HELOCs can be a great way to tap into your home’s equity, but they often come with a catch: the balloon payment. This final, large sum due at the end of your loan term can catch many homeowners off guard.

At HELOC360, we’ve seen how HELOC balloon payments can impact financial plans. That’s why we’re here to help you understand and prepare for this important aspect of your home equity line of credit.

What Is a HELOC Balloon Payment?

The Mechanics of Balloon Payments

A HELOC balloon payment is a lump sum paid at the end of a home equity line of credit account that pays off any outstanding balances in full. It’s not a minor detail – it’s a significant financial obligation that can surprise homeowners if they don’t prepare.

HELOCs typically have two phases: the draw period and the repayment period. During the draw period (which usually lasts 5-10 years), you can borrow against your credit line and make interest-only payments. When this period ends, some HELOCs require you to pay off the entire remaining balance in one go – that’s the balloon payment.

For example, if you borrowed $50,000 during your draw period and only made interest-only payments, you’d owe the full $50,000 as a balloon payment at the end of the term. This can be a substantial financial hit if you’re not ready for it.

The Rationale Behind Balloon Payments

Lenders include balloon payments in HELOC terms for several reasons. First, it allows them to offer lower monthly payments during the draw period, making the HELOC more attractive to borrowers. Second, it reduces the lender’s long-term risk by ensuring the loan is paid off in full by a specific date.

However, this structure can be risky for borrowers who don’t plan ahead. Borrowers can continue to draw funds throughout the draw period and are generally required to make only interest payments on the outstanding balance.

Debunking Common Myths

Many homeowners misunderstand HELOC balloon payments, which can lead to financial stress. Let’s clear up some common misconceptions:

- “All HELOCs have balloon payments.” In reality, while many do, some HELOCs transition into a repayment period with regular monthly payments of principal and interest.

- “Lenders will automatically refinance the balloon payment.” This isn’t guaranteed. Your ability to refinance depends on factors like your credit score, income, and home value at the time.

- “I can simply sell my home to cover the balloon payment.” While this is an option, it’s not always practical or desirable, especially if you want to stay in your home.

Understanding these facts can help you make informed decisions about your HELOC and prepare for any potential balloon payment. As we move forward, let’s explore how you can effectively prepare for your HELOC balloon payment and avoid financial surprises.

How to Prepare for Your HELOC Balloon Payment

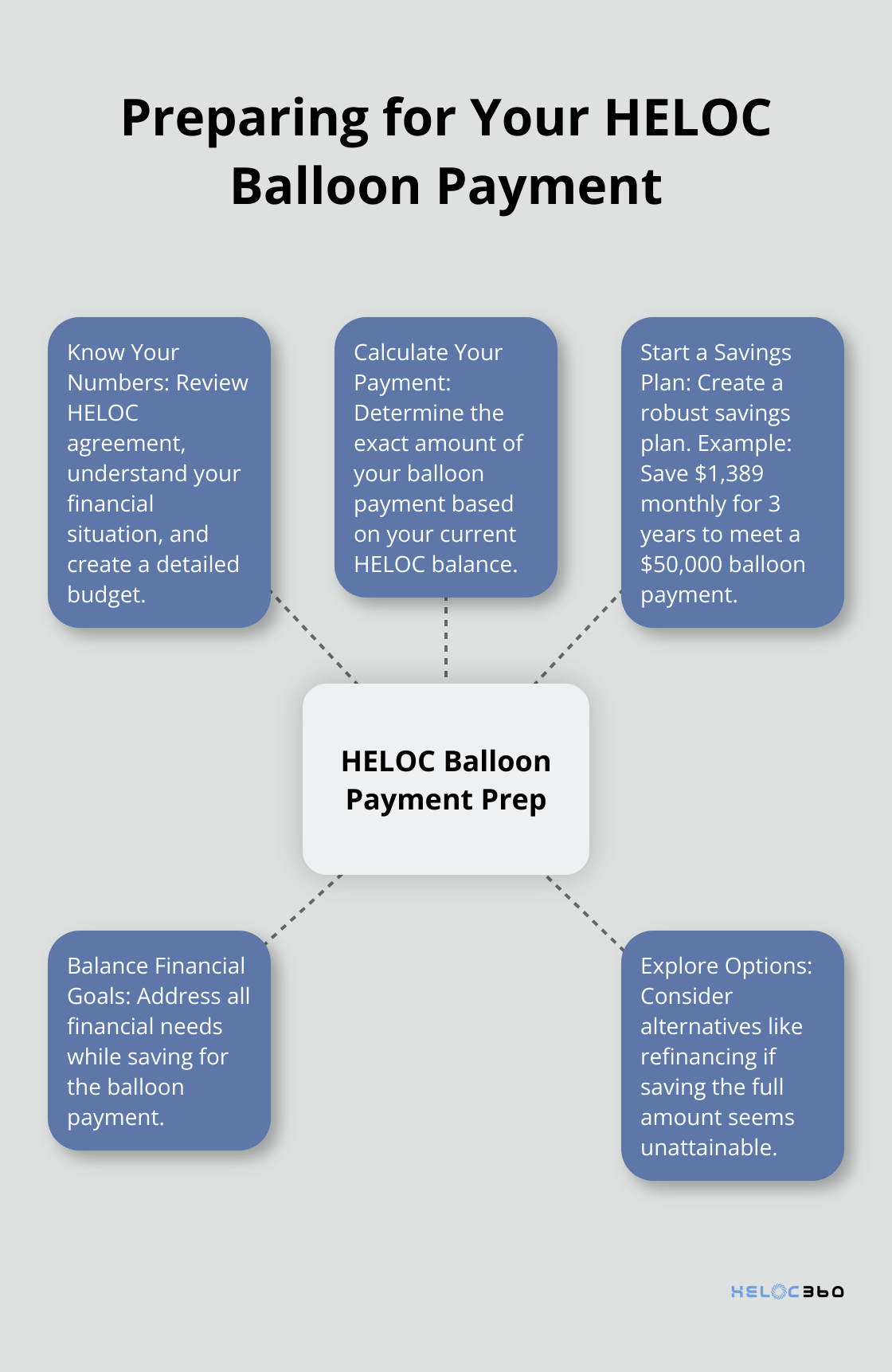

Know Your Numbers

The first step in preparation for your balloon payment involves a clear understanding of your financial situation. Review your HELOC agreement and identify key details such as the maturity date, current balance, and interest rate. These elements will help you grasp the size of the balloon payment you face.

Conduct a thorough examination of your income, expenses, and other debts. Create a detailed budget that accounts for all your financial obligations. This process will highlight areas where you can potentially reduce spending to save for the balloon payment.

Calculate Your Balloon Payment

After gaining clarity on your finances, determine the exact amount of your balloon payment. While your lender can provide this information, performing the calculation yourself can be empowering.

To calculate your balloon payment, start with your current HELOC balance. If you’ve made interest-only payments during the draw period, this balance will likely mirror your original borrowed amount. Add any additional draws you plan to make before the end of the term.

For instance, if you borrowed $75,000 and have made interest-only payments, your balloon payment will equal $75,000 plus any additional amounts you borrow before the draw period ends.

Start a Savings Plan

With your balloon payment amount in mind, create a robust savings plan. The earlier you initiate this process, the more manageable it becomes.

Consider this scenario: your balloon payment of $50,000 is due in three years. This situation requires you to save approximately $1,389 per month to meet this obligation. If this amount proves challenging within your current budget, explore additional strategies like increasing your income or reducing other expenses.

Set up a separate savings account specifically for your balloon payment. This approach can help you track your progress and resist the temptation to use these funds for other purposes.

Balance Your Financial Goals

While saving for your balloon payment is important, it shouldn’t overshadow other financial objectives (such as retirement savings or emergency funds). Strive for a balanced approach that addresses all your financial needs.

Explore Additional Options

If saving the full amount for your balloon payment seems unattainable, don’t lose hope. Various options exist for handling your HELOC balloon payment, including refinancing and other strategies. In the next section, we’ll explore these alternatives in detail, providing you with a comprehensive toolkit to address your HELOC balloon payment effectively.

How to Handle Your HELOC Balloon Payment

Refinance Your HELOC

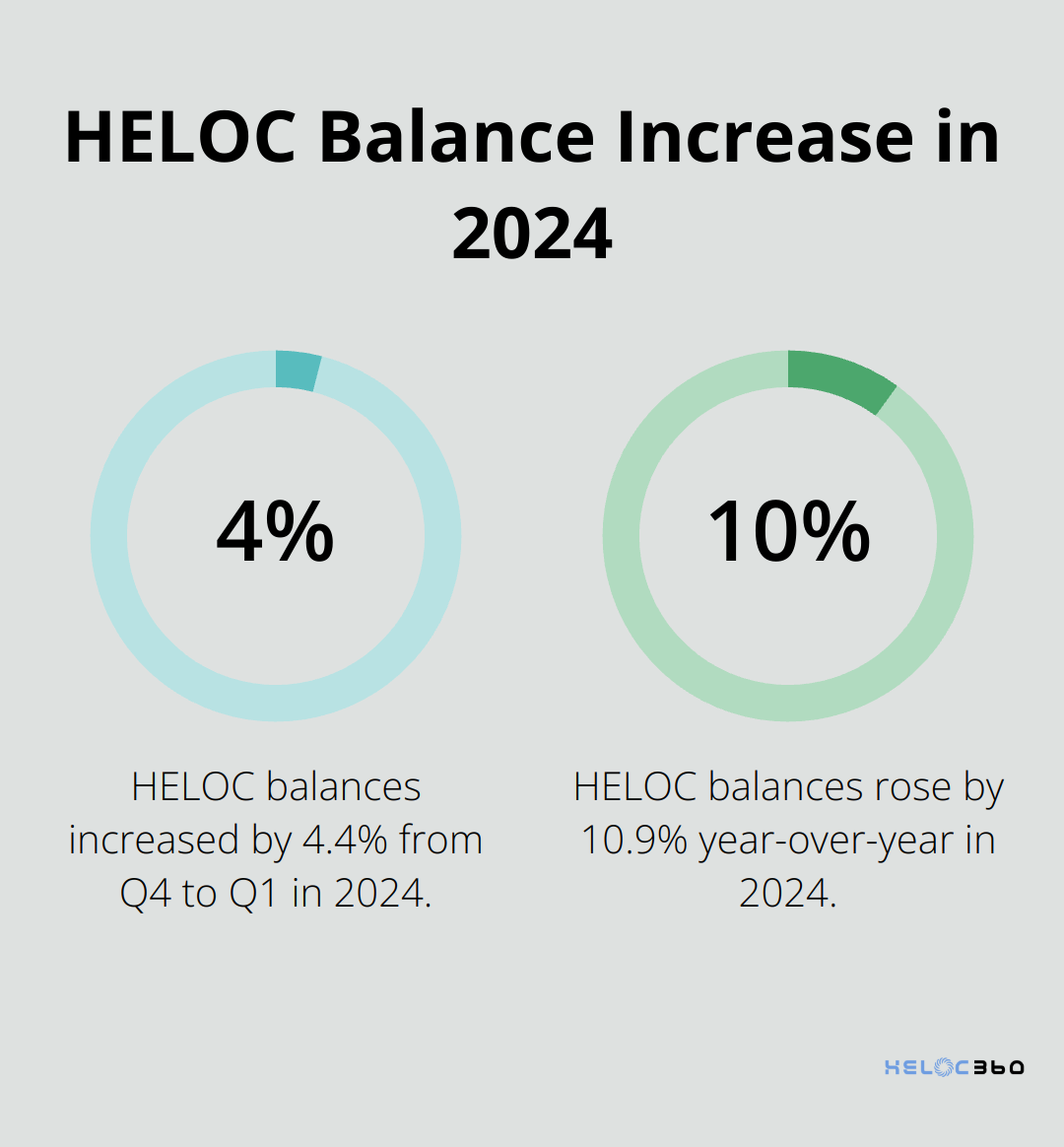

Refinancing your HELOC stands out as a common solution. This approach involves obtaining a new loan to settle your existing HELOC balance. HELOC balances jumped by $16 billion, or by 4.4% in Q1 from Q4, and by 10.9% year-over-year, to $376 billion in 2024.

When you refinance, you can opt for another HELOC with a new draw period or select a home equity loan with fixed payments. Keep in mind that refinancing typically incurs closing costs (ranging from 2% to 5% of the loan amount). You’ll also need to qualify based on your current credit score, income, and home value.

Convert to a Fixed-Rate Loan

Many lenders offer the option to convert your HELOC to a fixed-rate loan before the balloon payment becomes due. This strategy provides more predictable monthly payments and a set repayment term.

To pursue this option, contact your lender at least six months before your balloon payment is due. Ask about their conversion process and any associated fees.

Sell Your Home

If refinancing isn’t feasible and you’re open to moving, selling your home can be a viable option. The proceeds from the sale can pay off your HELOC balance, including the balloon payment.

This approach requires careful planning. Factor in the timeline when considering the sale option. Before listing your home, get a professional appraisal to ensure its current value will cover your mortgage balance and HELOC debt. If you’re in a seller’s market, you might even walk away with extra cash.

Use Other Assets

As a last resort, you might consider using other assets to pay off your HELOC balloon payment. This could include tapping into savings accounts, selling investments, or even borrowing from your 401(k).

However, financial advisors generally caution against using retirement funds to pay off debt. A hardship withdrawal may provide immediate relief, but it can be a major setback to your retirement savings.

If you’re considering this route, consult with a financial advisor to understand the long-term implications. They can help you weigh the costs and benefits of using different assets to address your HELOC balloon payment.

Final Thoughts

HELOC balloon payments can significantly impact your financial future if you don’t prepare. You have several options when facing a HELOC balloon payment, including refinancing, converting to a fixed-rate loan, selling your home, or using other assets. Each approach has its advantages and disadvantages, so you must carefully consider your unique circumstances before you make a decision.

Proactive planning will help you manage your HELOC balloon payment effectively. You should start early and explore all available options to avoid financial stress and make informed decisions that align with your long-term goals. At HELOC360, we understand the complexities of home equity lines of credit and the challenges that balloon payments can present.

Our platform helps homeowners navigate these financial waters with confidence. We provide expert guidance, simplify the process, and connect you with lenders that match your specific needs. Whether you want to refinance your HELOC, explore conversion options, or find alternative solutions, HELOC360 offers comprehensive support to help you make the most of your home’s equity.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.