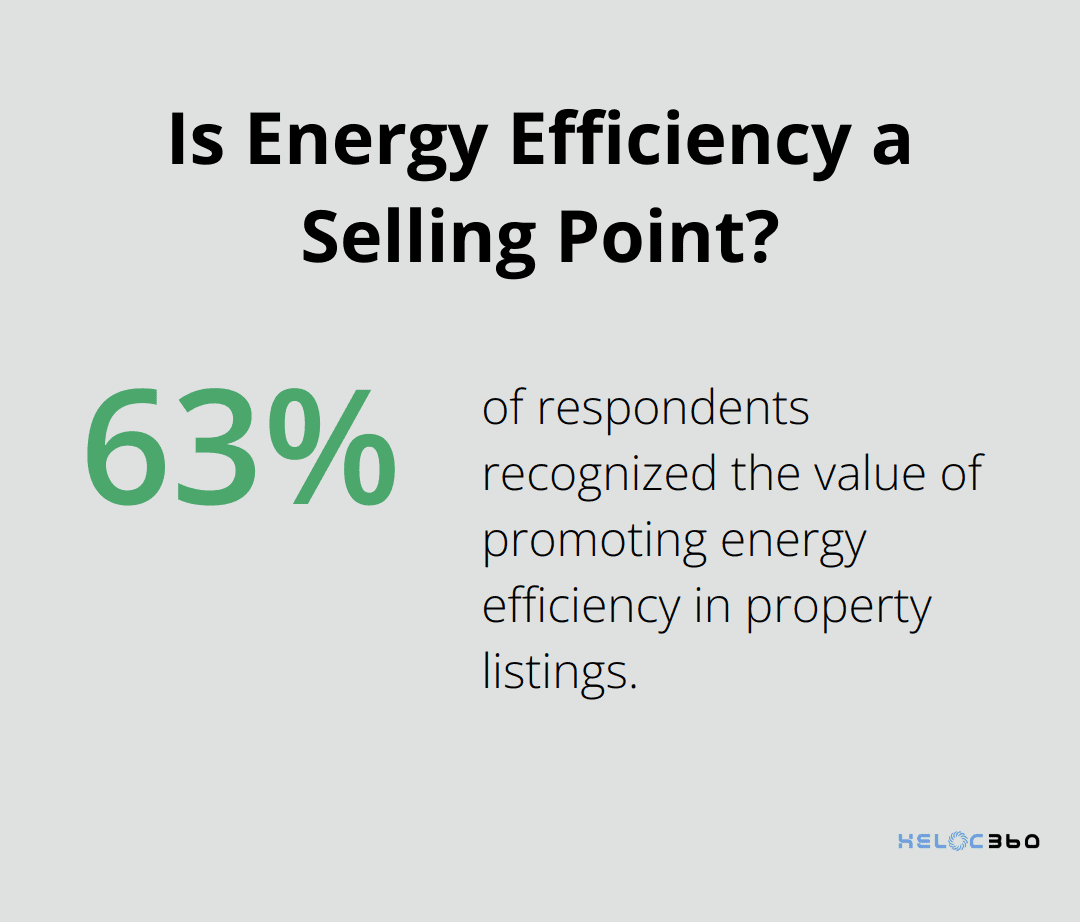

Use your HELOC funds for renovations that enhance your living space and increase your property value. Energy-efficient upgrades (such as solar panels or energy-efficient windows) can lead to long-term savings on utility bills while boosting your home’s market value. According to a 2023 survey, 63% of respondents recognized the value of promoting energy efficiency in property listings.

Address High-Interest Debt

If you have high-interest debt (like credit card balances), using your HELOC to consolidate can result in significant savings. As of 2024, the average credit card interest rate is 24.20%, while HELOC rates typically range from 4% to 8%. Transferring high-interest debt to your HELOC could potentially save you thousands in interest payments over time.

Implement a Smart Payment Strategy

Many lenders offer interest-only payments during the draw period. However, you should consider making principal payments as well. This approach can help you build equity faster and reduce your overall interest costs. Try to pay at least 1% of your principal balance each month in addition to the interest. This strategy can significantly reduce your debt burden when the repayment period begins.

A HELOC is a powerful financial tool when used wisely. These strategies can help you maximize the benefits of your draw period and set you up for long-term financial success. However, it’s important to stay vigilant and avoid common pitfalls that can derail your financial goals. In the next section, we’ll explore these potential pitfalls and how to steer clear of them.

Navigating HELOC Pitfalls

The Temptation of Easy Money

A Home Equity Line of Credit (HELOC) can be a powerful financial tool, but it comes with risks. Many homeowners fall into traps that lead to financial stress or even jeopardize their homes. One of the biggest dangers is the ease of access to funds. It’s tempting to use this money for non-essential purchases or luxuries. Balances on HELOCs rose by $9 billion, the eleventh consecutive quarterly increase after 2022Q1, and there is now $396 billion in outstanding HELOC debt. This can lead to debt accumulation without building long-term value.

To combat this, create a strict budget for your HELOC funds. Allocate every dollar to specific, value-adding purposes before you start withdrawing. If you consider using HELOC funds for something not in your original plan, implement a 30-day “cooling off” period to ensure it’s a wise decision.

The Minimum Payment Trap

Many HELOC borrowers make only minimum payments during the draw period. While this keeps monthly costs low, it can lead to a significant balance when the repayment period begins. The HELOC draw period is usually 10 years, where you can withdraw funds up to your limit. The repayment period is when you can no longer borrow from your HELOC and must start paying back the principal and interest.

To avoid this shock, pay more than the minimum each month. Even small additional payments can make a big difference over time. For example, on a $50,000 HELOC balance at 6% interest, paying an extra $100 per month during a 10-year draw period could save you over $12,000 in interest over the life of the loan.

Credit Score Impact

Your HELOC usage can significantly impact your credit score. High utilization rates (using a large percentage of your available credit) can lower your score. Keeping it below 10% (and consistently paying bills on time) can help you build and maintain a good FICO® Score.

To maintain a healthy credit score, keep your HELOC utilization low. If you need to use more, consider making larger payments to bring down the balance quickly. Regular monitoring of your credit report can help you stay on top of how your HELOC usage affects your overall credit health.

Neglecting the Repayment Period

Many borrowers focus solely on the draw period and neglect to plan for the repayment phase. This oversight can lead to financial strain when the repayment period begins. To avoid this, create a long-term financial plan that accounts for both the draw and repayment periods. Calculate your expected monthly payments during repayment and ensure they fit within your budget.

Misunderstanding Variable Interest Rates

HELOCs typically come with variable interest rates, which can fluctuate based on market conditions. Some borrowers underestimate the potential impact of rate increases on their monthly payments. Stay informed about market trends and factor potential rate increases into your financial planning. Consider setting aside extra funds as a buffer against potential rate hikes.

Final Thoughts

A HELOC draw period offers significant financial opportunities when managed wisely. You can maximize its benefits through careful planning, strategic investments, and smart debt management. Avoiding common pitfalls such as overspending and neglecting payments will help you navigate this financial tool successfully.

Responsible borrowing and thorough financial planning are essential for a successful HELOC experience. Understanding the mechanics of your HELOC, including variable interest rates and credit score impacts, will enable you to make informed decisions aligned with your long-term financial goals.

We at HELOC360 aim to simplify the HELOC experience and provide expert guidance throughout the process. Our platform offers tailored solutions to fit your unique needs and financial aspirations. HELOC360 empowers you with the knowledge and resources to make the most of your home’s value during the HELOC draw period and beyond.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.