Are you struggling to find HELOC lenders for bad credit? You’re not alone. Many homeowners with less-than-perfect credit scores face challenges when seeking a home equity line of credit.

At HELOC360, we understand these difficulties and want to help. In this 2025 review, we’ll explore the top HELOC lenders that work with borrowers who have bad credit, and provide tips to improve your chances of approval.

Understanding Bad Credit and Its Impact on HELOC Applications

What Constitutes Bad Credit?

Bad credit doesn’t have to derail your HELOC plans. At HELOC360, we often encounter homeowners with credit scores below 620 who face challenges in securing a home equity line of credit. This score range typically falls into the “bad credit” category for most lenders.

The Ripple Effects of Bad Credit on HELOC Applications

A low credit score can significantly influence your HELOC application. Lenders view applicants with bad credit as higher-risk borrowers, which can result in:

- Elevated interest rates

- Reduced credit limits

- More stringent terms and conditions

- Possible application rejection

To illustrate, a borrower with excellent credit might lock in a HELOC with a 6.5% interest rate, while someone with bad credit could face rates of 9% or higher.

Lenders’ Approach to Credit Assessment for HELOCs

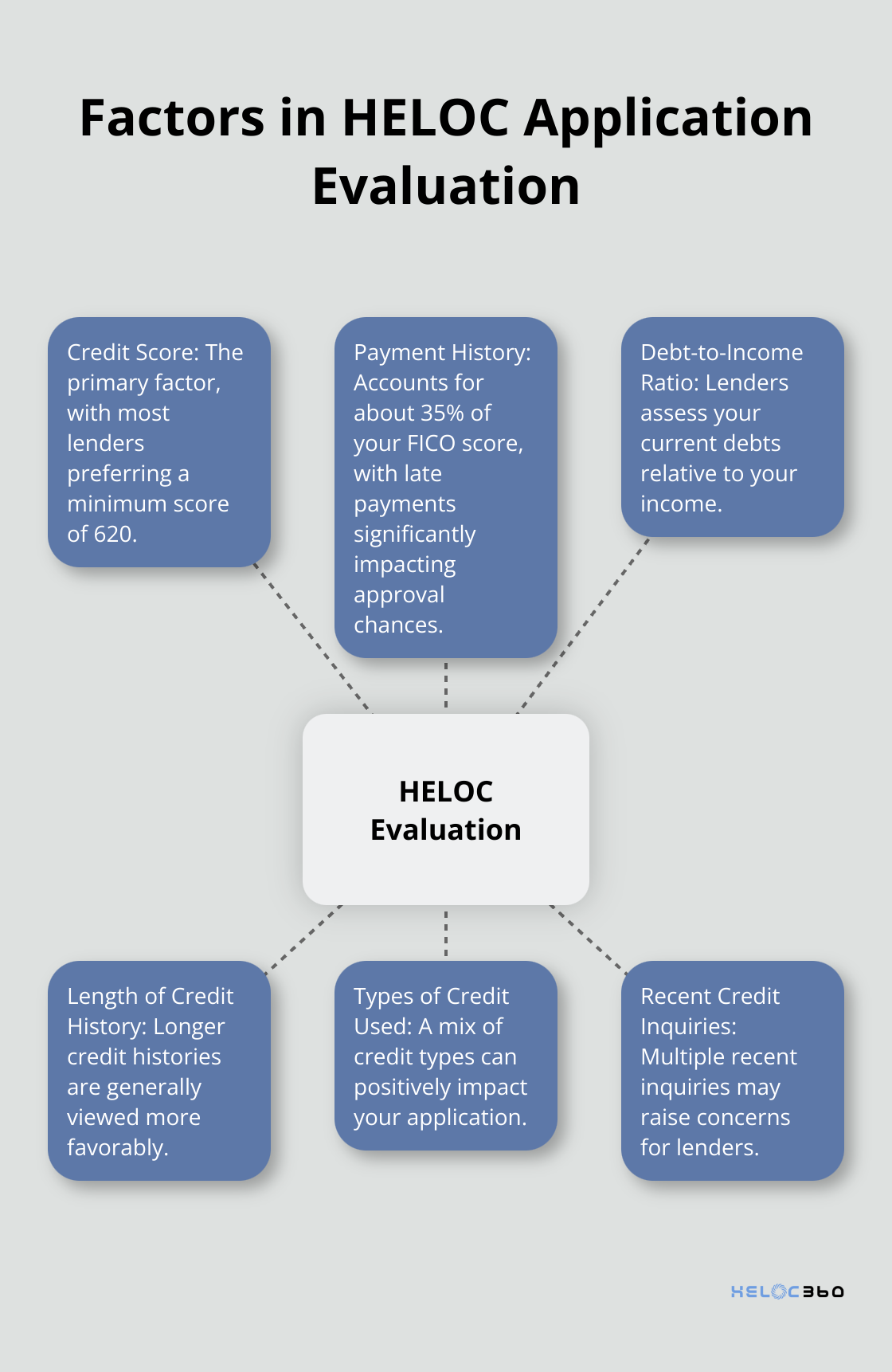

Your credit score isn’t the sole factor lenders consider when evaluating your HELOC application. They examine several aspects of your financial profile:

- Payment history (which accounts for about 35% of your FICO score)

- Debt-to-income ratio

- Length of credit history

- Types of credit used

- Recent credit inquiries

Late payments, especially on mortgages or other loans, can significantly hinder your approval chances.

Credit Score Thresholds for HELOC Approval

While requirements vary among lenders, most prefer a minimum credit score of 620 for HELOC approval. However, some lenders work with scores as low as 580. For example, Fifth Third Bank’s advertised rates are based on a minimum FICO score of 720 for a primary, owner-occupied residence with up to 80% loan-to-value ratio.

It’s crucial to note that meeting the minimum credit score requirement doesn’t guarantee approval. Lenders also scrutinize your overall financial picture, including your income, existing debts, and the amount of equity in your home.

Options for Borrowers with Sub-620 Credit Scores

If your credit score falls below 620, don’t lose hope. Some lenders specialize in working with borrowers who have less-than-perfect credit. These lenders may offer HELOCs with higher interest rates or require additional collateral.

Improving your credit score, even by a few points, can open up more HELOC options (and potentially better terms). HELOC360 can help you understand your current credit situation and connect you with lenders who are more likely to work with your specific credit profile.

Now that we’ve explored the impact of bad credit on HELOC applications, let’s take a closer look at the top HELOC lenders for bad credit in 2025.

Top HELOC Lenders for Bad Credit in 2025

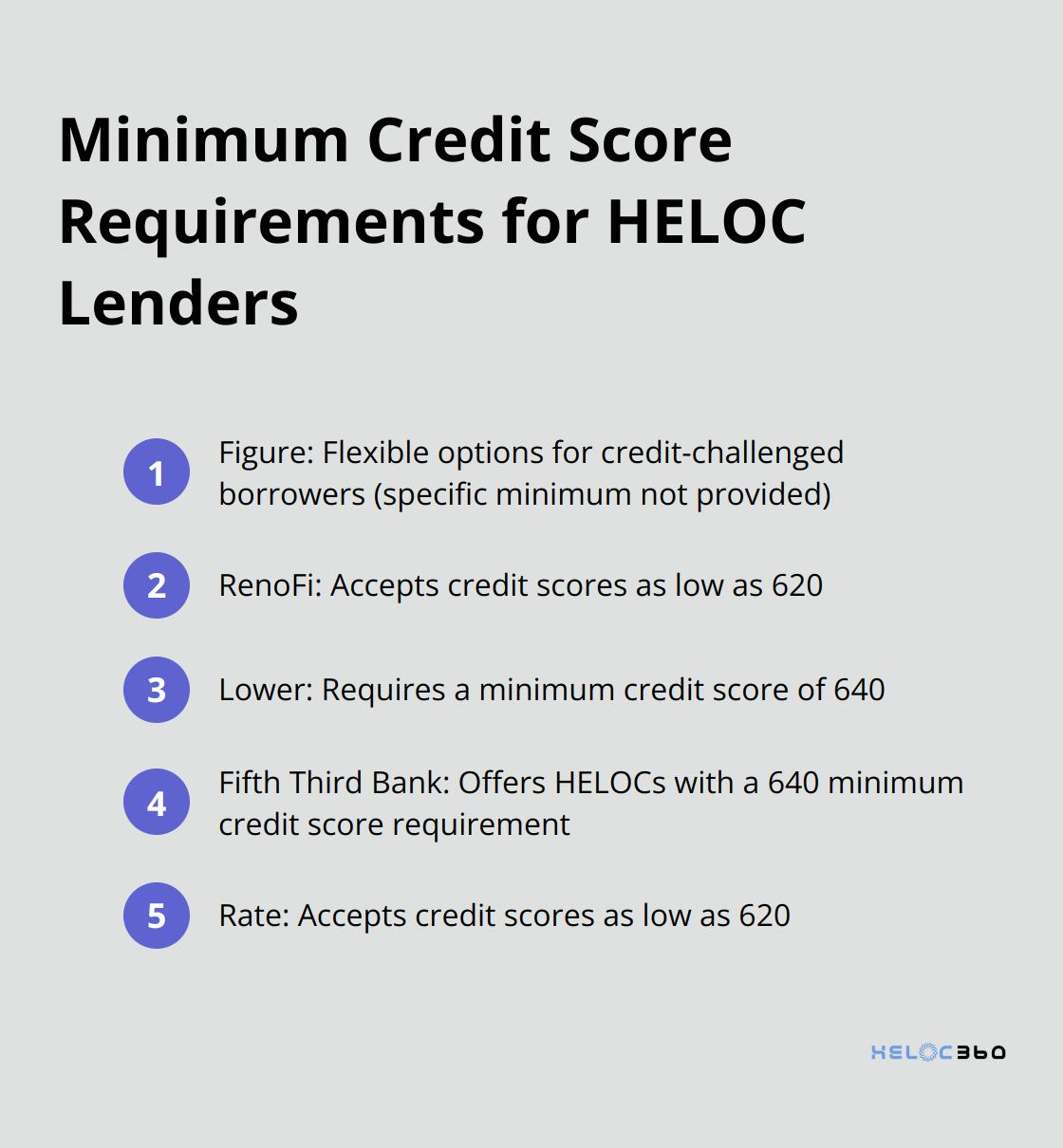

Figure: Flexible Options for Credit-Challenged Borrowers

Bankrate has rated dozens of HELOC lenders to find the best deals. Their online application provides quick approval and funding in as few as five days. Figure uses automated valuation models to speed up approvals, though this may result in lower home valuations. Their maximum combined loan-to-value ratio (CLTV) ranges from 75% to 90%. While interest rates may be higher for lower credit scores, Figure maintains pricing transparency. Note that they charge a 4.99% origination fee on initial draw amounts.

RenoFi: Renovation-Focused HELOCs for Various Credit Profiles

RenoFi specializes in renovation loans, including HELOCs, and works with credit scores as low as 620. They consider your home’s post-renovation value, potentially increasing your borrowing power. RenoFi offers loans up to 90% of this value, with terms from 5 to 30 years. However, they don’t operate in Hawaii, Utah, and New York. Their focus on renovation loans means you’ll need to provide detailed plans and contractor estimates with your application.

Lower: High CLTV Options for Credit-Challenged Homeowners

Lower requires a minimum credit score of 640 but offers a high maximum CLTV of 95%. Their user-friendly online application and competitive rates make them attractive for borrowers with less-than-perfect credit. Be prepared for a $495 application fee and a 1% origination fee (no annual fees). Lower requires a minimum initial draw of $50,000, which might exceed some borrowers’ needs. NerdWallet notes that while a DTI of 43% is the maximum to qualify for a HELOC with many lenders, a ratio of 36% or less will help you get the best rate offers.

Fifth Third Bank: Traditional Banking Option for Borderline Credit

Fifth Third Bank offers HELOCs with a 640 minimum credit score requirement. Their maximum CLTV is 70%, lower than some competitors. They provide competitive rates and flexible repayment terms, including interest-only payment options during the draw period. Fifth Third Bank has physical branches in several states (primarily Midwest and Southeast), allowing for in-person consultations.

Rate: Quick Funding for Those with Fair Credit

Rate accepts credit scores as low as 620 and offers HELOCs with a maximum CLTV of 85%. Their online application is straightforward, often providing funding within a week of approval. Rate’s draw period (2-5 years) is shorter than the typical 10-year period. They require borrowers to take out the full approved amount at closing, which could result in paying interest on unused funds.

While these lenders work with lower credit scores, improving your credit can lead to better terms and rates. The next section will provide tips to enhance your chances of HELOC approval with bad credit.

How to Boost Your HELOC Approval Odds with Bad Credit

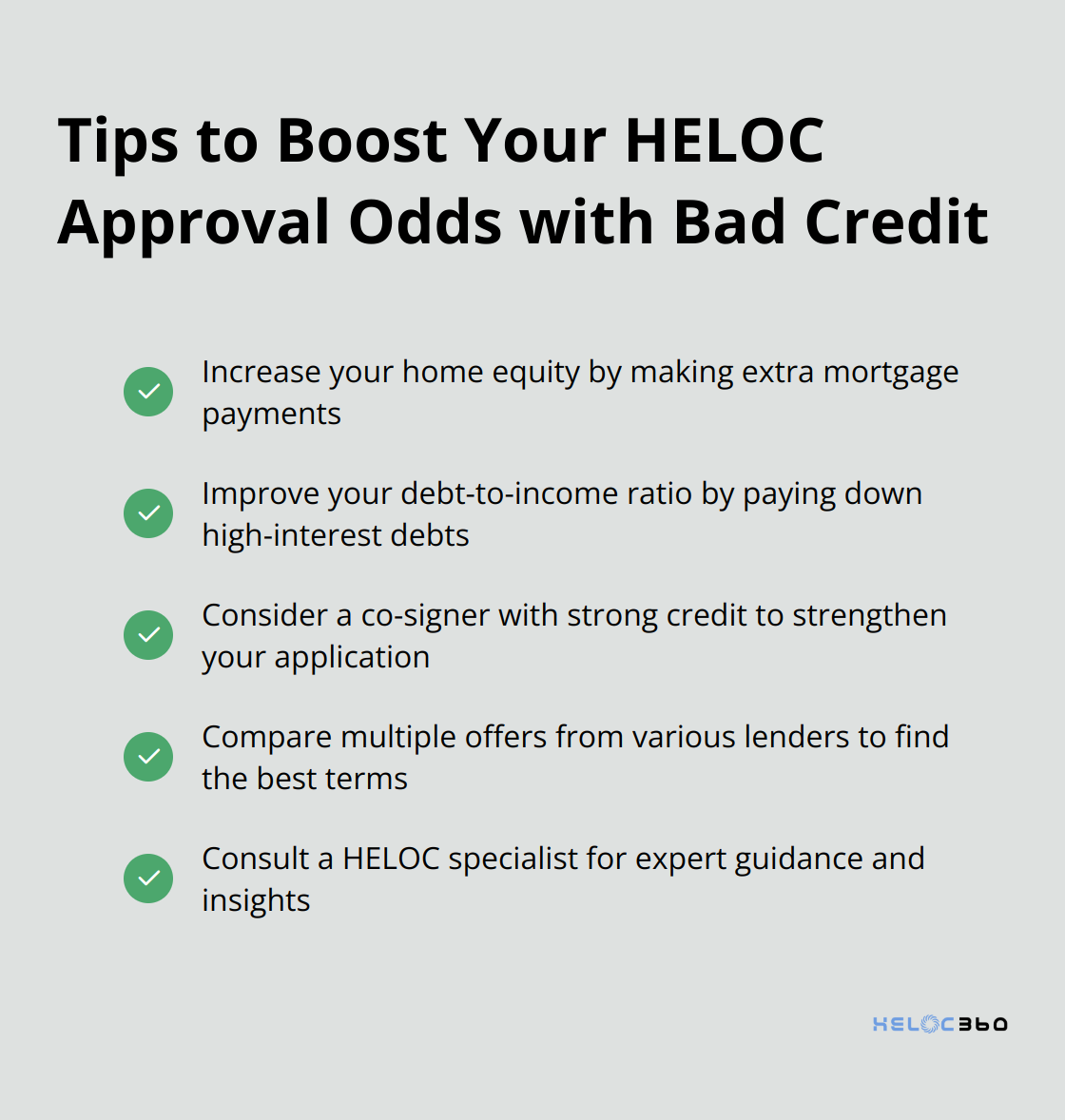

Increase Your Home Equity

One of the most effective ways to improve your HELOC approval odds is to increase your home equity. Lenders typically require 15-20% equity for HELOC approval. You can make extra mortgage payments to build equity faster. Even small additional payments can make a significant difference over time.

For example, if you have a $200,000 mortgage balance on a home valued at $250,000, you have 20% equity. If you pay an extra $200 per month, you could increase your equity to 25% in just one year, making you a more attractive candidate to lenders.

Improve Your Debt-to-Income Ratio

Your debt-to-income ratio (DTI) is a critical factor in HELOC approval. Most lenders prefer a DTI of 43% or lower. To improve your DTI, focus on paying down high-interest debts first. You can use the debt avalanche method, where you target the highest interest rate debts while making minimum payments on others.

For instance, if you have $5,000 in credit card debt at 18% APR, paying an extra $100 per month could save you over $1,000 in interest and shorten your repayment time by nearly two years. This approach not only improves your DTI but also boosts your credit score over time.

Consider a Co-Signer with Strong Credit

If your credit score holds you back, you can ask a family member or close friend with good credit to co-sign your HELOC application. A co-signer with a strong credit profile can significantly increase your approval chances and potentially secure better terms.

However, it’s important to understand the responsibilities involved. Your co-signer becomes equally liable for the debt, which could impact their credit if you miss payments. You should have a clear agreement in place and communicate openly about financial expectations.

Compare Multiple Offers

Don’t settle for the first HELOC offer you receive. Shop around and compare offers from multiple lenders. Each lender has different criteria for evaluating applications, and you might be surprised by the variations in terms and rates.

Use online comparison tools to streamline your search. Some lenders specialize in working with borrowers who have less-than-perfect credit, so cast a wide net to find the best fit for your situation.

Consult a HELOC Specialist

Navigating the HELOC landscape with bad credit can be challenging. A HELOC specialist can provide valuable insights and increase your chances of approval. These professionals have in-depth knowledge of lender requirements and can guide you through the application process.

A specialist can help you present your financial situation in the best light, potentially offsetting the impact of a low credit score. They can also identify lenders more likely to work with your credit profile, saving you time (and potentially multiple hard credit inquiries).

Final Thoughts

HELOC lenders for bad credit exist, but finding the right one requires effort. Figure, RenoFi, Lower, Fifth Third Bank, and Rate offer unique features for various credit profiles. You can improve your chances of approval by increasing home equity, reducing debt-to-income ratio, or finding a co-signer.

We at HELOC360 understand the complexities of home equity borrowing. Our platform connects homeowners with suitable HELOC lenders, even for those with less-than-perfect credit. We provide expert guidance and tailored solutions to simplify the process.

Don’t let bad credit stop you from achieving your financial goals. HELOC360 can help you turn your home equity into a powerful financial tool, opening doors to new opportunities. We strive to empower you to make informed decisions and build a stronger financial future.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.