At HELOC360, we’ve seen many homeowners caught off guard by unexpected HELOC closing costs.

While HELOCs can be valuable financial tools, it’s crucial to understand all the potential fees involved.

In this post, we’ll explore both common and surprising HELOC closing costs you should be aware of before signing on the dotted line.

We’ll also share effective strategies to help you minimize these expenses and make the most of your HELOC.

What Are Common HELOC Closing Costs?

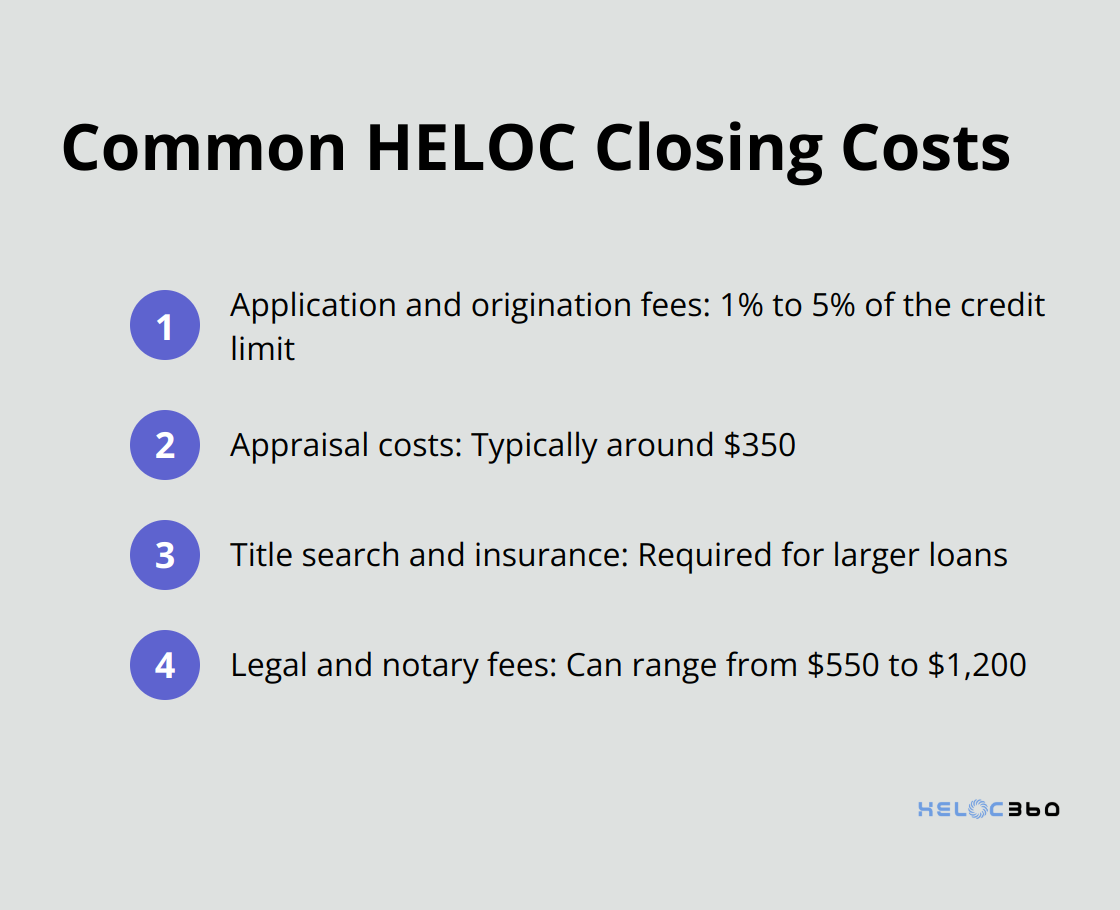

When you apply for a Home Equity Line of Credit (HELOC), you’ll encounter various closing costs. Let’s break down the most common HELOC closing costs you’re likely to face.

Application and Origination Fees

Most lenders charge application and origination fees to process your HELOC request. These fees typically range from 1% to 5% of the credit limit. Some lenders offer promotions that waive these fees, so ask about potential discounts or fee waivers. As of August 6, 2025, the national average HELOC interest rate is 8.13%, according to Bankrate’s latest survey of the nation’s largest home equity lenders.

Appraisal Costs

An appraisal determines your home’s current market value. Appraisal fees typically cost around $350. For lower loan amounts, some lenders use automated valuation models, which can reduce or eliminate this fee.

Title Search and Insurance

Lenders conduct a title search to check for liens or claims against your property. A title search is required on loans greater than $250,000, and title insurance is required on lines greater than $500,000. These fees protect both you and the lender from potential ownership disputes.

Legal and Notary Fees

Depending on your state and lender requirements, you might need to pay for attorney services and notary fees. Attorney fees can range from $500 to $1,000, while notary fees are typically much lower ($50 to $200). Some states require an attorney to be present at closing, so check your local regulations.

These costs can add up quickly. On a $100,000 HELOC, you might pay between $2,000 and $5,000 in closing costs. That’s why it’s smart to compare offers from multiple lenders. You can potentially save thousands of dollars in fees and secure better terms for your HELOC.

While these costs are common, they’re not set in stone. Many lenders will negotiate, especially if you have a strong credit profile or borrow a large amount. Don’t hesitate to ask about fee waivers or reductions – it could lead to significant savings on your HELOC.

Now that we’ve covered the common closing costs, let’s explore some hidden HELOC closing costs that might surprise you.

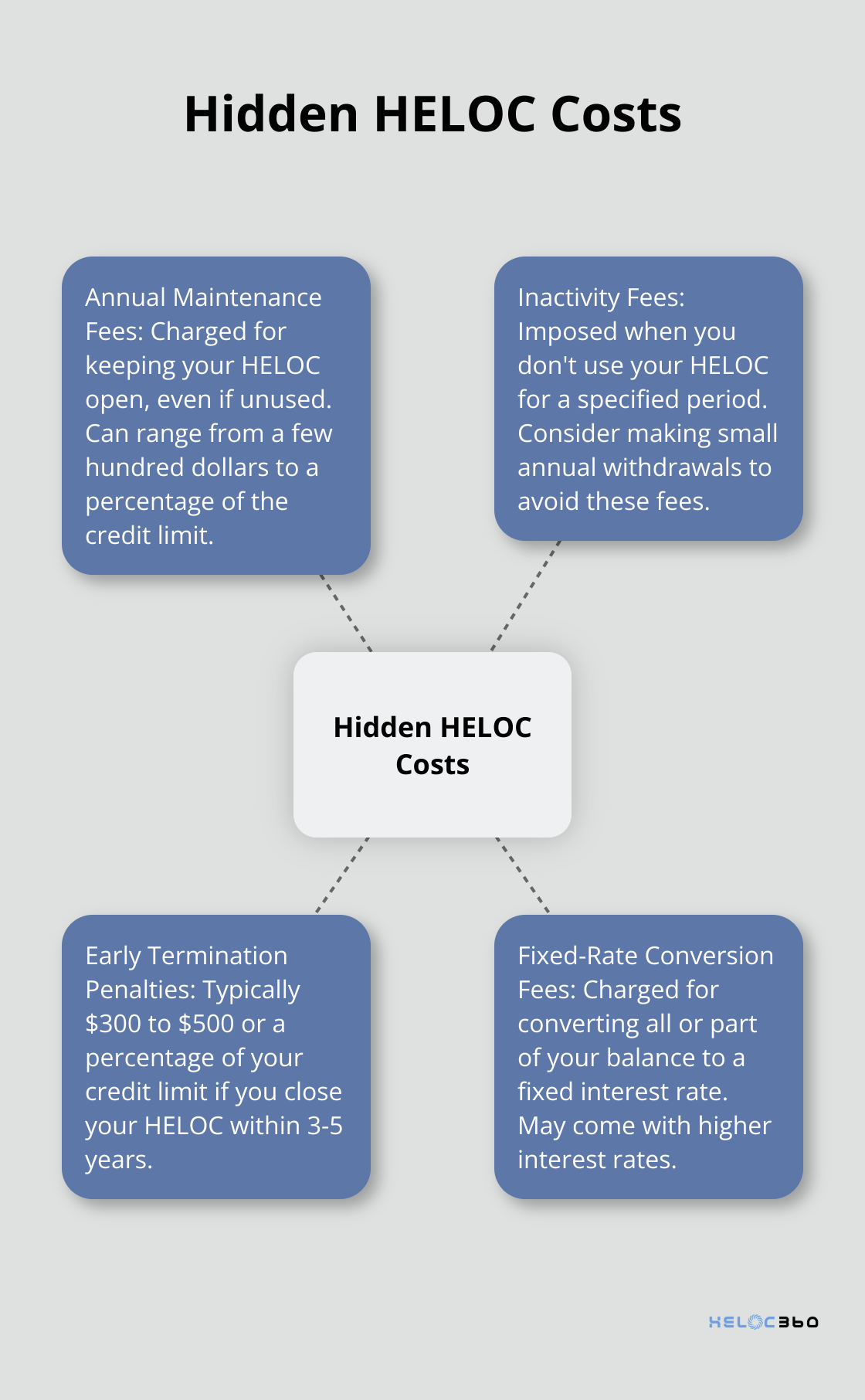

What Hidden HELOC Costs Might Surprise You?

Many homeowners focus on common HELOC closing costs, but several hidden fees can catch them off guard. Let’s explore these lesser-known expenses to help you make informed decisions about your HELOC.

Annual Maintenance Fees

Many lenders charge annual maintenance fees for keeping your HELOC open, even if you don’t use it. These fees can range from a few hundred dollars to a percentage of the credit limit. Some lenders waive this fee for the first year as a promotional offer, but it’s important to factor this ongoing cost into your long-term financial planning. Always ask your lender if they charge this fee and if they can negotiate or waive it. To avoid early closure fees, you may want to plan to keep your HELOC open for a longer period.

Inactivity Fees

Certain HELOC fees can quietly raise the cost of borrowing, including inactivity fees. Lenders impose these fees when you don’t use your HELOC for a specified period. To avoid this cost, understand your lender’s policy on inactivity fees and plan to make at least one small withdrawal annually if necessary. Some lenders don’t charge this fee, so it’s worth shopping around if you plan to use your HELOC sparingly.

Early Termination Penalties

If you close your HELOC within a certain timeframe (typically three to five years), you might face early termination fees. These can be substantial, often ranging from $300 to $500 or a percentage of your credit limit. Before signing, ask your lender about their early termination policy and consider how long you plan to keep the HELOC open. If you’re unsure about your long-term plans, look for lenders who don’t charge this fee or are willing to waive it.

Fixed-Rate Conversion Fees

Some HELOCs offer the option to convert all or part of your balance to a fixed interest rate. While this can provide stability in your payments, lenders often charge a fee for this service. Fixed-rate HELOCs may charge higher fees and come with higher interest rates. If you think you might want to use this feature, factor this cost into your decision-making process and compare the potential savings in interest against the conversion fee.

Understanding these hidden costs is essential for making an informed decision about your HELOC. Always read the fine print and ask your lender detailed questions about all potential fees. The lowest interest rate doesn’t always mean the best deal if it comes with high hidden costs (especially when it comes to annual fees and early termination penalties).

Now that you’re aware of these potential surprise expenses, let’s explore effective strategies to minimize your HELOC closing costs and secure the best possible deal for your financial needs.

How to Slash Your HELOC Closing Costs

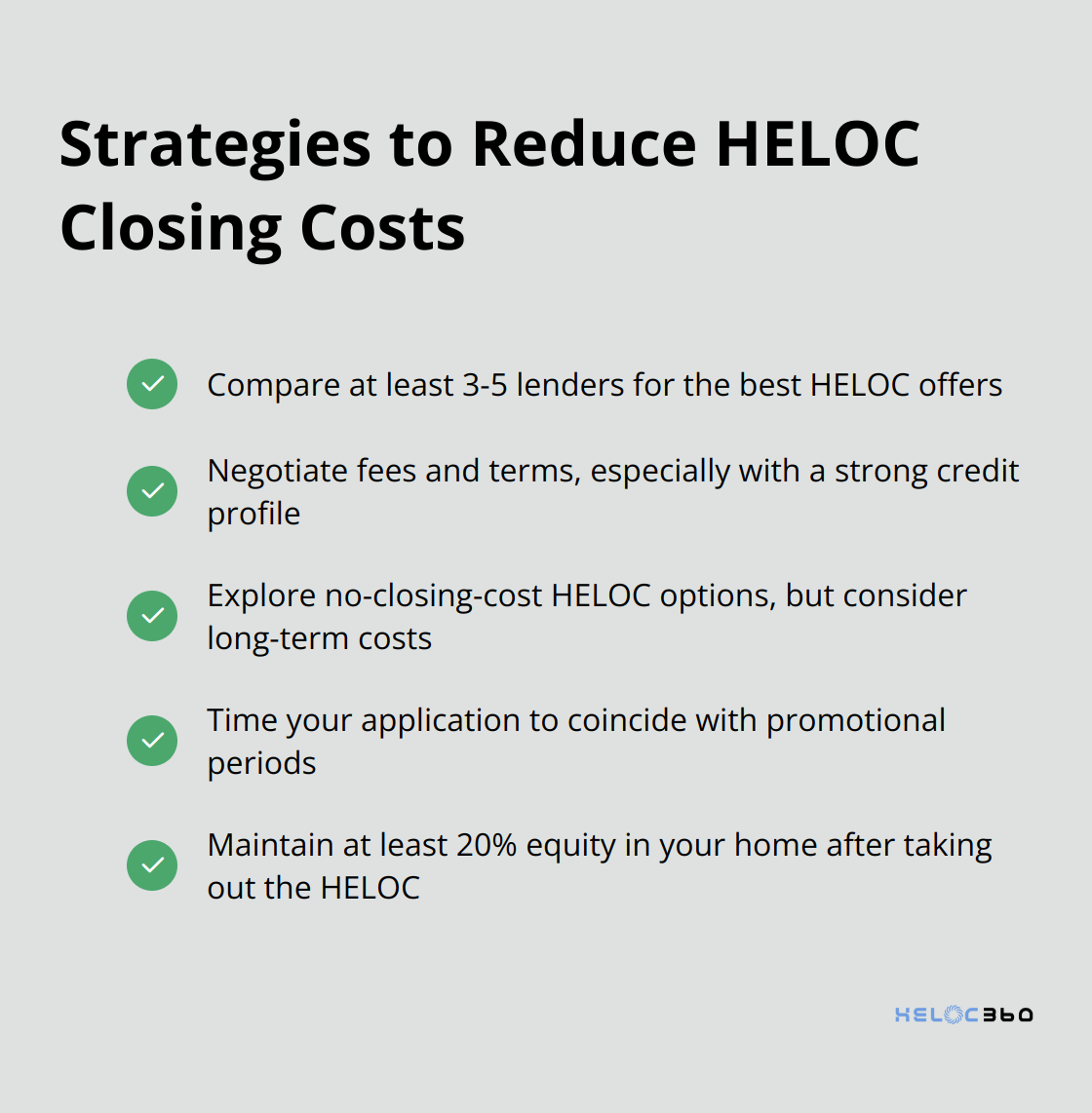

At HELOC360, we know homeowners can significantly reduce their HELOC closing costs by employing smart strategies. Here’s how you can do the same:

Compare Multiple Lenders

Don’t settle for the first offer you receive. Shop around and compare at least three to five lenders. Each lender has its own fee structure and promotional offers. Some lenders might waive application fees or offer lower interest rates to attract new customers. Use this competition to your advantage.

Master the Art of Negotiation

Once you’ve gathered multiple offers, use them as leverage to negotiate better terms. Many fees are negotiable, especially if you have a strong credit profile or a long-standing relationship with the bank.

For instance, if one lender offers to waive the application fee but has a higher interest rate, ask another lender if they can match the fee waiver and keep their lower rate. Be prepared to walk away if a lender won’t budge on fees – this often leads to better counter-offers.

Explore No-Closing-Cost Options

Some lenders offer no-closing-cost HELOCs, which can be attractive if you’re short on upfront cash. However, these often come with higher interest rates or fees spread out over the life of the loan.

For example, a lender might offer a no-closing-cost HELOC with a higher interest rate, compared to a lower rate with standard closing costs. Calculate the long-term cost to determine if this option truly saves you money.

Time Your Application Strategically

The HELOC market is competitive, and lenders often run promotions during certain times of the year. Spring and early summer (when home buying activity peaks) often see more HELOC promotions. Some lenders also offer end-of-quarter or end-of-year specials to meet their lending targets.

A common rule of thumb is to maintain at least 20% equity in your home after taking out a loan or line of credit. You could save significantly in closing costs if you time your application to coincide with promotional periods while maintaining this equity threshold.

Reducing closing costs is just one part of the equation. Always consider the long-term cost of the HELOC, including interest rates and ongoing fees. A HELOC with slightly higher closing costs but a lower interest rate might save you more money over time.

Final Thoughts

HELOC closing costs can impact your financial decisions. Common fees include application, origination, and appraisal costs, while surprising charges may involve annual maintenance, inactivity, and early termination fees. You can reduce these expenses by comparing lenders, negotiating terms, and exploring no-closing-cost options. The timing of your application also matters, as lenders often run promotions during peak home-buying seasons.

HELOC360 helps homeowners maximize their home equity. Our platform streamlines the HELOC process and connects you with suitable lenders. We encourage you to use the strategies discussed here to secure a HELOC that minimizes closing costs and aligns with your financial goals. Consider the long-term implications of interest rates and ongoing fees when evaluating HELOC offers.

A well-structured HELOC can become a powerful financial tool. You can leverage your home’s equity more effectively for home improvements, debt consolidation, or creating financial flexibility. Take a proactive approach to understand and manage HELOC closing costs (and associated fees) to achieve your financial aspirations.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.