Are you dreaming of your perfect home but struggling with traditional financing options? A HELOC piggyback loan might be the solution you’re looking for.

This innovative financing strategy can help you secure your dream property while avoiding private mortgage insurance and maximizing your purchasing power.

At HELOC360, we’re here to guide you through the ins and outs of piggyback HELOCs and how they can benefit your homebuying journey.

What Is a Piggyback HELOC?

Understanding the Basics

A piggyback loan combines two mortgages for the purpose of buying or refinancing a home. This strategy enables buyers to borrow up to 90% of the home’s value without paying private mortgage insurance (PMI).

The 80-10-10 Structure

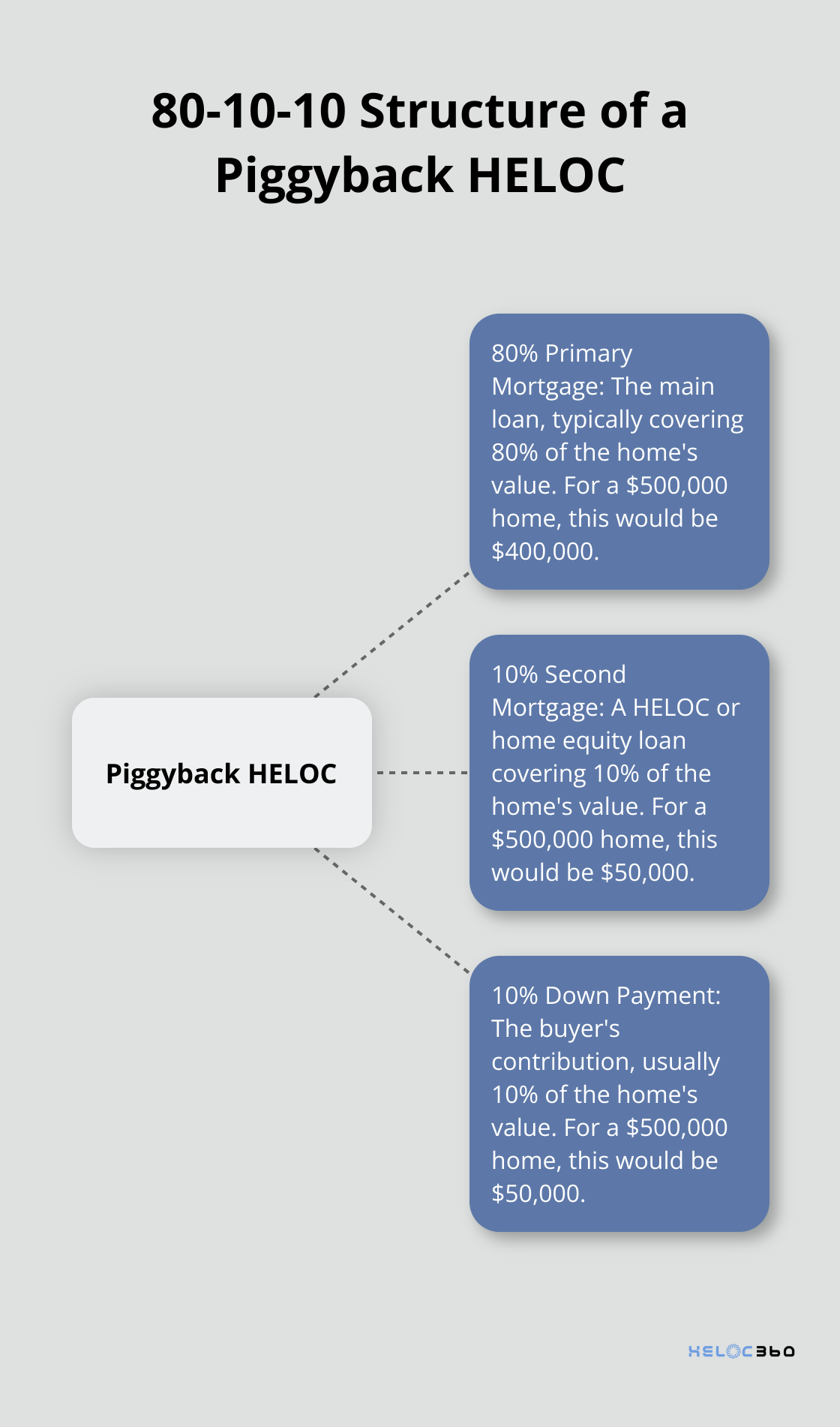

Piggyback HELOCs typically follow an 80-10-10 structure:

- 80% primary mortgage

- 10% second mortgage

- 10% down payment

For a $500,000 home, this translates to:

- $400,000 primary mortgage

- $50,000 second mortgage

- $50,000 down payment

Comparison to Traditional Financing

Traditional mortgages often require a 20% down payment to avoid PMI. Piggyback HELOCs offer more flexibility, allowing lower upfront payments while still avoiding PMI costs. This proves particularly beneficial in high-cost housing markets where large down payments present a challenge.

Key Advantages

- Significant Savings: By avoiding PMI, you could save thousands over your loan’s lifetime.

- Enhanced Flexibility: Piggyback HELOCs offer more versatility than traditional mortgages. You can draw from your HELOC as needed for home improvements or other expenses, paying interest only on the amount you use.

Financial Considerations

Before opting for a piggyback HELOC, evaluate your financial situation carefully. Consider factors such as:

- Credit score

- Debt-to-income ratio

- Long-term financial goals

These elements play a vital role in determining if a piggyback HELOC aligns with your dream home purchase strategy.

As we move forward, let’s explore the qualification requirements for a piggyback HELOC, ensuring you have all the necessary information to make an informed decision.

How to Qualify for a Piggyback HELOC

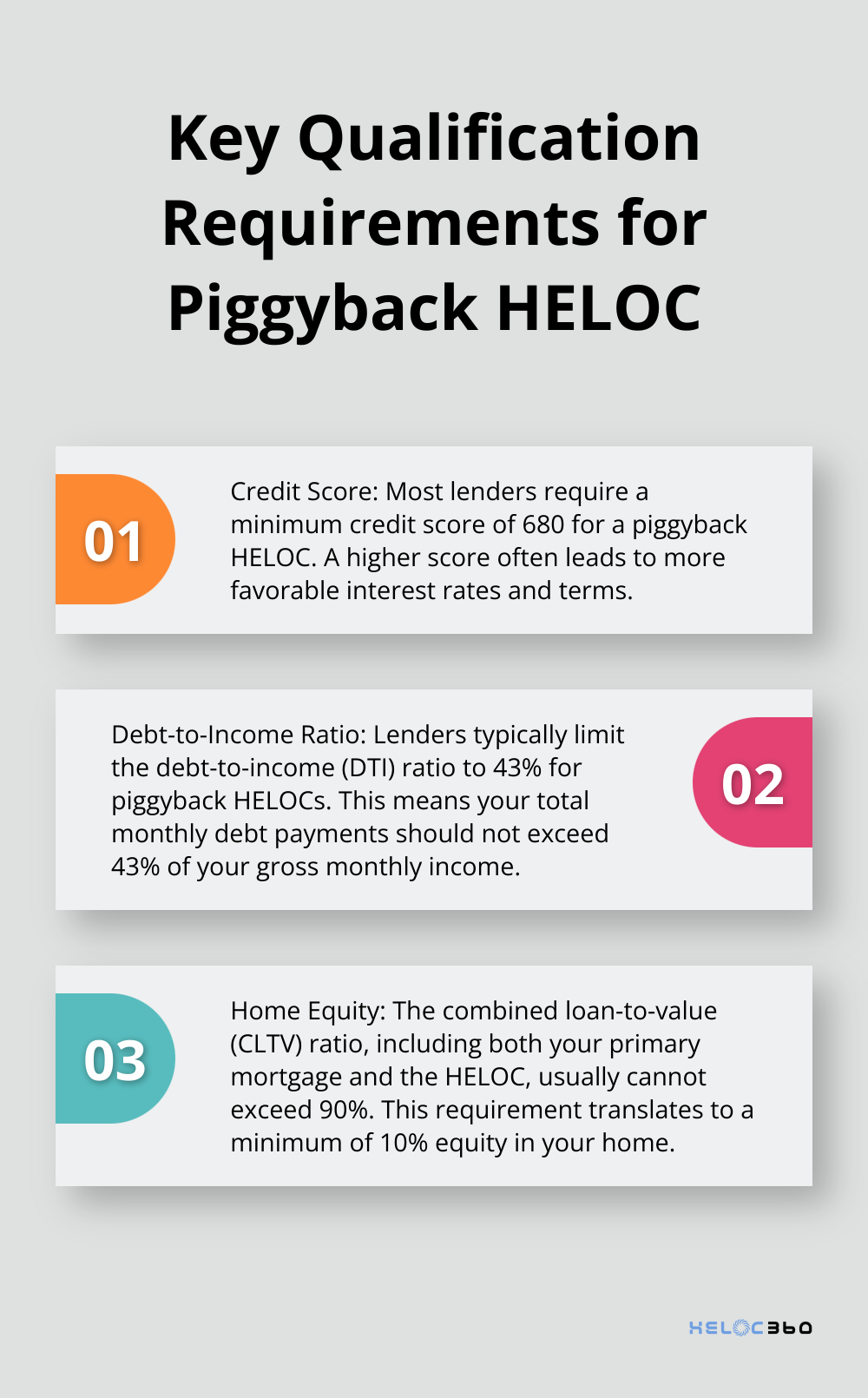

Credit Score Requirements

Your credit score significantly impacts your eligibility for a piggyback HELOC. Most lenders require a minimum score of 680, though this may vary depending on the lender. A higher score often translates to more favorable interest rates and terms.

Debt-to-Income Ratio Considerations

Lenders typically limit the debt-to-income (DTI) ratio to 43% for piggyback HELOCs. This means your total monthly debt payments (including both mortgages) should not exceed 43% of your gross monthly income. Some lenders might accept a higher DTI, but this usually comes with stricter requirements in other areas.

Home Equity and Loan-to-Value Expectations

To qualify for a piggyback HELOC, you need sufficient equity in your home. The combined loan-to-value (CLTV) ratio-which includes both your primary mortgage and the HELOC-usually cannot exceed 90%. This requirement translates to a minimum of 10% equity in your home.

Income Verification Process

Lenders will thoroughly examine your income to ensure you can manage both mortgage payments. They typically request:

- Two years of tax returns

- Recent pay stubs

- W-2 forms or 1099s

- Bank statements

Self-employed individuals may face additional scrutiny and might need to provide profit and loss statements or business tax returns.

Documentation Preparation

To streamline your application process and increase your approval chances, gather all necessary documentation beforehand. Review your credit report for any errors (these can significantly impact your eligibility). Taking these proactive steps will position you as a strong candidate for a piggyback HELOC.

The qualification process for a piggyback HELOC might seem complex, but understanding these requirements sets you up for success. In the next section, we’ll explore effective strategies to leverage your piggyback HELOC and maximize its benefits for your dream home purchase.

How to Maximize Your Piggyback HELOC

Piggyback HELOCs offer a powerful tool for homebuyers. Let’s explore some strategies to make the most of this financing option.

Avoid PMI Costs

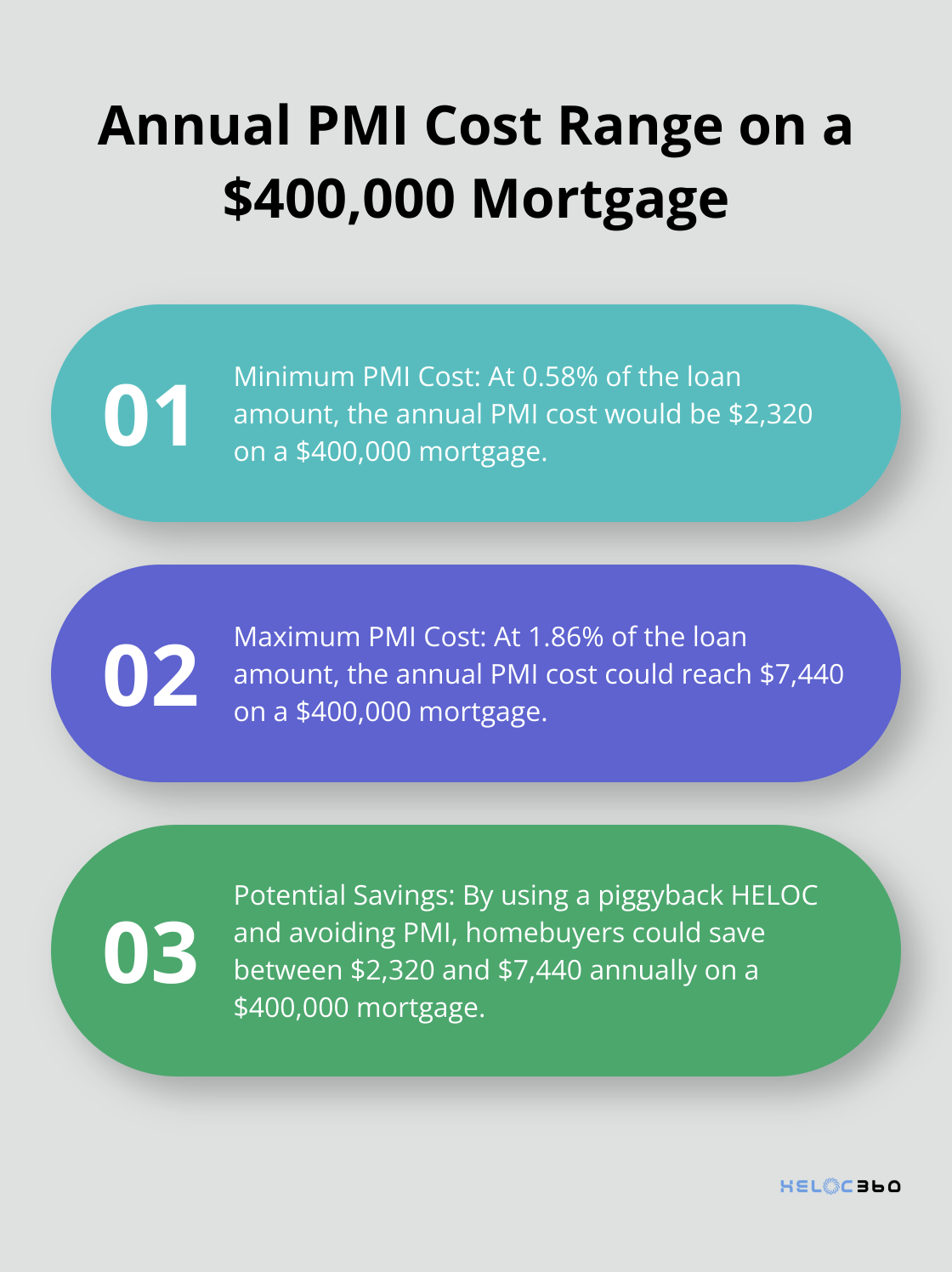

One of the primary benefits of a piggyback HELOC is the avoidance of private mortgage insurance (PMI). PMI typically ranges from 0.58% to 1.86% of the original loan amount annually. On a $400,000 mortgage, that could be $2,320 to $7,440 per year. A piggyback HELOC can potentially save you thousands over the life of your loan.

For example, if you buy a $500,000 home with a 10% down payment, you’d normally pay PMI on a $450,000 mortgage. With a piggyback HELOC, you’d have a $400,000 primary mortgage and a $50,000 HELOC, eliminating the need for PMI altogether.

Boost Your Buying Power

In high-cost housing markets, piggyback HELOCs can significantly increase your purchasing power. Let’s say you have $50,000 saved for a down payment. In a traditional mortgage scenario, you might only qualify for a $250,000 home (assuming a 20% down payment requirement). With a piggyback HELOC, you could potentially buy a $500,000 home using the 80-10-10 structure.

This strategy allows you to enter more competitive housing markets or secure a larger home that better fits your needs. Just ensure you’re comfortable with the higher overall debt and monthly payments.

Finance Home Improvements

Piggyback HELOCs offer flexibility for future home improvements or renovations. Unlike a traditional mortgage, you can draw from your HELOC as needed, paying interest only on the amount you use. This feature makes it an excellent option for homeowners who plan upgrades or renovations down the line.

For instance, if you buy a fixer-upper, you could use your piggyback HELOC to fund renovations over time. This approach allows you to increase your home’s value while you spread out the costs of improvements.

Understand Tax Implications

While the tax benefits of HELOCs have changed in recent years, potential advantages still exist. The IRS states that for tax years 2018 through 2025, interest paid on home equity loans and lines of credit may be tax-deductible if you use the funds to buy, build, or substantially improve the home that secures the loan.

However, tax laws are complex and subject to change. We at HELOC360 always recommend you consult with a tax professional to understand how a piggyback HELOC might affect your specific tax situation.

Consider Long-Term Financial Goals

When you decide to use a piggyback HELOC, you should align it with your long-term financial objectives. This strategy can provide immediate benefits (like avoiding PMI), but it’s important to consider how it fits into your overall financial plan.

Try to assess your future income prospects, potential changes in your lifestyle, and your plans for the property. A piggyback HELOC might be an excellent choice if you anticipate a significant income increase or plan to sell the property within a few years. However, if you’re uncertain about future financial stability, you might want to explore other options.

Final Thoughts

Piggyback HELOCs provide a powerful solution for homebuyers who want to maximize their purchasing power and avoid costly private mortgage insurance. This innovative financing strategy combines a primary mortgage with a home equity line of credit, which opens doors to dream homes that might otherwise seem out of reach. The benefits of a HELOC piggyback loan include lower upfront costs, increased flexibility for future home improvements, and potential tax advantages.

However, it’s important to approach this option with a thorough understanding of your financial situation and long-term goals. You should consider your credit score, debt-to-income ratio, and ability to manage multiple loan payments before you make a decision. While piggyback HELOCs can be an excellent tool for many homebuyers, they don’t fit every situation.

If you find the possibilities of a piggyback HELOC intriguing but feel overwhelmed by the complexities, HELOC360 can help. Our platform simplifies the process and provides expert guidance to connect you with lenders that match your specific needs. We strive to help you unlock the full potential of your home equity and turn your property’s value into a gateway for new opportunities.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.