Getting approved for a Home Equity Line of Credit (HELOC) can be a game-changer for homeowners looking to tap into their property’s value. However, the approval process can be challenging, especially if you’re not prepared.

At HELOC360, we’ve seen countless applications and know what it takes to boost your HELOC approval odds. This post will guide you through the key steps to strengthen your application and increase your chances of success.

What Lenders Look for in HELOC Applications

Credit Score: Your Financial Passport

Your credit score often serves as the first checkpoint for lenders. Most HELOC providers prefer a credit score of at least 680, with some setting the bar at 700 or higher. A FICO score of 700 is often used as a benchmark for HELOC rates. If your score falls below 680, you should prioritize its improvement before submitting an application. Effective strategies include reducing credit card balances, ensuring timely payments, and avoiding new credit accounts.

Debt-to-Income Ratio: Striking the Right Balance

Lenders assess your ability to manage additional debt through your debt-to-income (DTI) ratio. They typically seek a DTI of 43% or lower, meaning your monthly debt payments (including the potential HELOC payment) should not exceed 43% of your gross monthly income. If your DTI exceeds this threshold, try to pay off existing debts or increase your income before applying.

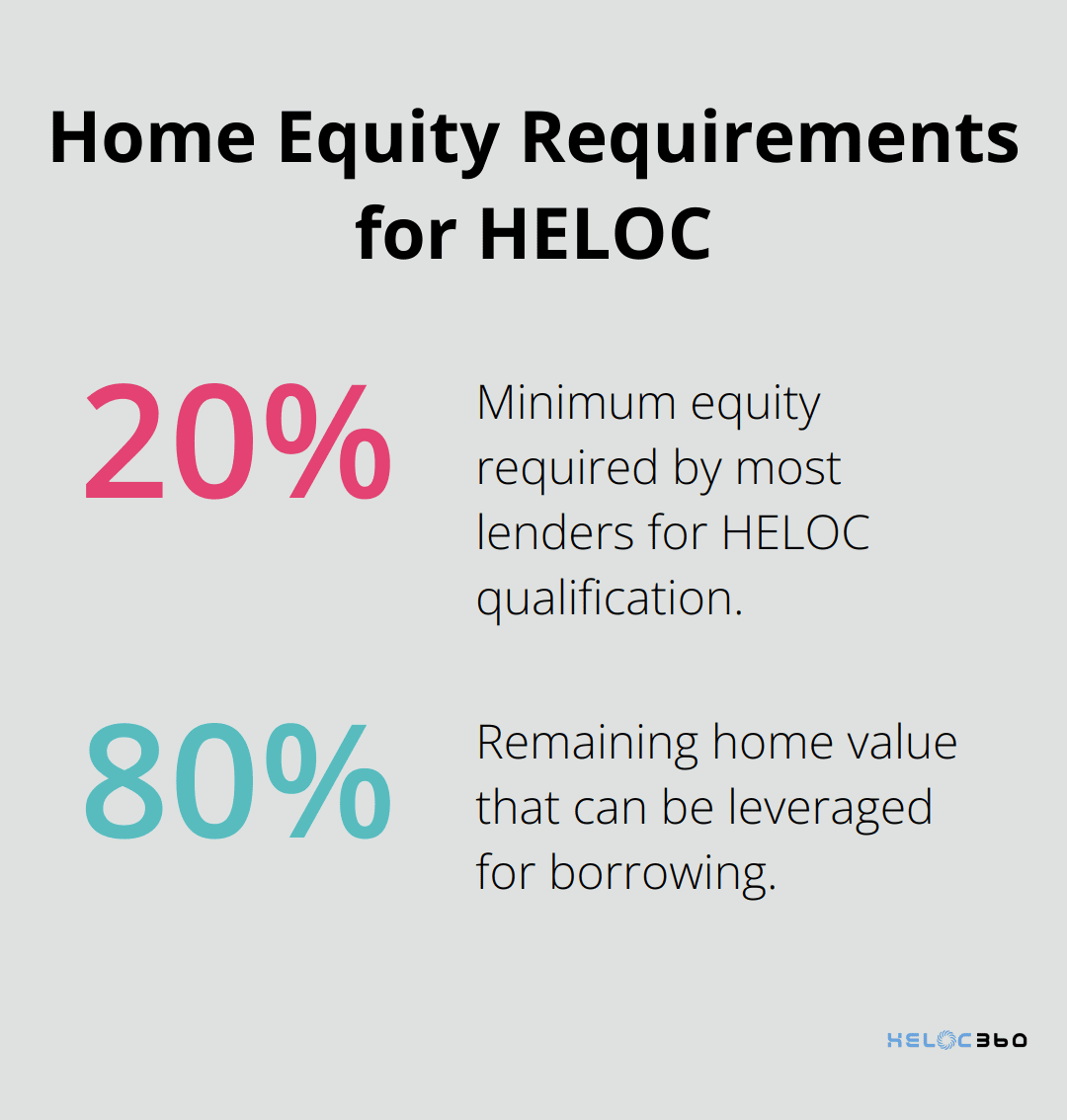

Home Equity: Unlocking Your Borrowing Potential

Your available home equity directly influences your borrowing capacity. Most lenders require at least 20 percent equity in your home to qualify for a home equity loan or line of credit. For instance, if your home’s value is $300,000 and you owe $200,000 on your mortgage, you have $100,000 in equity. A lender might allow you to borrow up to $40,000, preserving 20% equity ($60,000) in your home.

Income and Employment: Demonstrating Stability

Lenders seek evidence of a stable and sufficient income to repay the HELOC. They usually examine your employment history and income for the past two years. Self-employed applicants should prepare additional documentation, such as tax returns and profit and loss statements. A consistent income and long-term employment with the same company can significantly strengthen your application.

Documentation: Preparing Your Financial Dossier

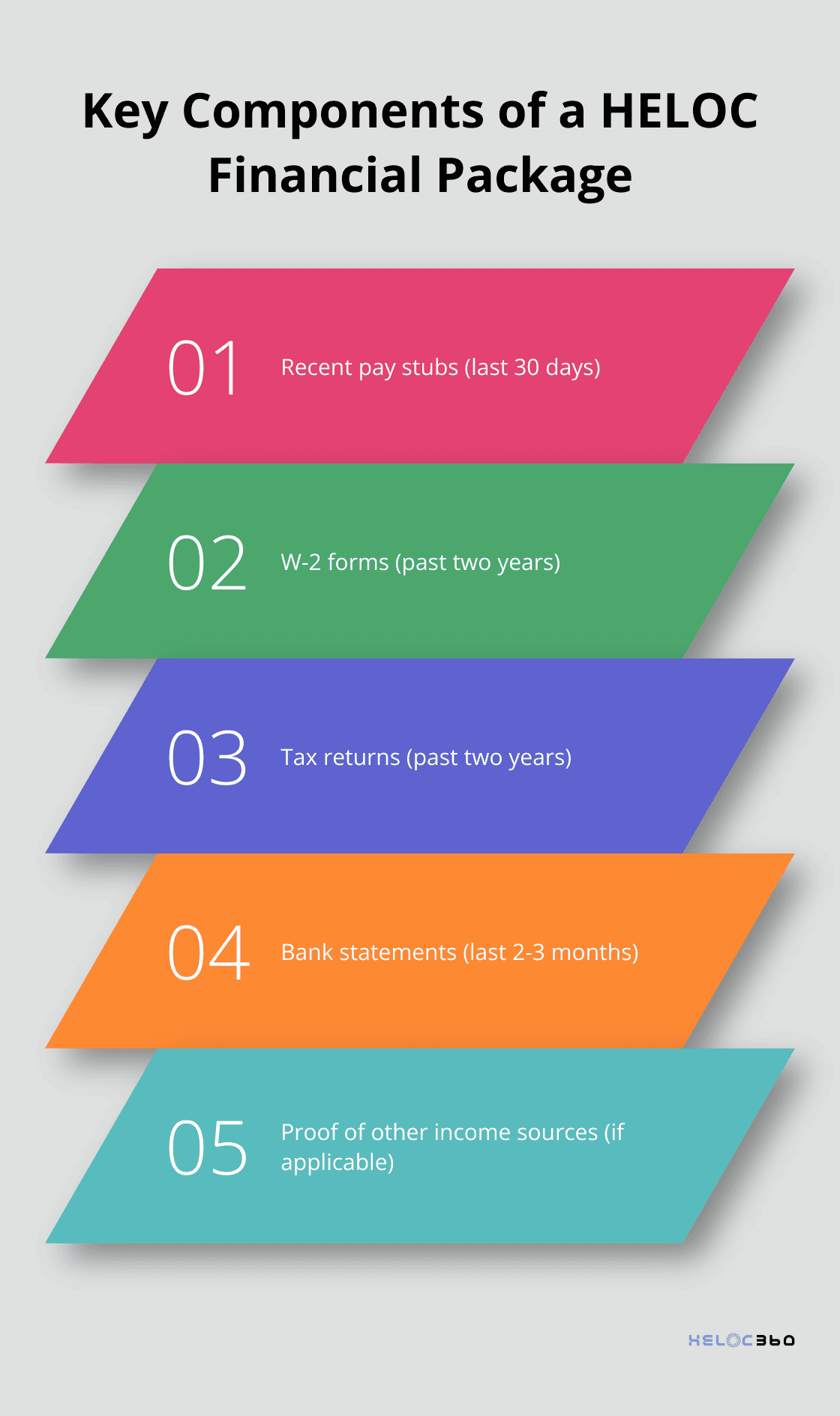

Lenders require comprehensive documentation to verify your financial situation. This typically includes:

- Recent pay stubs (last 30 days)

- W-2 forms (past two years)

- Tax returns (past two years)

- Bank statements (last 2-3 months)

- Proof of other income sources (if applicable)

Additional documentation may include a signed current year tax return extension, trust agreement (all pages must be submitted), 30-day payoff statement for all required payoffs, and power of attorney documentation if applicable.

Gathering these documents in advance can streamline your application process and demonstrate your organizational skills to potential lenders.

Understanding these key factors can help you present a strong HELOC application. However, each lender may have slightly different criteria. To maximize your chances of approval, you should thoroughly research and compare offers from multiple lenders. This approach will not only increase your odds of securing a HELOC but also help you find the most favorable terms for your financial situation.

How to Strengthen Your Financial Profile for HELOC Approval

Boost Your Credit Score

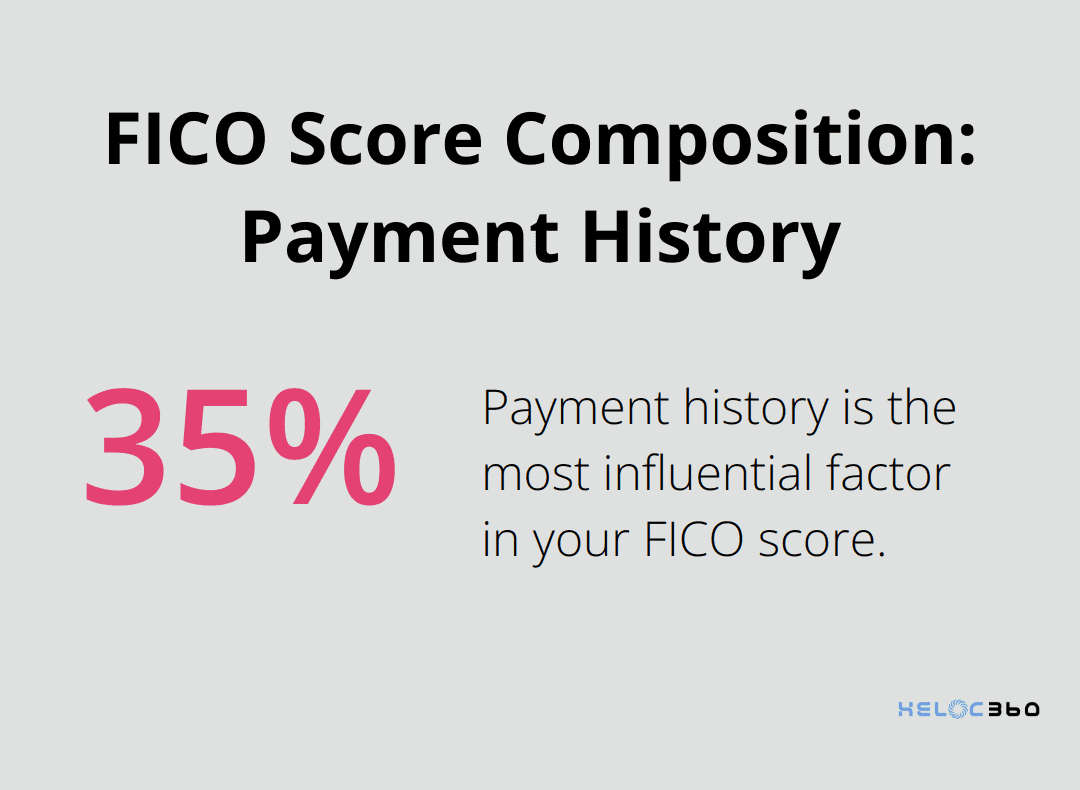

Applying for, opening and using a HELOC can help or hurt your credit scores depending on your overall credit profile and how you manage the account. Pay all bills on time to improve it. Set up automatic payments to avoid late fees and negative marks on your credit report. Payment history accounts for 35% of your FICO score (making it the most influential factor).

Reduce your credit utilization ratio. Try to keep your credit card balances below 30% of your credit limits. For a $10,000 credit limit, maintain a balance under $3,000. This strategy can greatly impact your score, as credit utilization comprises 30% of your FICO score.

Become an authorized user on a family member’s credit card with a long history of on-time payments. This can add positive payment history to your credit report, potentially increasing your score.

Lower Your Debt-to-Income Ratio

Create a detailed budget to identify areas where you can cut expenses. Redirect the saved money towards paying down existing debts, focusing on high-interest loans first.

Use the debt avalanche method: target the debt with the highest interest rate while making minimum payments on others. This approach can save you money on interest over time and help lower your DTI faster.

Explore ways to increase your income. Ask for a raise, take on part-time work, or start a side hustle. Even a modest increase in income can significantly impact your DTI ratio.

Increase Your Home Equity

Make extra mortgage payments to build home equity. Even small additional payments can add up over time. An extra $100 per month on a $200,000, 30-year mortgage at 4% interest could save you over $26,000 in interest (and shorten your loan term by four years).

Improve your home to increase its value and your equity. Focus on projects with high return on investment (ROI). Replacing your garage door offers an average ROI of 93.3%, while a minor kitchen remodel can yield an ROI of 72.2%.

Stabilize and Document Your Income

Self-employed applicants should maintain meticulous financial records. Traditionally, lenders require several documents to approve a HELOC. These include proof of income, such as pay stubs or tax returns, and verification of other financial information.

W-2 employees should stay with the same employer for at least two years to demonstrate income stability. If you’ve recently changed jobs within the same field, prepare to explain how this move contributes to your career progression and financial stability.

Keep detailed records of any additional income sources, such as rental properties, investments, or freelance work. Provide at least two years of documentation for these income streams to strengthen your application.

These strategies will improve your financial profile and increase your chances of HELOC approval. The next step is to prepare a strong HELOC application that showcases your improved financial standing.

How to Craft a Winning HELOC Application

Compile a Comprehensive Financial Package

Start your application process by collecting all necessary documentation. Include recent pay stubs, W-2 forms from the past two years, tax returns, and bank statements from the last few months. Self-employed applicants should add profit and loss statements and business tax returns. A 2024 study revealed that HELOC credit limits were up in 2024.

Don’t overlook proof of other income sources, such as rental income or investment dividends.

Showcase Your Financial Strengths

Put your positive financial attributes in the spotlight. Emphasize your track record of timely bill payments. Payment history is a factor in your credit score, and lenders review your credit report to see how well you manage your accounts.

Document any recent promotions or pay raises.

Address Potential Red Flags Proactively

Take a proactive approach to any potential issues in your financial history. Provide context for periods of unemployment or past credit issues, and explain how you overcame them.

If you have a high debt-to-income ratio, outline your plans to reduce it. This could involve paying off a car loan or consolidating credit card debt.

Consider Pre-Qualification

Many lenders offer pre-qualification, which provides an estimate of your approval odds without impacting your credit score. Warrantable condos qualify for conventional loans backed by Fannie Mae and Freddie Mac, often with lower interest rates.

Pre-qualification also allows you to compare offers from different lenders. While many homeowners choose HELOC360, exploring multiple options ensures you get the best terms for your situation.

Tailor Your Application to Lender Requirements

Research the specific requirements of your chosen lender. Some lenders may have unique criteria or prefer certain documentation formats. Tailoring your application to these specifications can streamline the process and demonstrate your attention to detail.

Include a well-written letter explaining your reasons for seeking a HELOC and how you plan to use the funds. This personal touch can help lenders understand your financial goals and potentially view your application more favorably.

Final Thoughts

HELOC approval requires strategic preparation and a thorough understanding of lender requirements. You will improve your chances of success when you apply with a high credit score, low debt-to-income ratio, and substantial home equity. Gather all necessary documents in advance, address potential issues in your financial history, and prepare to explain your intended use of funds.

HELOC360 simplifies the application process and provides expert guidance to help homeowners navigate HELOC applications successfully. Our platform connects you with lenders that match your unique financial situation. You can unlock the full potential of your home equity and achieve your financial goals with confidence through our comprehensive HELOC solutions.

A HELOC can serve as a powerful financial tool when used wisely. You can transform your home’s value into a gateway for new opportunities, such as funding major renovations or consolidating debt. These strategies and resources will help you secure HELOC approval and realize your financial aspirations.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.