Are you struggling to get approved for a HELOC? Your debt-to-income ratio might be the culprit.

At HELOC360, we’ve seen many clients miss out on great opportunities because their HELOC debt ratio wasn’t up to par. Understanding and optimizing this crucial financial metric can make all the difference in your approval odds.

Let’s explore how you can improve your debt ratio and boost your chances of securing that HELOC you’ve been eyeing.

What Is Your Debt-to-Income Ratio?

Understanding DTI

Your debt-to-income ratio (DTI) is a key factor in determining your eligibility for a Home Equity Line of Credit (HELOC). This financial metric compares your monthly debt payments to your gross monthly income, expressed as a percentage. Lenders use DTI to assess your ability to manage monthly payments and take on additional debt.

Calculating Your DTI

To calculate your DTI, add up all your monthly debt payments and divide that sum by your gross monthly income. For example, if your monthly debts total $2,000 and your gross monthly income is $6,000, your DTI would be 33.33% ($2,000 / $6,000 = 0.3333).

Lenders typically consider two types of DTI:

- Front-end ratio: This only includes housing-related expenses (mortgage, property taxes, insurance).

- Back-end ratio: This includes all monthly debt obligations (housing costs, credit cards, car loans, and student loans).

For HELOC approval, lenders focus more on the back-end ratio as it provides a comprehensive view of your financial obligations.

The Importance of DTI in HELOC Approval

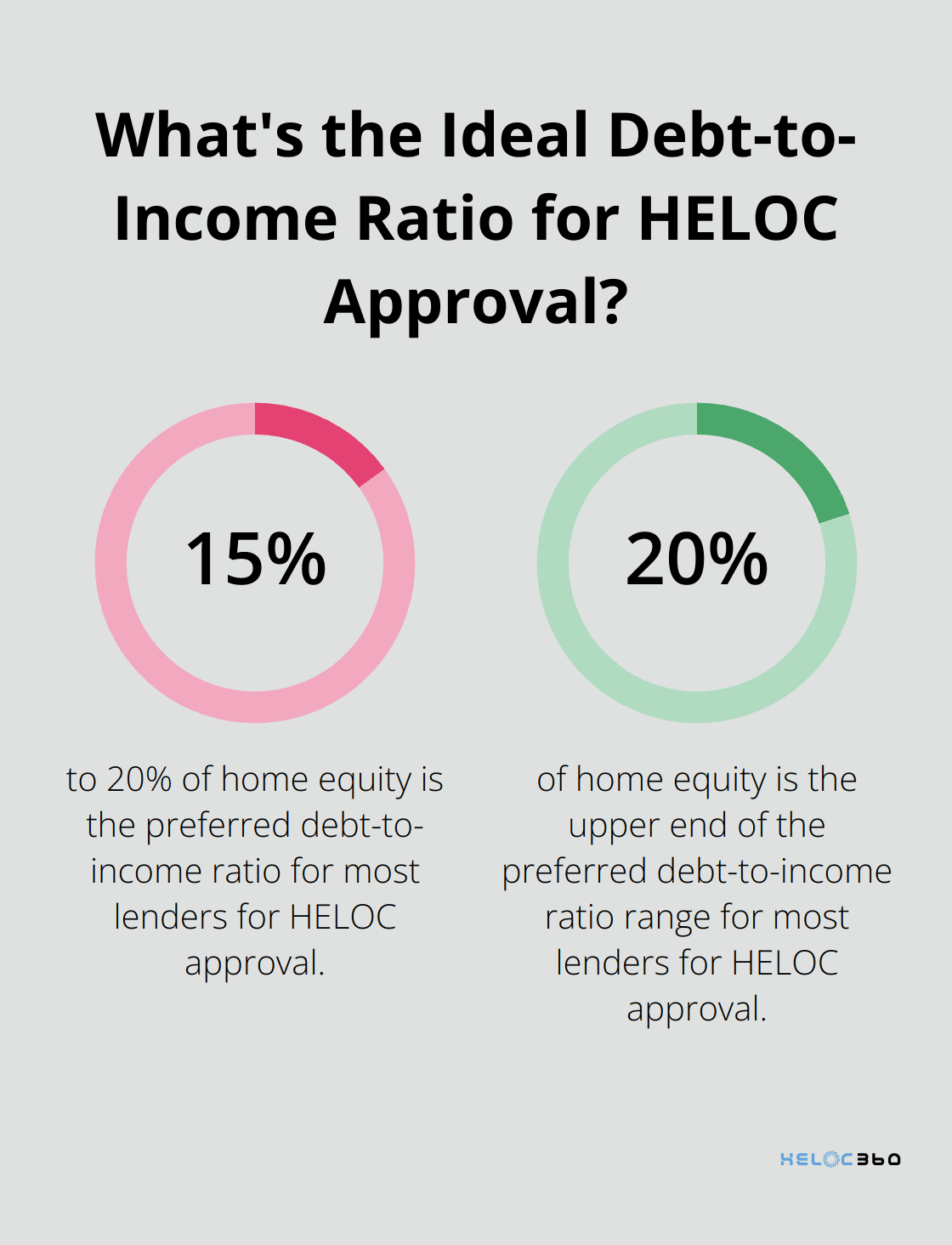

Your DTI plays a significant role in the HELOC approval process. Most lenders prefer a DTI of 15% to 20% of your home’s equity, though some may accept higher percentages in certain circumstances. A lower DTI indicates that you have a good balance between debt and income, making you a less risky borrower.

A 2024 Federal Reserve report revealed that almost half of applicants were denied HELOCs in the third quarter of 2024, more than double the rate of conventional mortgages. This statistic underscores the importance of maintaining a healthy debt-to-income ratio.

Strategies to Improve Your DTI

If your DTI is higher than desired, you can employ several strategies to improve it:

- Pay down existing debts: Focus on high-interest debts first to reduce your monthly obligations.

- Increase your income: Ask for a raise, take on a side job, or freelance to boost your gross monthly income.

- Refinance high-interest debts: Consolidate debts or refinance to lower interest rates to reduce your monthly payments.

Many homeowners have successfully lowered their DTI by implementing these strategies. This improvement can significantly increase your chances of HELOC approval and potentially secure better terms.

The Impact of Credit Score on DTI Requirements

While DTI is a critical factor, it’s important to note that your credit score can also influence the acceptable DTI range for HELOC approval. Many lenders allow you to tap your equity with a credit score in the 600s, with 620 being a common minimum, especially for HELOCs. Conversely, if your credit score is lower, you might need to aim for a lower DTI to compensate.

Understanding the interplay between your DTI and credit score is essential as we move forward to explore the ideal debt ratios for HELOC approval and how these requirements can vary among different lenders.

What’s the Ideal Debt Ratio for HELOC Approval?

The 43% Benchmark

Most lenders prefer a debt-to-income ratio (DTI) of 43% or lower when approving Home Equity Lines of Credit (HELOCs). This means your total monthly debt payments, including your potential HELOC payment, should not exceed 43% of your gross monthly income. HELOCs allow homeowners to leverage the equity they have already built in their homes.

Lender Variations

Different lenders have varying risk appetites and lending criteria. Some approve HELOCs for borrowers with DTIs as high as 50%, especially if other aspects of their financial profile are strong. More conservative lenders might cap their DTI requirements at 36%. For example, Wells Fargo typically requires a DTI of 43% or lower, with some mortgage lenders allowing up to 43%-45%. Loans insured by the Federal Housing Administration (FHA) may allow up to 50%.

Credit Score Impact

Your credit score can significantly influence the acceptable DTI range for HELOC approval. A higher credit score often offsets a slightly higher DTI. If you have a credit score above 740, some lenders might approve your HELOC application with a DTI of up to 45% or even 50%. However, if your credit score is around 620 (often the minimum for HELOC approval), you might need to aim for a DTI well below 43% to improve your chances of approval.

Income and Assets Matter

Your income level and assets can also impact the acceptable DTI ratio. High-income earners or those with significant liquid assets might receive approval with higher DTIs. For instance, a borrower with an annual income of $250,000 might receive approval with a 48% DTI, while someone earning $50,000 might face a limit of 40% DTI.

Some lenders also consider your residual income (the amount left after paying all debts each month). If this amount is substantial, they might show more leniency with DTI requirements.

As we move forward, let’s explore effective strategies to improve your debt ratio and increase your chances of HELOC approval.

How to Improve Your Debt Ratio

Pay Off High-Interest Debts

Start by listing all your debts and their interest rates. Focus on paying down high-interest debts, particularly credit card balances. If you have a $5,000 credit card balance at 18% APR, paying it off could save you $900 in annual interest and significantly lower your monthly obligations.

Increase Your Income

Increasing your income is a powerful way to improve your DTI. Ask for a raise at work or take on a side gig. A 2024 survey revealed that more than 1 in 3 Americans earn money through side hustles. That extra income could make a substantial difference in your DTI calculation.

Cut Monthly Expenses

Take a hard look at your monthly expenses and identify areas where you can cut back. Cancel unused subscriptions, negotiate better rates for services, or consider downsizing. According to a recent study, the average U.S. household spends more than $70,000 on housing, meals, transportation, health care and more.

Consider Debt Consolidation

Consolidating high-interest debts into a single, lower-interest loan can reduce your monthly payments and improve your DTI. You could receive a lower rate, get out of debt faster, have just one monthly payment, and potentially build your credit.

Use Balance Transfer Credit Cards

If you have good credit, try using a balance transfer credit card with a 0% introductory APR to pay off high-interest debt. This strategy can provide a 12-18 month window to aggressively pay down your balance without accruing additional interest (potentially saving thousands and improving your DTI).

Final Thoughts

Your HELOC debt ratio significantly impacts your eligibility for a Home Equity Line of Credit. A lower debt-to-income ratio increases your approval chances and can lead to better interest rates and terms. It demonstrates financial responsibility to lenders, positioning you as a low-risk borrower.

Improving your debt ratio provides greater financial flexibility and reduces stress. It allows you to allocate more resources towards savings and investments, positively impacting various aspects of your life. Take action now to optimize your debt-to-income ratio by assessing your current financial situation and implementing effective strategies.

At HELOC360, we help homeowners unlock the full potential of their home equity. Our platform provides tailored solutions to simplify the HELOC process and connect you with suitable lenders. Assess your debt-to-income ratio today and start working towards a stronger financial future.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.