Divorce can be a complex process, especially when it comes to dividing assets like Home Equity Lines of Credit (HELOCs). These financial tools, which allow homeowners to borrow against their home’s equity, can become a significant point of contention during marital dissolution.

At HELOC360, we understand the challenges of navigating HELOC divorce situations. This guide will provide you with essential information and practical strategies to protect your interests and make informed decisions about your HELOC during this difficult time.

What Happens to HELOCs During Divorce?

The Legal Status of HELOCs in Divorce

Home Equity Lines of Credit (HELOCs) often become complex issues during divorce proceedings. Courts typically consider HELOCs as marital property, regardless of whose name appears on the account. This means both spouses usually share responsibility for the debt, even if only one person used the funds.

The American Bar Association states that courts generally view any debt incurred during the marriage as a shared responsibility (unless clear evidence suggests otherwise).

Dividing HELOC Debt

The approach to dividing HELOC debt varies based on factors such as state laws, divorce agreements, and the couple’s financial situation. In community property states, marital assets and debts incurred by either spouse during the marriage are divided 50-50, while equitable distribution states try to achieve a fair (but not necessarily equal) division.

Impact on Existing HELOC Agreements

Divorce can significantly affect existing HELOC agreements. Lenders don’t have to remove a spouse from the HELOC, even if the divorce decree assigns the debt to one party. This situation could leave both ex-spouses liable for the debt, potentially impacting their credit scores and future borrowing capacity.

While a divorce won’t show up on your credit reports, dividing your financial assets can have a negative impact on your credit. To avoid this outcome, couples should address the HELOC in their divorce settlement and take steps to refinance or pay off the debt if possible.

Practical Steps to Take

- Obtain a current HELOC statement: Know the exact amount owed and the terms of the agreement.

- Freeze the HELOC: This action prevents either spouse from drawing more funds during divorce proceedings.

- Consult a financial advisor: An advisor can help you understand the long-term implications of different HELOC division strategies.

- Negotiate carefully: If one spouse keeps the house and HELOC, ensure the agreement includes provisions for refinancing to remove the other spouse’s name.

The Role of Professional Guidance

Navigating HELOCs during divorce requires expert advice. Financial advisors and divorce attorneys (specializing in property division) can provide invaluable insights. They can help you understand the nuances of your specific situation and develop a strategy that protects your financial interests.

As you consider your options for handling HELOCs in divorce, it’s important to explore all available avenues. The next section will delve into specific strategies for managing these complex financial instruments during the divorce process.

How to Handle HELOCs in Divorce

When facing divorce, dealing with a Home Equity Line of Credit (HELOC) presents challenges. However, several strategies exist to manage this financial obligation effectively. Let’s explore your options and their potential implications.

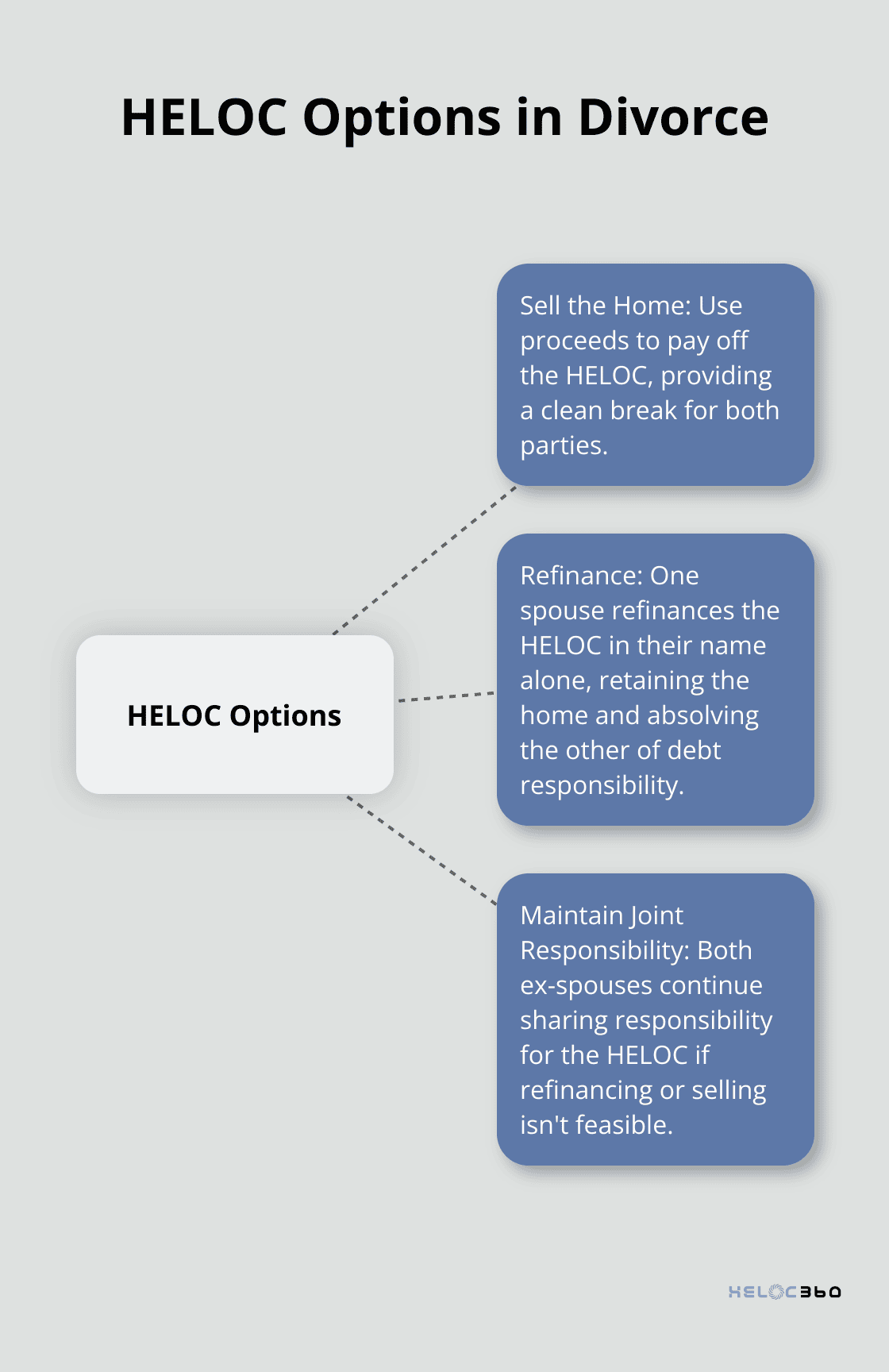

Sell the Home to Settle the HELOC

One straightforward approach involves selling the marital home and using the proceeds to pay off the HELOC. This option eliminates the shared debt and provides a clean break for both parties.

This strategy may not suit everyone if:

- The housing market is unfavorable

- One spouse wishes to keep the home

- The emotional impact of selling a family home is too great

- Relocation costs are prohibitive

Refinance the HELOC Under One Spouse’s Name

Another option allows one spouse to refinance the HELOC in their name alone. This approach enables one party to retain the home while absolving the other of responsibility for the debt. The spouse keeping the home must qualify for the refinance based on their individual income and credit score.

Consider these factors when refinancing:

- Closing costs may apply

- Interest rates could potentially increase

- Individual rates vary based on credit score and other factors

Maintain Joint Responsibility for the HELOC

In some cases, ex-spouses might choose to continue sharing responsibility for the HELOC. This arrangement might become necessary if:

- Neither party can afford to refinance

- Selling the home isn’t feasible

However, this option carries significant risks:

- If one party fails to make payments, both individuals’ credit scores could suffer

- Ongoing financial ties can complicate the divorce process

- Personal financial recovery may be hindered

Seek Professional Guidance

Addressing HELOC concerns during divorce proceedings requires expert advice. Financial advisors and divorce attorneys (specializing in property division) can provide invaluable insights. They can help you understand the nuances of your specific situation and develop a strategy that protects your financial interests.

As you weigh these options for handling HELOCs in divorce, it’s essential to consider the long-term implications of each choice. The next section will explore strategies to protect your interests when dealing with HELOCs during the divorce process.

Safeguarding Your Interests in HELOC Divorce Negotiations

The Importance of Full Financial Disclosure

Protecting your financial interests during a divorce involving a Home Equity Line of Credit (HELOC) requires careful planning and expert guidance. The decisions made during this process can impact your financial future significantly.

Complete financial transparency forms the foundation of fair HELOC negotiations in divorce. Both parties must provide a comprehensive picture of their assets, debts, and income. This includes all HELOC-related documents, such as statements, draw history, and repayment terms.

The American Academy of Matrimonial Lawyers warns that hiding assets or debts during divorce proceedings can lead to severe legal consequences. Some of the information that must be exchanged includes copies of tax returns, statements for all bank accounts, statements for all investment and retirement accounts.

To ensure full disclosure:

- Collect all HELOC-related documents from the past several years.

- Create a detailed list of all draws on the HELOC, including dates and purposes.

- Compile records of all payments made towards the HELOC.

- Document any agreements or discussions about the HELOC made during the marriage.

Leveraging Professional Expertise

HELOC issues during divorce require specialized knowledge. Engage professionals who can provide targeted advice:

- Divorce Financial Analyst: These experts can help you understand the long-term implications of different HELOC settlement options.

- Real Estate Attorney: They can advise on property laws specific to your state and how they impact HELOC division.

- Tax Professional: Understanding the tax implications of various HELOC settlement options is essential. The IRS provides guidelines on the tax treatment of home equity debt in divorce situations, which can significantly impact your financial outcome.

- HELOC Specialist: Consult with experts who understand the nuances of HELOC products. (Platforms like HELOC360 can connect you with professionals who specialize in HELOC management during divorce.)

Strategic Negotiation of HELOC Responsibilities

When negotiating HELOC responsibilities in your divorce settlement, consider these strategies:

- Equity Offset: If one spouse keeps the home and HELOC, they might offer other assets of equal value to the other spouse as compensation.

- Refinancing Agreement: Include a clause in your settlement that requires the spouse keeping the home to refinance the HELOC within a specific timeframe, removing the other spouse from the obligation.

- Contingency Plans: Establish clear consequences if the refinancing doesn’t occur as agreed. This might include forced sale of the property or other financial penalties.

- Payment Responsibility: If joint responsibility continues, clearly outline who is responsible for payments and how missed payments will be handled.

- Future Draw Restrictions: If the HELOC remains open, set clear rules about future draws, potentially requiring mutual consent for any new borrowing.

The American Bar Association emphasizes the importance of clearly defined financial responsibilities in divorce agreements to prevent future disputes and protect both parties’ interests.

Post-Settlement Vigilance

After reaching a settlement, maintain vigilance about your HELOC:

- Monitor Credit Reports: Regularly check your credit report to ensure the HELOC is managed as agreed.

- Communicate with the Lender: Inform the HELOC lender about the divorce settlement terms (especially if one spouse is no longer responsible for the debt).

- Document Everything: Keep detailed records of all HELOC-related communications and transactions post-divorce.

Final Thoughts

HELOC divorce situations present unique challenges, but you can protect your financial interests with the right approach and expert guidance. Full financial disclosure, professional advice, and strategic negotiation will help you reach a fair settlement. Your decisions about your HELOC will impact your financial future, so make informed choices.

After divorce, you must stay vigilant about your HELOC responsibilities. Monitor your credit reports, communicate with lenders, and keep detailed records to ensure compliance with your settlement agreement. These actions will minimize potential conflicts and protect your financial well-being as you move forward.

HELOC360 offers valuable assistance for those facing HELOC divorce situations. Our platform provides expert guidance and connects you with lenders who understand the complexities of HELOCs in divorce (simplifying the process and empowering you with knowledge). HELOC360 helps you make informed decisions about your home equity, ensuring a more secure financial future as you start this new chapter of your life.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.