Home Equity Lines of Credit (HELOCs) are often touted as a financial lifeline, but they come with significant drawbacks that many homeowners overlook.

At HELOC360, we believe it’s crucial to understand the full picture before tapping into your home’s equity.

This post will shed light on the hidden risks, true costs, and common pitfalls associated with HELOCs, helping you make an informed decision about your financial future.

What Lurks Behind HELOCs?

HELOCs might appear as an easy way to access your home’s value, but they hide serious risks that can blindside homeowners. Let’s explore these hidden dangers.

The Interest Rate Rollercoaster

HELOCs typically feature variable interest rates. This characteristic can cause your monthly payments to fluctuate wildly, turning budgeting into a nightmare. According to Bankrate’s national survey of lenders, the average HELOC interest rate closed out the year almost a full percentage point lower. This change can significantly impact monthly payments for borrowers.

The Debt Trap

HELOCs can easily lead borrowers into a cycle of debt. The revolving nature of this credit line encourages continuous borrowing, similar to a credit card. A study by the Urban Institute revealed that the average American household with a HELOC carries nearly $20,000 in outstanding balance. This high reliance on HELOCs can strain finances and hinder long-term wealth building (a concern for financial advisors).

Your Home on the Line

The most significant risk of a HELOC is the potential for foreclosure. Missed payments don’t just impact your credit score – they put your home at risk. This underscores the gravity of using your home as collateral (a decision not to be taken lightly).

Hidden Fees and Costs

Many homeowners overlook the additional expenses associated with HELOCs. These can include appraisal fees, closing costs, and annual maintenance fees. These hidden costs can significantly increase the overall expense of borrowing.

The Draw Period Trap

HELOCs typically have a draw period (usually 5-10 years) during which borrowers can access funds and only pay interest. When this period ends, borrowers must repay both principal and interest, which can lead to payment shock. Your lender may set a schedule so that you repay the full amount, often over ten or 15 years.

The risks associated with HELOCs demand careful consideration. As we move forward, let’s examine the true cost of HELOCs beyond just interest rates and monthly payments.

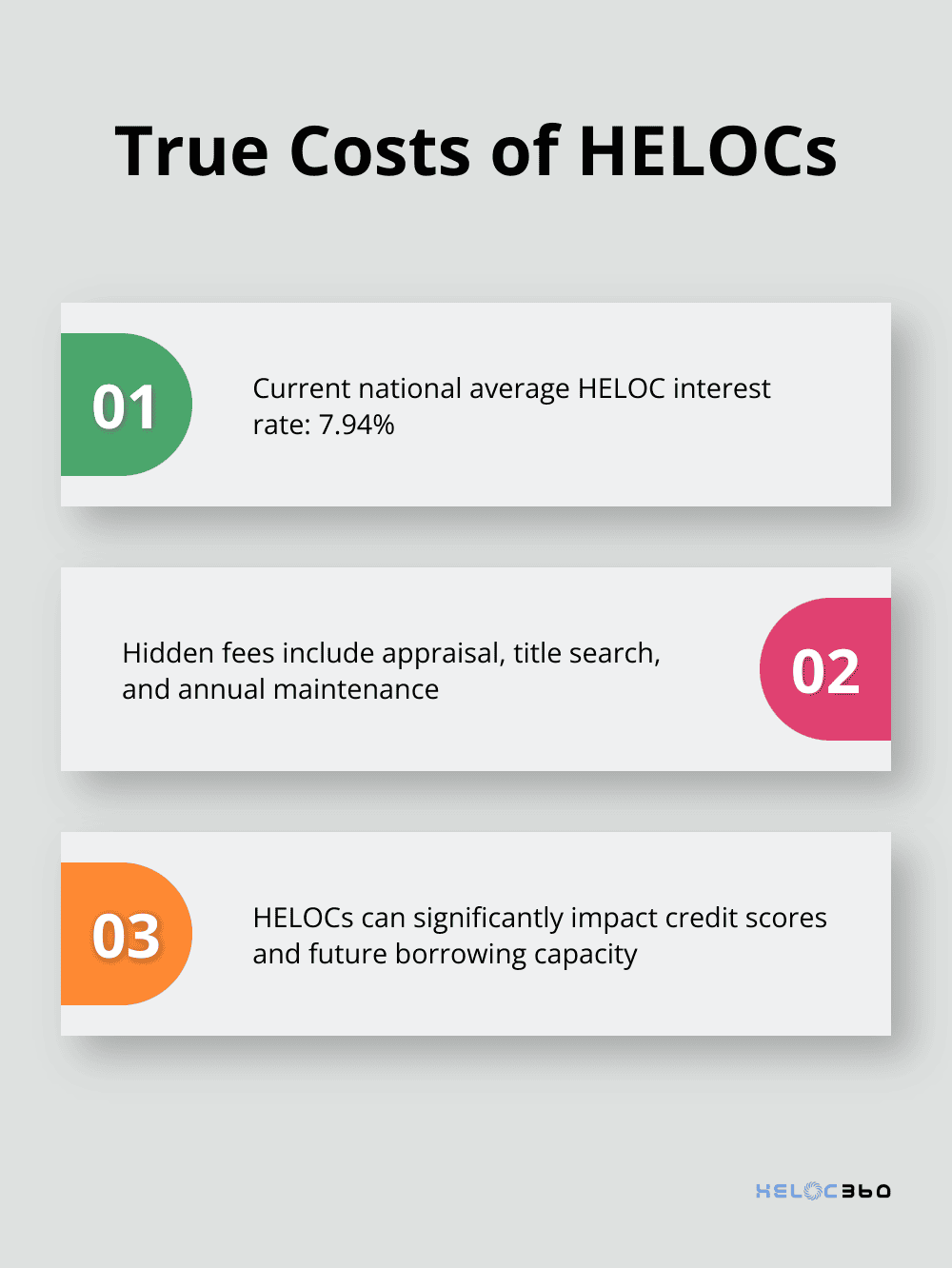

The True Cost of HELOCs: Beyond Interest Rates

Hidden Fees That Surprise Borrowers

HELOCs come with a multitude of fees that often catch borrowers off guard. While closing costs can vary, it’s important to consider the current interest rates. As of April 23, 2025, the national average HELOC interest rate is 7.94%, according to Bankrate’s latest survey of the nation’s largest home equity lenders. These expenses may include appraisal fees, title search fees, and application fees. Some lenders also impose annual maintenance fees.

The Long-Term Interest Expense Burden

While HELOCs often start with attractive introductory rates, their variable interest rate structure can lead to substantial long-term costs. The Federal Reserve Bank of St. Louis provides economic data series on home equity loans, which can help borrowers understand historical rate trends. This volatility means your monthly payments could potentially change if rates fluctuate. An increase in your rate over a long repayment period could result in significant additional interest.

Credit Score Impact and Future Borrowing Capacity

Opening a HELOC significantly affects your credit score and future borrowing capacity. FICO considers a HELOC a revolving account, similar to a credit card. It impacts your credit utilization ratio, which accounts for 30% of your FICO score. Using a high balance on your HELOC might affect your credit scores, potentially impacting your ability to secure future loans or favorable interest rates.

The Draw Period Dilemma

HELOCs typically feature a draw period (usually 5-10 years) during which borrowers can access funds and only pay interest. When this period ends, borrowers must repay both principal and interest. This transition often leads to payment shock, as monthly obligations can increase significantly. Many homeowners fail to plan for this inevitable change in their repayment structure.

The Risk of Foreclosure

Perhaps the most significant cost associated with a HELOC is the potential loss of your home. Unlike unsecured loans, HELOCs use your home as collateral. Missed payments don’t just impact your credit score – they put your home at risk of foreclosure. This underscores the importance of careful consideration before using your home’s equity as a financial tool.

Understanding these often-overlooked costs associated with HELOCs empowers homeowners to make informed decisions. As we explore common HELOC pitfalls in the next section, you’ll gain a comprehensive view of the potential risks and how to navigate them effectively.

How to Sidestep HELOC Traps

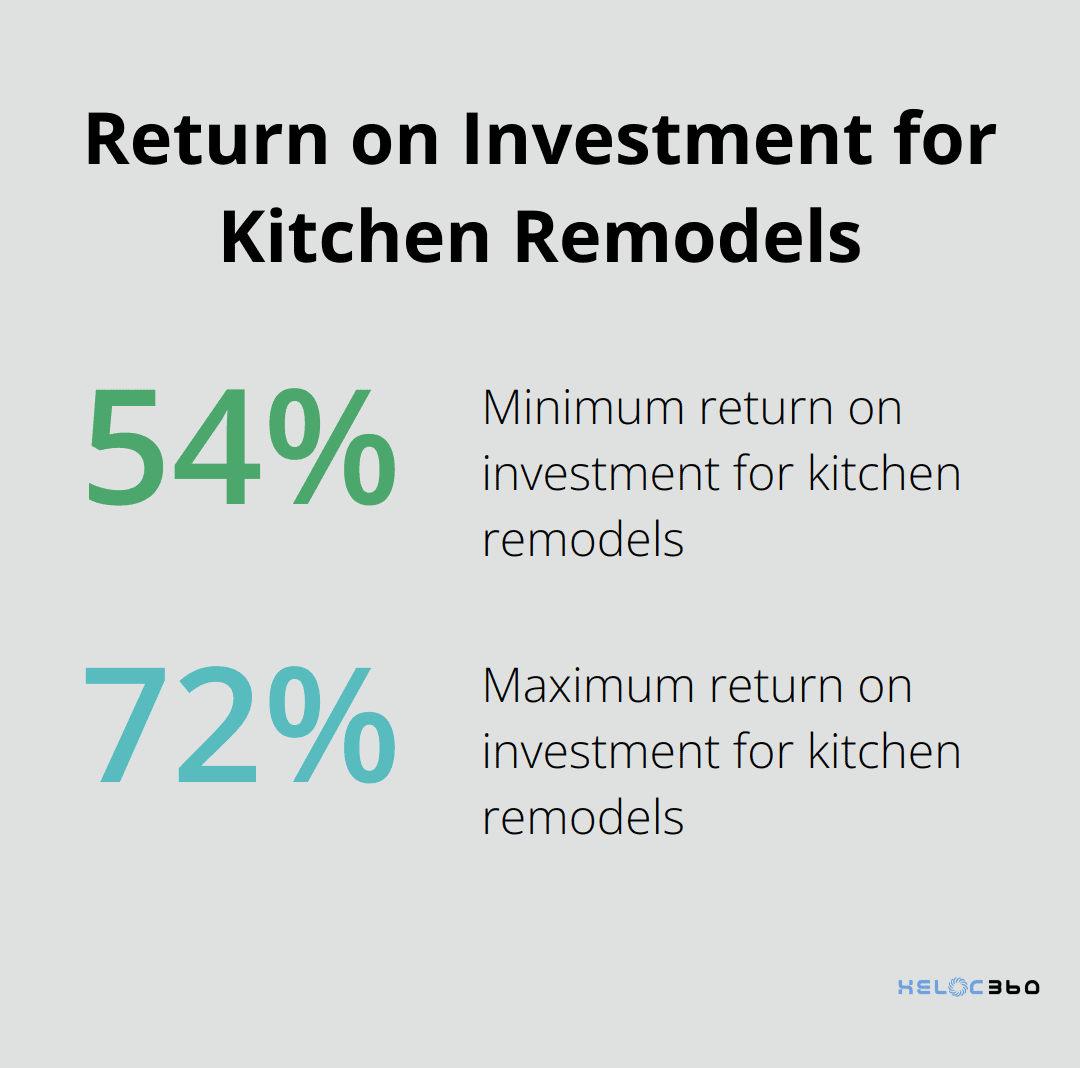

The Temptation of Non-Essential Spending

HELOCs can lure borrowers into using funds for non-essential purchases. A Federal Reserve Bank of Philadelphia study revealed that some HELOC borrowers use the funds for everyday expenses or luxury items. This practice often leads to a dangerous debt cycle.

Use HELOC funds for value-adding home improvements or debt consolidation instead. Kitchen remodels, for example, typically yield a return on investment of 54% to 72% (according to Remodeling Magazine’s Cost vs. Value Report).

The Draw Period Danger Zone

Many borrowers overlook the implications of the draw period ending. The Consumer Financial Protection Bureau reports that payments can increase significantly when the repayment period begins. This sudden jump often catches borrowers unprepared.

To avoid this shock, prepare for higher payments well before the draw period ends. Consider refinancing options or make principal payments during the draw period to reduce the balance.

The Fine Print Fiasco

Many borrowers fail to read and understand HELOC agreements thoroughly. Some adults don’t read financial agreements carefully before signing.

Take time to understand all terms, including potential rate increases, fees, and prepayment penalties. If anything remains unclear, ask your lender for clarification or consult with a financial advisor.

The Home-as-Collateral Risk

HELOCs use your home as collateral, which puts your property at risk if you default on payments. This fact often gets overlooked in the excitement of accessing funds.

Treat your HELOC with the same seriousness as your primary mortgage. Create a solid repayment plan and stick to it religiously to protect your most valuable asset.

The Variable Rate Rollercoaster

HELOCs typically come with variable interest rates, which can lead to unpredictable payment amounts. This variability can wreak havoc on your budget if you’re unprepared.

Try to maintain a financial buffer to accommodate potential rate increases. Consider converting a portion of your HELOC to a fixed-rate option if your lender offers this feature.

Final Thoughts

HELOCs offer financial flexibility but come with significant drawbacks. Variable interest rates, potential overspending, and foreclosure risks demand careful consideration. The true costs of HELOCs extend beyond interest rates, including hidden fees and impacts on credit scores.

HELOC drawbacks underscore the importance of thorough financial planning. Alternatives such as cash-out refinancing or fixed-rate home equity loans merit exploration. Each option has its own advantages and considerations, emphasizing the need for personalized financial strategies.

HELOC360 helps homeowners navigate these financial waters, providing guidance and connecting you with suitable lenders. We offer tailored solutions and expert insights to empower homeowners to make informed decisions about their home equity. Your home is more than a financial asset – it’s your sanctuary, and any decision involving your home equity requires caution and professional guidance.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.