Funding your education can be a daunting task, with rising costs and limited options. Many homeowners are turning to Home Equity Lines of Credit (HELOCs) as an alternative to traditional student loans.

At HELOC360, we’ve seen a growing interest in using HELOCs for education expenses. This blog post will explore the pros and cons of this financing strategy, helping you make an informed decision about whether a HELOC is the right choice for your educational funding needs.

How Does a HELOC Work for Education Funding?

The Mechanics of a HELOC

A Home Equity Line of Credit (HELOC) allows you to borrow against the equity in your home, which is the difference between the home’s market value and the amount you still owe on your mortgage. It functions like a credit card, with your home as collateral. Lenders approve a maximum credit limit based on your home’s value and outstanding mortgage balance. During the draw period (typically 10 years), you can borrow as needed and pay interest only on the amount used. The repayment period follows, where you repay both principal and interest.

The Appeal of HELOCs for Education Costs

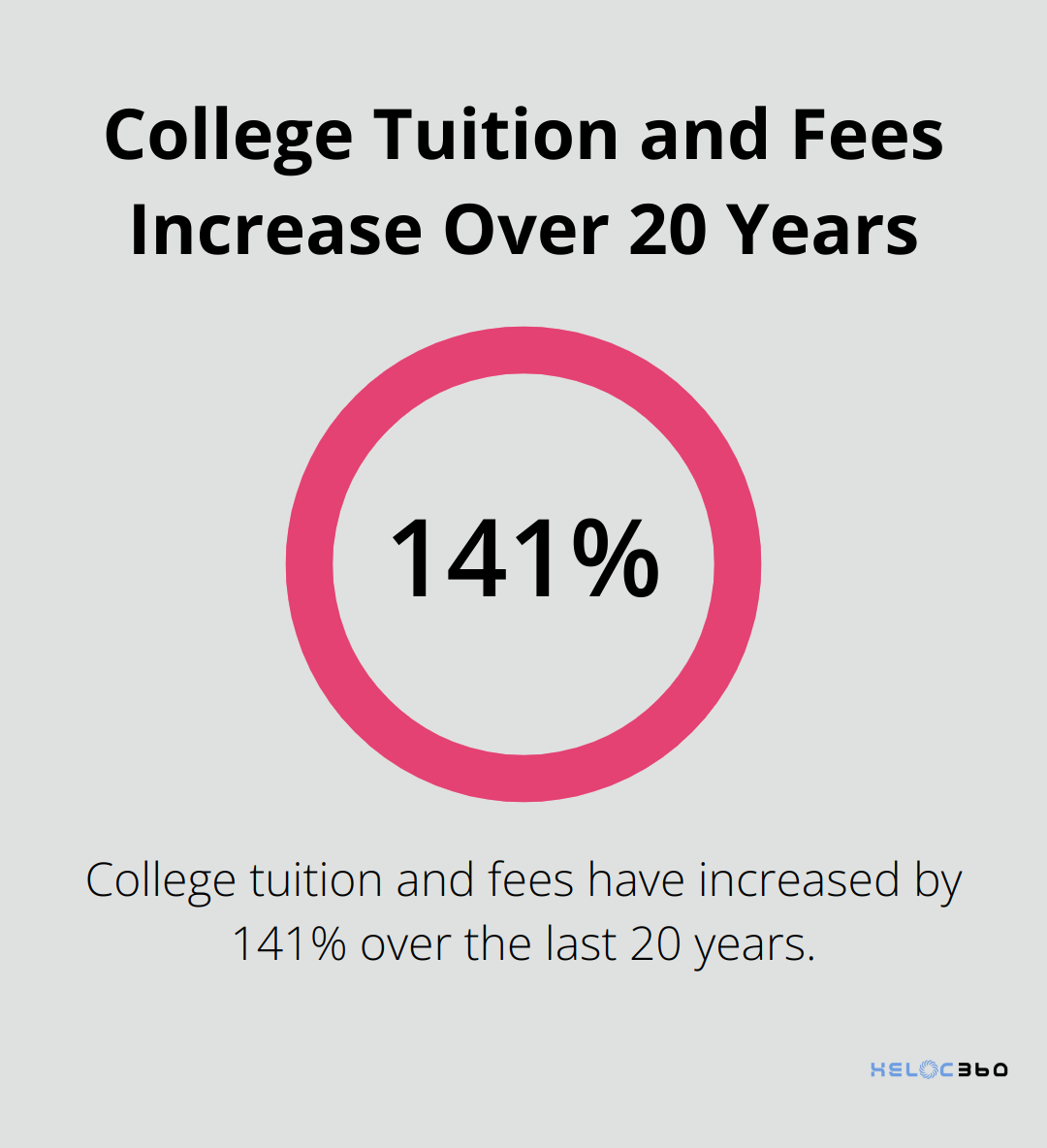

HELOCs attract homeowners for education funding due to their flexibility and potentially lower interest rates. A 2023 Bureau of Labor Statistics report revealed that college tuition and fees have increased by 141% over the last 20 years for an average annual increase of 7.0%. This dramatic rise has prompted many families to explore alternatives to traditional student loans.

HELOCs often offer more competitive interest rates compared to private student loans or Parent PLUS loans. For example, the interest rate for Parent PLUS Loans can be variable or fixed, with variable rates potentially capped at 18%, while HELOCs may offer lower rates. This difference can result in substantial savings over the loan’s lifetime.

Navigating the HELOC Landscape

The world of HELOCs can seem complex, but various platforms exist to guide homeowners through their options and connect them with suitable lenders. These services aim to simplify the process, ensuring you make an informed decision about using your home’s equity for education funding.

Potential Risks to Consider

While HELOCs can serve as a valuable tool, they come with inherent risks. The primary concern lies in using your home as collateral. Failure to make payments could potentially lead to foreclosure. This risk underscores the importance of careful financial planning before choosing a HELOC for education expenses.

The Role of HELOCs in Education Financing

As education costs continue to rise, HELOCs play an increasingly significant role in financing higher education. They offer an alternative to traditional student loans, providing flexibility and potentially lower interest rates. However, the decision to use a HELOC for education funding requires careful consideration of both the benefits and risks involved.

The next section will explore the specific advantages of using a HELOC for education costs, helping you weigh your options more effectively.

Why HELOCs Can Be a Smart Choice for Education Funding

HELOCs offer several advantages when it comes to financing education costs. Let’s explore why many homeowners turn to this option for their educational funding needs.

Lower Interest Rates: A Significant Advantage

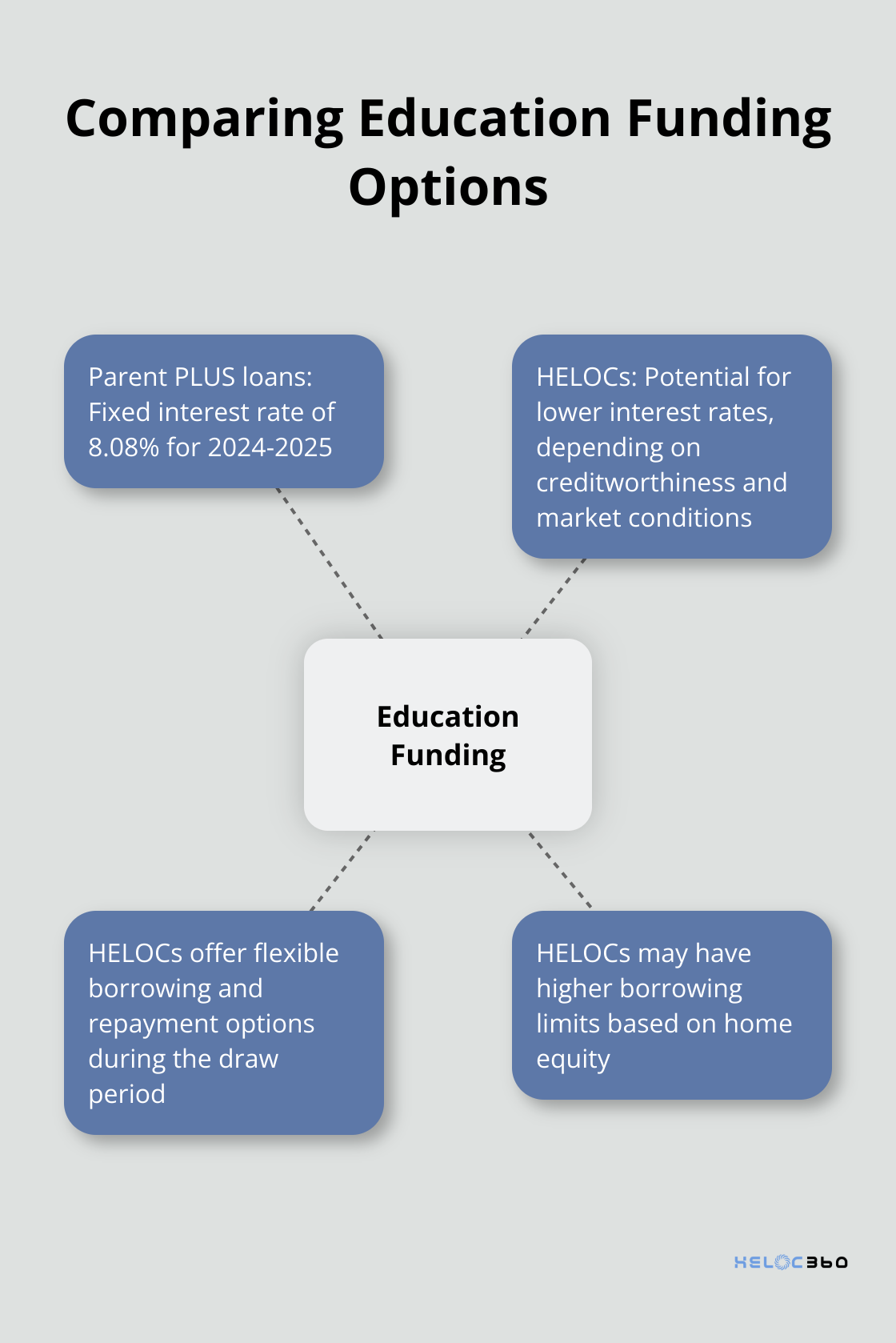

One of the most compelling reasons to consider a HELOC for education expenses is the potential for lower interest rates. For 2024-2025, the fixed interest rate for federal Parent PLUS loans is 8.08%. Depending on your creditworthiness and market conditions, HELOC rates may be lower, potentially translating to substantial savings over the life of the loan, especially for larger borrowing amounts.

Flexible Borrowing and Repayment Options

HELOCs offer unparalleled flexibility in both borrowing and repayment. HELOCs have two different phases. The first phase is the draw period, during which you can withdraw funds from the line of credit. This allows you to borrow exactly what you need when you need it, potentially reducing unnecessary debt.

Repayment terms are also more flexible with a HELOC. Many lenders offer interest-only payments during the draw period, which can benefit families managing multiple education expenses over several years. However, it’s important to have a solid repayment plan in place to avoid financial strain when the repayment period begins.

Potential Tax Benefits

While the tax landscape has changed in recent years, there may still be tax advantages to using a HELOC for education expenses. Interest on home equity loans and lines of credit are deductible only if the borrowed funds are used to buy, build, or substantially improve the taxpayer’s home. Tax laws are complex and subject to change, so it’s essential to consult with a tax professional to understand the current regulations and how they apply to your specific situation.

Higher Borrowing Limits

Another advantage of HELOCs is the potential for higher borrowing limits. The amount you can borrow is based on your home’s equity, which can be substantial for long-time homeowners or those in appreciating markets. This can particularly benefit families with multiple children in college or those pursuing graduate degrees with higher tuition costs.

For instance, if your home is valued at $400,000 and you owe $200,000 on your mortgage, you could potentially access up to $120,000 through a HELOC (assuming an 80% loan-to-value ratio). This far exceeds the annual and aggregate limits on many federal student loan programs.

While HELOCs offer numerous benefits for education funding, it’s important to weigh these advantages against the potential risks. The next section will explore the cons and risks associated with using a HELOC for education expenses, providing a balanced view to help you make an informed decision.

The Hidden Dangers of Using HELOCs for Education

Your Home is at Risk

The most significant risk of using a Home Equity Line of Credit (HELOC) for education funding is that your home serves as collateral. If you fail to make payments, you could face foreclosure. While specific foreclosure rates for HELOC defaults are not available, it’s important to note that the housing market can be volatile. According to the National Association of Realtors, existing-home sales fell 5.9% month-over-month to a seasonally adjusted rate of 4.02 million in March 2025, with a year-over-year decline of 2.4%. This data highlights the potential risks in the housing market.

Interest Rate Uncertainty

HELOCs typically come with variable interest rates, which can change based on market conditions. The Federal Reserve’s actions directly impact these rates. Current HELOC borrowers can expect their interest rate and payments to adjust within a month or two after a Fed rate change. This unpredictability can complicate budgeting and potentially increase your debt burden over time.

The Risk of Overborrowing

Access to a large sum of money can lead to excessive borrowing. Easy access to funds can result in taking on more debt than necessary for education expenses, which may lead to financial strain in the future.

Impact on Long-Term Financial Goals

Using a HELOC for education can significantly affect your long-term financial planning. When you tap into your home equity, you borrow against your future. This decision could impact your ability to fund other important life goals, such as retirement or future home upgrades.

Limited Repayment Flexibility

Unlike federal student loans, HELOCs often lack flexible repayment options. Federal loans offer income-driven repayment plans and potential loan forgiveness programs. HELOCs, on the other hand, typically require immediate repayment and don’t offer deferment or income-based options. This lack of flexibility can create financial stress if your income changes or you face unexpected expenses.

Final Thoughts

Using a HELOC for education funding requires careful consideration of both benefits and risks. Lower interest rates and flexible borrowing options make HELOCs attractive, but homeowners must weigh these against the potential of putting their home at risk. Financial planning plays a key role in this decision, as it impacts long-term goals and overall financial strategy.

We at HELOC360 understand the complexities of using HELOCs for education expenses. Our platform helps homeowners navigate HELOC options and connect with suitable lenders. We provide expert guidance to ensure you have all the necessary information to make the best decision for your family’s educational and financial future.

Exploring all available options, including scholarships, grants, and federal student loans, before tapping into home equity is advisable. A HELOC can provide immediate financial relief, but it requires careful management as a long-term commitment. We encourage you to thoroughly explore your options if you consider using a HELOC for education funding.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.