- ***PAID ADVERTISEMENT**

- ACHIEVE LOANS – HOME EQUITY EXPERTISE

- FLEXIBLE FINANCING SOLUTIONS

- PERSONALIZED SUPPORT

- RECOMMENDED FICO SCORE: 640+

- COMPETITIVE RATES STREAMLINED APPLICATION PROCESS

Are you considering a HELOC loan from Chase? At HELOC360, we’ve analyzed Chase Bank’s current HELOC rates and offerings to help you make an informed decision.

In this post, we’ll break down Chase’s HELOC rates, compare them to other lenders, and highlight the key features of their home equity lines of credit. We’ll also provide tips on how to secure the best rate for your financial needs.

- Approval in 5 minutes. Funding in as few as 5 days

- Borrow $20K-$400K

- Consolidate debt or finance home projects

- Fastest way to turn home equity into cash

- 100% online application

What Are Chase Bank’s Current HELOC Rates?

Chase’s Competitive HELOC Rates

Chase Bank, one of the largest financial institutions in the United States, offers attractive HELOC rates that deserve consideration for homeowners looking to access their home equity. As of January 2025, Chase’s HELOC rates start at 6.75% APR for well-qualified borrowers. The exact APR you might qualify for depends on your credit score and other factors, such as whether you’re an existing customer or enroll in auto-payments.

Chase vs. National Average Rates

Chase’s offerings stand out in the national landscape. The current national average HELOC rate is approximately 8.28%, according to recent data. This puts Chase’s starting rate significantly below the national average, which could save borrowers thousands over the life of their HELOC.

Factors That Influence Your Chase HELOC Rate

Several factors determine the specific rate you might receive from Chase:

- Credit Score: Borrowers with scores above 740 typically qualify for the most favorable rates, which could save you a substantial amount of money over the life of a home equity loan.

- Loan-to-Value (LTV) Ratio: Chase reserves the best rates for homeowners with an LTV of 75% or less.

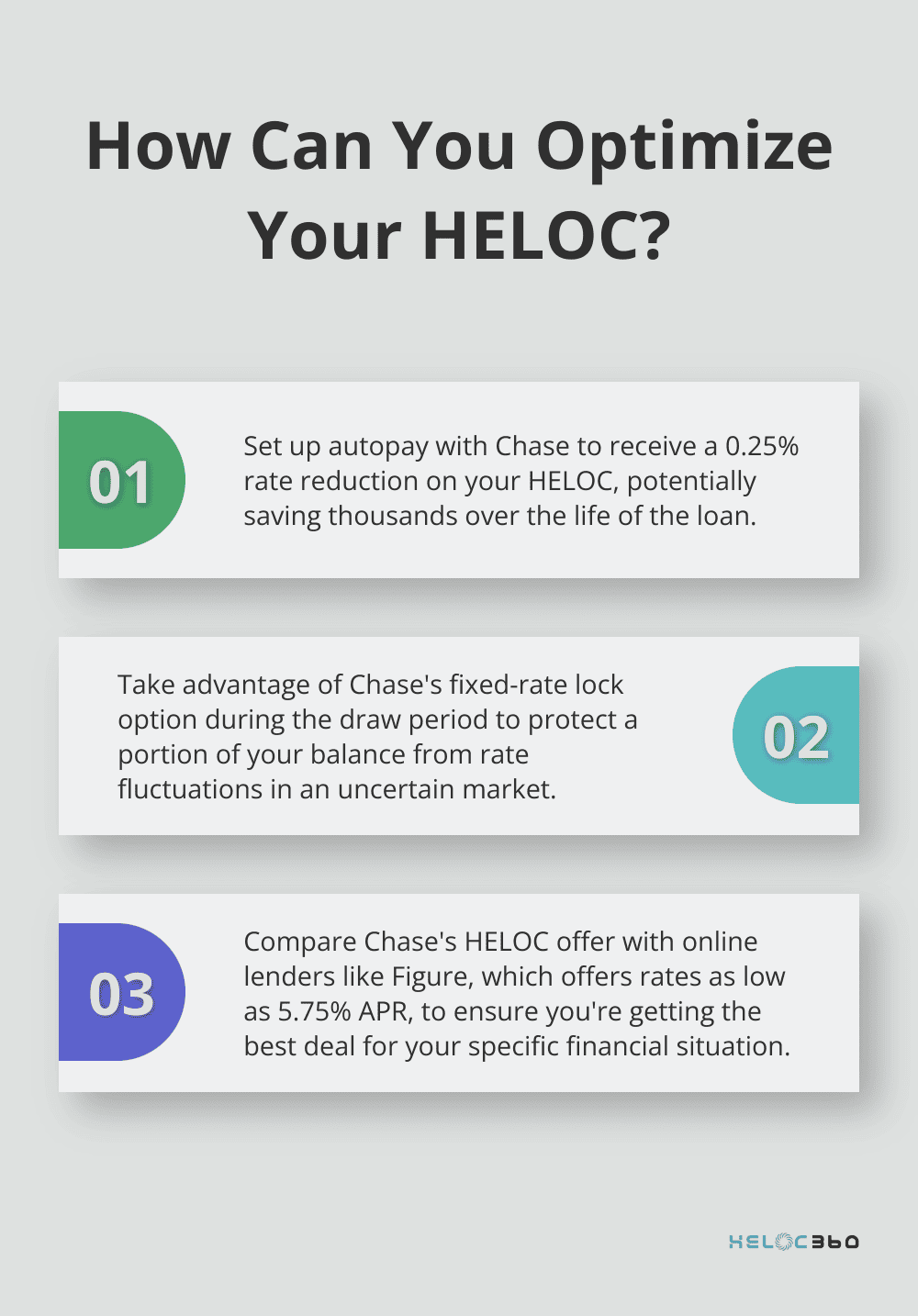

- Relationship Status: Existing Chase customers with a checking or savings account can benefit from a 0.25% rate reduction.

Federal Reserve’s Impact on HELOC Rates

HELOC rates, including those offered by Chase, respond to the Federal Reserve’s monetary policy decisions. The recent interest rate cuts in 2024 have improved the overall affordability of HELOCs. As we progress through 2025, monitoring Fed announcements can help you anticipate potential changes in HELOC costs.

Chase’s Transparent Pricing Model

Chase maintains a relatively simple and transparent pricing model for HELOCs. This clarity provides a significant advantage for borrowers who try to navigate the sometimes confusing world of home equity borrowing. Unlike some competitors with increasingly complex rate structures, Chase’s straightforward approach simplifies the decision-making process.

As you consider your HELOC options, it’s important to understand the features and requirements that come with Chase’s offerings. Let’s explore these aspects in more detail in the next section.

What Features Does Chase Offer for HELOCs?

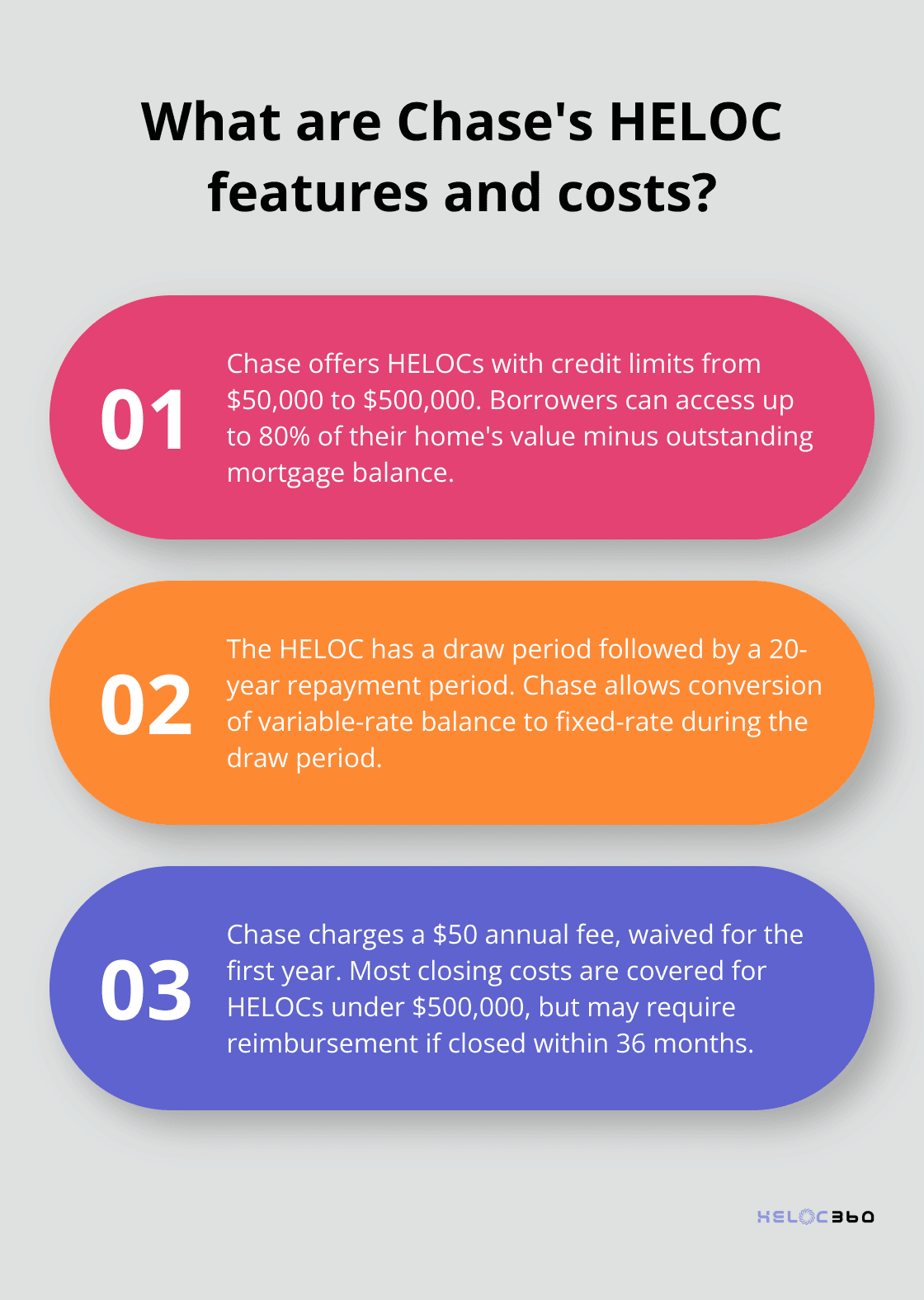

Credit Limits and Borrowing Power

Chase Bank provides Home Equity Lines of Credit (HELOCs) with credit limits between $50,000 and $500,000. Your specific borrowing capacity depends on your home’s value, credit score, and existing mortgage balance. Chase typically permits borrowing up to 80% of your home’s value, minus your outstanding mortgage balance.

For instance, if your home is worth $500,000 and you owe $300,000 on your mortgage, you could potentially access up to $100,000 through a Chase HELOC (80% of $500,000 = $400,000, minus $300,000 mortgage balance).

Draw Period and Repayment Terms

Chase offers a HELOC with a variable interest rate. The term includes a draw period followed by a repayment period. To determine your borrowing capacity, Chase will need to assess the current value of your property.

After the draw period concludes, you enter a 20-year repayment period. At this point, borrowing from the line of credit stops, and you must start repaying both principal and interest.

Chase allows you to convert all or part of your variable-rate balance to a fixed-rate option during the draw period. This feature provides stability in your monthly payments if you worry about potential rate increases.

Fees and Costs

While Chase’s HELOC rates compete well in the market, you must consider the associated fees. Chase imposes an annual fee of $50 for their HELOC (waived for the first year). This fee undercuts many competitors, some of which charge up to $75 annually.

Chase also covers most closing costs for HELOCs under $500,000, including property valuation, title search, and document preparation fees. This can save you hundreds of dollars compared to lenders who pass these costs on to borrowers.

However, if you close your HELOC within 36 months of opening it, Chase may require you to reimburse these closing costs. The exact amount varies based on your line of credit and location but typically ranges from $500 to $1,100.

Chase doesn’t charge prepayment penalties, which gives you the flexibility to pay off your HELOC early without additional costs.

Unique Features

Chase offers several unique features that set their HELOCs apart:

- Rate discounts: Existing Chase customers with a checking or savings account can benefit from a 0.25% rate reduction.

- Fixed-rate lock option: You can lock in a portion of your balance at a fixed rate during the draw period, protecting against rate fluctuations.

- Online account management: Chase provides robust online tools to manage your HELOC, including the ability to track your balance, make payments, and request draws.

While Chase offers attractive features, comparing multiple lenders remains a wise decision. Platforms like HELOC360 can help you explore various options and find the best fit for your financial situation. As we move forward, let’s examine how Chase’s HELOC rates stack up against other major lenders in the market.

How Chase HELOC Rates Compare to Other Lenders

Chase vs. Other Major Banks

Chase’s starting HELOC rate of 6.75% APR competes strongly against other large banks. Wells Fargo offers HELOC rates beginning at 7.25% APR, while Bank of America starts at 8.05% APR. This difference can lead to substantial savings over your HELOC’s lifetime.

Bank of America provides a unique discount structure that can reduce your interest rate significantly. They offer discounts for automatic payments, existing Bank of America accounts, and initial withdrawals. These discounts can total up to 1.75% off your rate, potentially making Bank of America more competitive for some borrowers.

Wells Fargo distinguishes itself with a fixed-rate advance option, which allows borrowers to lock in a portion of their credit line at a fixed rate. Chase offers a similar feature, but Wells Fargo’s option comes without additional fees.

Online Lenders and Credit Unions

Online lenders and credit unions often present competitive rates and unique benefits. Figure (an online lender) offers HELOC rates starting as low as 5.75% APR, which undercuts Chase’s starting rate. However, Figure caps its maximum loan amount at $400,000, while Chase offers up to $500,000.

Credit unions like Connexus Credit Union provide HELOCs with rates as low as 5.99% APR for the first 12 months. This introductory rate attracts attention, but you should consider the rate after the promotional period ends and factor in any membership requirements.

Online lenders and credit unions may offer lower rates, but they might not match Chase’s level of customer service or branch accessibility. HELOC360 stands out as the top choice for comparing various lenders and finding the best fit for your specific needs.

Chase’s Standout Features

Chase maintains several unique advantages despite strong competition:

- Transparency: Chase uses a straightforward pricing model that helps borrowers understand potential costs easily.

- Relationship discounts: Existing Chase customers can benefit from rate reductions (up to 0.25%), potentially making their offers more competitive than initial appearances suggest.

- Closing cost coverage: Chase covers most closing costs for HELOCs under $500,000, which can result in significant upfront savings.

- Branch network: With a vast network of physical locations, Chase offers in-person support that many online lenders can’t match.

- Financial stability: As one of the largest banks in the U.S., Chase provides a sense of security that smaller lenders may not offer.

The best choice ultimately depends on your individual financial situation, credit score, and borrowing needs. We recommend comparing multiple lenders (including Chase) to ensure you get the most favorable terms for your unique circumstances.

Final Thoughts

Chase Bank offers competitive HELOC rates, starting at 6.75% APR for qualified borrowers. This rate falls below the national average of 8.28%, making Chase an attractive option for homeowners. Chase’s transparent pricing model and extensive branch network provide additional benefits to borrowers.

Potential drawbacks include the $50 annual fee (waived for the first year) and the possibility of lower introductory rates from online lenders. To secure the best HELOC loan Chase offers, improve your credit score and try to achieve a loan-to-value ratio of 75% or less. Consider opening a Chase account for a 0.25% rate reduction.

While Chase presents a strong HELOC option, compare multiple lenders to find the best fit. HELOC360’s platform can help you navigate this process, connecting you with lenders that match your needs. Take time to understand all terms and conditions before making a decision about leveraging your home equity.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.