- ***PAID ADVERTISEMENT**

- ACHIEVE LOANS – HOME EQUITY EXPERTISE

- FLEXIBLE FINANCING SOLUTIONS

- PERSONALIZED SUPPORT

- RECOMMENDED FICO SCORE: 640+

- COMPETITIVE RATES STREAMLINED APPLICATION PROCESS

Are you wondering what credit score you need for a HELOC? You’re not alone. Many homeowners are curious about the HELOC credit requirements when considering this financial option.

At HELOC360, we understand the importance of credit scores in the HELOC application process. In this post, we’ll break down the credit score requirements and offer tips to improve your chances of approval.

- Approval in 5 minutes. Funding in as few as 5 days

- Borrow $20K-$400K

- Consolidate debt or finance home projects

- Fastest way to turn home equity into cash

- 100% online application

What’s a HELOC and Why Does Your Credit Score Matter?

Understanding Home Equity Lines of Credit (HELOCs)

A Home Equity Line of Credit (HELOC) allows homeowners to borrow against the available equity in their home. It functions similarly to a credit card, but it’s secured by your home as collateral for the line of credit. This financial tool offers flexibility and potentially lower interest rates compared to unsecured loans.

The Role of Credit Scores in HELOC Applications

Your credit score serves as a quick snapshot of your financial health and creditworthiness for lenders. A higher score can unlock better interest rates and more favorable terms, potentially saving you thousands of dollars over the life of your HELOC.

Credit Score Requirements for HELOC Approval

While specific credit score requirements may vary, a good credit score is generally important for HELOC approval. To secure the best rates, you’ll typically need a higher credit score. If your score is lower, you might face higher interest rates or even rejection.

The impact of your credit score extends beyond mere approval. For instance, a borrower with a higher credit score might qualify for a lower interest rate compared to someone with a lower score. This difference could translate to significant savings in interest payments over time.

How Lenders Evaluate Your Creditworthiness

Lenders don’t just look at your credit score in isolation. They use it as part of a broader risk assessment. Here’s what they consider:

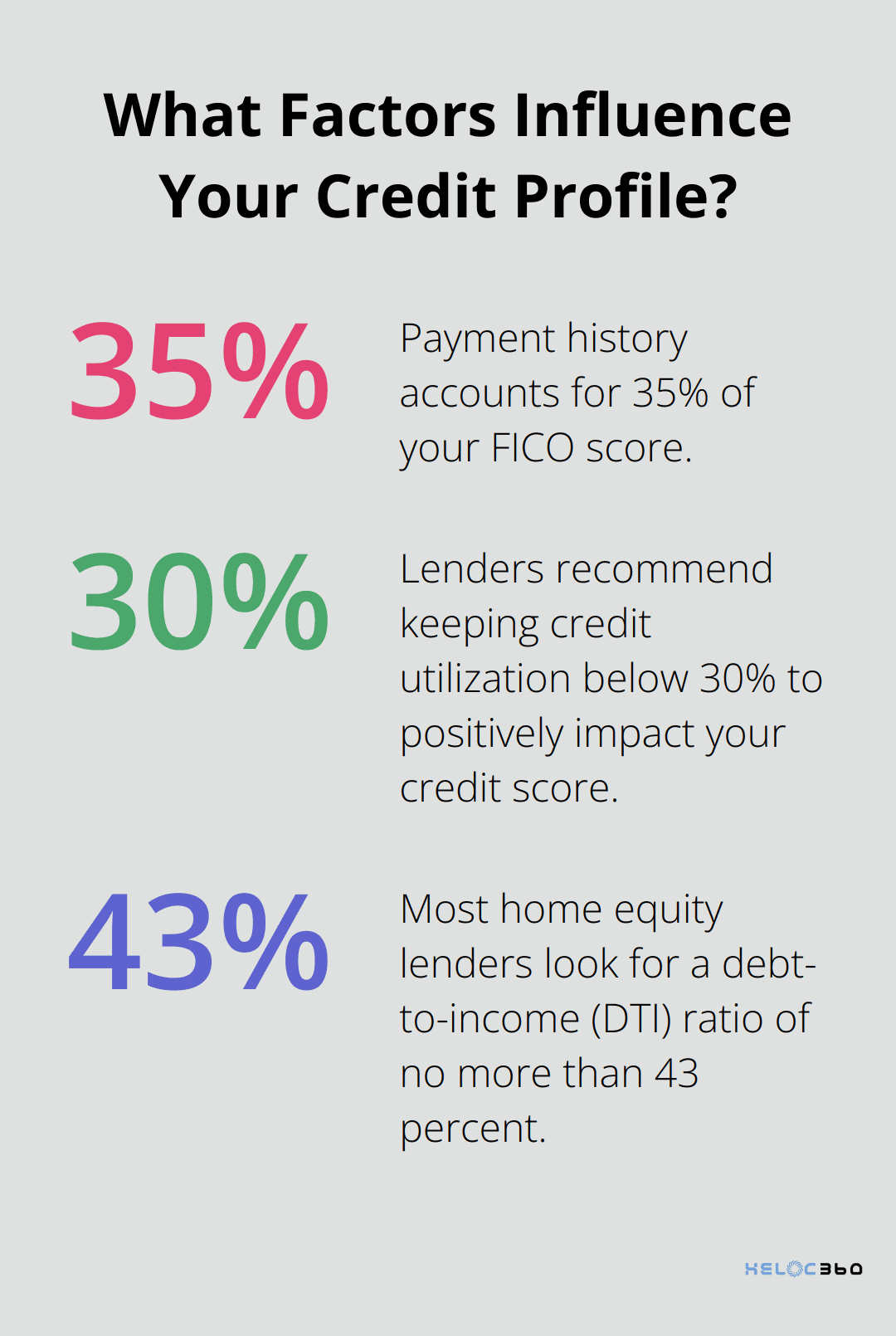

- Payment History (accounts for about 35% of your FICO score): Lenders want to see a consistent record of on-time payments.

- Credit Utilization: How much of your available credit you’re using matters. Try to keep this below 30% to positively impact your score and lender perception.

- Length of Credit History: Longer credit histories provide more data for lenders to assess your financial behavior.

- Types of Credit: A mix of credit types (e.g., credit cards, installment loans) can demonstrate your ability to manage various financial obligations.

- Recent Credit Inquiries: Too many recent applications for credit can raise red flags for lenders.

Understanding these factors can help you take proactive steps to improve your creditworthiness before applying for a HELOC. Your credit score is a key piece of the puzzle, but lenders also consider your debt-to-income ratio, home equity, and overall financial stability when making their decision. Most home equity lenders look for a DTI ratio of no more than 43 percent.

As we move forward, let’s explore the specific credit score ranges that lenders typically look for when approving HELOCs, and how these requirements can vary among different financial institutions.

What Credit Score Do You Need for a HELOC?

Understanding Credit Score Requirements

Your credit score significantly influences your ability to secure a Home Equity Line of Credit (HELOC). Most lenders look for a FICO® Score of at least 680 to qualify for a HELOC. However, this represents only the baseline. To obtain the most favorable rates and terms, you’ll typically need a score of 740 or higher.

The Impact of Credit Scores on HELOC Approval

Your credit score directly affects not only your approval chances but also the interest rates lenders will offer. According to Experian, here’s a general breakdown:

- Excellent (740+): Best rates and terms

- Good (670-739): Competitive rates, good approval odds

- Fair (580-669): Higher rates, may require additional qualifying factors

- Poor (below 580): Difficult to qualify, very high rates if approved

These ranges can vary among lenders. Some may enforce stricter requirements, while others might show more leniency.

Lender Variations in Credit Score Requirements

Different lenders have different risk tolerances and policies. Major banks often have stricter credit requirements, typically looking for scores of 680 or above. Credit unions might show more flexibility, sometimes accepting scores as low as 620.

Online lenders and fintech companies often use more sophisticated algorithms to assess risk. They might consider factors beyond just your credit score, potentially approving borrowers with lower scores if other aspects of their financial profile show strength.

Beyond the Credit Score: Other Approval Factors

While your credit score holds importance, lenders consider additional factors. Here are other key elements that influence HELOC approval:

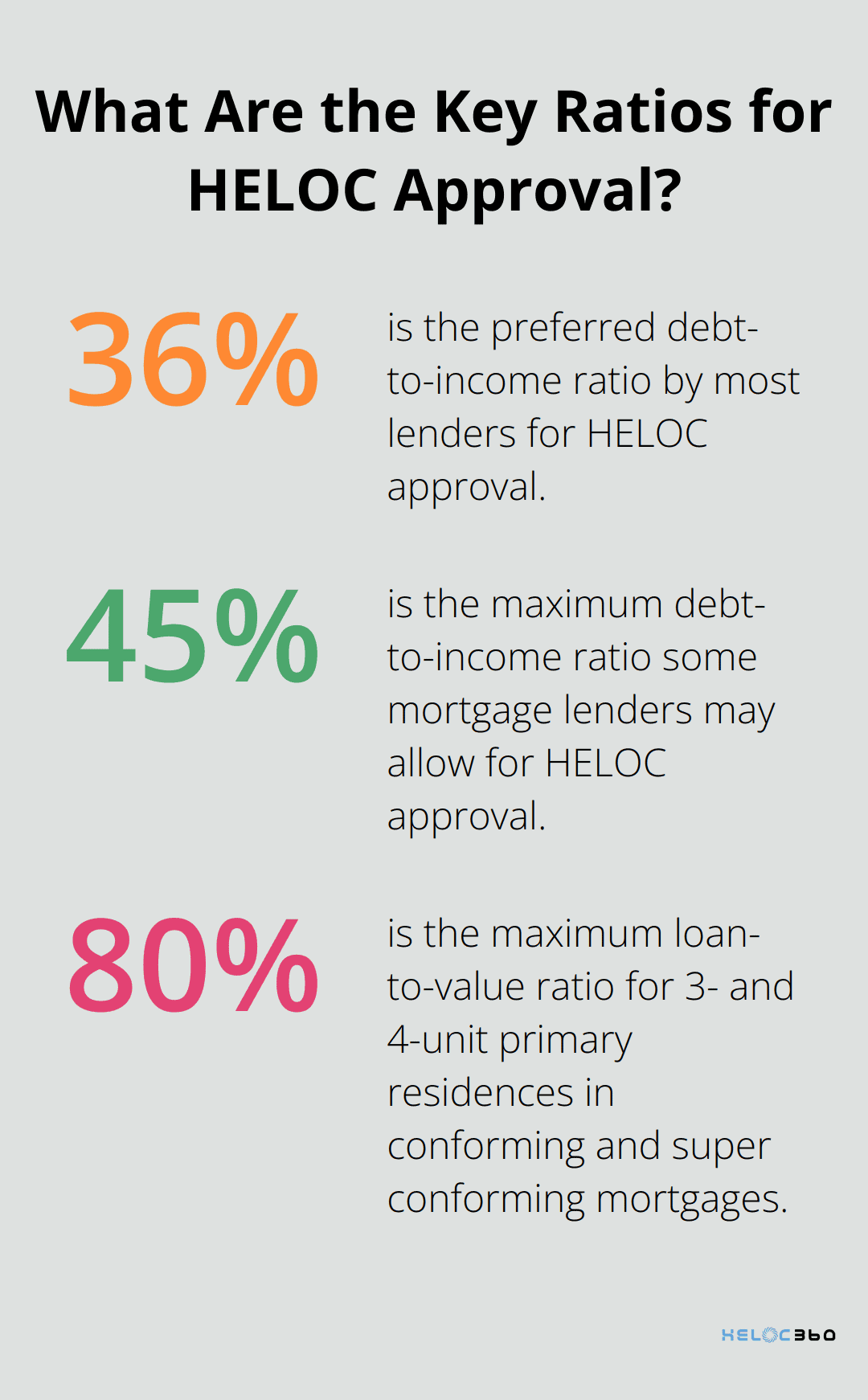

- Debt-to-Income Ratio (DTI): Most lenders prefer a DTI ratio below 35%-36%. Some mortgage lenders may allow up to 43%-45%.

- Loan-to-Value Ratio (LTV): For conforming and super conforming mortgages, maximum LTV ratios are 85% for 2-unit primary residences and 80% for 3- and 4-unit primary residences.

- Income Stability: A steady, verifiable income improves your chances of approval.

- Payment History: Late payments, especially on your mortgage, can hurt your chances even if your overall credit score appears decent.

- Home Equity: The more equity you have in your home, the better your chances of approval.

Improving Your Credit Score for Better HELOC Terms

If your credit score falls below the ideal range for a HELOC, you can take steps to improve it. Paying bills on time, reducing credit card balances, and avoiding new credit applications can all help boost your score. Even a small increase in your score could mean substantial savings over the life of your HELOC.

As you consider your options for a HELOC, it’s important to understand that improving your credit score takes time and effort. In the next section, we’ll explore specific strategies you can employ to enhance your creditworthiness and increase your chances of HELOC approval.

How to Boost Your Credit Score for HELOC Approval

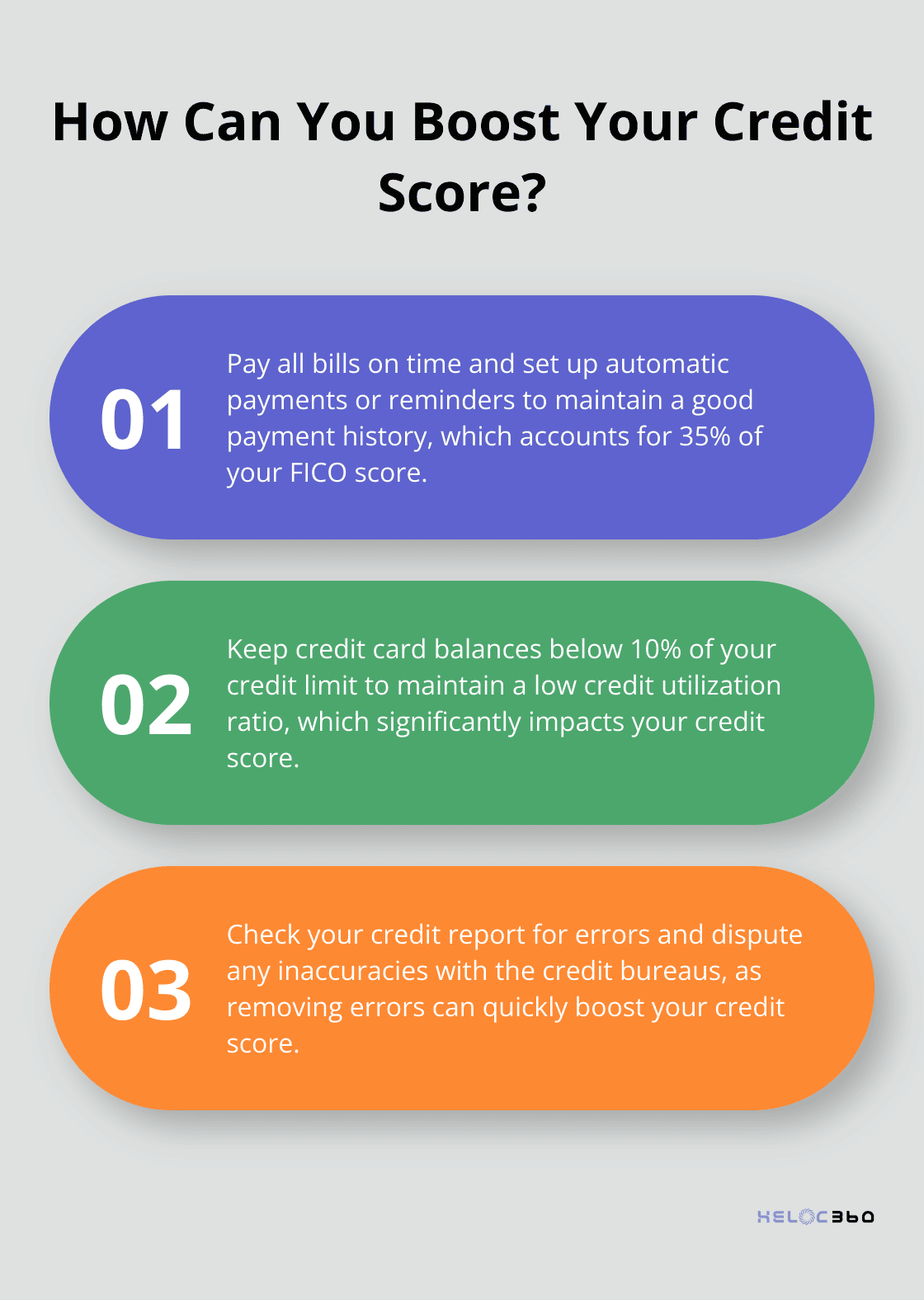

Pay Your Bills on Time

Payment history makes up 35% of your score and is a major factor in its calculation. Set up automatic payments or reminders to ensure you never miss a due date.

Reduce Your Credit Utilization

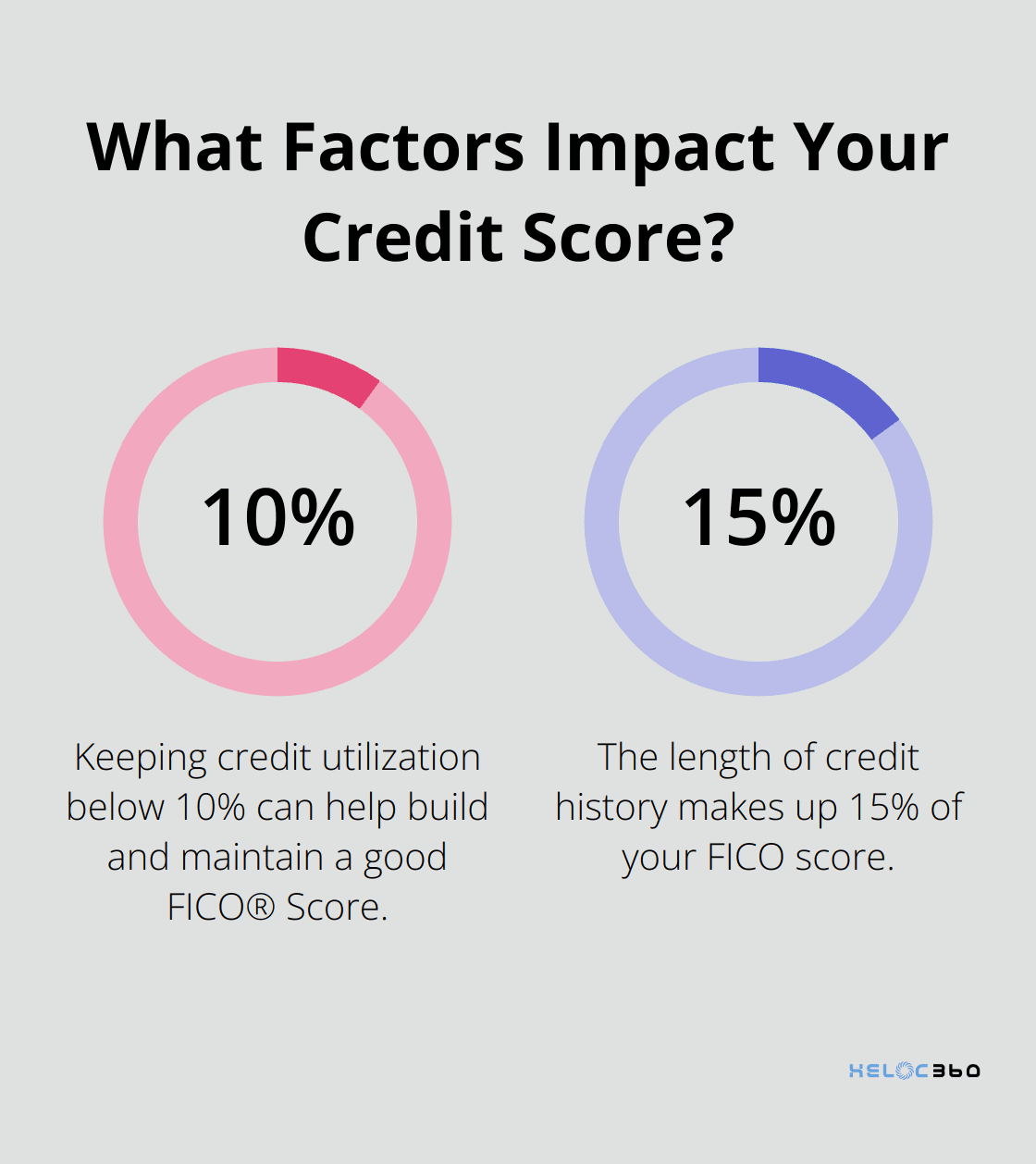

Keep your credit card balances low. Try to maintain a credit utilization ratio below 10%. For example, if you have a $10,000 credit limit, keep your balance under $1,000. Generally, keeping it below 10% (and consistently paying bills on time) can help you build and maintain a good FICO® Score.

Maintain Old Credit Cards

The length of your credit history makes up 15% of your FICO score. Keep old accounts open, even if unused, to maintain a longer average credit history.

Limit New Credit Applications

Each hard inquiry can lower your score. Space out new credit applications and only apply when necessary.

Check Your Credit Report for Errors

Dispute any inaccuracies you find with the credit bureaus. The removal of errors can lead to a quick boost in your score.

By following these steps, you can improve your credit and increase your chances of qualifying for a HELOC with favorable terms.

Final Thoughts

A solid credit foundation proves essential for HELOC approval. Most lenders require a minimum FICO® Score of 680, with the best rates offered to those with scores of 740 or higher. Your credit score represents just one aspect of the evaluation process, as lenders also consider factors such as debt-to-income ratio, loan-to-value ratio, and income stability.

Good credit habits benefit both HELOC approval and overall financial health. Timely bill payments, low credit utilization, and responsible account management can improve your creditworthiness and potentially qualify you for better HELOC terms. HELOC credit requirements can seem complex, but you don’t need to navigate this process alone.

HELOC360 aims to simplify the HELOC application process (by providing expert guidance and connecting you with suitable lenders). Our platform helps homeowners make informed decisions about leveraging their home equity for renovations, debt consolidation, or financial flexibility. We strive to unlock the full potential of your home’s value and help you achieve your financial goals.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.