- ***PAID ADVERTISEMENT**

- ACHIEVE LOANS – HOME EQUITY EXPERTISE

- FLEXIBLE FINANCING SOLUTIONS

- PERSONALIZED SUPPORT

- RECOMMENDED FICO SCORE: 640+

- COMPETITIVE RATES STREAMLINED APPLICATION PROCESS

Are you considering a HELOC interest-only option for your financial needs? This unique type of home equity line of credit can offer significant advantages for homeowners in specific situations.

At HELOC360, we’ve seen how interest-only HELOCs have helped many of our clients achieve their financial goals. In this post, we’ll explore the benefits and ideal scenarios for using this flexible borrowing tool.

- Approval in 5 minutes. Funding in as few as 5 days

- Borrow $20K-$400K

- Consolidate debt or finance home projects

- Fastest way to turn home equity into cash

- 100% online application

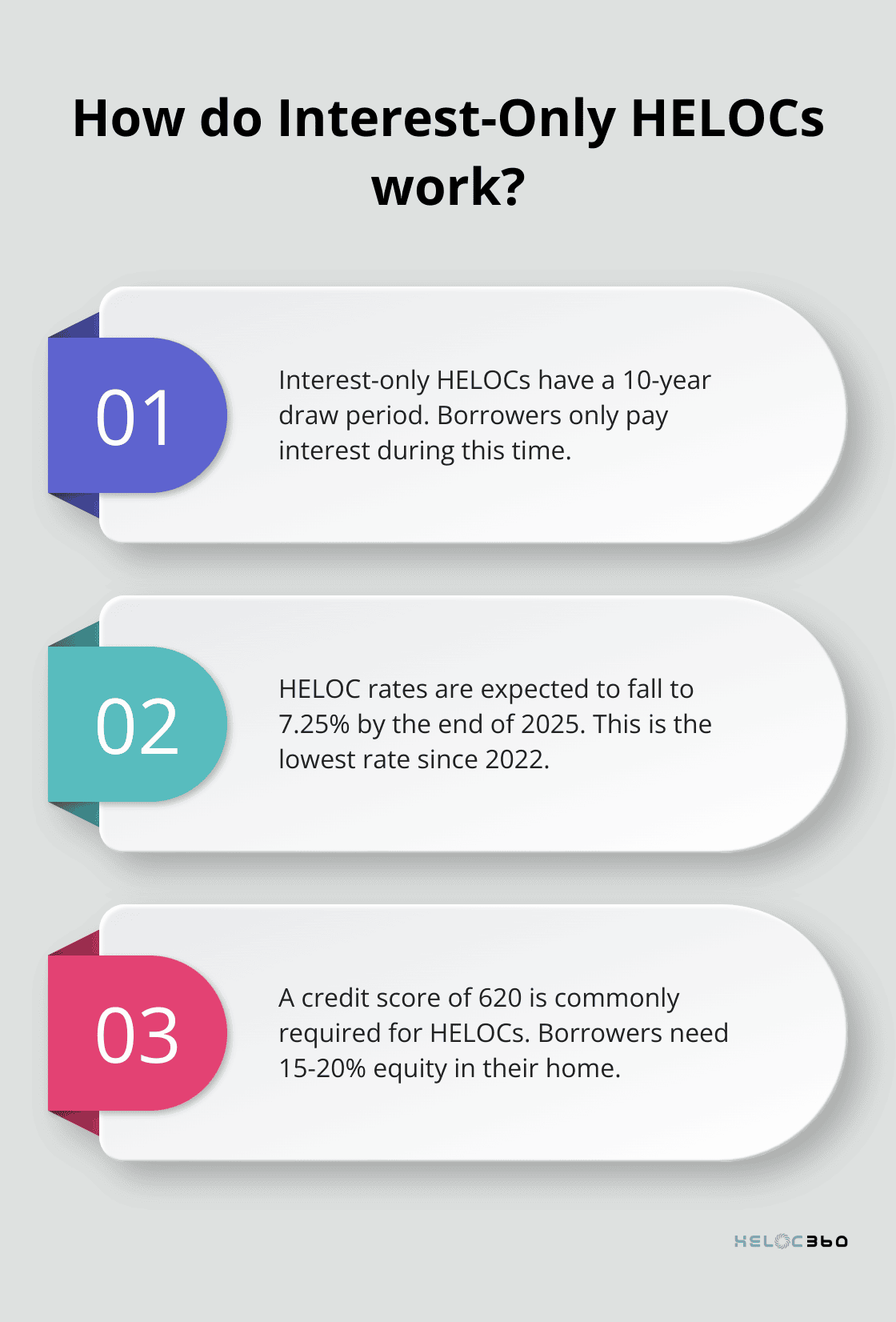

What Is an Interest-Only HELOC?

Definition and Basic Structure

An interest-only HELOC is a home equity line of credit you can draw on for a set period of time, which usually lasts 10 years. This financial product allows homeowners to borrow against their home’s equity while paying only interest during the initial draw period.

Unique Features of Interest-Only HELOCs

Interest-only HELOCs differ from traditional HELOCs in their payment structure. With an interest-only HELOC, you receive a revolving line of credit secured by your home. During the draw period, you can borrow, repay, and borrow again (up to your credit limit). The key distinction lies in the monthly payments, which cover only the interest accrued on the borrowed amount. This results in lower initial payments compared to traditional HELOCs, where repayment of both principal and interest starts immediately.

Terms and Conditions

Interest rates for these products are typically variable, often based on the prime rate plus a margin. As of February 2025, HELOC rates are expected to continue falling, with the average HELOC rate projected to reach 7.25 percent by the end of the year, a low not seen since 2022.

Many lenders allow you to tap your equity with a credit score in the 600s, with 620 becoming more common, especially for HELOCs. You’ll also need sufficient equity in your home (typically 15-20% at minimum).

The Repayment Phase

After the draw period ends, the repayment phase begins. This is where interest-only HELOCs can become challenging for some borrowers. Your payments will increase significantly as you start repaying both principal and interest. The repayment period usually lasts 10 to 20 years.

For example, if you borrowed $100,000 at 7.25% interest during a 10-year draw period, your monthly payment would be about $604. However, once the repayment phase begins, this could jump to over $1,100 per month for a 15-year repayment term.

Strategic Use and Considerations

Interest-only HELOCs can serve as a powerful financial tool when used strategically. They offer lower initial payments and flexibility, which can benefit those with variable income or short-term cash flow needs. However, they also come with risks, including potential payment shock when the repayment phase begins and the possibility of owing more than your home is worth if property values decline.

Many homeowners use interest-only HELOCs effectively for various purposes, from funding home improvements to managing unexpected expenses. However, it’s important to have a solid repayment plan in place before committing to this type of financing.

As we move forward, let’s explore the specific advantages that make interest-only HELOCs an attractive option for many homeowners.

Why Interest-Only HELOCs Appeal to Homeowners

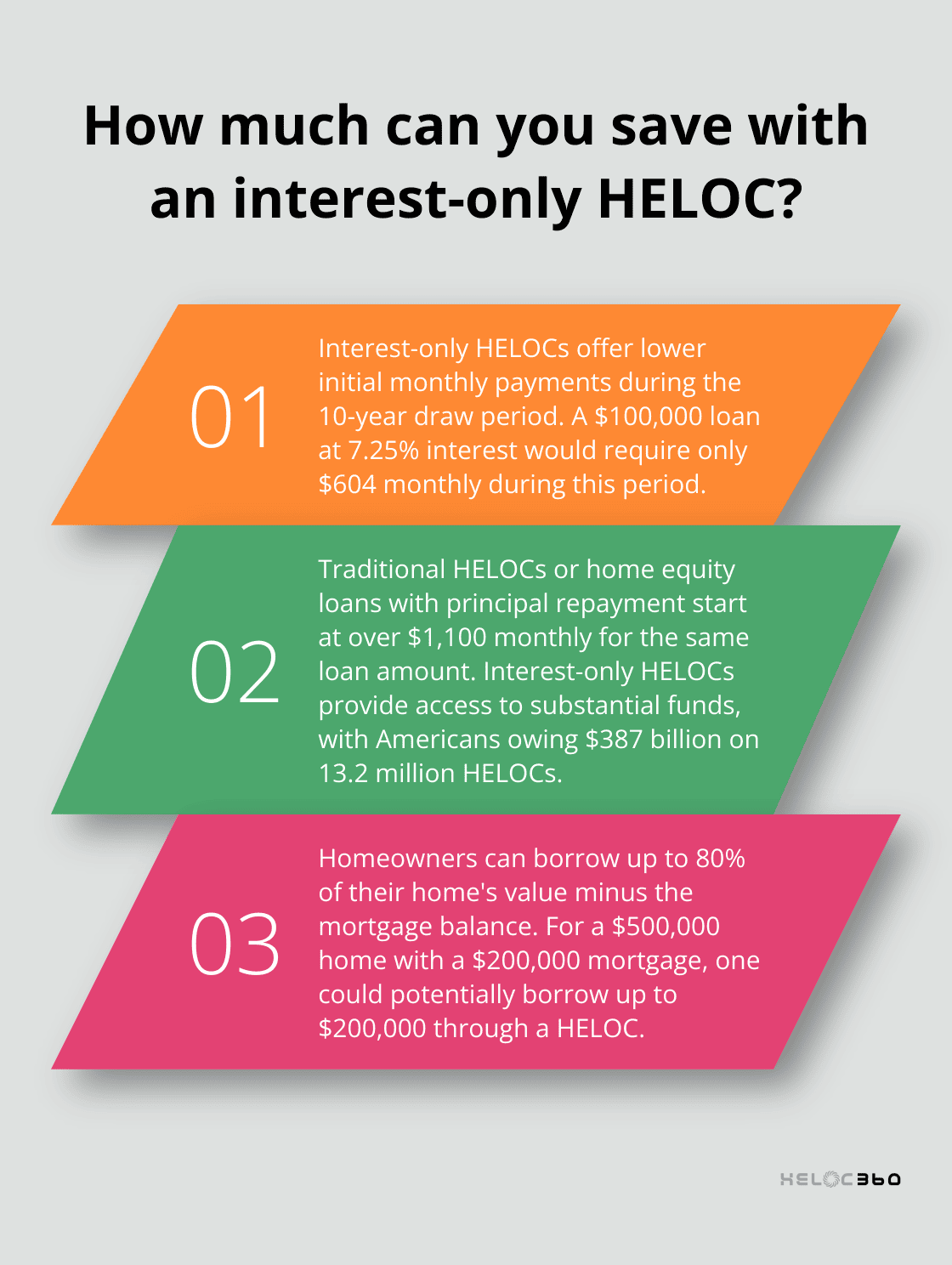

Lower Initial Monthly Payments

Interest-only HELOCs offer homeowners a significant advantage: reduced monthly payments during the draw period (typically 10 years). Borrowers pay only interest on the amount they use, resulting in substantially lower payments compared to traditional HELOCs or home equity loans.

For instance, a $100,000 loan at 7.25% interest would require a monthly payment of about $604 during the draw period. This amount is considerably less than the $1,100+ you might pay with a traditional HELOC or home equity loan that includes principal repayment from the start.

Unmatched Financial Flexibility

Interest-only HELOCs provide exceptional flexibility in fund access and repayment. Homeowners can borrow as much or as little as they need (up to their credit limit) and pay interest only on the used amount. This feature makes them ideal for ongoing projects or expenses with uncertain costs.

The revolving nature of these credit lines allows borrowers to reuse funds as they repay the principal. This eliminates the need to apply for new loans repeatedly, saving time and potentially avoiding additional fees.

Possible Tax Benefits

Interest paid on home equity debt may offer tax advantages (if the funds improve the home that secures the loan). This potential benefit can make interest-only HELOCs an even more cost-effective option for home improvements or renovations.

(It’s important to consult a tax professional to understand the current tax implications based on your specific situation and the latest tax laws.)

Access to Substantial Funds

Interest-only HELOCs can provide access to large sums of money, often at lower interest rates than unsecured loans or credit cards. Recent data shows Americans owe $387 billion on 13.2 million home equity lines of credit, indicating significant usage of these financial products.

Consider this example: If your home is worth $500,000 and you owe $200,000 on your mortgage, you might borrow up to $200,000 (80% of your home’s value minus your mortgage balance) through a HELOC. This level of funding can prove invaluable for major expenses like home renovations, debt consolidation, or even funding a business venture.

Alignment with Variable Income Streams

For homeowners with fluctuating incomes (such as freelancers, seasonal workers, or commission-based employees), interest-only HELOCs offer a perfect fit. The lower payments during the draw period allow for easier budgeting during lean times, while the option to make larger payments when income increases provides flexibility.

These advantages make interest-only HELOCs an attractive option for many homeowners. However, it’s essential to consider the long-term implications and have a solid repayment plan. The next section will explore specific scenarios where an interest-only HELOC can be particularly beneficial.

When to Use an Interest-Only HELOC

Interest-only HELOCs serve as powerful financial tools when used strategically. Let’s explore some scenarios where they excel.

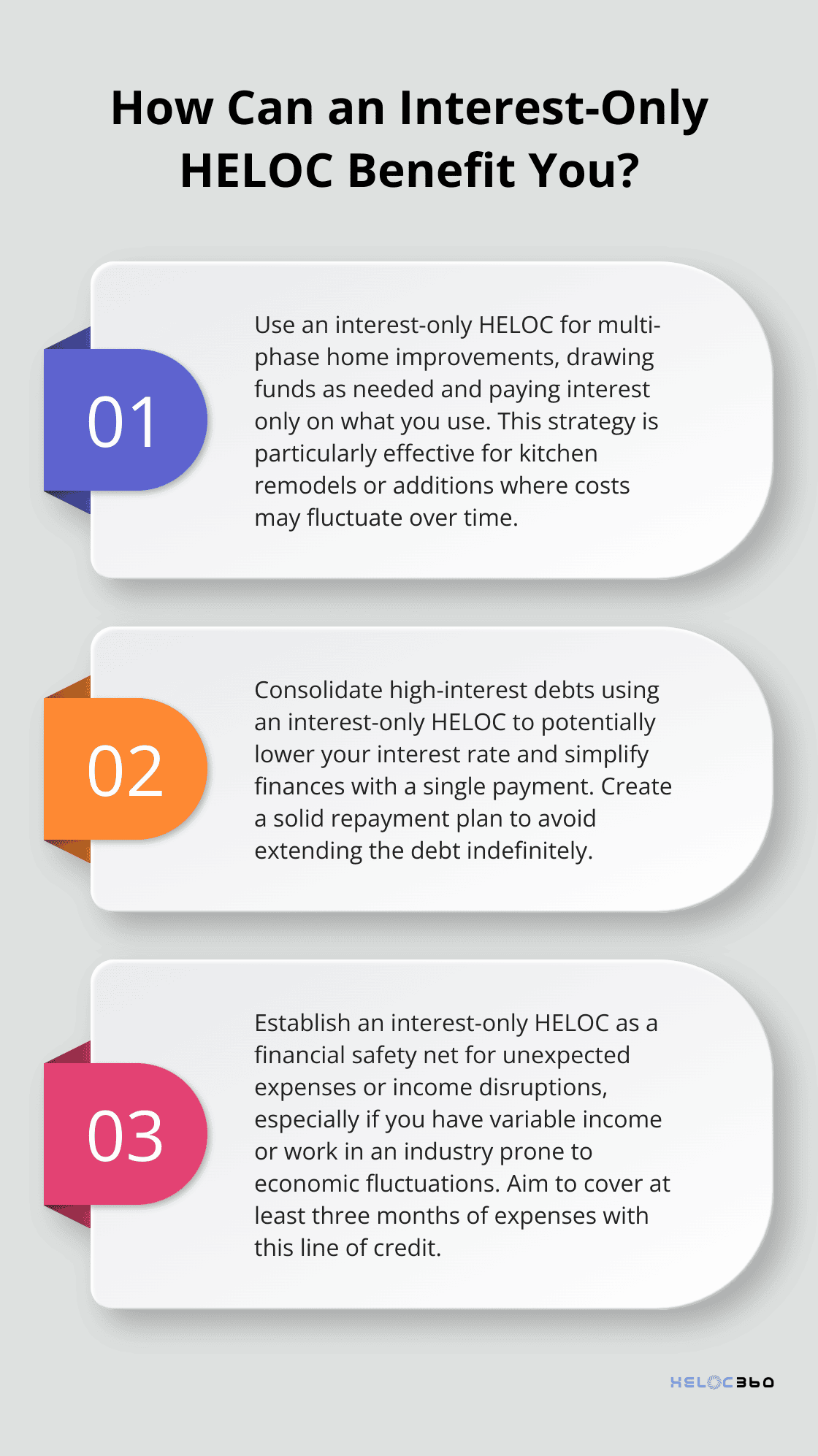

Home Improvements

Home renovations rank as the top reason homeowners tap into their equity. An interest-only HELOC fits perfectly for multi-phase projects. You can draw funds as needed and pay interest only on what you use. This flexibility suits kitchen remodels or additions where costs may fluctuate.

The National Association of Realtors reports that kitchen remodels are among the top return-on-investment projects for homeowners. An interest-only HELOC allows you to manage cash flow during the project and potentially increase your home’s value.

Debt Consolidation

High-interest debt can weigh heavily on your finances. An interest-only HELOC offers a way to consolidate these debts at a potentially lower rate. The Federal Reserve provides historical data on credit card interest rates and other consumer loan rates.

Using an interest-only HELOC to pay off high-interest debts could save you money in interest and simplify your finances with a single payment. (However, you must create a solid repayment plan to avoid extending the debt indefinitely.)

Investment Opportunities

For savvy investors, an interest-only HELOC provides quick access to funds for time-sensitive opportunities. The lower initial payments can help manage cash flow while the investment matures, whether you purchase an investment property or fund a business venture.

This strategy works well if the return on investment outpaces the HELOC interest rate.

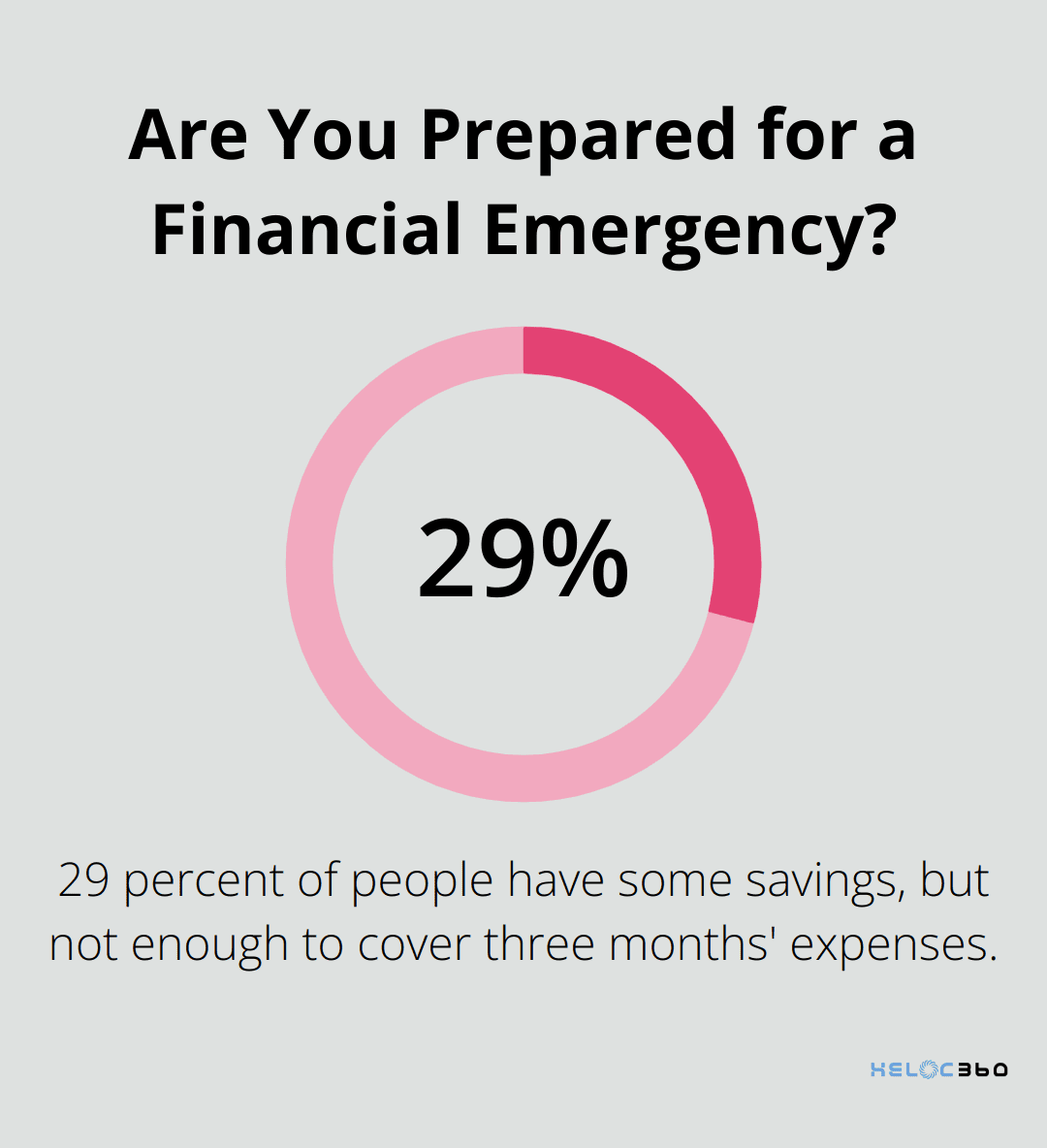

Financial Safety Net

Life throws curveballs, and access to funds can provide peace of mind. An interest-only HELOC can act as a financial cushion for unexpected expenses or income disruptions. A recent survey found that almost 3 in 10 (29 percent) of people have some savings, but not enough to cover three months’ expenses.

An interest-only HELOC gives you a ready source of funds without the pressure of immediate principal repayment. (This proves especially valuable for those with variable incomes or in industries prone to economic fluctuations.)

Education Expenses

Funding education often requires substantial financial resources. An interest-only HELOC can help cover tuition, books, and living expenses for higher education. The lower initial payments during the draw period align well with the typical timeline of a college education.

An interest-only HELOC allows families to manage these costs more flexibly than traditional student loans.

Final Thoughts

Interest-only HELOCs provide homeowners with a powerful financial tool that offers numerous benefits. The lower initial monthly payments during the draw period allow for improved cash flow management, which proves valuable for those with variable incomes or temporary financial constraints. Homeowners can access substantial funds at potentially lower interest rates than other borrowing options, making interest-only HELOCs attractive for various purposes, from home improvements to debt consolidation.

Borrowers must prepare for the transition to full principal and interest payments after the draw period ends. This shift can result in significantly higher monthly obligations, which requires a solid repayment strategy. Homeowners should evaluate their financial goals, income stability, and risk tolerance before they commit to this type of borrowing.

HELOC360 offers comprehensive support and guidance for those who consider a HELOC interest-only option. Our platform simplifies the process of exploring and securing a HELOC that aligns with your financial objectives (we provide expert insights and connect you with suitable lenders). You can unlock new financial opportunities and work towards your long-term goals with an interest-only HELOC as a valuable addition to your financial toolkit.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.