- ***PAID ADVERTISEMENT**

- ACHIEVE LOANS – HOME EQUITY EXPERTISE

- FLEXIBLE FINANCING SOLUTIONS

- PERSONALIZED SUPPORT

- RECOMMENDED FICO SCORE: 640+

- COMPETITIVE RATES STREAMLINED APPLICATION PROCESS

Are you ready to transform your home but unsure how to finance it? A Home Equity Line of Credit (HELOC) might be the solution you’re looking for.

At HELOC360, we’ve seen countless homeowners use HELOCs to fund their dream renovations. From kitchen makeovers to energy-efficient upgrades, HELOC improvements can increase your home’s value and enhance your living space.

In this guide, we’ll explore how to leverage a HELOC for home transformations, highlight top renovation projects, and share tips to maximize your investment.

- Approval in 5 minutes. Funding in as few as 5 days

- Borrow $20K-$400K

- Consolidate debt or finance home projects

- Fastest way to turn home equity into cash

- 100% online application

How a HELOC Works for Home Improvements

Understanding the HELOC Basics

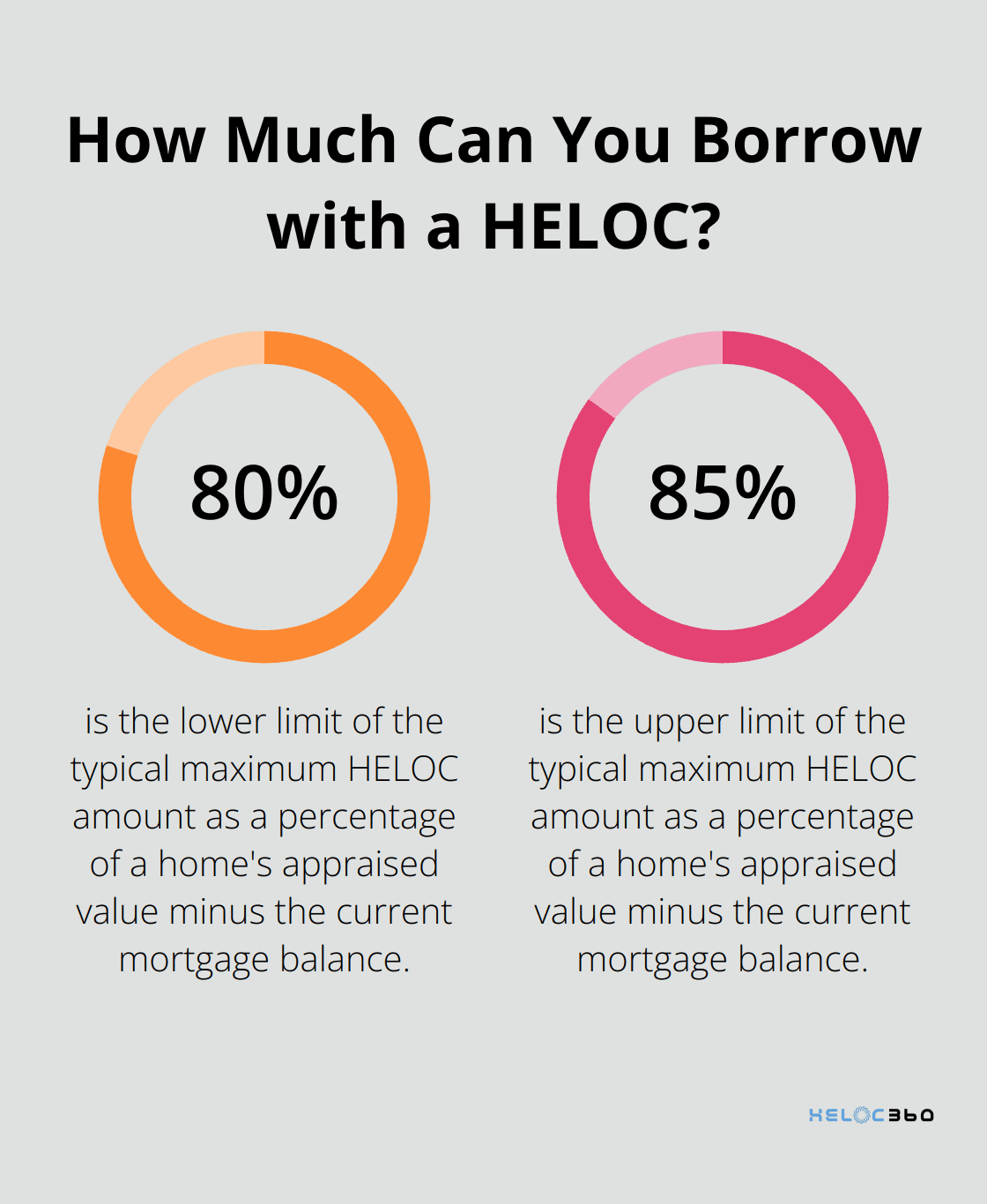

A Home Equity Line of Credit (HELOC) serves as a potent financial instrument for homeowners who want to fund renovations. This type of credit allows you to borrow against your home’s equity, typically up to 80%-85% of your home’s appraised value minus your current mortgage balance.

The HELOC Application Process

When you apply for a HELOC, lenders evaluate your creditworthiness and home value. After approval, you receive a credit line that you can access as needed. This flexibility makes HELOCs ideal for home improvements, as you only borrow the amount you require when you need it.

Most HELOCs feature a 10-year draw period during which you can access funds and make interest-only payments. Following this, you enter a repayment phase (usually lasting 10-20 years) where you pay back both principal and interest.

Advantages of HELOCs for Home Renovations

HELOCs offer several benefits for financing home improvements:

- Lower Interest Rates: HELOCs typically have lower interest rates compared to credit cards or personal loans. As of January 22, 2025, Bankrate reported the average HELOC rate at 8.28% (significantly lower than most credit card rates).

- Potential Tax Benefits: The interest paid on HELOCs may be tax-deductible when used for home improvements. (Always consult a tax professional to understand your specific situation.)

- Flexible Borrowing: The revolving nature of HELOCs allows you to draw funds as your project progresses, potentially saving on interest compared to taking a lump sum upfront.

HELOC vs. Other Financing Options

While HELOCs prove excellent for many homeowners, it’s worth comparing them to alternatives:

- Cash-Out Refinancing: This option might offer lower rates but involves refinancing your entire mortgage.

- Home Equity Loans: These provide a lump sum with fixed rates, which can be preferable if you know exactly how much you need.

- Personal Loans: These don’t use your home as collateral but often have higher rates. According to Bankrate’s January 22, 2025 report, the average personal loan rate was 12.46%, notably higher than typical HELOC rates.

For those seeking a comprehensive solution, platforms like HELOC360 offer guidance in navigating these options, ensuring you choose the best fit for your specific renovation goals. As you consider these financing options, it’s important to understand which home improvement projects can provide the best return on investment. Let’s explore some top renovation ideas in the next section.

Which Home Improvements Offer the Best ROI?

Kitchen Remodels: The Heart of Home Value

Kitchen renovations rank among the top ROI projects. The 2024 Cost vs. Value Report by Zonda’s JLC and Remodeling magazine details the best ROI in home remodeling projects.

Popular upgrades include:

- Replacing outdated appliances with energy-efficient models

- Installing quartz or granite countertops

- Updating cabinet fronts

These changes modernize your kitchen and appeal to potential buyers if you decide to sell.

Bathroom Renovations: Small Spaces, Big Impact

Bathroom renovations provide another excellent opportunity for value enhancement. The Cost vs. Value Report compares average costs for 23 remodeling projects with the value those projects retain at resale in 162 U.S. markets.

Key improvements include:

- Replacing old fixtures with water-efficient models

- Installing a new vanity

- Updating lighting

For a more extensive renovation, you can add a walk-in shower or a double sink vanity (features highly attractive to modern homebuyers).

Energy-Efficient Upgrades: Long-Term Savings

Energy-efficient improvements increase your home’s value and lead to significant savings on utility bills. The EPA estimates that homeowners can save an average of 15% on heating and cooling costs (or an average of 11% on total energy costs) by air sealing their homes.

Other high-ROI energy upgrades include:

- Installing solar panels

- Replacing old windows with energy-efficient models

- Upgrading to a smart thermostat

These improvements reduce your carbon footprint and make your home more appealing to environmentally conscious buyers.

Outdoor Living Spaces: Expanding Your Home’s Footprint

The growing trend of outdoor living has made functional outdoor spaces increasingly valuable. A well-designed deck or patio can provide an ROI of up to 65-75% (according to the National Association of Realtors).

Try adding a deck, installing an outdoor kitchen, or creating a cozy patio area with a fire pit. These additions expand your living space and create attractive entertainment areas that potential buyers love.

When you plan your home improvements, consider both immediate enjoyment and long-term value. The key to maximizing ROI lies in choosing improvements that align with your local market trends and personal needs. Now that you know which projects offer the best return, let’s explore how to maximize your HELOC for these home transformations.

How to Maximize Your HELOC for Home Transformations

Create a Realistic Budget and Timeline

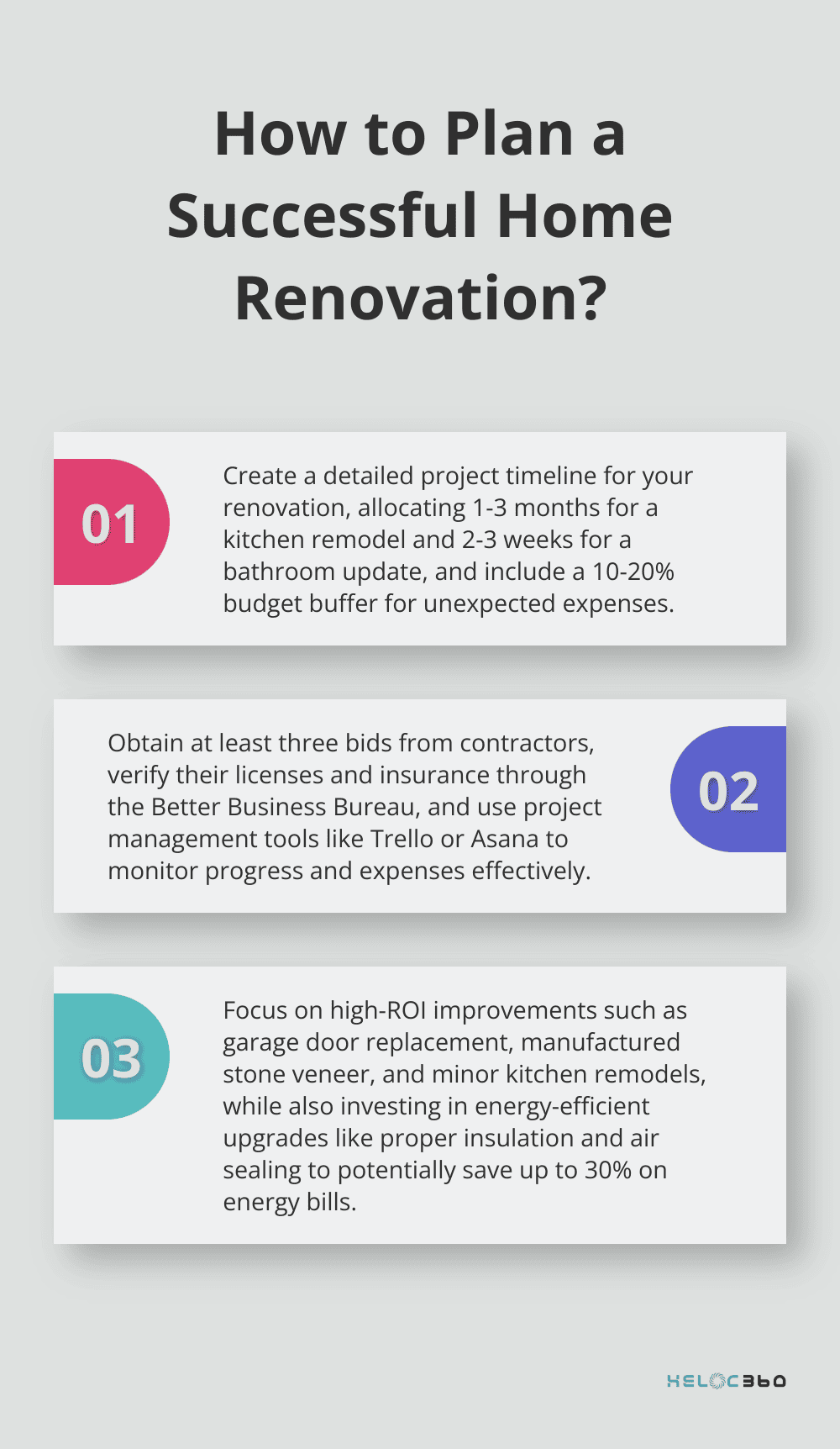

Set a clear budget before you start renovations. Homeowners spend an average of $79,982 on a major kitchen remodel with midrange finishes, while a bathroom overhaul averages $20,000. Include a 10-20% buffer for unexpected expenses.

Develop a detailed project timeline. Kitchen renovations typically take 1-3 months, while bathroom remodels can finish in 2-3 weeks (according to the National Association of Realtors). Prepare for potential delays due to supply chain issues or contractor availability.

Select and Manage Contractors Effectively

Pick the right contractor for your project. Obtain at least three bids and verify references. The Better Business Bureau advises homeowners to verify your contractor’s license and insurance.

After selecting a contractor, maintain clear communication. Schedule regular progress meetings and address any issues promptly. Use project management tools (such as Trello or Asana) to monitor progress and expenses effectively.

Sidestep Common Financing Mistakes

Stick to your budget and avoid using your HELOC for unrelated expenses. Your home serves as collateral for this loan, so responsible borrowing is essential.

Pay attention to interest rate changes. HELOCs often have variable rates that may increase over time. Consider making principal payments during the draw period to reduce overall interest costs.

Maintain detailed records of all expenses. This practice helps with budgeting and may prove necessary for tax purposes if you plan to deduct HELOC interest.

Boost Home Value Strategically

Prioritize improvements that offer the best return on investment. The 2024 Cost vs. Value Report by Remodeling Magazine ranks garage door replacement, manufactured stone veneer, and minor kitchen remodels as top ROI projects.

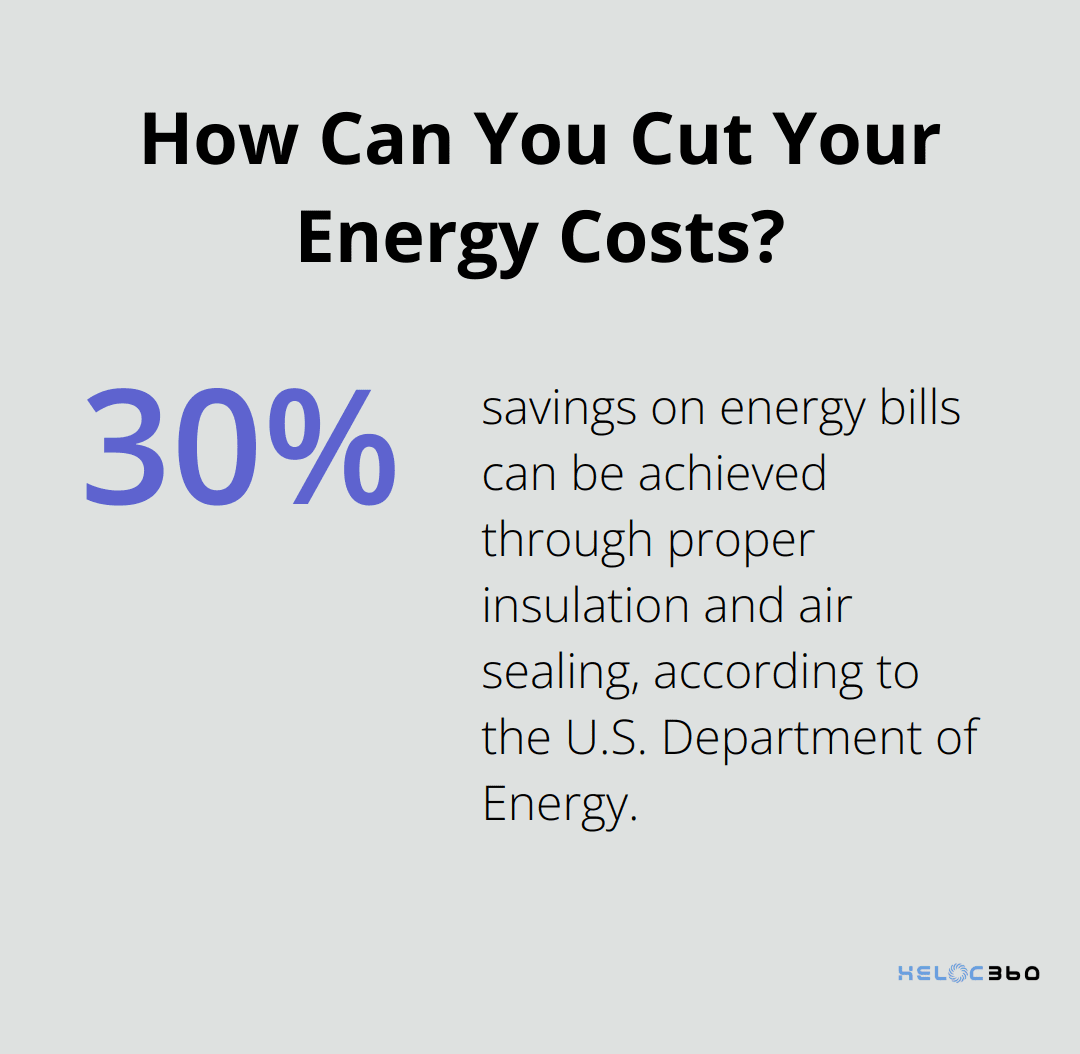

Invest in energy-efficient upgrades. The U.S. Department of Energy states that proper insulation and air sealing can lead to up to 30% savings on energy bills.

Enhance your home’s curb appeal. Lawn care service can recover 267% of its cost at resale, while standard lawn care recovers 243% (National Association of Realtors).

Leverage Expert Guidance

Seek professional advice to navigate the complexities of home renovation financing. Platforms like HELOC360 offer valuable insights and connect homeowners with suitable lenders, ensuring informed decisions throughout the renovation process.

Final Thoughts

A HELOC offers a powerful way to transform your home and boost property value. The flexibility and potential cost savings of HELOCs make them an attractive option for financing HELOC improvements. You can tackle projects that might otherwise be out of reach, from kitchen remodels to energy-efficient upgrades.

Careful planning and execution will maximize the benefits of your renovation investment. Create a realistic budget, choose the right contractors, and prioritize projects with high ROI. Consider both immediate enjoyment and long-term value when you select home improvement projects.

HELOC360 simplifies the process of home equity financing. We provide expert guidance and connect you with lenders that match your specific needs. HELOC360 helps you make informed decisions about using your home’s equity to achieve your financial goals.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.