HELOC deferment has become a hot topic in 2025, with many homeowners seeking financial flexibility.

At HELOC360, we’ve seen a surge in questions about this option.

This post will explore the ins and outs of deferring HELOC payments, including eligibility requirements, potential benefits, and long-term implications.

What Is HELOC Payment Deferral?

Definition and Basics

HELOC payment deferral allows homeowners to temporarily pause their Home Equity Line of Credit payments. This option has gained popularity in 2025 as economic uncertainties persist. Lenders typically offer this solution during financial hardships to provide short-term relief. During the draw period, which typically lasts up to 10 years, borrowers are usually only required to pay interest on what they borrow.

Reasons for Considering Deferral

Financial setbacks often strike unexpectedly. Common reasons homeowners seek payment deferrals include:

- Job loss

- Medical emergencies

- Sudden income reductions

An Urban Institute study revealed that elevated home prices and interest rates have kept the cost burden for a median-priced home above 30 percent of the median household’s income, highlighting the relevance of HELOC deferrals as a short-term solution.

Comparison with Other Payment Options

Deferrals differ from refinancing or loan modifications in that they don’t alter your loan terms. They simply postpone payments for a set period (usually 3 to 6 months). However, it’s important to note that interest often continues to accrue during this time. While deferrals offer immediate relief, they don’t serve as a long-term fix.

The Deferral Process

To initiate a deferral, homeowners must contact their lender directly. Many major banks have streamlined this process since the pandemic. For example, Wells Fargo now offers an online deferral request form, which can reduce approval times to as little as 48 hours.

Alternative Options

Deferral isn’t the only available option. Some lenders provide:

- Interest-only payments

- Reduced payment plans

These alternatives might better suit your financial situation. It’s crucial to explore all available options before making a decision.

As we move forward, let’s examine the specific conditions lenders typically require for HELOC payment deferral eligibility. Understanding these requirements will help you determine if this option aligns with your current financial circumstances.

Who Can Defer HELOC Payments?

Eligibility Requirements

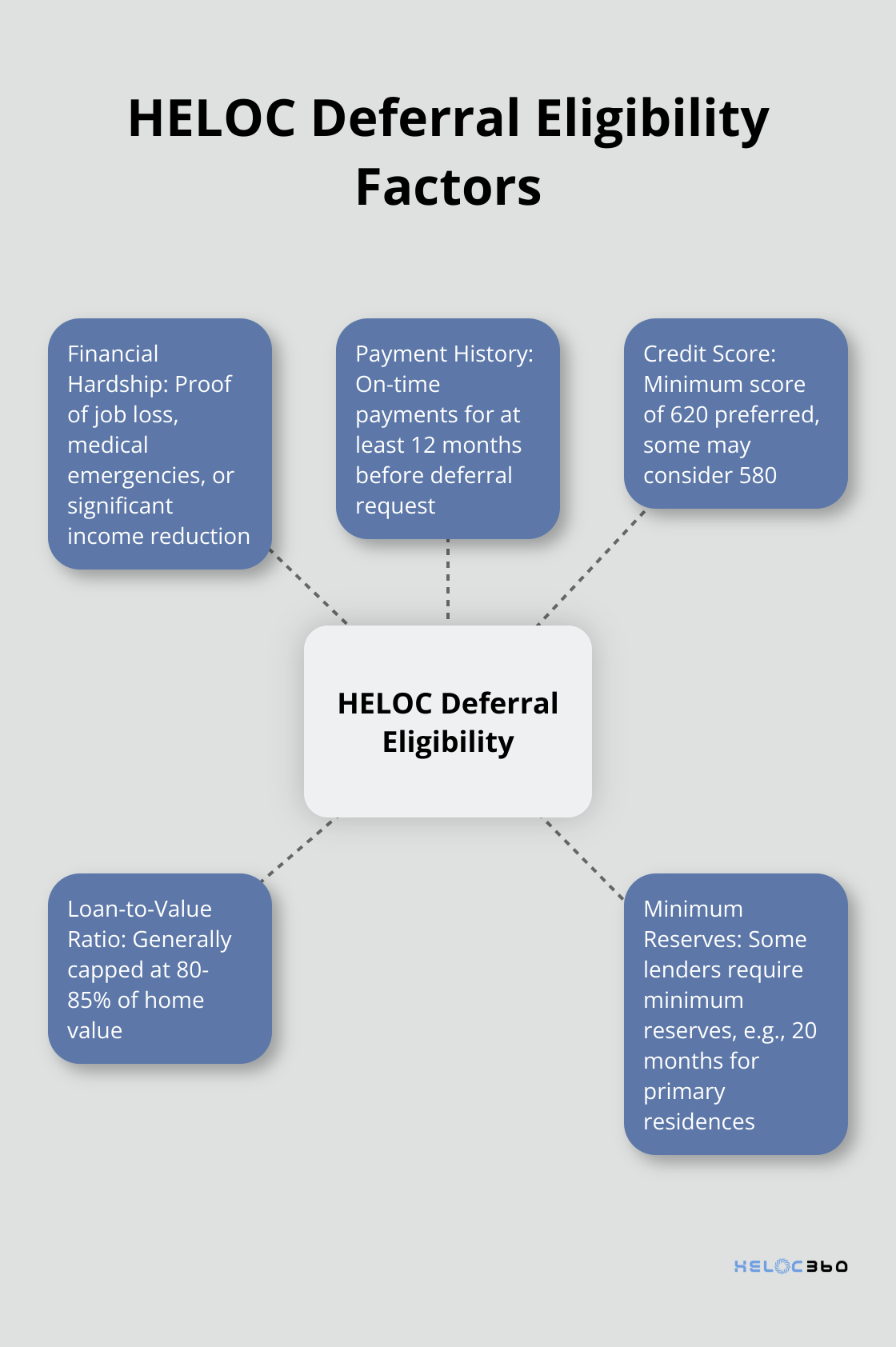

Lenders have specific criteria to determine who can defer HELOC payments. Most require borrowers to prove financial hardship, such as job loss, medical emergencies, or significant income reduction. Bank of America, for example, requires minimum reserves for primary residences, with loans up to $2 million requiring minimum reserves of 20 months. Wells Fargo has a similar threshold but also considers increased expenses due to unforeseen circumstances.

Your payment history matters. Lenders typically want to see on-time payments for at least 12 months before the deferral request. Recent late payments or defaults can significantly reduce your approval chances.

Credit Score Considerations

While a perfect credit score isn’t necessary, it impacts your deferral chances. Most lenders prefer a minimum credit score of 620. Some may consider scores as low as 580 if other factors are strong. Deferred payments generally won’t directly hurt your credit, according to Experian.

Loan-to-Value Ratio

Your current loan-to-value (LTV) ratio is another critical factor. Lenders generally cap this at 80-85%. If your home’s value has decreased since you took out the HELOC, you might face challenges. The National Association of Realtors reported a 5.2% average increase in home values in 2024 (which could work in your favor).

Deferral Duration

The length of deferral periods varies by lender. Most offer 3 to 6 months, with some extending up to 12 months in extreme cases. JPMorgan Chase offers initial 3-month deferrals with the option to extend for another 3 months upon review.

Interest typically continues to accrue during the deferral period. This means your overall debt could increase, even though you’re not making payments.

Application Process

To apply for a deferral, you’ll need to provide:

- Proof of income (or loss of income)

- Recent bank statements

- A hardship letter explaining your situation

Some lenders have streamlined this process. Citibank now offers an online portal where borrowers can upload documents and receive decisions within 5 business days.

Post-Deferral Options

After the deferral period, lenders may offer different repayment options. These could include:

- Lump-sum repayment of deferred amount

- Spreading the deferred amount over future payments

- Extending the loan term

Understanding these options is important for long-term financial planning.

Now that we’ve covered who can defer HELOC payments and what the process entails, let’s explore the pros and cons of this financial strategy. This information will help you make an informed decision about whether deferring your HELOC payments is the right choice for your situation.

Is Deferring HELOC Payments Right for You?

Short-Term Benefits of Deferral

HELOC payment deferral offers immediate financial relief during hardships. If you carry balances on credit cards from month to month, consolidating that debt into a HELOC can lessen the amount of interest you pay and help pay off debts.

Long-Term Financial Impact

The relief from deferral is temporary. Interest typically continues to accrue during the deferral period, which increases your overall debt. On a $100,000 HELOC with a 6% interest rate, a 6-month deferral could add $3,000 to your balance. This results in higher payments or a longer repayment term when you resume payments.

Effects on Credit Score

A HELOC deferral doesn’t automatically harm your credit score. The Consumer Financial Protection Bureau confirms that if you agree upon the deferral with your lender, it shouldn’t appear as a missed payment. However, the increased debt load could impact your credit utilization ratio, potentially affecting your score indirectly.

Impact on Future Borrowing

A deferred HELOC might affect your ability to secure future loans. Lenders may view it as a sign of financial instability. A 2024 study by LendingTree found that 22% of borrowers who deferred payments faced challenges obtaining new credit within the following year.

Alternative Options to Consider

Before you opt for deferral, consider alternatives. Some lenders offer interest-only payments or reduced payment plans. These options keep you in the habit of making payments while providing some relief. A financial advisor can help you weigh these options against deferral.

Final Thoughts

HELOC deferment offers short-term relief for homeowners facing financial challenges. However, it can increase overall debt due to accruing interest during the deferral period. Homeowners should explore alternatives like interest-only payments or reduced payment plans before choosing deferment.

The decision to defer HELOC payments requires careful consideration of long-term financial implications. Increased debt load may affect credit utilization ratios and future borrowing capacity. Consulting with a financial advisor can help navigate the complexities of this decision.

HELOC360 provides expert guidance to help homeowners explore various options and connect with suitable lenders. Our platform simplifies the process and empowers you to make informed decisions about your home equity (a valuable asset). We encourage you to leverage our resources for effective financial planning.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.