Your credit score is a vital financial metric that impacts your borrowing power and interest rates. Many homeowners are unaware of the significant HELOC impact on their credit scores.

At HELOC360, we’ve seen firsthand how Home Equity Lines of Credit (HELOCs) can influence credit scores in surprising ways. This post will explore the positive and negative effects of HELOCs on your creditworthiness, helping you make informed decisions about your financial future.

How HELOCs Impact Your Credit Score

Understanding HELOCs and Credit Scores

A Home Equity Line of Credit (HELOC) allows homeowners to borrow against their home’s equity. It functions as a revolving credit line, similar to a credit card, but uses your home as collateral. This unique feature of HELOCs plays a significant role in their impact on your credit score.

Credit scores, calculated by companies like FICO and VantageScore, represent your creditworthiness numerically. These scores consider various factors, including payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries. Each factor carries different weights in the score calculation.

The Credit Mix Factor

HELOCs can affect your credit score depending on your overall credit profile and how you manage the account. Adding a HELOC to your credit profile diversifies your credit types, which can potentially impact your score.

Credit Utilization and HELOCs

Credit utilization (the amount of credit you use compared to your credit limits) is an important factor in your credit score. Closing a HELOC could increase your credit utilization ratio for VantageScore credit scores because you’ll have less available credit.

Payment History and HELOCs

Payment history constitutes the most significant factor in your credit score. Timely HELOC payments can substantially improve your credit score over time. However, late payments can severely damage your score.

Potential Risks to Consider

While HELOCs offer several benefits to your credit score, they also come with potential risks. The application process typically involves a hard inquiry on your credit report, which can temporarily lower your score by a few points. Additionally, since a HELOC uses your home as collateral, defaulting on payments could put your home at risk of foreclosure.

An unused HELOC can still affect your credit scores if the lender reports the account to the credit bureaus. The account’s payment history and other factors can impact your credit profile.

Homeowners who use HELOCs responsibly often see improvements in their credit scores over time. However, it’s important to understand how HELOCs work and their potential impact on your overall financial health before opening one. In the next section, we’ll explore the positive effects of HELOCs on credit scores in more detail.

How HELOCs Can Boost Your Credit Score

HELOCs can positively impact your credit score when you use them responsibly. This chapter explores how these financial tools enhance your creditworthiness and open doors to better financial opportunities.

Diversifying Your Credit Mix

A HELOC added to your credit profile can improve your credit mix, which determines 10% of a FICO® Score. Credit scoring models favor a diverse range of credit types, including revolving accounts (like credit cards and HELOCs) and installment loans (such as mortgages and car loans). When you introduce a HELOC into your credit portfolio, you demonstrate to lenders that you can manage different types of credit responsibly.

For instance, if you currently only have credit cards, a HELOC could potentially boost your score by showing you can handle secured debt. However, this benefit only applies if you manage the HELOC responsibly.

Lowering Your Overall Credit Utilization

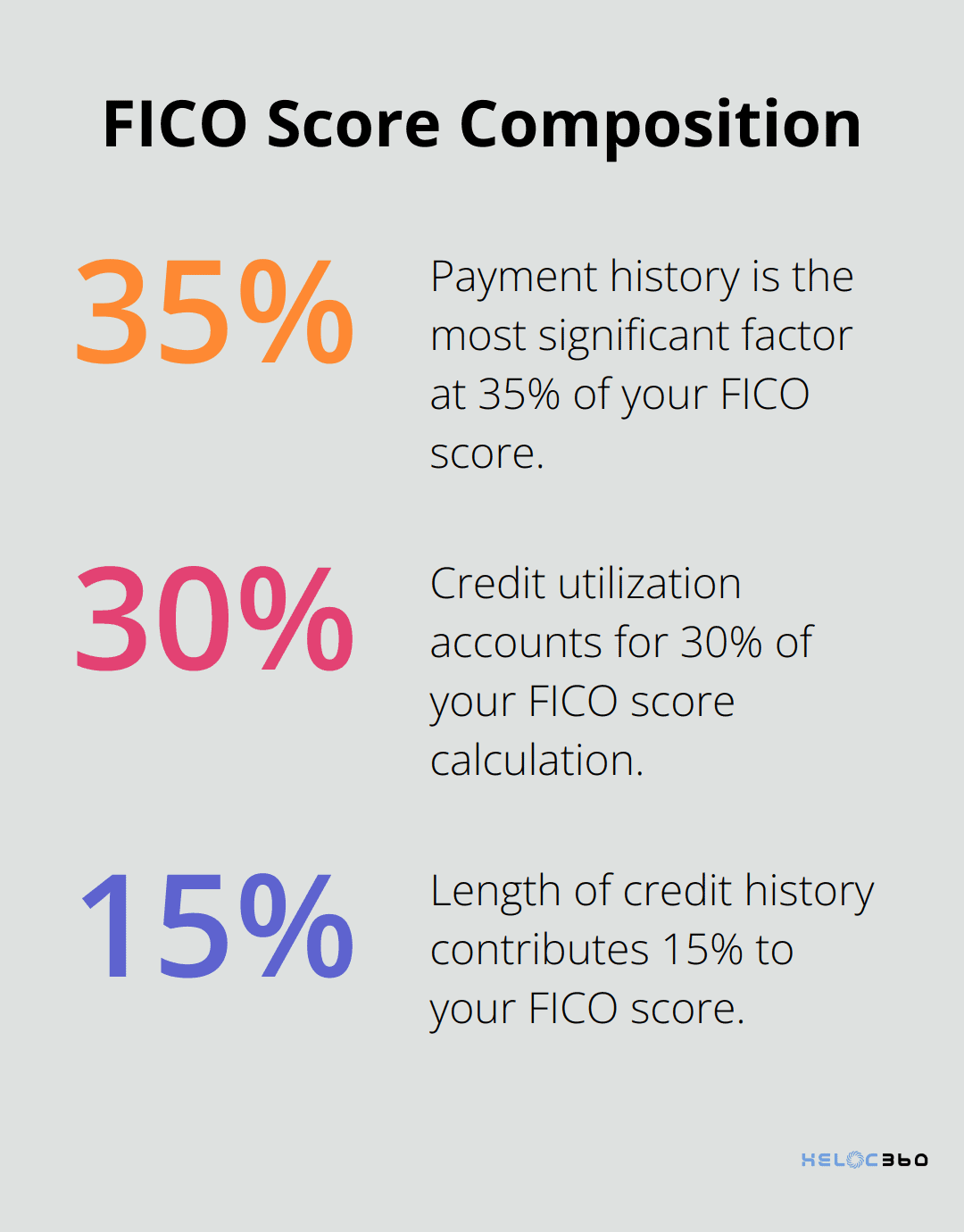

Credit utilization (the amount of credit you use compared to your available credit limits) makes up 30% of your FICO score. HELOCs can help lower your overall credit utilization ratio in two ways:

- Increasing available credit: A new HELOC adds to your total available credit, potentially lowering your utilization ratio if you don’t use the entire credit line.

- Debt consolidation: You can use a HELOC to pay off high-interest credit card balances, which can significantly reduce your credit utilization on revolving accounts and have a more immediate positive impact on your score.

Consider this example: If you have $10,000 in credit card debt across cards with a total limit of $20,000 (50% utilization), using a $20,000 HELOC to pay off that debt could drop your credit card utilization to 0% and your overall utilization to 25%, potentially boosting your score.

Building a Solid Payment History

Payment history makes up 35% of your FICO score and is the most significant factor in its calculation. A HELOC provides an excellent opportunity to build a positive payment history over time. Each on-time payment you make on your HELOC gets reported to the credit bureaus, gradually strengthening your credit profile.

To maximize this benefit, you should set up automatic payments for at least the minimum amount due each month. This ensures you never miss a payment and consistently build a positive credit history. Even one late payment can significantly damage your credit score, so staying on top of your HELOC payments is essential.

Leveraging Long-Term Credit History

The length of your credit history contributes to about 15% of your FICO score. A HELOC, as a long-term financial product, can positively impact this aspect of your credit score. As your HELOC account ages, it adds to the average age of your credit accounts, potentially improving your score over time.

However, it’s important to note that opening a new HELOC may initially lower the average age of your credit accounts, which could cause a temporary dip in your score. This effect typically balances out as you maintain the account responsibly over time.

While HELOCs offer these potential benefits to your credit score, it’s crucial to approach them with caution and a clear financial strategy. Understanding these positive effects allows you to leverage your home equity to improve your overall financial health. However, HELOCs also come with potential risks that can negatively impact your credit score if not managed properly. Let’s explore these risks in the next section to give you a comprehensive understanding of how HELOCs interact with your credit profile.

How HELOCs Can Negatively Impact Your Credit Score

Initial Credit Score Reduction

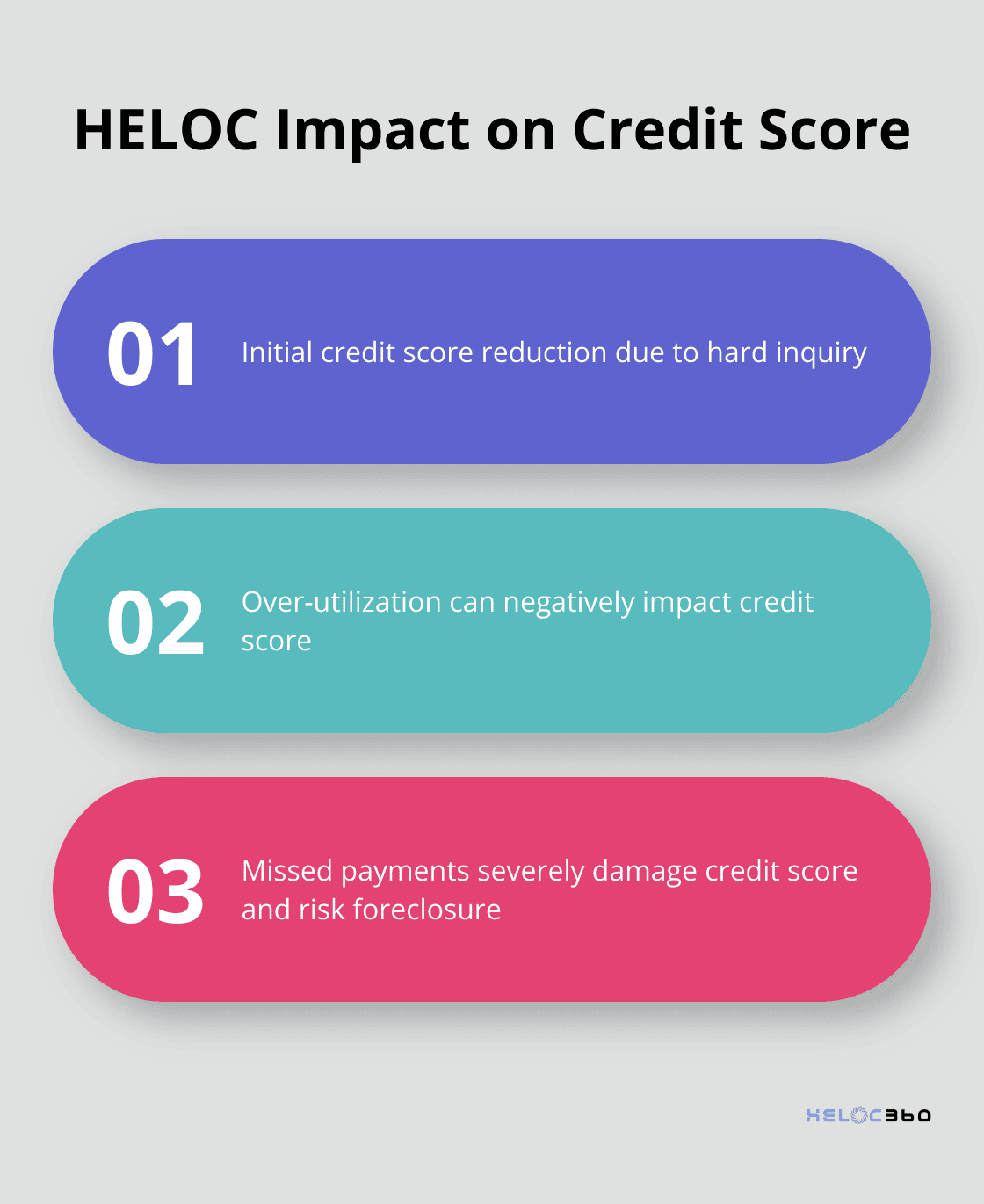

When you apply for a HELOC, lenders perform a hard inquiry on your credit report. FICO scores generally will count HELOC/Mortgage inquiries as one inquiry within the same 45 day period. So if you’re shopping multiple mortgage options, it’s best to do so within this timeframe to minimize the impact on your credit score.

The Danger of Over-Utilization

HELOCs offer revolving credit, which can tempt you to borrow more than you can comfortably repay. High utilization rates on your HELOC can negatively impact your credit score, similar to maxing out a credit card. Credit scoring models typically view utilization rates above 30% unfavorably. Using more than 30% of your available credit on your cards can hurt your credit score. The lower you can get your balance relative to your limit, the better it is for your credit score.

Severe Consequences of Missed Payments

Missed payments on a HELOC can cause the most damage to your credit score. Payment history accounts for 35% of your FICO score, making it the most influential factor. A single late payment can cause a significant drop in your credit score. Depending on where you get your score, you have over 40 different scores, and one or more of them could drop significantly depending on the formula used. Moreover, since HELOCs are secured by your home, the consequences of defaulting extend beyond your credit score. Missed payments could lead to foreclosure, putting your home at risk.

Long-Term Impact on Credit History

While a HELOC can positively impact your credit mix, it can also affect the average age of your credit accounts. Opening a new HELOC may initially lower this average, which could cause a temporary dip in your score. This effect typically balances out as you maintain the account responsibly over time, but it’s important to consider this potential short-term impact.

Increased Debt-to-Income Ratio

A HELOC can increase your debt-to-income ratio (DTI), which lenders use to assess your ability to manage monthly payments. While DTI doesn’t directly affect your credit score, a high DTI can make it more difficult to qualify for new credit or favorable terms in the future. You should carefully consider how a HELOC will impact your overall financial picture before applying.

Final Thoughts

HELOCs can significantly impact your credit score in both positive and negative ways. When managed responsibly, they diversify your credit mix, lower overall credit utilization, and help build a solid payment history. However, the risks of over-utilization, missed payments, and increased debt-to-income ratio highlight the importance of careful HELOC management.

We at HELOC360 understand the complexities of managing a HELOC effectively. Our platform helps homeowners navigate home equity borrowing, providing tailored solutions and expert guidance. We connect you with lenders that match your unique needs, simplifying the process and empowering you to make the most of your home’s value.

HELOC360 offers the tools and resources you need to optimize your strategy, whether you consider a HELOC for home improvements, debt consolidation, or financial flexibility. Our support allows you to confidently harness the power of your home equity while maintaining a healthy credit profile (and potentially improving your HELOC impact on your credit score).

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.