HELOC amortization can be a game-changer for your financial strategy, but it’s often misunderstood.

At HELOC360, we’ve seen how mastering this concept can lead to significant savings and improved financial health.

This guide will break down HELOC amortization, offer practical strategies for managing it, and show you how to leverage it for long-term financial success.

What Is HELOC Amortization?

The Unique Structure of HELOCs

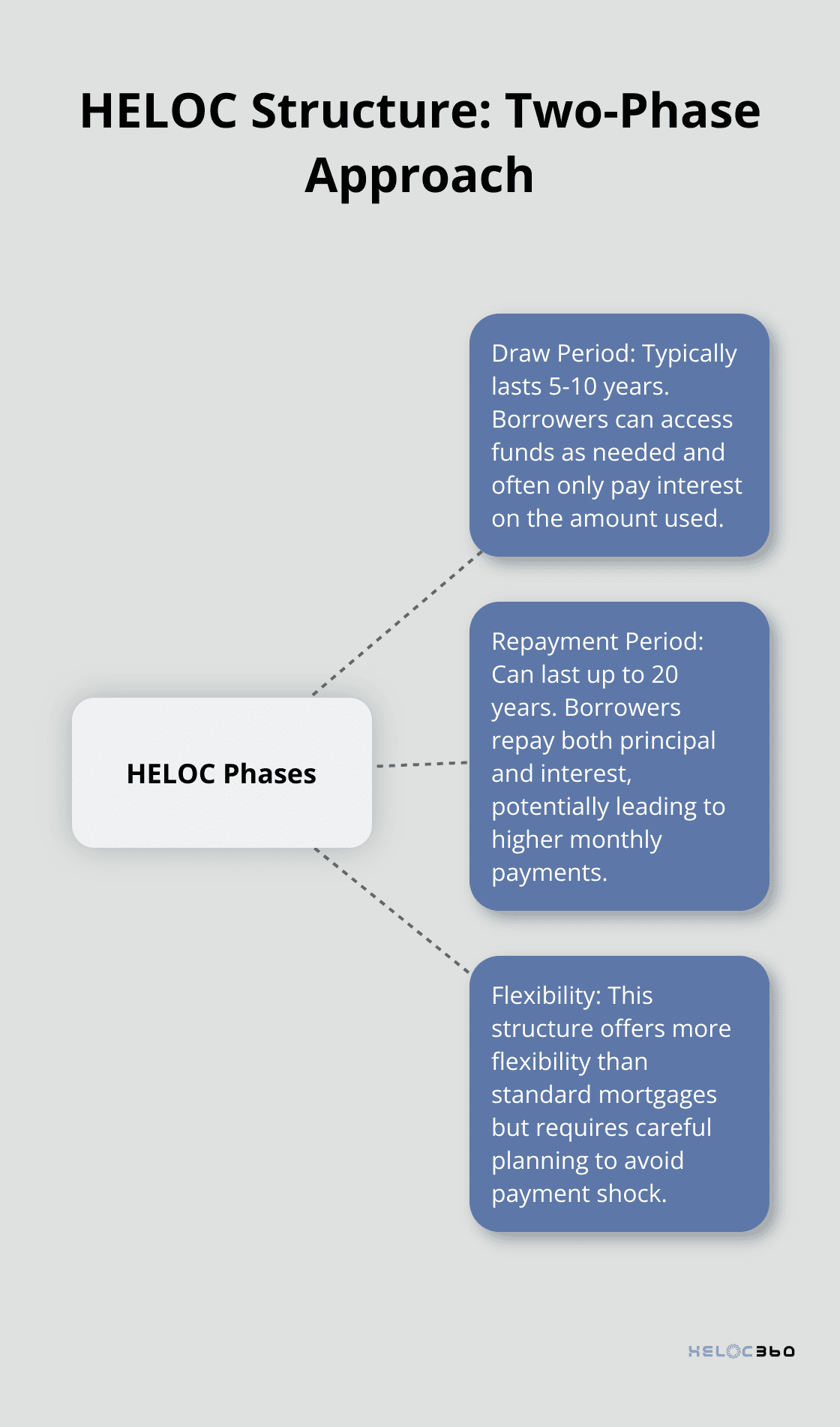

HELOC amortization refers to the process of paying off your Home Equity Line of Credit over time. HELOCs have a distinctive two-phase structure that sets them apart from traditional loans. This structure consists of a draw period and a repayment period.

During the draw period (typically 5-10 years), you can borrow money as needed and often only pay interest on the amount you’ve used. The HELOC repayment period follows, which can last up to 20 years, where you repay both principal and interest.

This structure offers more flexibility than standard mortgages, where you start paying both principal and interest immediately. However, it also requires careful planning to avoid payment shock when the repayment period begins.

Key Elements of HELOC Amortization

To effectively plan your finances, you must understand your HELOC’s amortization schedule. Here are the main components to consider:

- Interest Rate: HELOCs usually have variable rates tied to the prime rate. A 1% increase in your rate can add hundreds to your monthly payment during repayment.

- Draw Period Length: Longer draw periods allow more time to access funds but can result in larger balances to repay later.

- Repayment Period Length: This determines your payoff timeline. Shorter periods mean higher monthly payments but less total interest paid.

- Minimum Payment Requirements: Some lenders only require interest payments during the draw period. Be aware that this can lead to a larger balance when repayment begins.

Preparing for HELOC Repayment

Start planning for repayment early to avoid surprises. If you’ve borrowed $50,000 during a 10-year draw period, you might face monthly payments of $600 or more when repayment starts (assuming a 20-year repayment term).

You should consider making principal payments during the draw period to reduce your balance. Even small additional payments can make a significant difference. For example, paying an extra $100 per month on a $50,000 balance could save you thousands in interest over the life of the loan.

The Impact of Amortization on Your Finances

Understanding HELOC amortization allows you to use this flexible financial tool to your advantage without risking your financial stability. It helps you predict future payments, plan your budget, and make informed decisions about borrowing and repayment.

As we move forward, we’ll explore strategies for managing HELOC amortization effectively, ensuring you maximize the benefits while minimizing potential risks.

How to Optimize Your HELOC Repayment

Start Principal Payments Early

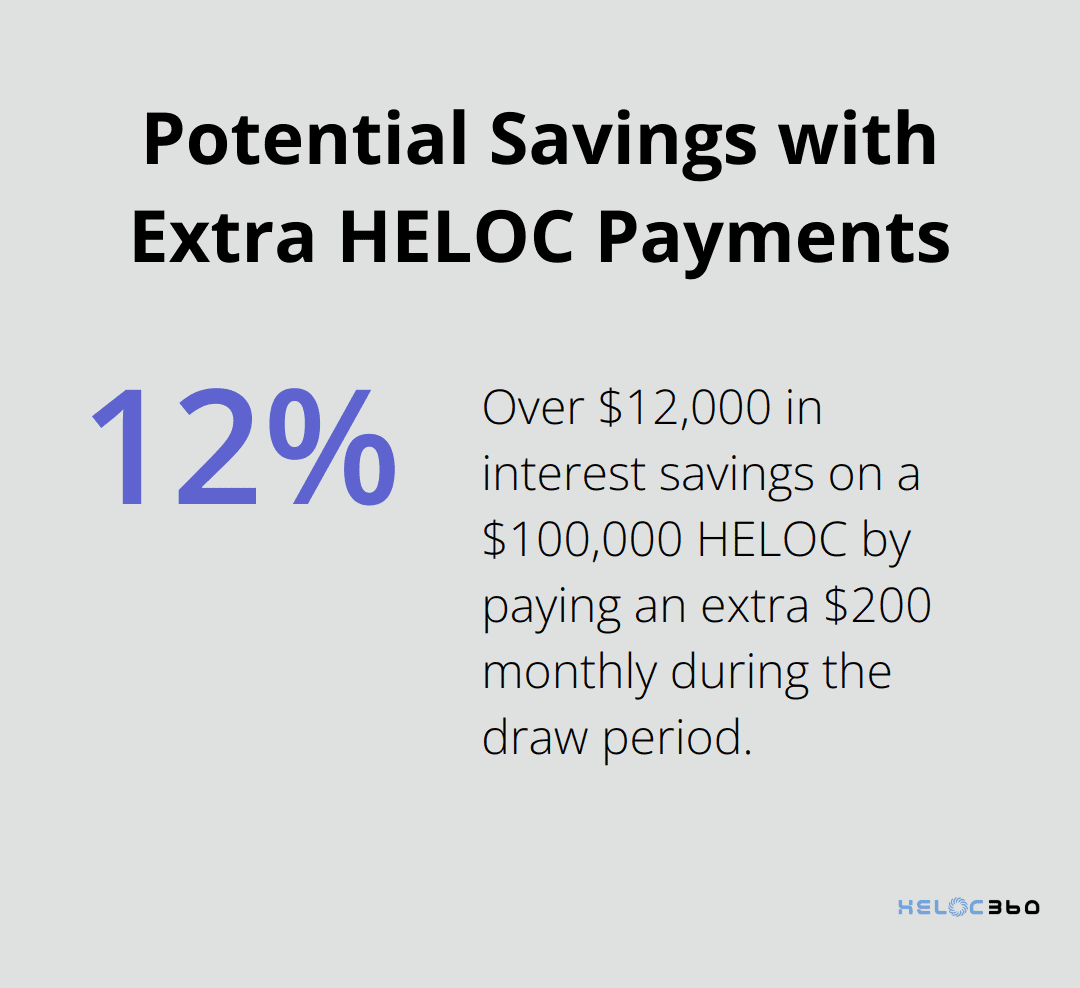

Don’t wait for the repayment period to begin. Make principal payments during the draw period to reduce your overall balance. Even small amounts can make a big difference. On a $100,000 HELOC with a 5% interest rate, paying an extra $200 monthly during a 10-year draw period could save you over $12,000 in interest over the life of the loan.

Use the ‘All-in-One’ Method

This strategy involves using your HELOC as your primary bank account. Deposit your income directly into the HELOC account and pay expenses from it. This approach can significantly reduce your average daily balance, leading to lower interest charges. A study by the Journal of Financial Planning found that this method could potentially save homeowners tens of thousands of dollars over the life of their mortgage.

Implement the Debt Snowball Technique

If you have multiple debts, consider using the debt snowball method. Pay minimum amounts on all debts except your HELOC, then funnel extra funds to your HELOC balance. Once you pay off your HELOC, move to the next highest-interest debt. This approach can provide psychological wins and accelerate your overall debt repayment.

Leverage Rate Conversion Options

Some HELOCs offer the ability to convert variable rates to fixed rates on portions of your balance. If you anticipate rising interest rates, this feature can protect you from payment increases. For example, if you have a $50,000 balance and expect to use it for a long-term project, converting it to a fixed rate could provide stability and potentially save money if rates rise.

Set Up Automatic Payments

Automatic payments ensure you never miss a due date, avoiding late fees and potential credit score impacts. However, it’s important to note that HELOCs generally permit the lender to freeze or reduce your credit line if the value of your home falls or if they see a change for the worse in your financial situation.

As you implement these strategies to optimize your HELOC repayment, it’s important to understand how HELOC amortization impacts your overall financial planning. Let’s explore this in the next section.

How HELOC Amortization Shapes Your Financial Future

The Equity Equation

HELOC amortization directly impacts your home equity. As you repay your HELOC, you rebuild the equity you borrowed against. This process accelerates or slows depending on your repayment strategy. If you make only minimum payments during the draw period, you might see your equity stagnate or even decrease if you continue to borrow.

Making additional principal payments can rapidly increase your equity. A study by the Urban Institute found that homeowners who made extra payments on their home loans built equity 30% faster than those who didn’t. This principle applies to HELOCs as well.

Tax Implications

The tax implications of HELOC interest can significantly affect your financial planning. As of 2025, HELOC interest is tax-deductible if the funds are used to “buy, build, or substantially improve” the property. This rule, established by the Tax Cuts and Jobs Act of 2017, will expire in 2026 unless Congress extends it.

To maximize potential tax benefits, keep meticulous records of how you use HELOC funds. If you’re using the money for home improvements, save all receipts and documentation. This can save you thousands in taxes over the life of your HELOC.

Budgeting for Success

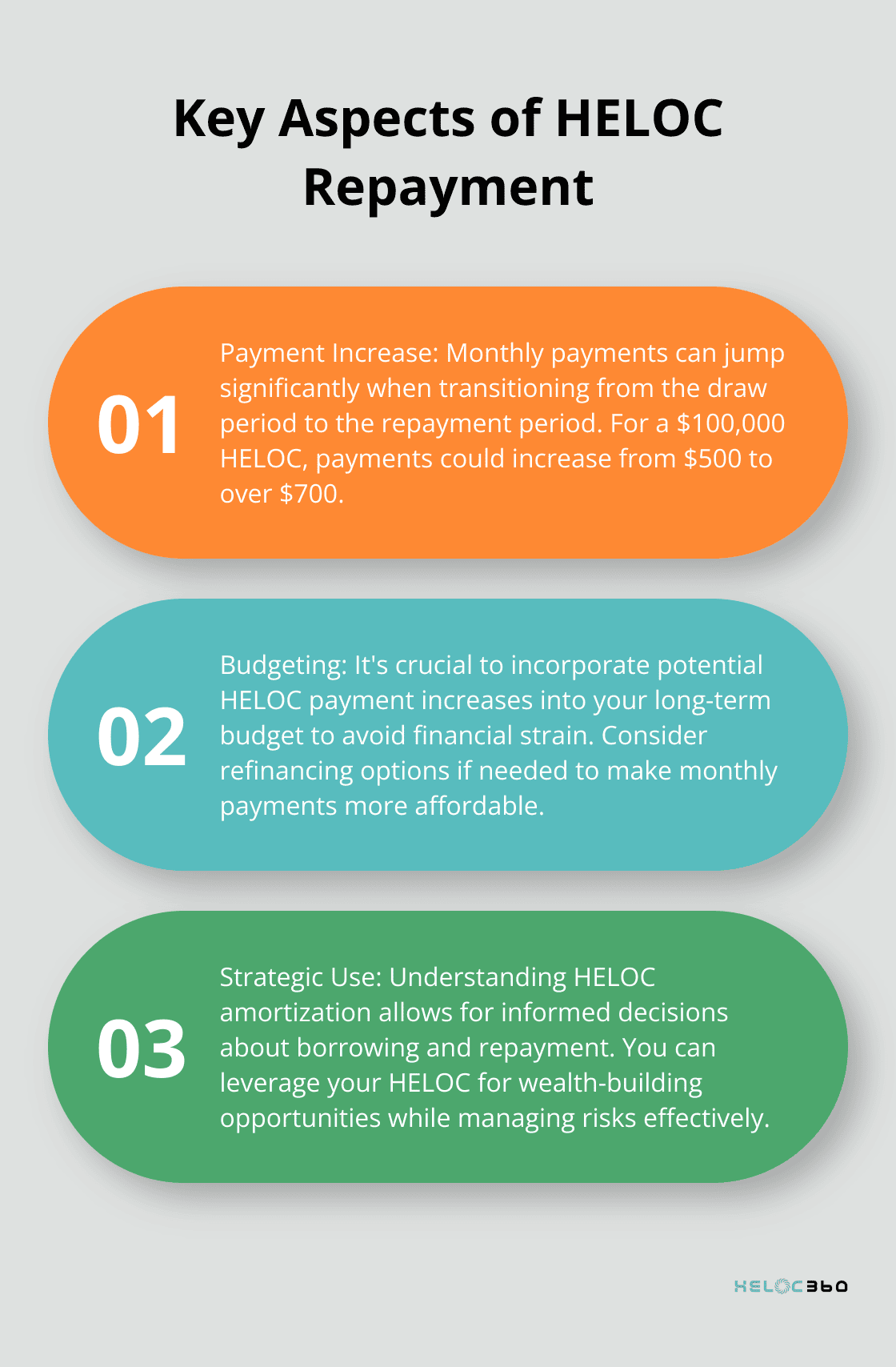

Incorporating HELOC payments into your overall budget requires foresight and flexibility. During the draw period, your minimum payments might be relatively low, covering only interest. However, when the repayment period begins, your payments can increase substantially.

For example, on a $100,000 HELOC with a 10-year draw period and 20-year repayment period at 6% interest, your monthly payment could jump from about $500 (interest-only) to over $700 (principal and interest) when repayment begins.

To avoid payment shock, consider refinancing your HELOC to make your monthly payments more affordable, either by reducing your interest rate or the payment size (or possibly both).

Long-Term Financial Planning

Understanding HELOC amortization allows you to make informed decisions about borrowing and repayment that align with your overall financial goals. You can use your HELOC strategically to build wealth and achieve your financial objectives.

For instance, you might use your HELOC to fund investments that generate higher returns than the interest rate on your HELOC. However, this strategy involves risk and requires careful consideration of your financial conditions and your personal risk tolerance.

Leveraging Home Equity

Your home equity is a powerful tool powerful tool for financial flexibility when you understand its amortization. You can use it to fund major life expenses, consolidate high-interest debt, or invest in your future.

For example, you might use your HELOC to fund a home renovation that increases your property value. This strategy can potentially increase your overall wealth while improving your living conditions.

Final Thoughts

HELOC amortization empowers you to shape your financial future. You can maximize its benefits through proactive management, early principal payments, and strategic repayment techniques. HELOC amortization affects more than monthly payments; it influences your home equity, tax situation, and overall financial planning.

Your HELOC can become a valuable asset in your financial toolkit with the right approach. We at HELOC360 offer tailored solutions and expert guidance to help you make informed decisions about your HELOC. Our platform unlocks the full potential of your home equity, supporting your journey to financial success.

Take control of your HELOC amortization today to pave the way for a more secure financial future. With proper understanding and management, you can leverage your home equity to achieve your financial goals while minimizing risks. Your path to financial prosperity starts with mastering HELOC amortization.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.