Are HELOC payments tax deductible? This question often puzzles homeowners and real estate investors alike.

At HELOC360, we understand the importance of maximizing your financial benefits when it comes to home equity.

In this 2025 guide, we’ll break down the criteria for HELOC tax deductibility and clear up common misconceptions, helping you make informed decisions about your home equity line of credit.

What Is a HELOC and How Does It Affect Your Taxes?

Understanding Home Equity Lines of Credit

A Home Equity Line of Credit (HELOC) allows homeowners to borrow against their property’s equity. It functions similarly to a credit card, but with the added benefit of typically lower interest rates and potential tax advantages.

The Evolution of HELOC Tax Deductions

The tax landscape for HELOCs in 2025 mirrors recent years, following changes introduced by the Tax Cuts and Jobs Act of 2017. Interest paid on a HELOC may be deductible if used specifically for home improvements. For example, if you use your HELOC to renovate your kitchen or add a new room, you might qualify to deduct the interest on your taxes.

However, using funds to pay off credit card debt or finance a vacation disqualifies that interest from deduction. This distinction often catches homeowners off guard.

Navigating the Deduction Limit

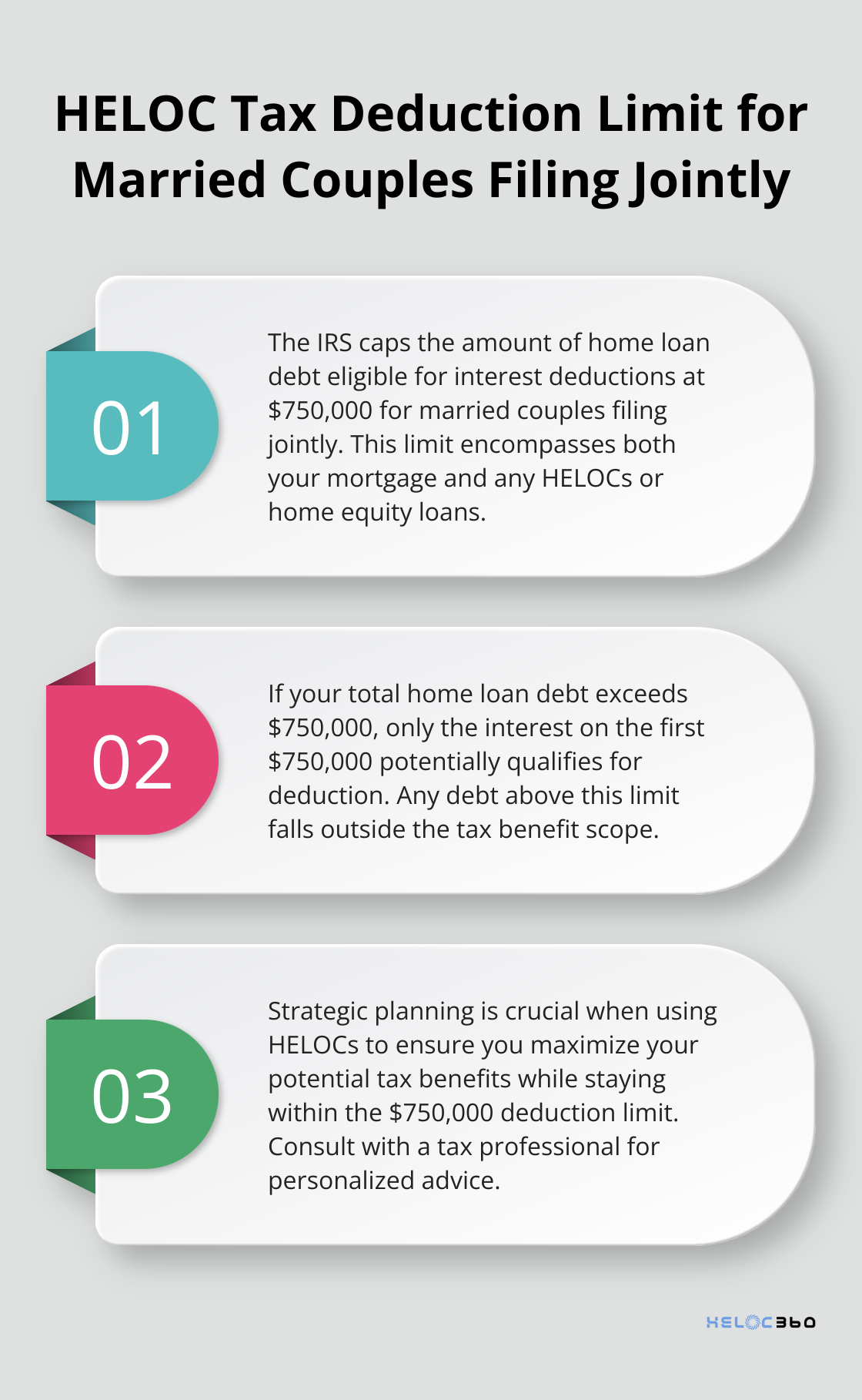

The IRS caps the amount of home loan debt eligible for interest deductions at $750,000 for married couples filing jointly. This limit encompasses your mortgage and any HELOCs or home equity loans.

Consider this scenario: You have a $600,000 mortgage and take out a $200,000 HELOC for home improvements. Only the interest on $750,000 of that debt potentially qualifies for deduction. The remaining $50,000 falls outside the tax benefit scope.

The Impact on Financial Planning

Understanding these rules can significantly influence your financial strategy. Strategic use of HELOCs in tax-advantaged ways can lead to substantial annual savings.

Take the case of a homeowner who planned to use a HELOC for both home improvements and debt consolidation. By adjusting their plan to use the HELOC solely for home improvements (and finding alternative methods for debt management), they maximized their potential tax deductions.

Leveraging HELOC Knowledge

Grasping these nuances extends beyond mere tax savings. It empowers you to make informed decisions that align with your overall financial goals. Whether you aim to increase your home’s value, manage debt, or create financial flexibility, understanding how HELOCs interact with your taxes proves invaluable.

As we move forward, let’s explore the specific criteria that determine HELOC tax deductibility, ensuring you can make the most of this financial tool.

How to Qualify for HELOC Tax Deductions

Understanding Qualifying Home Improvements

The IRS sets specific guidelines for deductible expenses. Improvements that add value to your home, extend its useful life, or adapt it for new uses typically qualify. Major renovations (such as room additions, kitchen upgrades, or energy-efficient system installations) fall into this category. However, routine repairs or maintenance do not qualify.

For instance, a roof replacement qualifies, but fixing a leak doesn’t. Similarly, a new HVAC system installation is deductible, while servicing your current one isn’t. It’s essential to maintain detailed records of these improvements (including receipts and contracts) to support your deduction claims.

Debt Limits and Their Impact

The IRS caps the total amount of home loan debt eligible for interest deductions at $750,000 for married couples filing jointly ($375,000 for single filers or married filing separately). This limit encompasses your mortgage and any HELOCs or home equity loans.

Consider this scenario: You have a $600,000 mortgage and take out a $200,000 HELOC. Only the interest on $750,000 of that total $800,000 debt potentially qualifies for deduction. The remaining $50,000 falls outside the tax benefit scope. This highlights the importance of strategic planning when using HELOCs.

Primary vs. Secondary Homes: What You Need to Know

While many homeowners focus on their primary residence, the IRS allows deductions for qualified loans on second homes as well. However, the $750,000 limit applies to the combined total of loans on both properties. This opens up interesting possibilities for those with vacation homes or investment properties.

For example, if you have a $500,000 mortgage on your primary home and take out a $250,000 HELOC on your vacation property for substantial improvements, you could potentially deduct interest on the full amount, as it falls within the $750,000 limit.

Documentation Requirements

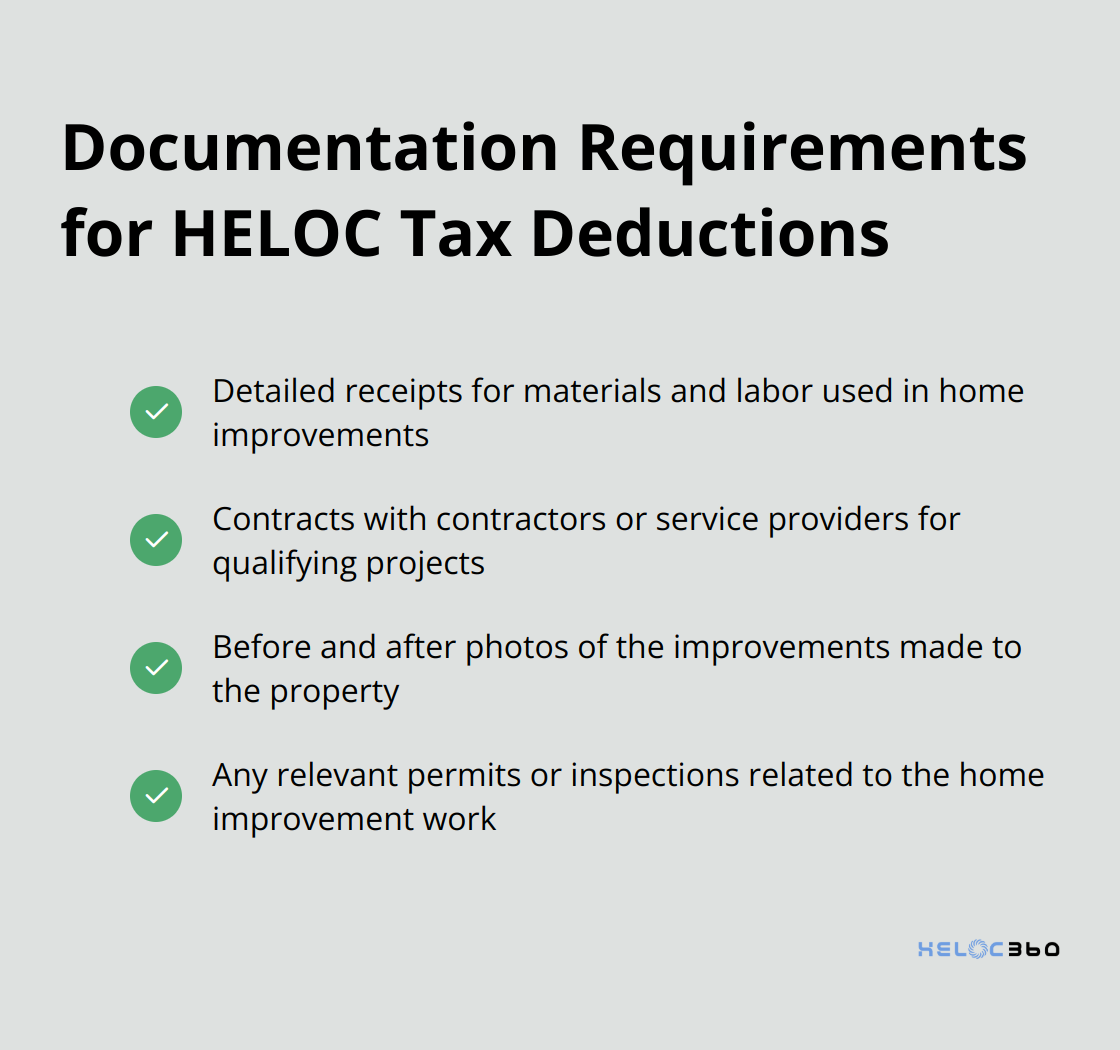

Proper documentation is key to claiming HELOC tax deductions. The IRS requires clear evidence that the funds were used for qualifying home improvements. This includes:

- Detailed receipts for materials and labor

- Contracts with contractors or service providers

- Before and after photos of the improvements

- Any relevant permits or inspections

Keeping these records organized will not only support your tax claims but also prove invaluable if you face an audit.

The Role of Professional Advice

Tax laws can be complex and subject to change. While this guide provides a solid foundation, consulting with a tax professional can help you navigate the nuances of your specific situation. They can offer personalized advice on maximizing your deductions while ensuring compliance with current tax regulations.

As we move forward, it’s important to address some common misconceptions about HELOC tax deductions that often lead homeowners astray. For tax years 2018 through 2025, interest paid on a loan secured by your main home or second home may be deductible, subject to certain conditions. Let’s clear up these misunderstandings to help you make more informed decisions about your home equity.

Debunking HELOC Tax Deduction Myths

HELOC tax deductions often confuse homeowners. This chapter clears up common misconceptions that could cost you money or lead to tax troubles.

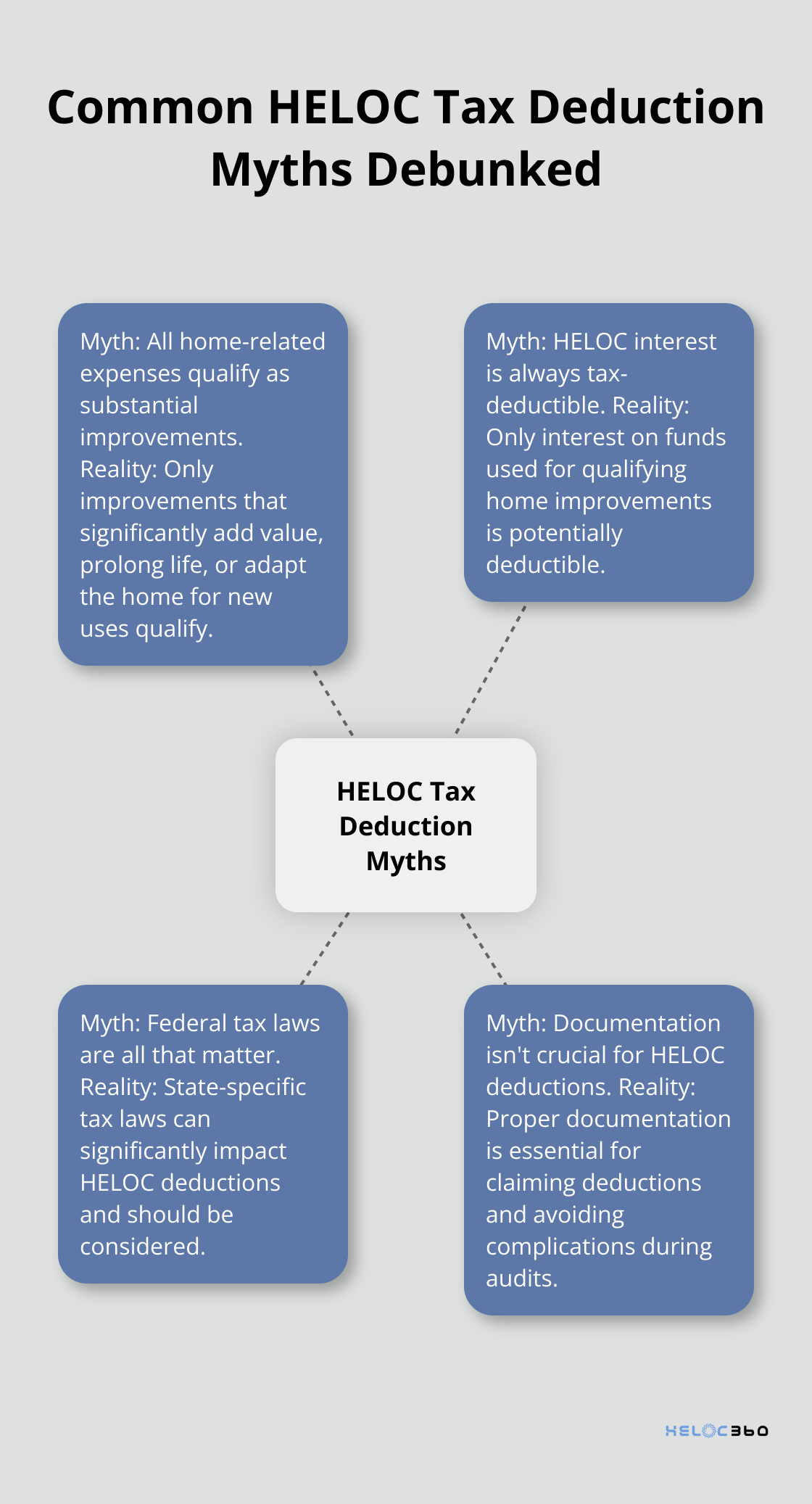

The “Substantial Improvement” Misconception

Many homeowners incorrectly assume any home-related expense qualifies as a substantial improvement. The IRS has specific criteria for what counts. The improvement must “substantially add” value to your home, prolong its useful life, or be permanent. Adding a new room or modernizing your kitchen qualifies, but painting your living room doesn’t. A useful guideline: if it significantly increases your home’s value or extends its life, it’s likely deductible. Routine maintenance probably isn’t.

Mortgage Interest vs. HELOC Interest: Key Differences

People often confuse HELOC interest with mortgage interest. While both can be tax-deductible, the rules differ. HELOC interest is only deductible if the borrowed funds are used to buy, build, or substantially improve the taxpayer’s home that secures the loan. If you use your HELOC for a vacation or to pay off credit card debt, that interest isn’t deductible.

State-Specific Tax Laws: An Often Overlooked Factor

Federal tax laws get most of the attention, but state-specific rules can significantly impact your HELOC deductions. Some states mirror federal guidelines, while others have their own set of rules. HELOC tax deductions can save you money, but it’s important to explore the rules and benefits specific to your state to decide if it’s worth it.

The “All HELOC Interest is Deductible” Myth

A prevalent misconception is that all HELOC interest is automatically tax-deductible. This isn’t true. The deductibility depends on how you use the funds. Only interest on HELOC funds used for qualifying home improvements (as defined by the IRS) is potentially deductible. Using HELOC money for personal expenses or non-qualifying purposes makes that portion of the interest non-deductible.

Overlooking Documentation Requirements

Many homeowners underestimate the importance of proper documentation for HELOC tax deductions. The IRS requires clear evidence that the funds were used for qualifying home improvements. This includes detailed receipts, contracts, before-and-after photos, and relevant permits or inspections. Failing to keep these records can result in denied deductions or complications during an audit.

Final Thoughts

HELOC payments tax deductibility hinges on specific criteria. The IRS allows deductions only for funds used for qualifying home improvements, within set debt limits. Proper documentation of HELOC fund usage and awareness of federal and state tax laws prove essential for maximizing benefits.

Tax laws surrounding HELOCs have changed since 2017. Not all HELOC interest qualifies for deduction, and “substantial improvement” has a precise definition. These factors highlight the need for careful planning when using a HELOC.

We at HELOC360 offer tailored solutions for effective home equity use. Our platform streamlines HELOC exploration, providing expert guidance and lender connections. Whether you plan renovations or seek financial flexibility, HELOC360 empowers informed decisions about your home equity (and potential tax benefits).

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.