Timing is everything when it comes to applying for a Home Equity Line of Credit (HELOC). At HELOC360, we understand that choosing the right moment can significantly impact your financial future.

This post will guide you through the ideal conditions, life events, and market factors to consider when deciding on HELOC timing. We’ll also share practical tips to help you make an informed decision about when to tap into your home’s equity.

What Makes the Perfect HELOC Timing?

The Power of Equity

Your home equity plays a pivotal role in HELOC approval. Most lenders require at least 15-20% equity in your home. U.S. homeowners with mortgages saw their home equity decrease by 0.7% year-over-year–an average loss of $5,400 per borrower–according to CoreLogic. To calculate your equity, subtract your current mortgage balance from your home’s market value. For instance, if your home is worth $400,000 and you owe $250,000 on your mortgage, you have $150,000 in equity (or 37.5%).

Financial Stability Matters

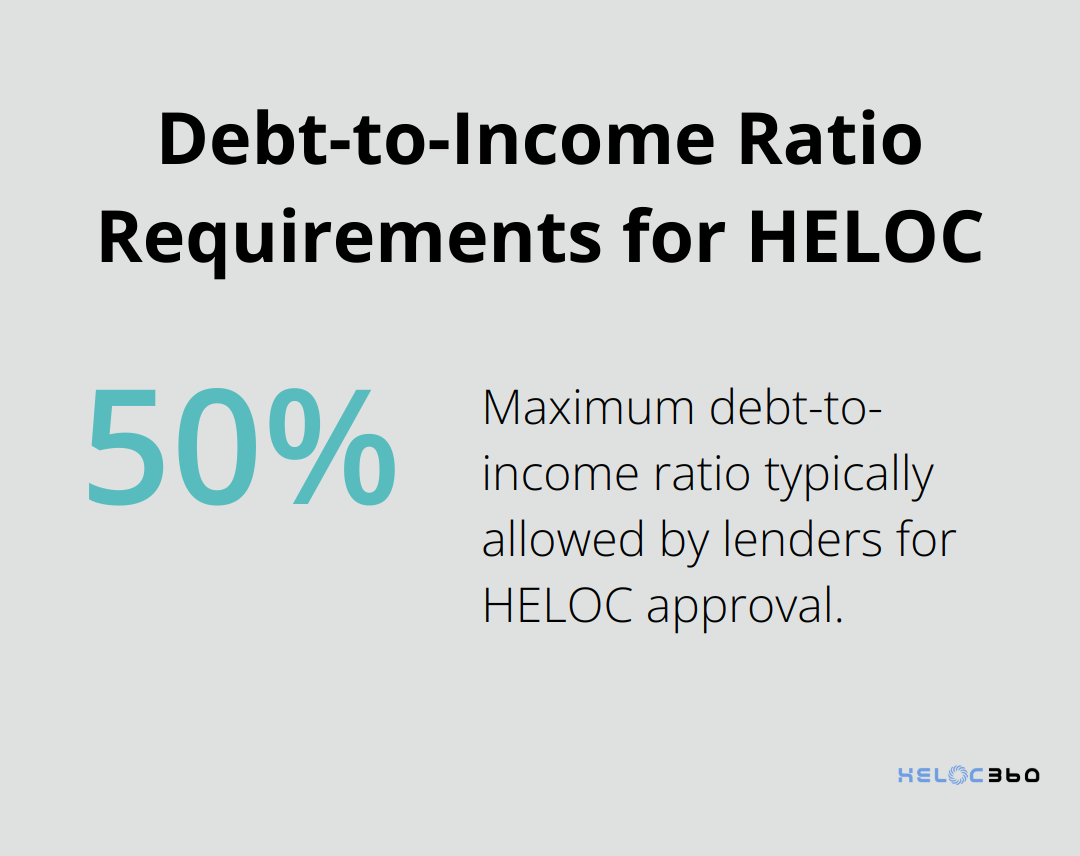

Lenders want to see a stable income and solid employment history. They typically look for at least two years of consistent employment. Self-employed individuals should prepare to provide additional documentation, such as tax returns for the past two years. Your debt-to-income (DTI) ratio also holds significant weight. Lenders will want you to have a debt-to-income ratio of 43% to 50% at most, although some will require this to be even lower. To calculate your DTI, divide your monthly debt payments by your gross monthly income.

Credit Score Considerations

Your credit score significantly impacts your HELOC approval odds and interest rates. While the minimum score varies by lender, try to achieve at least 620. However, scores of 700 or higher will likely secure you better rates. Experian noted no change in the average FICO® Score, which held steady at 715 through the 12 months ending September 2024. If your score needs improvement, focus on paying bills on time and reducing credit card balances before applying.

Market Conditions

The current interest rate environment and housing market trends can influence your decision to apply for a HELOC. Lower interest rates generally make borrowing more attractive, while rising home values can increase your available equity. Keep an eye on economic forecasts and consult with financial experts to understand how market conditions might affect your HELOC application.

Personal Financial Goals

Your personal financial objectives should align with your decision to apply for a HELOC. Whether you plan to fund home improvements, consolidate debt, or create an emergency fund, ensure that a HELOC fits into your broader financial strategy. Consider alternative financing options and weigh the pros and cons of each before making your decision.

These factors work in concert to create the ideal conditions for a HELOC application. A strong position in one area can sometimes offset a weaker one in another. Understanding these key elements will equip you to time your HELOC application for maximum success. As you consider your options, it’s important to explore how life events might trigger the need for a HELOC.

When Should You Consider a HELOC?

Home Improvements: A Popular Choice

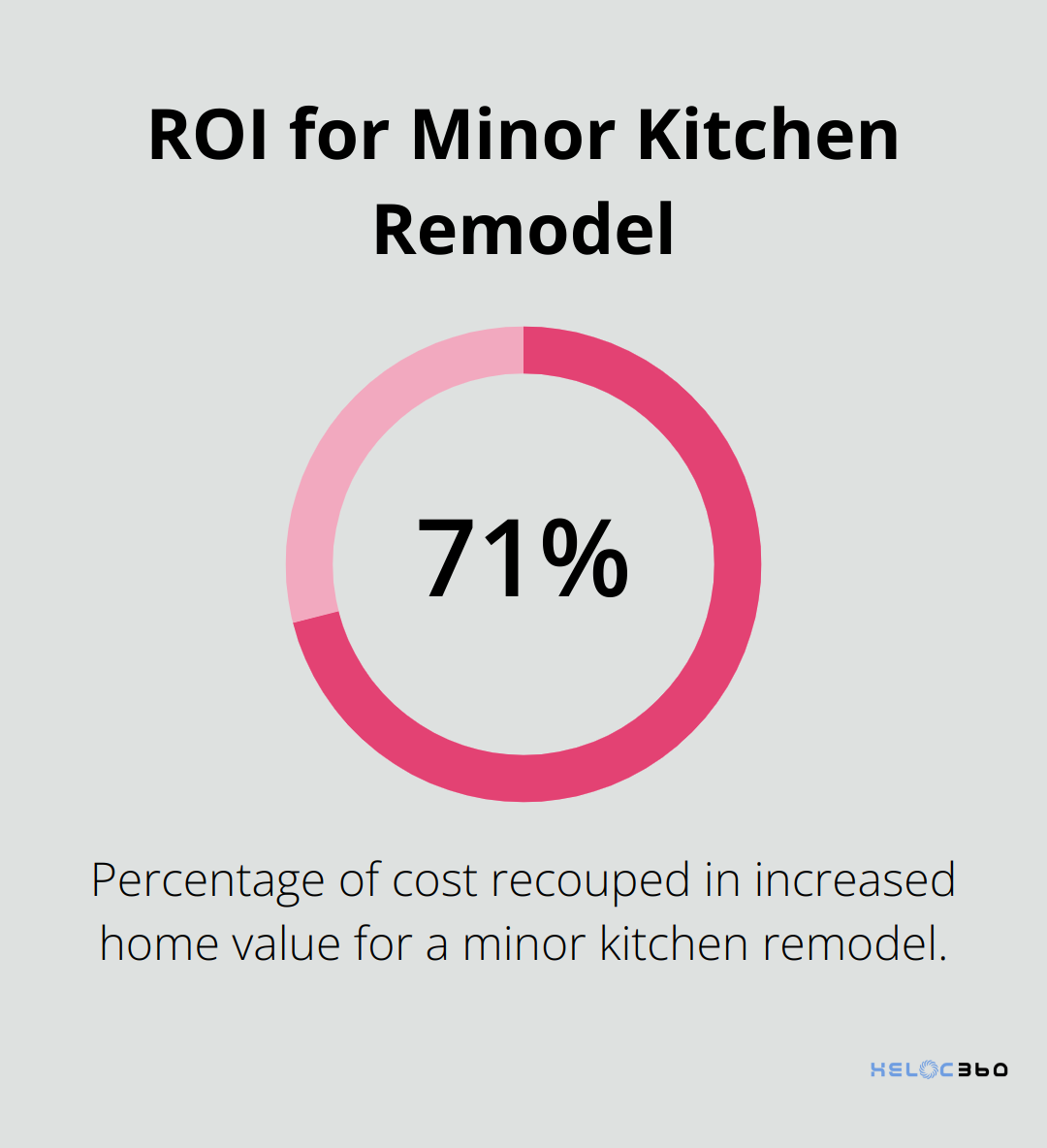

Home renovations top the list of reasons to tap into home equity. A HELOC can finance these projects and potentially increase your home’s value. For example, a minor kitchen remodel (average cost: $28,279) can recoup about 71% of that cost in increased home value, according to Remodeling Magazine’s 2024 Cost vs. Value Report.

Education Costs: Investing in the Future

The rising cost of education often prompts families to explore HELOC options. Out-of-state tuition at public 4-year institutions costs $28,445 for the 2024-2025 academic year, representing 62.1% of the cost of attendance for on-campus students. A HELOC’s flexible nature allows you to draw funds as needed, which suits ongoing education expenses perfectly.

Debt Consolidation: Lowering Interest Payments

High-interest debt, especially credit card balances, can drain your finances. As of June 2025, HELOC rates average 8.22%, according to Bankrate’s latest survey of the nation’s largest home equity lenders. Using a HELOC to pay off high-interest debt could save you thousands in interest payments over time.

Emergency Fund: Financial Safety Net

Financial experts recommend saving 3-6 months of living expenses for emergencies. A HELOC can serve as a backup emergency fund, providing financial flexibility. However, you must use this option judiciously and create a solid repayment plan.

Timing Your HELOC Application

While these life events might trigger the need for additional funds, the timing of your HELOC application depends on various factors. Your financial situation, market conditions, and personal goals all play a role. The next section will explore the market conditions you should watch when considering a HELOC application.

How Market Conditions Affect HELOC Timing

Interest Rate Trends

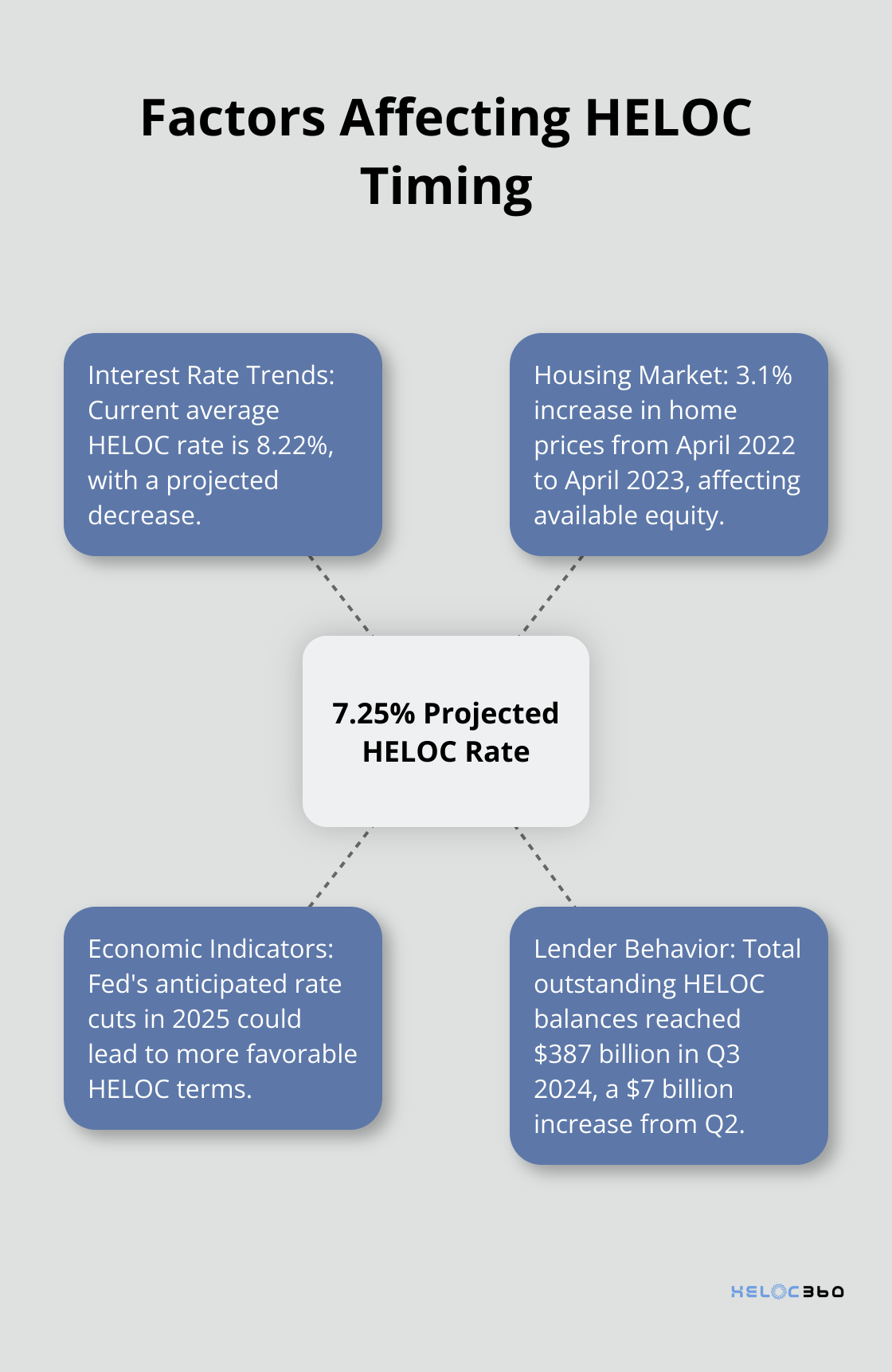

Interest rates significantly impact HELOC affordability. As of June 2025, HELOC rates average 8.22%. This rate marks a change from previous trends, indicating a shift in the market for borrowers.

Greg McBride, CFA and chief financial analyst at Bankrate, predicts HELOC rates to average 7.25% by the end of 2025. This projection suggests a potential downward trend, which could make HELOCs more attractive in the coming months.

Housing Market Dynamics

Your home’s value directly impacts your available equity. The Federal Housing Finance Agency reported a 3.1% increase in home prices from April 2022 to April 2023. While this growth is slower than previous years, it still indicates potential equity gains for many homeowners.

However, CoreLogic data shows that on a year-over-year basis, negative equity rose by 4% to 1.1 million homes, or 1.9% of all mortgaged properties, from the second quarter of 2023. This underscores the importance of regular assessment of your home’s value and equity position.

Economic Indicators

The overall economic outlook affects lending practices and HELOC availability. The Federal Reserve’s actions, particularly regarding interest rates, have a ripple effect on HELOC rates. The Fed’s anticipated rate cuts in 2025 could lead to more favorable HELOC terms.

Unemployment rates and GDP growth also influence lenders’ risk assessments. As of June 2025, the U.S. Bureau of Labor Statistics reports an unemployment rate of 3.6%, indicating a stable job market. This stability may positively influence lenders’ willingness to extend credit.

Lender Behavior

Lending standards can tighten or loosen based on economic conditions. In Q3 2024, total outstanding HELOC balances reached $387 billion, a $7 billion increase from Q2 2024. This growth suggests that lenders have become more comfortable with HELOCs.

Moreover, the number of active HELOC accounts increased by 80,000 in Q3 2024 compared to Q2 2024. This trend indicates that more homeowners find HELOCs to be viable financial tools.

Final Thoughts

HELOC timing requires careful consideration of multiple factors. Your home equity, financial stability, credit score, and debt-to-income ratio form the foundation for a successful application. Life events like home improvements, education expenses, debt consolidation, or emergency fund needs often prompt homeowners to explore HELOC options.

Market conditions significantly influence HELOC timing. Current interest rates, housing market trends, economic indicators, and lender behavior all affect the attractiveness and availability of HELOCs. With rates projected to average 7.25% by the end of 2025 (and a stable housing market), many homeowners find themselves in a favorable position to consider this financial tool.

HELOC360 can help you navigate the HELOC landscape with ease and confidence. We provide comprehensive solutions tailored to your unique needs, simplifying the process and offering expert guidance. Our platform connects you with suitable lenders and empowers you with knowledge to unlock the full potential of your home equity.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.