- ***PAID ADVERTISEMENT**

- ACHIEVE LOANS – HOME EQUITY EXPERTISE

- FLEXIBLE FINANCING SOLUTIONS

- PERSONALIZED SUPPORT

- RECOMMENDED FICO SCORE: 640+

- COMPETITIVE RATES STREAMLINED APPLICATION PROCESS

Are you drowning in high-interest debt? A Home Equity Line of Credit (HELOC) might be your lifeline.

At HELOC360, we’ve seen many homeowners successfully use HELOC consolidation to tackle their debt problems. This powerful financial tool can offer lower interest rates and more flexible repayment options than traditional debt consolidation methods.

In this post, we’ll explore how a HELOC can be a smart choice for debt consolidation and what you need to consider before diving in.

- Approval in 5 minutes. Funding in as few as 5 days

- Borrow $20K-$400K

- Consolidate debt or finance home projects

- Fastest way to turn home equity into cash

- 100% online application

How Does a HELOC Work for Debt Consolidation?

Understanding HELOCs

A Home Equity Line of Credit (HELOC) allows homeowners to borrow against their property’s equity. It functions similarly to a credit card, offering a revolving line of credit. The main advantage? Your home serves as collateral, often resulting in lower interest rates compared to unsecured loans or credit cards.

When you open a HELOC, the lender approves you for a maximum credit limit based on your home’s value and your equity. You can borrow against this limit during the draw period (typically 5 to 10 years). During this time, you usually only need to make interest payments on the borrowed amount.

After the draw period ends, you enter the repayment phase. At this point, you can no longer borrow from the line of credit and must repay both principal and interest. This phase usually lasts 10 to 20 years.

The Basics of Debt Consolidation

Debt consolidation combines multiple debts into a single loan, ideally with a lower interest rate. This strategy can simplify your finances by reducing the number of monthly payments and potentially lowering your overall interest costs.

Using a HELOC for Debt Consolidation

A HELOC can be an effective tool for debt consolidation. Here’s why:

- Lower Interest Rates: HELOCs often offer lower rates than credit cards or personal loans. McBride forecasts that HELOC rates will continue to fall in 2025, sending the average HELOC to 7.25 percent by the end of the year, a low not seen since 2022.

- Flexible Borrowing: You can draw exactly the amount you need to pay off your debts, and you only pay interest on what you borrow.

- Potential Tax Benefits: In some cases, the interest paid on a HELOC used for home improvements may be tax-deductible. As of January 2025, the interest from your home equity loan is deductible for the tax year 2025. However, it’s possible the laws will change, so always consult with a tax professional for specifics.

- Improved Cash Flow: Consolidating high-interest debts into a lower-rate HELOC might significantly reduce your monthly payments.

A Real-World Example

Consider this scenario: You have $20,000 in credit card debt at 18% APR. Your monthly payment might be around $600. If you transfer this to a HELOC at 7.25% APR, your monthly payment could drop significantly, freeing up money in your budget each month.

Potential Risks to Consider

While HELOCs offer many benefits for debt consolidation, they also come with risks:

- Your Home as Collateral: If you default on payments, you risk foreclosure.

- Variable Interest Rates: HELOC rates typically fluctuate, so your payments could increase over time.

- Discipline Required: It’s essential to avoid the temptation of racking up new charges on your newly paid-off credit cards.

A solid repayment plan is key to successful debt consolidation with a HELOC. It’s not just about lowering your interest rate; it’s about committing to paying off your debt.

As we move forward, let’s explore the specific advantages of using a HELOC for debt consolidation in more detail.

Why HELOCs Shine for Debt Consolidation

Significant Interest Savings

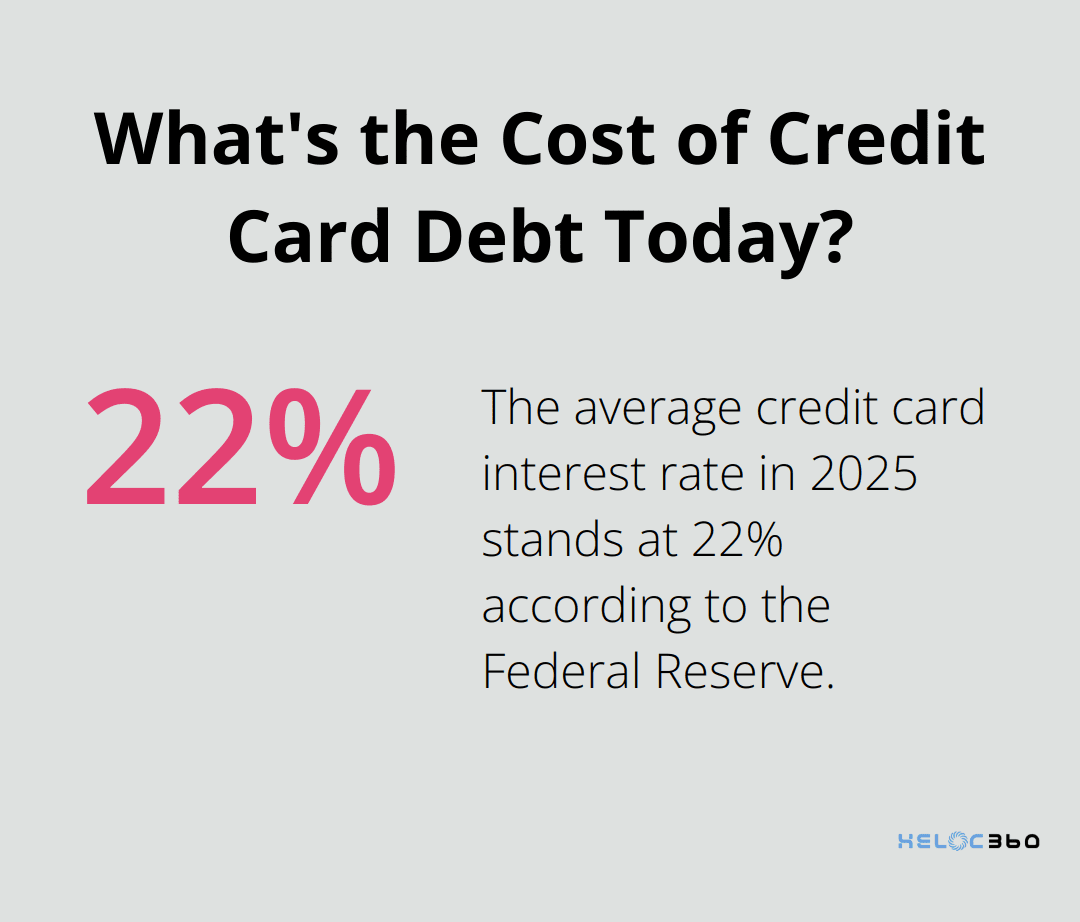

HELOCs offer a powerful advantage for homeowners who want to consolidate their debt: substantial interest savings. The Federal Reserve reports that the average credit card interest rate in 2025 stands at 22%, while HELOC rates are much lower. Bankrate’s data shows the average HELOC rate at 7.25% as of February 2025. This difference can result in thousands of dollars saved over time.

Consider this example: A $20,000 credit card debt at 22% APR incurs about $4,400 in interest in the first year. Transfer that debt to a HELOC at 7.25% APR, and your interest cost drops to approximately $1,450 – a saving of nearly $3,000 in just one year.

Unmatched Flexibility

HELOCs provide unparalleled flexibility in borrowing and repayment. Unlike traditional loans with fixed monthly payments, HELOCs allow you to borrow only what you need, when you need it. This feature proves particularly beneficial when consolidating various debts with different payoff timelines.

The draw period (typically 5-10 years) often allows for interest-only payments. This option can significantly lower your monthly obligations, providing breathing room in your budget. However, you must create a solid plan to tackle the principal during or after the draw period to avoid future financial strain.

Potential Tax Advantages

As of 2025, HELOCs still offer potential tax benefits (though tax laws can change). The Internal Revenue Service (IRS) allows homeowners to deduct the interest paid on HELOCs if the funds buy, build, or substantially improve the home that secures the loan. While this doesn’t directly apply to debt consolidation, it’s worth noting for homeowners who might use a portion of their HELOC for home improvements alongside debt consolidation.

Always consult with a tax professional to understand how these potential benefits apply to your specific situation, as tax laws can be complex and subject to change.

Access to Substantial Credit

HELOCs typically offer access to larger amounts of credit compared to personal loans or credit cards. The credit limit is based on your home’s equity. For homeowners with significant equity, this can mean access to a substantial line of credit, often ranging from tens of thousands to hundreds of thousands of dollars.

This larger credit pool allows you to consolidate multiple high-interest debts in one go, simplifying your financial life and potentially improving your credit utilization ratio – a key factor in credit scores. Experian notes that lowering your credit utilization can positively impact your credit score, potentially opening doors to better financial opportunities in the future.

While HELOCs offer numerous advantages for debt consolidation, it’s important to understand the potential risks and considerations. Let’s explore these factors to help you make an informed decision about whether a HELOC is the right choice for your debt consolidation needs.

What Are the Risks of Using a HELOC for Debt Consolidation?

Using a Home Equity Line of Credit (HELOC) for debt consolidation offers potential benefits, but it also comes with significant risks. Homeowners must understand these potential pitfalls to make an informed decision about whether a HELOC aligns with their financial situation.

Your Home as Collateral

The most significant risk of using a HELOC for debt consolidation is that your home serves as collateral for the loan. If you default on your HELOC payments, you could lose your home to foreclosure. This risk highlights the importance of creating a solid repayment plan before choosing a HELOC.

Variable Interest Rates

Most HELOCs come with variable interest rates, which can fluctuate based on market conditions. Using a HELOC for debt consolidation has its downsides, including variable interest rates that can cause your repayments to increase if rates rise. Additionally, using your home as collateral for a HELOC poses a risk. You must factor in potential rate increases when budgeting for HELOC repayments.

Financial Discipline Required

Using a HELOC for debt consolidation requires a high level of financial discipline. The temptation to tap into your HELOC for non-essential expenses can be strong, especially during the draw period when you only need to make interest payments.

To avoid this pitfall:

- Create a strict budget and repayment plan before taking out a HELOC

- Set up automatic payments to ensure consistent debt repayment

- Consider freezing your credit cards to avoid the temptation of accumulating new debt

Impact on Credit Score

Consolidating debt with a HELOC can potentially improve your credit score by lowering your credit utilization ratio, but it’s not without risks. Opening a HELOC will result in a hard inquiry on your credit report, which can temporarily lower your score by a few points. Additionally, maxing out your HELOC or missing payments could significantly damage your credit score.

Closing credit card accounts after consolidating their balances into a HELOC can potentially harm your credit score by reducing your available credit and shortening your credit history. Instead, try keeping these accounts open but inactive to maintain a positive credit utilization ratio.

Long-Term Financial Implications

While a HELOC can provide immediate relief from high-interest debt, it’s important to consider the long-term financial implications. Extending the repayment period of your debt (which often happens when consolidating with a HELOC) might result in paying more interest over time, even if the interest rate is lower. You must carefully calculate the total cost of the HELOC over its entire term and compare it to your current debt situation.

Final Thoughts

HELOCs offer a powerful tool for debt consolidation, providing homeowners with lower interest rates, flexible repayment options, and access to substantial credit. The potential for significant interest savings and simplified financial management makes HELOC consolidation an attractive option for many. However, you must approach this strategy with caution and careful planning.

The risks associated with using a HELOC for debt consolidation are real and should not be overlooked. Your home serves as collateral, variable interest rates can lead to increased payments, and the temptation to overspend remains a concern. Financial discipline and a solid repayment plan are essential for success.

Before you decide on a HELOC for debt consolidation, take time to assess your financial situation, calculate the long-term costs, and consider alternative options. We at HELOC360 understand the complexities of using home equity for debt consolidation and our platform helps homeowners navigate this process. Visit HELOC360 to explore your options and take the first step towards financial freedom.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.