Are you considering a HELOC but unsure about the risks involved? Understanding HELOC collateral is essential for making informed decisions about your home equity.

At HELOC360, we believe knowledge is power when it comes to financial choices. This post will explore what’s really at stake when you use your home as collateral for a HELOC.

What’s Really at Stake with HELOC Collateral?

Your Home as Security

When you consider a Home Equity Line of Credit (HELOC), you put your home on the line. A HELOC is a revolving credit line that uses your property as collateral. This arrangement gives the lender a claim to your home if you fail to repay.

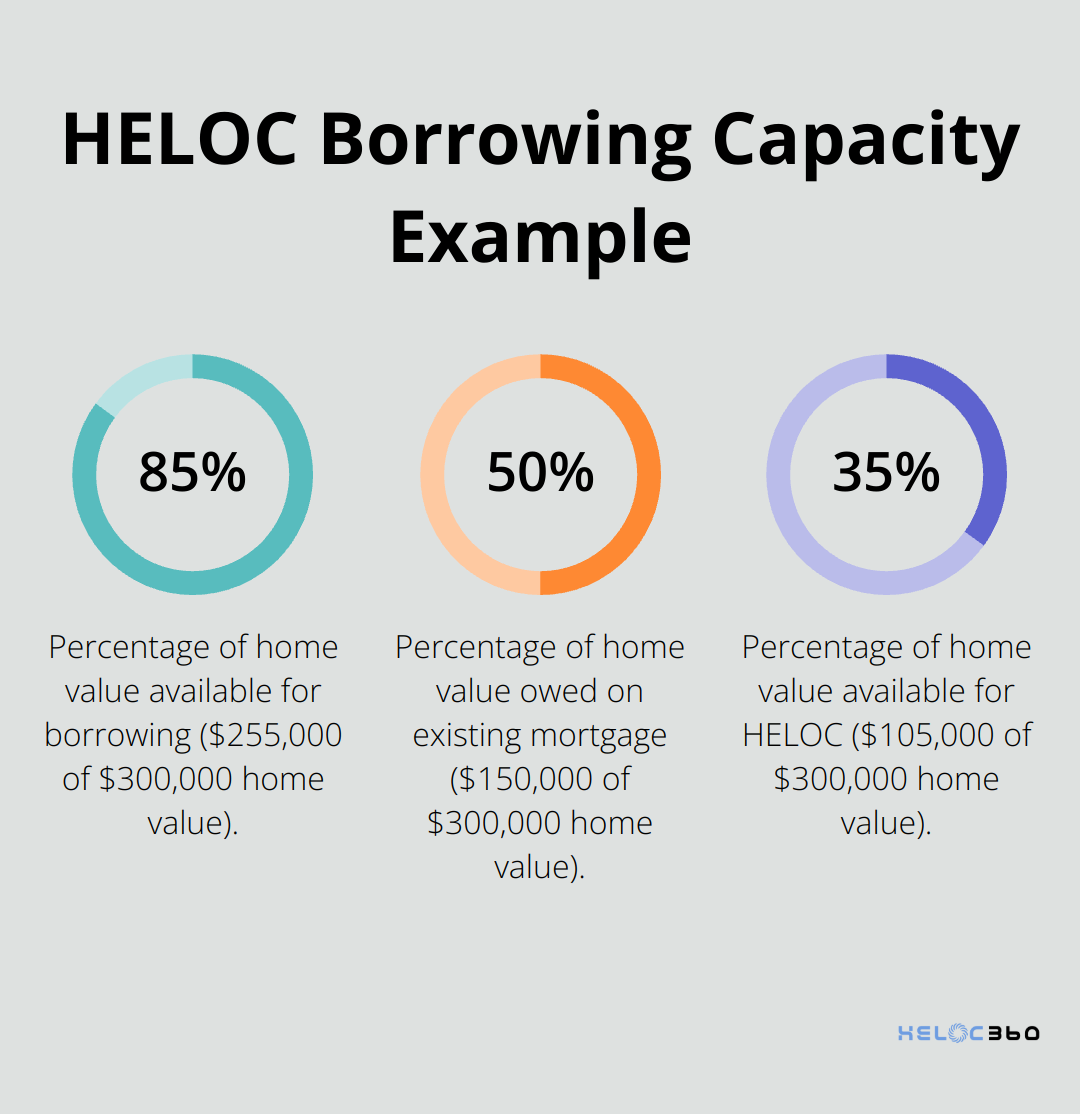

Your home acts as the foundation of a HELOC. Lenders often allow you to borrow up to 85% of your home’s value, minus your mortgage balance. For instance, if your home is worth $300,000 and you owe $150,000 on your mortgage, you might qualify for a HELOC of up to $105,000 (85% of $300,000 minus $150,000).

The Unique Nature of HELOC Collateral

HELOCs offer lower interest rates than unsecured loans because they’re backed by a valuable asset – your home. This security boosts lenders’ confidence, but it also means you take on significant risk.

HELOC vs. Other Loan Types

HELOCs differ from traditional mortgages in their flexibility. Both use your home as collateral, but a HELOC allows you to draw funds as needed during the draw period (typically 10 years). You only pay interest on what you borrow, not the entire credit line.

Personal loans or credit cards don’t require collateral but often come with higher interest rates. As of May 8, 2023, the average interest rate on a 20-year HELOC was 8.15%, which is lower than typical credit card rates.

Market Fluctuations and Your HELOC

Your home’s value can change over time. If property values decline, you might end up owing more than your home is worth. This situation (known as being “underwater” on your loan) can complicate refinancing or selling your home in the future.

Responsible Use of HELOCs

Homeowners use HELOCs for various purposes, from funding home improvements to consolidating high-interest debt. However, it’s vital to understand that your home is at stake. Before you proceed, evaluate your financial situation and ability to repay carefully.

As you weigh the risks and benefits of using your home as collateral, it’s important to consider the potential consequences if things don’t go as planned. Let’s explore the risks associated with HELOC collateral in more detail.

What Are the Real Risks of HELOC Collateral?

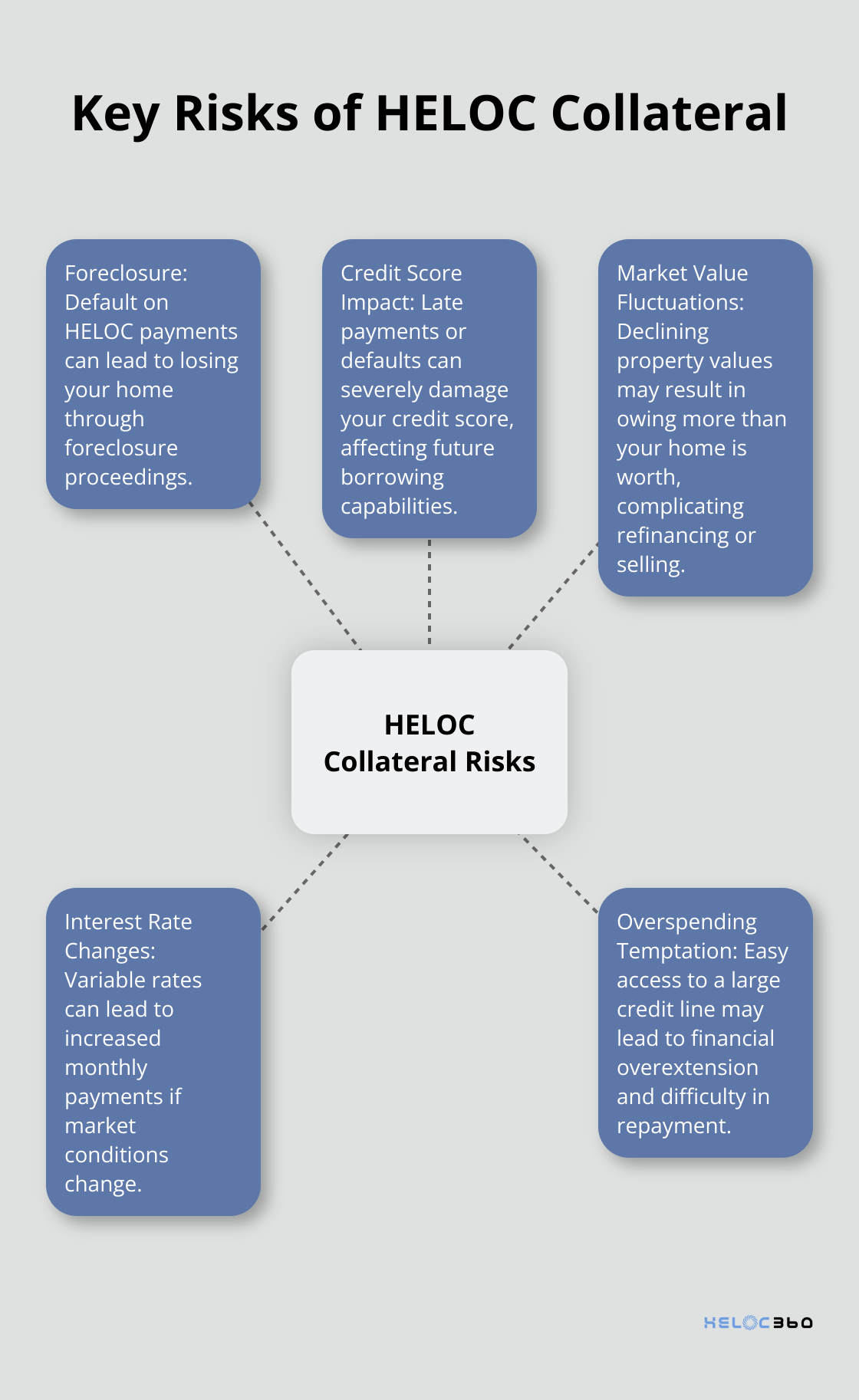

The Threat of Foreclosure

When you use your home as HELOC collateral, you face the risk of foreclosure. If you default on your HELOC payments, the lender can initiate foreclosure proceedings. The Federal Reserve Bank of New York reports that as of March 2024, 3.2% of outstanding debt was in some stage of delinquency, up by 0.1 percentage point from the previous quarter. This increase highlights the need for careful financial planning when taking out a HELOC.

Foreclosure can lead to severe consequences. You could lose your home, face eviction, and suffer long-term financial repercussions. The foreclosure process typically starts after four consecutive missed payments or 120 days of non-payment. If you struggle to make payments, communicate with your lender about options like forbearance to avoid default.

Impact on Credit Score

Defaulting on your HELOC doesn’t just put your home at risk; it can severely damage your credit score. Late payments and defaults on a HELOC appear on your credit report for up to seven years. Research indicates that a single missed mortgage payment could lower your credit score, while multiple missed payments could result in a significant drop.

A lower credit score can make it difficult to secure future loans, credit cards, or even rent an apartment. It can also lead to higher interest rates on any credit you obtain, increasing your overall cost of borrowing.

Market Value Fluctuations

The housing market isn’t static, and your home’s value can change over time. If property values in your area decline, you might owe more on your HELOC and mortgage combined than your home is worth. This scenario (known as being “underwater” on your loan) can complicate refinancing or selling your home.

For example, if you took out a HELOC when your home was valued at $300,000, but its value drops to $250,000, you might struggle to repay the full amount if you need to sell. This risk is particularly relevant in areas prone to housing market volatility or economic downturns.

Unexpected Changes in Interest Rates

HELOCs often come with variable interest rates, which can change based on market conditions. As of July 23, 2025, the national average HELOC interest rate is 8.26%, according to Bankrate’s latest survey of the nation’s largest home equity lenders. If interest rates rise significantly, your monthly payments could increase, potentially straining your budget. Try to understand how potential rate changes could affect your ability to repay the HELOC before committing to one.

Temptation of Easy Credit

The availability of a large credit line can tempt some homeowners to overspend. It’s important to use your HELOC responsibly and for planned expenses rather than impulsive purchases. Overextending yourself financially can lead to difficulty in repayment and increase the risk of default.

Understanding these risks is essential before taking out a HELOC. While HELOCs can be valuable financial tools when used responsibly, it’s important to have a solid repayment plan and consider potential market changes. In the next section, we’ll explore strategies to protect your home as HELOC collateral and minimize these risks.

How to Safeguard Your Home as HELOC Collateral

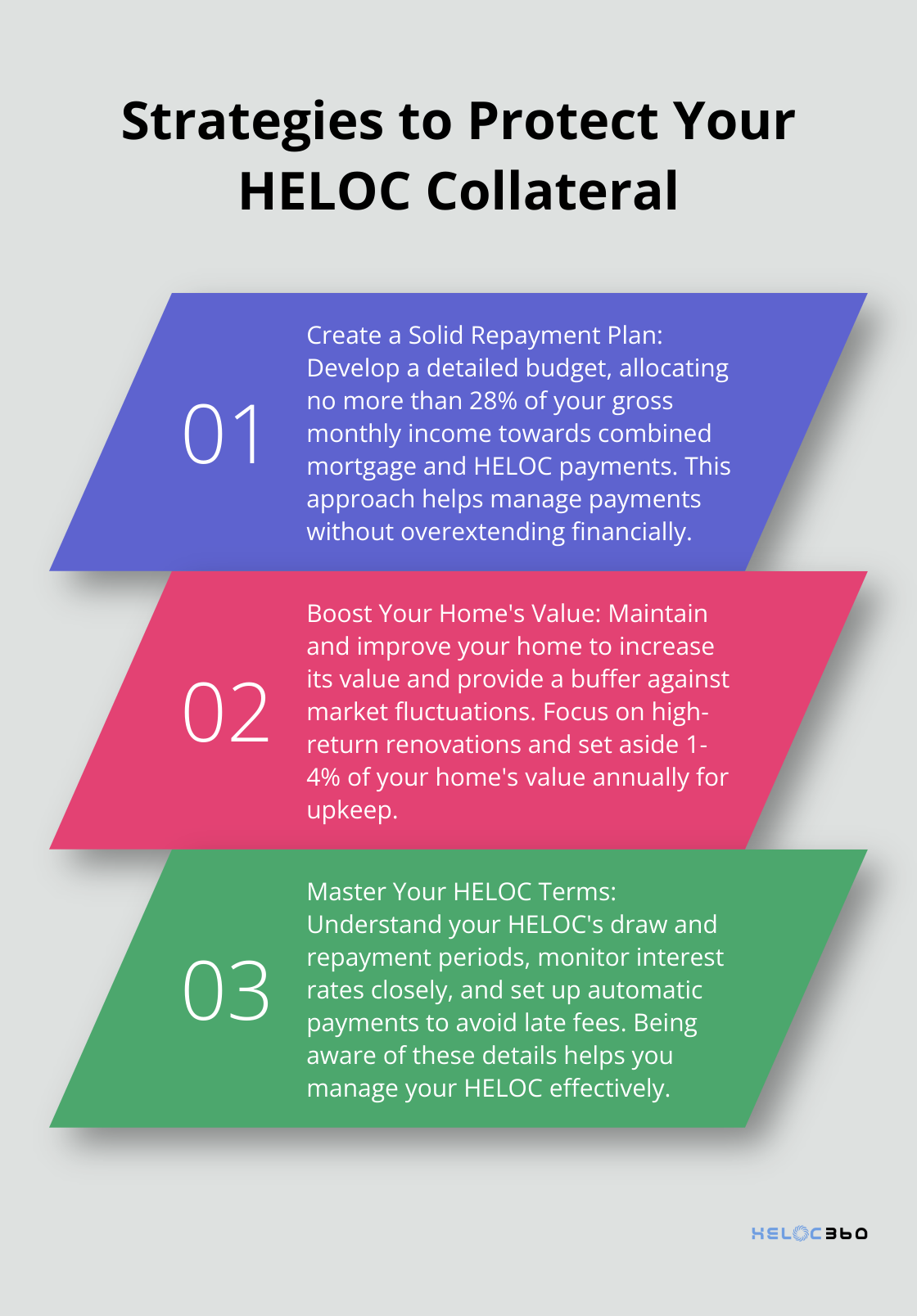

Create a Solid Repayment Plan

Before you take out a HELOC, develop a detailed repayment plan. Calculate your monthly budget, including all expenses and income sources. Try to allocate no more than 28% of your gross monthly income towards your mortgage and HELOC payments combined. This percentage (known as the front-end ratio) is a standard many lenders use to assess affordability.

For example, if your monthly income is $6,000, your combined mortgage and HELOC payments should not exceed $1,680. This approach helps you manage your payments without overextending yourself financially.

Boost Your Home’s Value

Maintain and improve your home to increase its value and provide a buffer against market fluctuations. Focus on high-return renovations that typically offer the best value for money. According to Remodeling Magazine’s 2024 Cost vs. Value Report, garage door replacement has an average return on investment of 93.3%, while adding a wood deck can recoup about 65.5% of its cost.

Regular maintenance is equally important. Set aside 1-4% of your home’s value annually for upkeep. For a $300,000 home, this translates to $3,000-$12,000 per year. This proactive approach can prevent costly repairs and help maintain your home’s value.

Master Your HELOC Terms

Understanding your HELOC’s terms is vital for effective management. Pay close attention to the draw period length (typically 5-10 years) and the repayment period (which can last up to 20 years). Be aware of any balloon payments due at the end of the draw period.

Monitor your interest rate closely, especially if it’s variable. As of July 18, 2025, the average HELOC rate is 8.28%. Calculate how a 1% or 2% increase would affect your payments. On a $100,000 HELOC balance, a 1% rate increase could mean an additional $83 in monthly interest.

Set up automatic payments to avoid late fees, which can be as high as 5% of the missed payment amount. Some lenders offer rate discounts for automatic payments, potentially saving you money over the life of your HELOC.

Explore Alternative Options

While HELOCs can be valuable financial tools, it’s important to consider alternatives. Cash-out refinancing, for example, provides a lump sum without needing a separate line of credit. Home equity loans offer fixed interest rates, which can be beneficial if you prefer predictable payments.

HELOC360 can help you explore these options and find the best solution for your financial needs. Our platform connects you with lenders that fit your unique situation, ensuring you make an informed decision about using your home as collateral.

Final Thoughts

HELOC collateral requires careful consideration from homeowners. Your home serves as the foundation for a HELOC, offering lower interest rates but also carrying significant risks. The potential for foreclosure, credit score impact, and market value fluctuations demand thorough evaluation before committing to this financial tool.

Homeowners must protect their HELOC collateral through responsible borrowing practices and property maintenance. Creating a solid repayment plan, investing in home improvements, and understanding the HELOC terms will minimize risks and maximize benefits. Each homeowner’s situation differs, so it’s essential to weigh the pros and cons and align your choice with long-term financial goals.

HELOC360 simplifies the process of navigating HELOC collateral complexities. We offer expert guidance and connect you with lenders that match your specific needs. Our comprehensive solutions empower you with knowledge to make informed choices about using your home’s equity as a stepping stone to achieve your financial aspirations.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.