Calculating HELOC interest accurately is crucial for managing your finances effectively. At HELOC360, we understand the importance of precise calculations when it comes to your home equity line of credit.

In this guide, we’ll walk you through the process of how to calculate HELOC interest, breaking down the components and providing a step-by-step approach. Whether you’re a new HELOC borrower or looking to refine your understanding, this post will equip you with the knowledge to stay on top of your interest payments.

What Drives HELOC Interest Rates?

Variable vs. Fixed Rates: The HELOC Landscape

Most HELOCs offer variable interest rates, which fluctuate over time. These rates typically link to a benchmark index (often the Prime Rate) plus a lender-set margin. For instance, a Prime Rate of 3.25% with a 2% lender margin results in a 5.25% HELOC rate.

Fixed-rate HELOCs exist but are less common. They provide stable monthly payments, which aids budgeting. However, they often start with higher rates compared to variable-rate options.

Key Factors Shaping Your HELOC Rate

Several elements influence your HELOC interest rate:

- Credit Score: Higher scores often lead to lower rates. Lenders view excellent credit as less risky.

- Loan-to-Value Ratio (LTV): This compares your borrowing amount to your home’s value. A lower LTV ratio frequently results in better rates.

- Debt-to-Income Ratio (DTI): Lenders prefer lower DTIs, which indicate better debt management ability.

- Economic Conditions: Broader factors, including Federal Reserve policies, impact HELOC rates.

HELOC Rates vs. Other Loan Types

HELOCs typically offer more competitive rates than unsecured loans or credit cards. This stems from their secured nature (your home serves as collateral), which reduces lender risk. However, this also means your home is at stake if you default on payments.

HELOC rates usually exceed traditional mortgage rates slightly. For example, a 30-year fixed mortgage might have a 3.5% rate, while a HELOC could reach 4.5% or 5%.

Personal loans, another popular financing option, typically carry higher rates than HELOCs. The average home equity loan rate is 8.14% and the average HELOC rate is 8.31% as of July 2025, according to Experian.

The Importance of Rate Comparison

Understanding these rate dynamics proves essential when considering a HELOC. It’s wise to shop around and compare multiple offers to secure the best possible rate for your financial situation. (This practice can potentially save you thousands of dollars over the life of your HELOC.)

As we move forward, let’s explore the components that factor into HELOC interest calculations, providing you with a deeper understanding of how these rates translate into actual payments.

What Factors Determine Your HELOC Interest Payments?

The Impact of Principal Balance

Your principal balance directly affects your HELOC interest payments. This balance represents the amount you’ve borrowed from your HELOC. As you make withdrawals and payments, this figure changes. For example, if you have a $100,000 HELOC limit and withdraw $20,000, your principal balance becomes $20,000. A higher balance results in higher interest payments.

Interest Rates and Their Effect

Interest rates play a significant role in determining your HELOC payments. Variable interest rates mean that if interest rates rise, so will the interest rate on your HELOC. This can lead to unpredictable payments, as your monthly payments can fluctuate due to changes in interest rates.

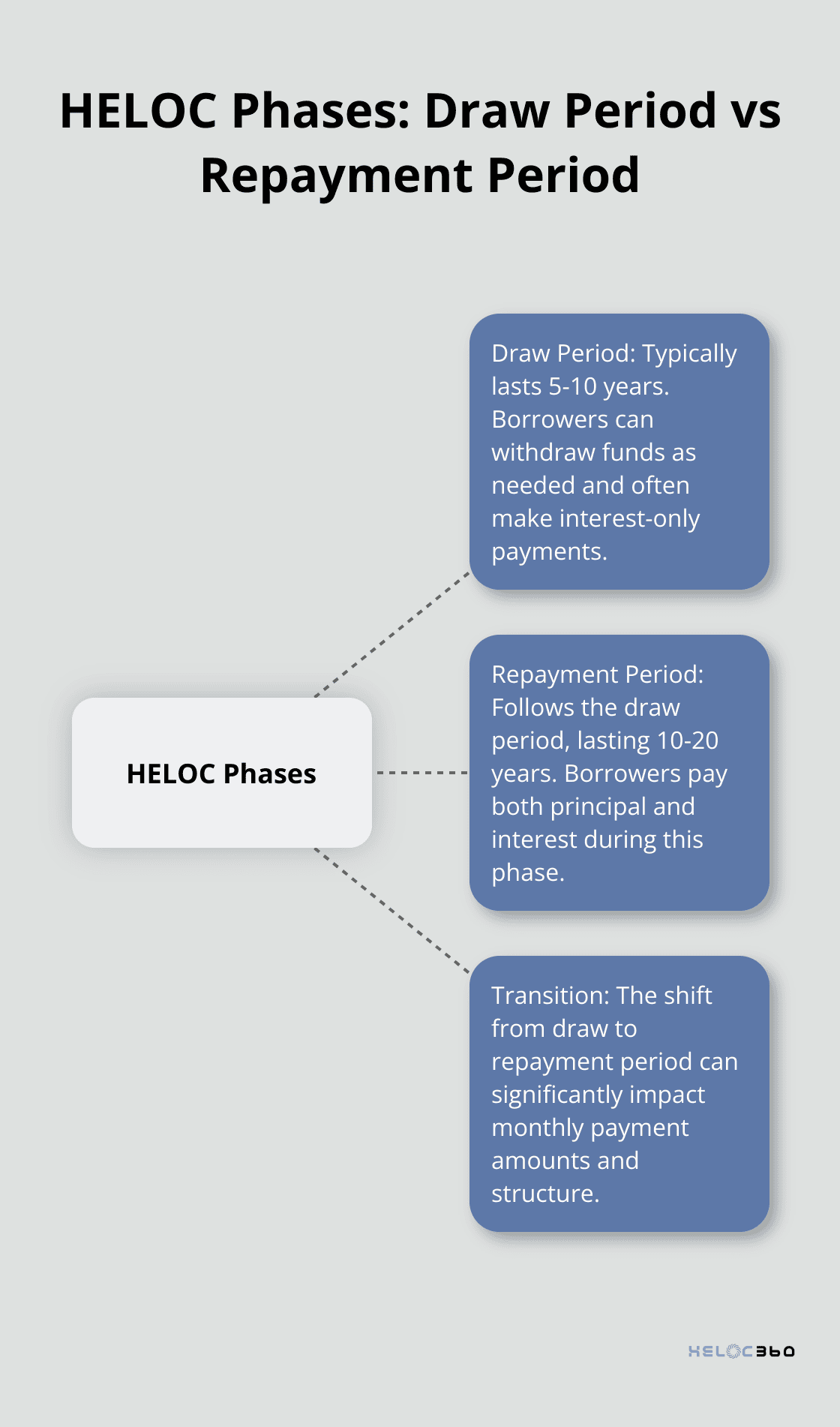

Draw Period vs. Repayment Period

HELOCs typically consist of two distinct phases: the draw period and the repayment period. These phases significantly influence your payment structure:

- Draw Period: Usually lasts 5-10 years. You can borrow funds as needed and often make interest-only payments.

- Repayment Period: Follows the draw period, lasting 10-20 years. You pay both principal and interest.

You repay part of the money borrowed during the “draw period” and the rest of it during the “repayment period.”

Minimum Payment Requirements

Lenders set minimum payment requirements, which vary based on your balance and the HELOC phase. During the draw period, you might only need to pay accrued interest. In the repayment phase, your minimum payment will include both principal and interest.

Some lenders use a percentage-based system for minimum payments. For example, your minimum payment might be 1% of the outstanding balance plus interest. On a $30,000 balance at 5% interest, this could result in a minimum payment of about $425 per month.

While minimum payments offer flexibility, paying only the minimum can lead to higher overall costs and extend your repayment timeline. Paying more than the minimum when possible can reduce your principal faster and potentially help you pay off your HELOC sooner.

Understanding these components forms the foundation for effective HELOC management. In the next section, we’ll provide a detailed, step-by-step guide to help you calculate your HELOC interest payments with precision.

How to Calculate HELOC Interest Step by Step

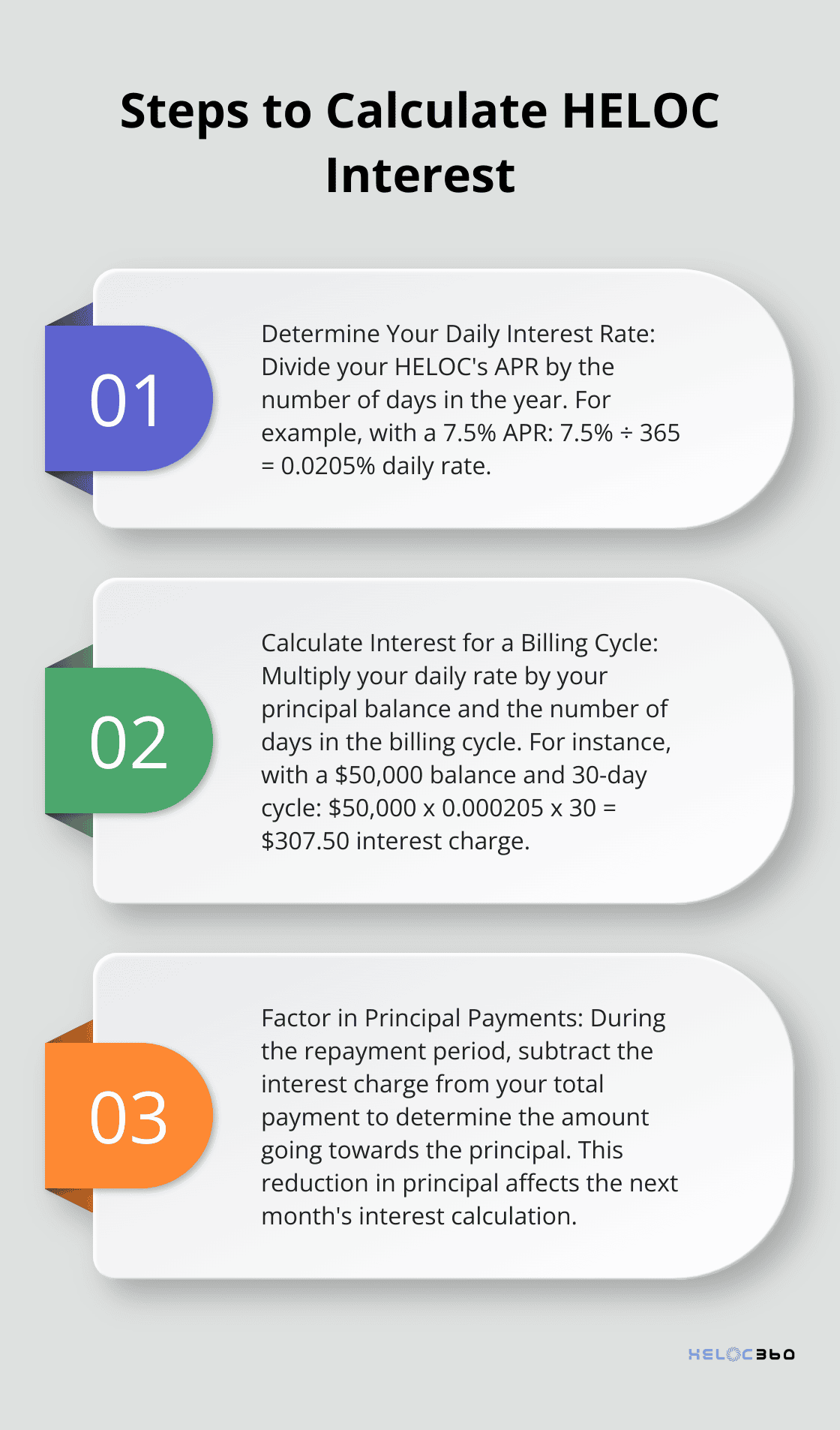

Determine Your Daily Interest Rate

To calculate HELOC interest accurately, you must first find your daily interest rate. Most HELOCs use simple interest, calculated daily. To get your daily rate, divide your HELOC interest rate by the number of days in that year.

For example, if your HELOC has an APR of 7.5%, your daily interest rate would be:

7.5% ÷ 365 = 0.0205% or 0.000205

This small number plays a significant role in accurate calculations.

Calculate Interest for a Billing Cycle

After you have your daily rate, you can calculate interest for a billing cycle. Multiply your daily rate by your principal balance and the number of days in the billing cycle.

Let’s say you have a $50,000 balance and a 30-day billing cycle:

$50,000 x 0.000205 x 30 = $307.50

This $307.50 represents your interest charge for the month. (Keep in mind that your balance may change daily if you make additional draws or payments, which will affect your interest calculation.)

Factor in Principal Payments

During the repayment period, your payments will include both principal and interest. To calculate how much of your payment goes towards the principal, subtract the interest charge from your total payment.

For instance, if your monthly payment is $500 and your interest charge is $307.50:

$500 – $307.50 = $192.50 goes towards the principal

This reduction in principal will affect your next month’s interest calculation, as you’ll pay interest on a smaller balance.

Use Online HELOC Calculators

While manual calculations help you understand the process, online calculators can streamline your efforts. Many financial institutions offer HELOC calculators on their websites. These tools allow you to estimate monthly home equity payments based on the amount you want, rate options, and other factors.

However, exercise caution when using third-party calculators. Always verify the source and ensure the calculator is up-to-date with current financial regulations. (For the most accurate results, try using calculators provided by reputable financial institutions or trusted platforms.)

Consider Additional Factors

Understanding how to calculate HELOC interest empowers you to make informed decisions about your borrowing and repayment strategies. It allows you to anticipate costs, plan your budget effectively, and potentially save money by making strategic additional payments when possible.

Your actual HELOC terms may have additional factors that affect your interest payments. Always refer to your specific loan agreement and consult with your lender for the most accurate information regarding your HELOC.

Final Thoughts

Accurate HELOC interest calculations empower homeowners to control their financial future. Regular monitoring of balances and rates allows you to anticipate changes and adjust your budget. This proactive approach can save you money and help you maximize your HELOC benefits.

Responsible HELOC management involves setting clear financial goals, making timely payments, and considering extra principal payments. You can reduce overall interest costs and potentially pay off your HELOC faster if you pay more than the minimum (especially during the draw period).

Market conditions and personal financial situations change over time. You must stay informed about these factors and how they affect your HELOC interest. We at HELOC360 offer comprehensive solutions tailored to your unique needs, including guidance on how to calculate HELOC interest.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.