HELOC maturity is a critical milestone for homeowners with a home equity line of credit. Many borrowers are caught off guard when their draw period ends and repayment begins.

At HELOC360, we’ve seen firsthand how proper preparation can make this transition smoother. This guide will walk you through what to expect and how to get ready for your HELOC’s maturity date.

What Happens When Your HELOC Matures?

The End of the Draw Period

HELOC maturity marks the conclusion of your draw period and the start of repayment. After this date, the HELOC will transition from the draw period to the repayment period, in which you no longer withdraw any funds and your monthly payments increase. A typical HELOC has two phases: the draw period and the repayment period. During the draw period (usually 5 to 10 years), you can borrow against your credit line and make interest-only payments. When this period ends, your HELOC matures, and you enter the repayment phase.

HELOC Structures Explained

Most HELOCs come with a variable interest rate that changes with market conditions. In the most recent week, the average rate on a $30,000 home equity line of credit (HELOC) rose 13 basis points to 8.27 percent, close to the highest levels of 2025.

The repayment period typically spans 10 to 20 years, during which you must pay back both principal and interest. Some lenders might require a balloon payment at the end of the draw period (paying off the entire balance at once).

The Importance of Preparation

Preparation for HELOC maturity is essential. Many homeowners face payment shock when their monthly obligations suddenly increase. A review of complaints shows homeowners felt frustrated or even misled about various aspects of home equity contracts-including confusion about terms. Understanding your HELOC terms and planning ahead will help you avoid financial stress and make informed decisions about your home equity.

Critical Dates to Note

Mark these important dates on your calendar:

- The conclusion of your draw period

- The beginning of your repayment period

- Any rate adjustment dates

Knowing these dates will help you plan your finances and explore options before your HELOC matures. Try to review your HELOC agreement at least a year before maturity to understand your specific terms and prepare accordingly.

Navigating the Transition

The transition from the draw period to the repayment period can be smooth with proper planning. You’ll need to adjust your budget to accommodate potentially higher monthly payments. Some homeowners choose to refinance their HELOC or convert it to a fixed-rate loan to manage their payments more effectively. Others might decide to pay off the balance in full if they have the means.

As you approach HELOC maturity, you’ll want to explore all available options (refinancing, conversion, or full repayment). This exploration will set you up for success in the next phase of your HELOC journey and help you make the best decision for your financial future.

What Are Your Options When Your HELOC Matures?

Paying Off the Balance in Full

When your HELOC reaches maturity, you have several choices. Paying off your HELOC balance in full is often the simplest option. This approach eliminates your debt and frees up your home equity. However, it requires a significant lump sum payment, which isn’t feasible for everyone. A 2023 Federal Reserve report revealed that 54 percent of adults said they had set aside money for three months of expenses in an emergency savings or “rainy day” fund.

Refinancing Your HELOC

Refinancing into a new HELOC can be a smart move if you still need access to funds and your home has appreciated in value. This option allows you to extend your draw period and potentially secure a better interest rate. The average HELOC interest rate as of June 9, 2025 is 6.85%, but rates can vary widely based on your credit score and lender.

When you consider refinancing, it’s important to shop around. Different lenders offer varying terms and rates. You should compare options from multiple lenders to ensure you find the best fit for your needs.

Converting to a Fixed-Rate Loan

Converting your HELOC to a fixed-rate home equity loan can provide more predictable payments. This option is particularly attractive if you worry about rising interest rates. Fixed-rate home equity loans typically have slightly higher interest rates than HELOCs, but the stability can be worth it for many homeowners.

Selling Your Home

While not always the first choice, selling your home is an option if you struggle to manage your HELOC payments. In today’s housing market, many homeowners have significant equity. The National Association of Realtors reported that the median existing-home sales price was $414,000 in April 2025. This appreciation could allow you to pay off your HELOC and potentially have money left over.

However, selling your home is a major decision with many factors to consider, including the current real estate market in your area, your future housing needs, and potential capital gains taxes.

You should start planning well before your HELOC matures. Most lenders will contact you about six months before maturity, but proactive planning can start even earlier. Assess your financial situation, review your goals, and don’t hesitate to seek professional advice. Expert guidance can provide valuable insights and help you navigate this important financial decision.

As you weigh these options, it’s essential to consider how each choice aligns with your long-term financial goals. The next section will outline specific steps you can take to prepare for HELOC maturity, ensuring you’re well-equipped to make the best decision for your financial future.

How to Prepare for HELOC Maturity

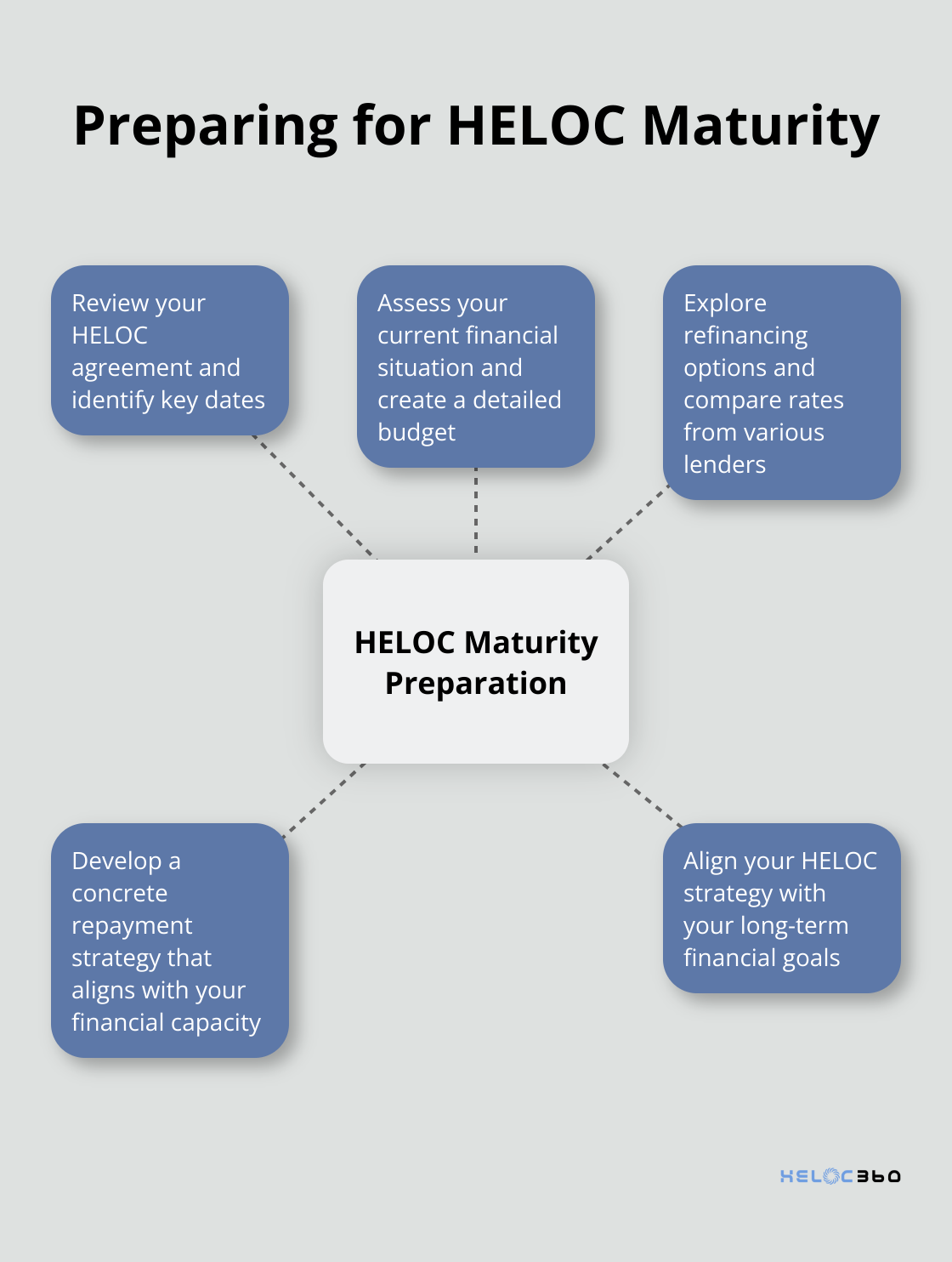

Review Your HELOC Agreement

Start your preparation by thoroughly examining your HELOC agreement. Identify the exact date your draw period ends and when repayment begins. The HELOC draw period is the first phase of the loan, during which you can take out money up to the limit as often as you’d like.

Calculate your current HELOC balance and estimate your future monthly payments. Use online calculators or consult with a financial advisor to get an accurate picture.

Assess Your Financial Situation

Evaluate your current financial standing. Examine your income, expenses, and other debts. Create a detailed budget to understand how increased HELOC payments will affect your finances.

Explore Refinancing Options

Research current HELOC rates and terms from various lenders. Don’t overlook HELOC360’s offerings, as they often provide competitive rates and flexible terms.

Develop a Repayment Strategy

Create a concrete repayment plan. If you can afford higher payments, consider making principal payments during the draw period to reduce your balance.

If you worry about affording the payments, explore options like refinancing or converting to a fixed-rate loan. Some lenders offer hybrid HELOCs that allow you to lock in a portion of your balance at a fixed rate.

Align with Your Financial Goals

Evaluate how your HELOC fits into your broader financial picture. If you’re nearing retirement, you might prioritize paying off the HELOC to reduce your monthly expenses.

Consider the tax implications of your HELOC. While the Tax Cuts and Jobs Act of 2017 limited HELOC interest deductions, you may still deduct interest if you used the funds for home improvements. Consult a tax professional to understand how this affects your situation.

Seek professional advice. A certified financial planner can help you navigate this transition and ensure your HELOC strategy aligns with your long-term financial goals.

Final Thoughts

HELOC maturity represents a critical point in your home equity journey. You must understand the transition from the draw period to repayment to maintain financial stability. Your proactive planning will help you avoid payment shock and make informed decisions about your HELOC’s future.

We at HELOC360 understand the complexities of HELOC maturity. Our platform simplifies the process and connects you with lenders that match your unique needs. We provide expert guidance and tailored solutions to help you maximize your home equity.

Your HELOC is a powerful financial tool, not just a loan. Visit HELOC360 to explore your options and take control of your financial future. You can turn HELOC maturity into an opportunity for financial growth and stability with proper planning and the right support.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.