Are you ready to breathe new life into your home? A HELOC renovation plan could be the key to unlocking your property’s full potential.

At HELOC360, we’ve seen firsthand how strategic home improvements can dramatically increase both comfort and value. This guide will show you how to make the most of your home equity line of credit for transformative renovations.

How HELOC-Funded Renovations Can Boost Your Home’s Value

Strategic renovations can significantly increase your home’s value. Using a Home Equity Line of Credit (HELOC) to fund these improvements allows you to borrow against the equity you’ve built in your home, providing a revolving line of credit that you can access as needed while potentially increasing its market worth.

High-Impact Renovation Projects

Not all home improvements offer equal return on investment (ROI). According to Remodeling Magazine’s 2024 Cost vs. Value Report, which compares average costs for 23 remodeling projects with the value those projects retain at resale in 150 U.S. markets, some of the most lucrative projects include:

- Garage door replacement: This relatively simple upgrade can boost curb appeal.

- Manufactured stone veneer: Adding this to your home’s exterior can recoup a significant portion of its cost.

- Minor kitchen remodel: Updating your kitchen with new appliances, countertops, and cabinet fronts can yield a good ROI.

Balancing Aesthetics and Functionality

While aesthetically pleasing renovations add value, it’s important to balance these with functional upgrades. Energy-efficient improvements enhance your home’s appeal and can lead to long-term savings.

Consider these dual-purpose upgrades:

- Window replacement: New, energy-efficient windows reduce utility bills while updating your home’s look.

- Deck addition: A new deck expands your living space.

- Bathroom remodel: Updating fixtures and improving functionality can yield a good ROI.

Maximizing Your HELOC Investment

Homeowners who plan their renovations carefully tend to see the best returns. Here are some tips to maximize your HELOC-funded improvements:

- Research local market trends: Understand what features are most valued in your area. A local real estate agent can provide insights into what buyers want.

- Focus on the essentials: Prioritize repairs and updates that address fundamental issues in your home. A well-maintained house is always more valuable than one with cosmetic upgrades but underlying problems.

- Don’t over-improve: Be cautious about making your home the most expensive on the block. Improvements should align with neighborhood standards to ensure the best return on investment.

- Get multiple quotes: Shop around for contractors and materials to ensure you’re getting the best value for your HELOC funds.

- Consider long-term value: While quick fixes can be tempting, focus on improvements that will stand the test of time and continue to add value for years to come.

Planning Your Next Steps

Now that you understand how HELOC-funded renovations can boost your home’s value, it’s time to create a strategic renovation plan. This will help you assess your home’s current condition, prioritize projects, and develop a phased approach for long-term improvements.

How to Create a Winning Renovation Plan

Creating a strategic renovation plan maximizes the value of your HELOC-funded home improvements. Here’s how to craft a winning strategy:

Conduct a Comprehensive Home Assessment

Start by thoroughly evaluating your home’s current condition. Walk through each room and note areas that need attention. Look for issues like outdated fixtures, worn flooring, or inefficient appliances. Don’t forget to examine the exterior, including the roof, siding, and landscaping.

The National Association of Realtors reports that homeowners who completed remodeling projects reported feeling happy with their renovations. This highlights the importance of addressing both visible and hidden issues in your home.

Prioritize Your Projects Strategically

After you identify potential improvements, prioritize them. Consider these factors:

- Urgency: Address critical repairs first to prevent further damage.

- ROI: Focus on projects with high return on investment.

- Personal enjoyment: Don’t neglect improvements that will enhance your daily life.

The Joint Center for Housing Studies of Harvard University reports that homeowners spent $457 billion on home improvements in 2023. To make the most of your budget, concentrate on projects that align with both market trends and your personal needs.

Create a Realistic Timeline and Budget

Develop a detailed timeline for your renovations. Factor in the scope of each project and potential disruptions to your daily life. Be realistic about how long each improvement will take and plan accordingly.

When budgeting, always add a 10-20% buffer for unexpected costs. Planning for contingencies helps you avoid financial stress and project delays.

Implement a Phased Approach

For extensive renovations, a phased approach can prove more manageable both financially and logistically. Break your plan into stages, focusing on one area of your home at a time. This method allows you to:

- Spread costs over a longer period

- Minimize disruptions to your daily life

- Adjust your plan based on results from earlier phases

A study by Houzz found that 51% of homeowners plan to continue or start renovations in 2025, indicating a trend towards ongoing home improvement rather than one-time overhauls.

Consult with Professionals

While DIY can save money, some projects require professional expertise. Consult with contractors, architects, or interior designers to refine your plan. Their insights can help you avoid costly mistakes and ensure your renovations add maximum value to your home.

The National Association of Home Builders reports that 85% of homeowners use professional remodelers for their projects (a statistic that underscores the value of expert guidance in home renovation).

Now that you have a solid renovation plan in place, it’s time to explore how to navigate the HELOC process specifically for home improvements. Understanding this process will help you make the most of your available home equity and manage your funds responsibly.

How to Navigate the HELOC Process for Home Improvements

Calculate Your Available Home Equity

Before you apply for a HELOC, you must know your home’s equity. Your available equity is typically the difference between your home’s current market value and your outstanding mortgage balance. Most lenders allow you to borrow up to 80-85% of your home’s value, minus what you owe on your mortgage.

For example, if your home has a current appraised value of $400,000 and you owe $140,000 on your mortgage, your total equity is $260,000.

To get an accurate estimate of your home’s value, consider a professional appraisal or online home value estimators (though these tools may not always be 100% accurate).

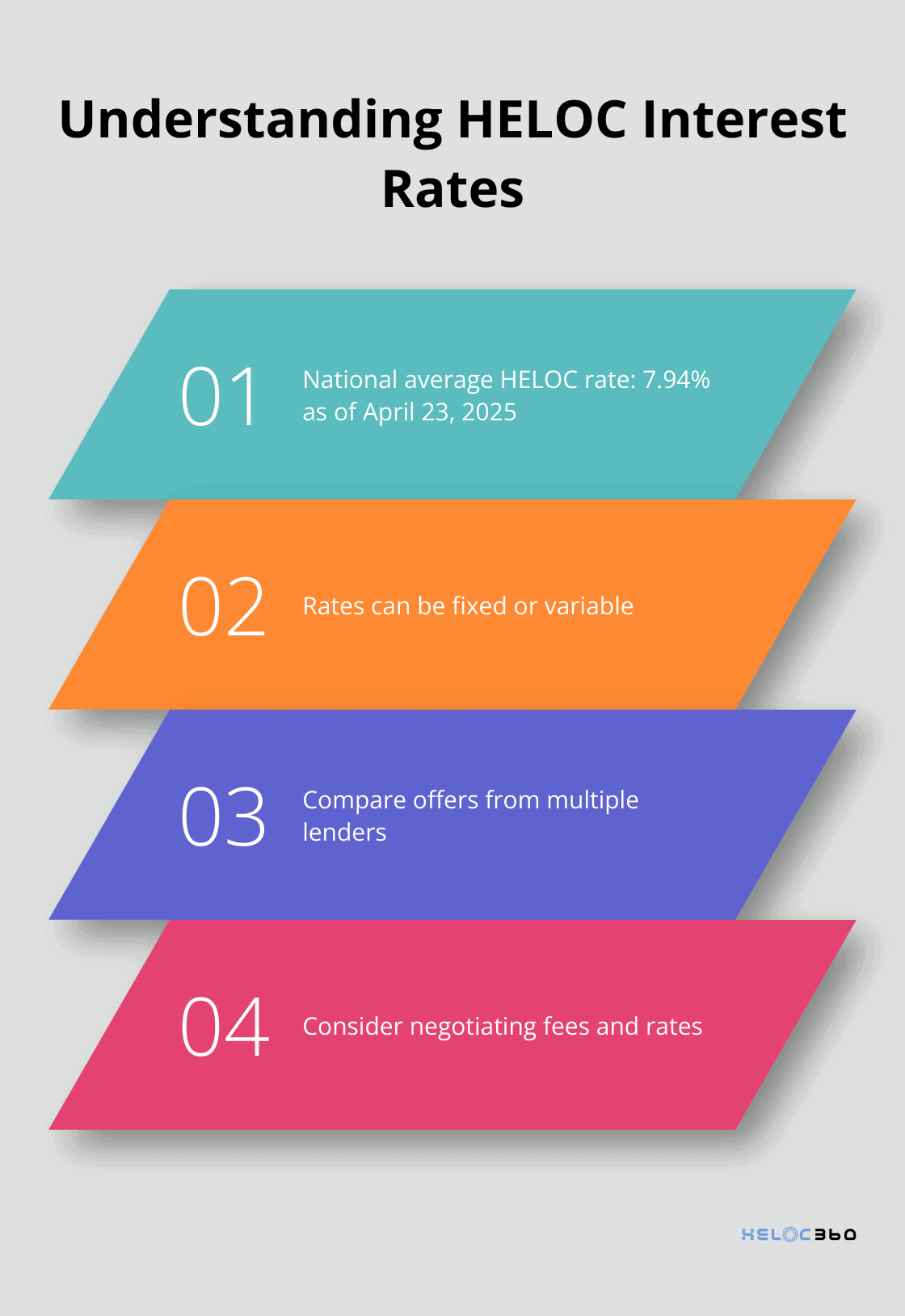

Find the Best HELOC Terms and Rates

Once you know your equity, shop around for the best HELOC terms and rates. The national average HELOC interest rate is 7.94%, as of April 23, 2025, according to Bankrate’s latest survey of the nation’s largest home equity lenders.

When comparing offers, focus on:

- Interest rates: Look for competitive rates and understand whether they’re fixed or variable.

- Draw period: This is the time you can borrow from your HELOC (typically 5-10 years).

- Repayment period: After the draw period, you’ll enter the repayment phase (which can last up to 20 years).

- Fees: Some lenders charge annual fees, closing costs, or inactivity fees. Understand all potential charges.

Don’t hesitate to negotiate with lenders. Many will waive certain fees or offer better rates to win your business.

Manage Your HELOC Funds Responsibly

After you secure your HELOC, manage the funds responsibly. Here are some tips to help you make the most of your home equity:

- Stick to your renovation plan: Use the funds only for the projects you’ve outlined. Avoid the temptation to overspend or take on unnecessary projects.

- Draw funds as needed: A HELOC allows you to borrow only what you need, when you need it. This can help you minimize interest charges.

- Track your spending: Use a spreadsheet or budgeting app to monitor your HELOC withdrawals and ensure you stay within your budget.

- Make payments on time: Even during the draw period, you’ll typically need to make interest payments. Set up automatic payments to avoid late fees and potential damage to your credit score.

- Consider principal payments: If possible, pay more than the minimum required payment to reduce your balance and save on interest over time.

- Prepare for rate changes: If you have a variable-rate HELOC, be aware that your interest rate may fluctuate. Budget for potential increases in your monthly payments.

A HELOC is a powerful financial tool, but it’s secured by your home. Always borrow responsibly and prioritize your long-term financial health.

Final Thoughts

A HELOC renovation plan can transform your living space and boost property value. You will gain access to flexible funding with competitive interest rates and potential tax advantages. Your success depends on careful planning, which includes assessing your home’s condition, prioritizing projects, and developing a realistic timeline and budget.

Responsible management of your HELOC funds is essential. You must stick to your renovation plan, draw funds as needed, and make timely payments to maintain financial health. Your home serves as collateral for the HELOC, so you should borrow wisely and within your means.

HELOC360 offers a comprehensive platform to help you navigate the HELOC process for renovations. We provide expert guidance and connect you with lenders that match your unique needs. You can create the home of your dreams while potentially increasing its value through a well-planned HELOC renovation strategy.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.