Curious about your HELOC eligibility in 2025? You’re not alone.

At HELOC360, we’ve created a quick quiz to help you determine if you’re an ideal candidate for a Home Equity Line of Credit.

This assessment will guide you through the key factors lenders consider, including credit score, home equity, and income stability.

What Makes You HELOC-Eligible in 2025?

In 2025, HELOC eligibility has evolved. Let’s break down the key factors that lenders consider when evaluating your HELOC application.

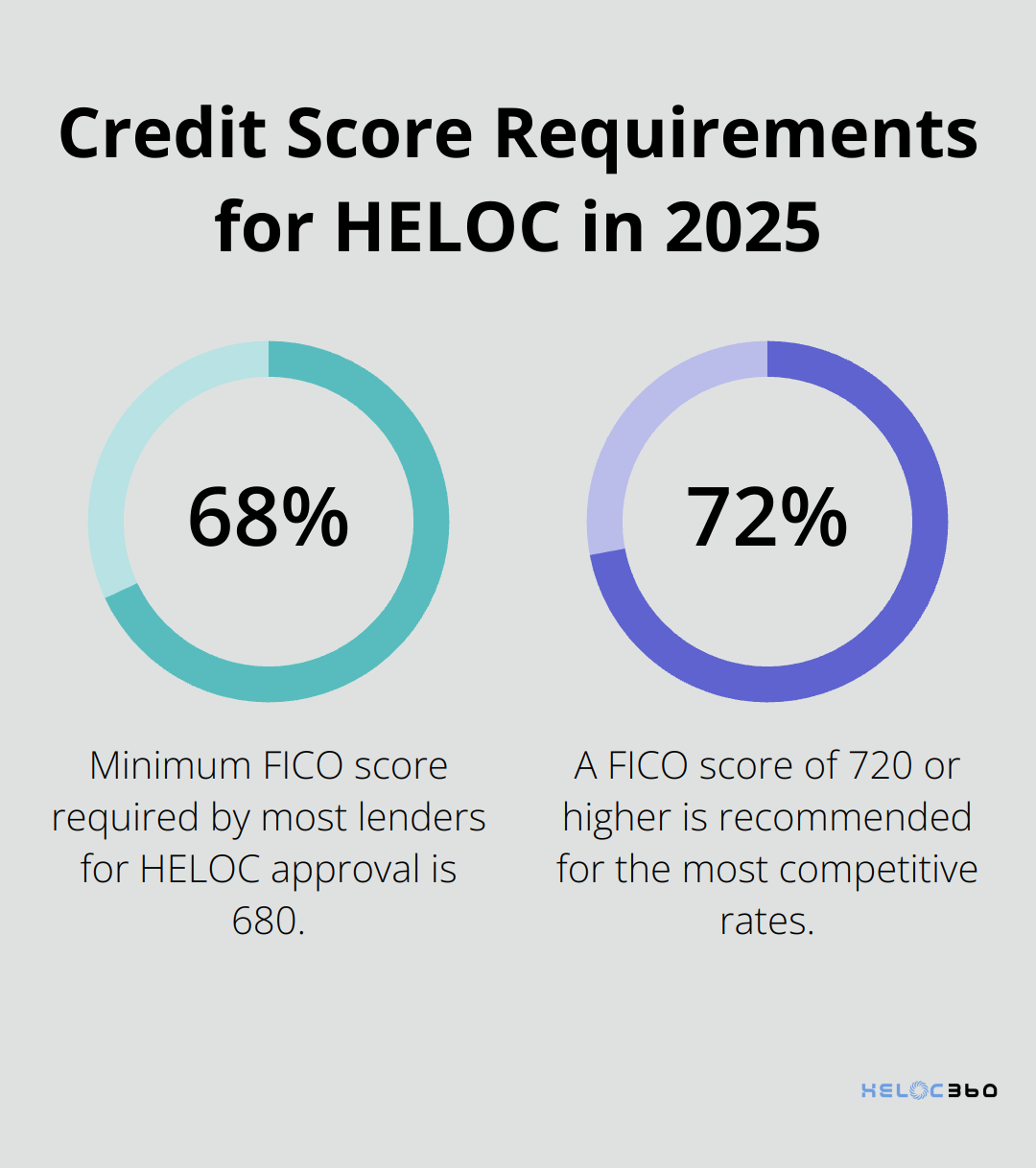

Credit Score: Your Gateway to Better Rates

Credit score plays a pivotal role in HELOC approval. In 2025, most lenders look for a minimum FICO score of 680. However, to secure the most competitive rates, try to achieve a score of 720 or higher. If your score falls short, don’t worry. You can boost your score quickly by paying bills on time and reducing credit card balances.

Debt-to-Income Ratio: A Balancing Act

Lenders scrutinize your debt-to-income (DTI) ratio to assess your ability to handle additional debt. In 2025, a DTI of 43% to 50% is typically acceptable, though some lenders may require it to be even lower. To calculate your DTI, divide your monthly debt payments by your gross monthly income. If your DTI is high, consider paying off some existing debts before you apply for a HELOC.

Home Equity: Your Borrowing Power

Your home equity determines how much you can borrow. Most lenders require you to have enough home equity. They typically allow borrowing up to 80-90% of your home’s value, minus your existing mortgage balance. For instance, if your home is worth $300,000 and you owe $200,000 on your mortgage, you could potentially access up to $70,000 (with a 90% loan-to-value limit).

Income Stability: Proving Your Reliability

Lenders want assurance that you can repay your HELOC. For W-2 employees, this usually means providing recent pay stubs and tax returns. Self-employed individuals face more scrutiny. Be prepared to show at least two years of tax returns and possibly profit and loss statements. Consistent or increasing income over time strengthens your application significantly.

The Overall Financial Picture

HELOC eligibility isn’t just about meeting minimum requirements. It’s about presenting a strong overall financial profile. Each lender has slightly different criteria, so don’t feel discouraged if one turns you down. Shop around and consider improving your financial standing if needed.

Now that we’ve covered the eligibility factors, let’s explore what makes an ideal HELOC candidate. Are you ready to see if you fit the bill?

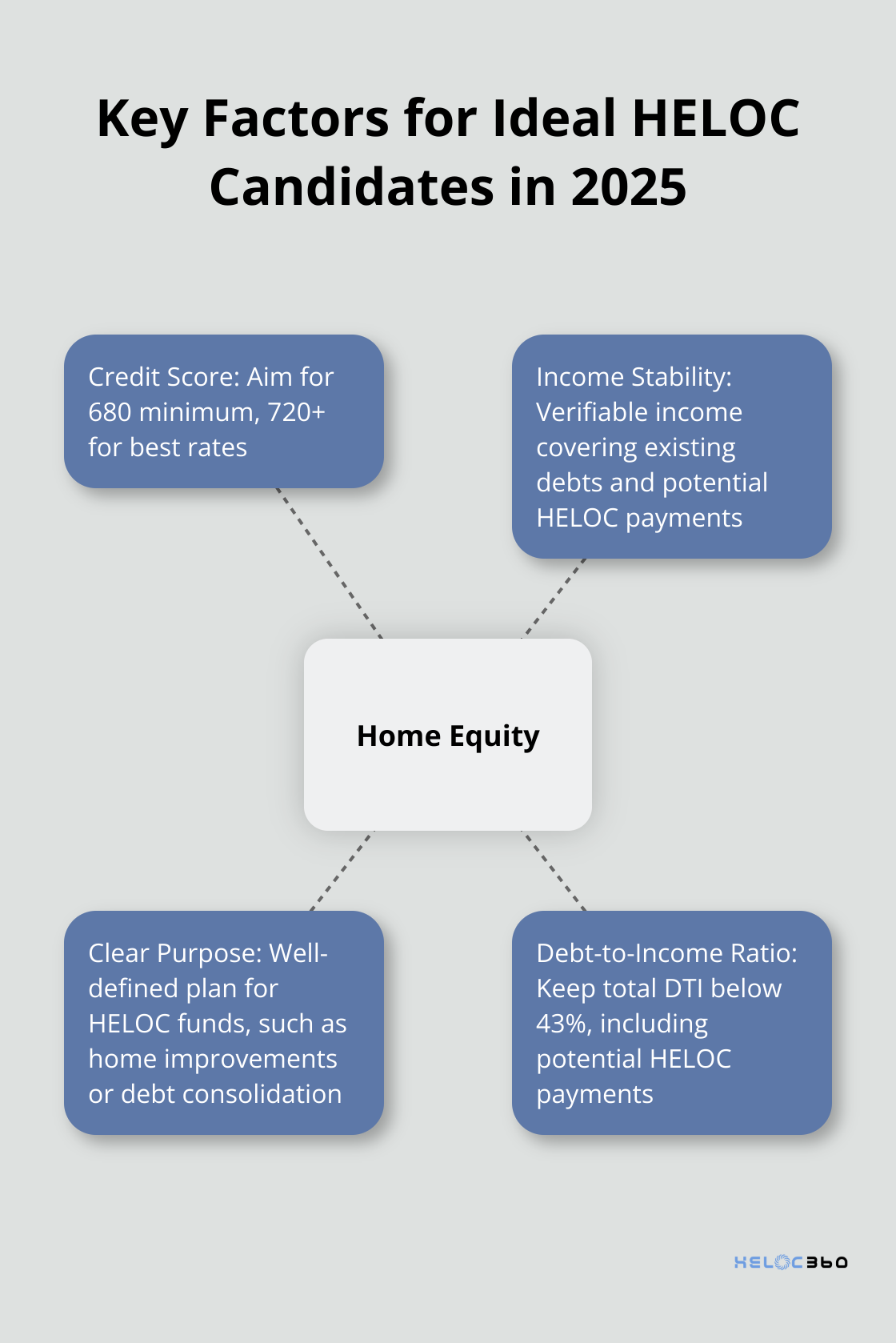

What Makes You the Perfect HELOC Candidate?

In 2025, the ideal HELOC candidate combines financial stability, substantial home equity, and clear objectives for fund usage. Let’s explore these key factors in detail.

A Solid Foundation of Home Equity

The cornerstone of a strong HELOC application is significant home equity. Lenders typically want to see at least 20% equity in your home. This means if your home is valued at $400,000, you should have at least $80,000 in equity. To calculate your equity, subtract your current mortgage balance from your home’s current market value. If you’re unsure about your home’s value, consider a professional appraisal or online valuation tools for an estimate.

Stellar Credit: Your Financial Report Card

Your credit history speaks volumes to lenders. While a credit score in the mid-600s might get you in the door, a higher score will likely secure you better rates and terms. According to Bankrate’s latest survey, the national average HELOC interest rate is 8.12% as of August 20, 2025. If your score isn’t quite where you want it to be, focus on paying down credit card balances and making all payments on time. Even a few months of diligent credit management can boost your score significantly.

Rock-Solid Income: Proving Your Repayment Power

Lenders want to see a stable, verifiable income that comfortably covers your existing debts plus potential HELOC payments. For W-2 employees, this typically means providing pay stubs and tax returns from the past two years. Self-employed individuals face a higher bar, often needing to show consistent or increasing income over the past two to three years through tax returns and financial statements. Try to achieve a total debt-to-income ratio below 43%, including your potential HELOC payments.

Clear Purpose: A Plan for Your HELOC Funds

A well-defined purpose for your HELOC funds not only helps you use the money wisely but also strengthens your application. Lenders favor applicants who plan to use the funds for home improvements, debt consolidation, or other financially sound purposes. Be prepared to explain your plans in detail. For instance, if you’re planning home improvements or renovations, have contractor quotes ready. If you’re consolidating debt, list out the debts you plan to pay off and how much you’ll save in interest.

Applicants who meet these criteria not only have a higher chance of approval but also tend to secure better rates and terms. However, don’t feel discouraged if you fall short in one area. Many lenders take a holistic view of your financial situation, and there’s often room for negotiation or improvement in your application. HELOCs shine in their flexibility, allowing you to borrow what you need, when you need it, without reapplying for new loans. Now, let’s examine some potential red flags that might disqualify you from a HELOC.

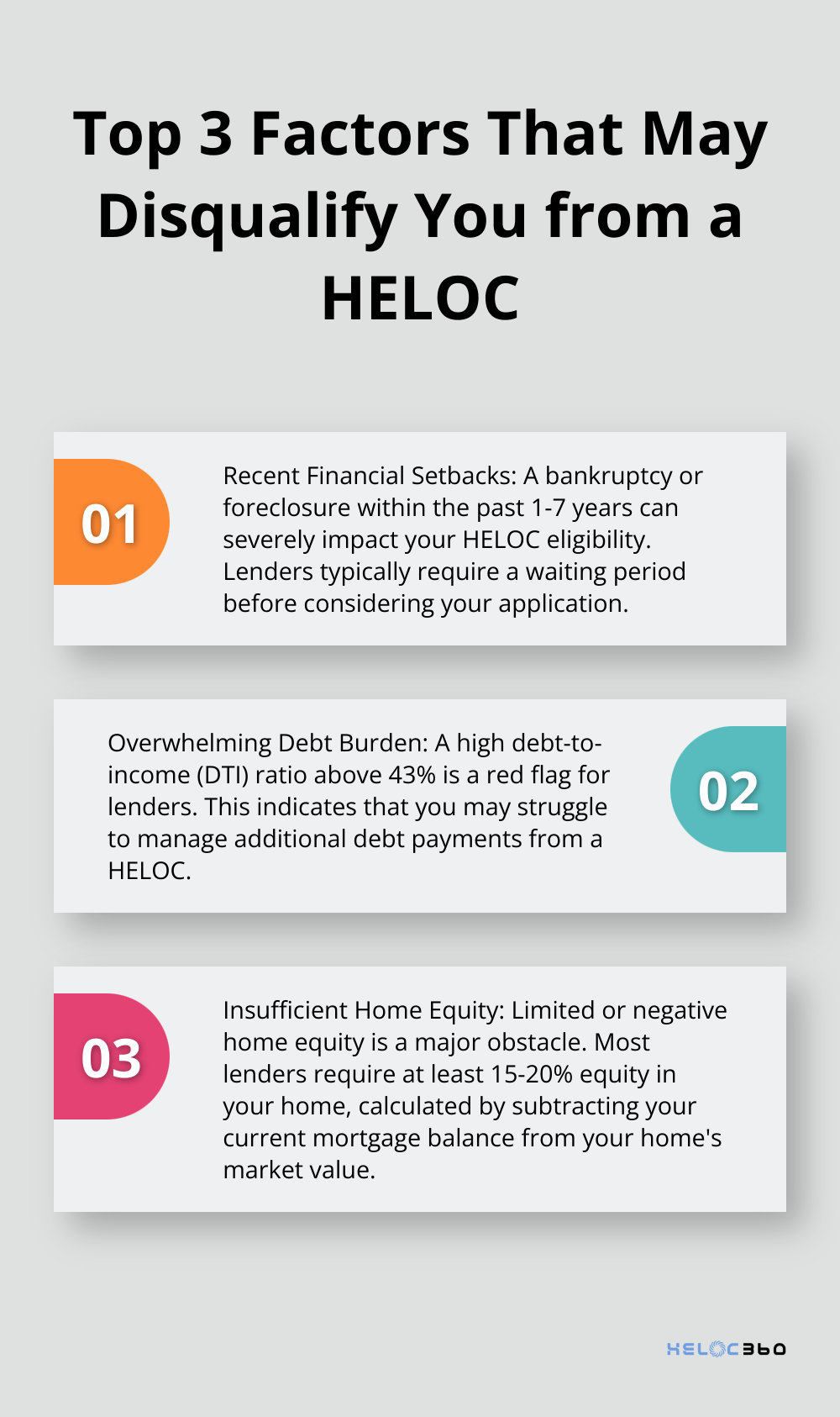

What Might Disqualify You from a HELOC?

While many homeowners qualify for HELOCs, certain factors can significantly reduce your chances of approval. Understanding these potential roadblocks can help you address them before applying or explore alternative financing options.

Recent Financial Setbacks

A recent bankruptcy or foreclosure can severely impact your HELOC eligibility. Most lenders require a waiting period of one to seven years after a bankruptcy discharge before they consider you for a HELOC. For foreclosures, the waiting period typically ranges from 3-7 years. During this time, you should focus on rebuilding your credit and financial stability. You can see significant improvements in your credit score within 12-24 months of consistent on-time payments and responsible credit use.

Overwhelming Debt Burden

A high debt-to-income (DTI) ratio is a red flag for lenders. Most lenders require a debt-to-income ratio below 43%. To improve your DTI, consider paying down high-interest debts or increasing your income. Even a small reduction in your DTI can significantly boost your chances of approval.

Property Value Concerns

Lenders are cautious about properties in areas with unstable or declining values. If your local real estate market has seen significant drops in property values, you might face challenges in HELOC approval. Keep an eye on local market trends and consider getting a professional appraisal if you’re unsure about your home’s current value. As of July 2025, the median existing-home price was $422,400, showing a general trend of stability in many markets.

Insufficient Equity

Limited or negative home equity is a major obstacle for HELOC approval. Most lenders require a maximum loan-to-value of 85%. If you’ve recently purchased your home or if property values have declined in your area, you might not have built up enough equity. To calculate your equity, subtract your current mortgage balance from your home’s estimated market value. If you’re close to the required equity threshold, try making extra mortgage payments to build equity faster.

Unstable Income

Lenders want to see a stable income that can comfortably cover your existing debts plus potential HELOC payments. If you have irregular income or have recently changed jobs, you might face challenges in HELOC approval. Self-employed individuals often need to show consistent or increasing income over the past two to three years through tax returns and financial statements. Try to achieve a total debt-to-income ratio below 43% (including your potential HELOC payments) to improve your chances of approval.

Final Thoughts

The ideal HELOC candidate in 2025 combines financial stability, substantial home equity, and a clear purpose for the funds. A strong credit score (680 or higher), significant home equity (at least 20% of property value), and stable income form the foundation for HELOC eligibility. Recent financial setbacks, high debt loads, or insufficient equity can impact your eligibility, so an honest self-assessment is essential before applying.

Your next steps should include gathering necessary documentation and comparing offers from multiple lenders. A professional appraisal can accurately determine your home’s worth, which is vital for your application. HELOC eligibility criteria may vary among lenders, so thorough research is key to finding the best terms for your situation.

If you need guidance through the HELOC process, HELOC360 offers expert assistance tailored to your unique financial goals. Their platform simplifies the HELOC process, providing you with the knowledge and connections to make informed decisions about leveraging your home equity. A HELOC can be a powerful financial tool when used wisely, helping you achieve your financial objectives.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.