Wondering about HELOC eligibility? You’re not alone. Many homeowners are curious about tapping into their home’s equity but aren’t sure if they qualify.

At HELOC360, we’ve helped countless individuals navigate the world of Home Equity Lines of Credit. In this post, we’ll explore what makes someone an ideal candidate for a HELOC and when it might not be the best financial move.

What Is a HELOC and Why Should You Care?

The Basics of Home Equity Lines of Credit

A Home Equity Line of Credit (HELOC) empowers homeowners to borrow against their property’s equity. With a HELOC, you’re borrowing against the available equity in your home and the house is used as collateral for the line of credit.

How HELOCs Operate

When you receive HELOC approval, lenders determine your credit limit based on your home’s value and outstanding mortgage balance. The draw period (typically 10 years) allows you to access funds as needed. During this time, you pay interest only on the borrowed amount.

Advantages: Flexibility and Lower Interest Rates

HELOCs shine in their flexibility. You can borrow what you need, when you need it, without reapplying for new loans. This feature makes HELOCs ideal for ongoing expenses like home renovations or education costs.

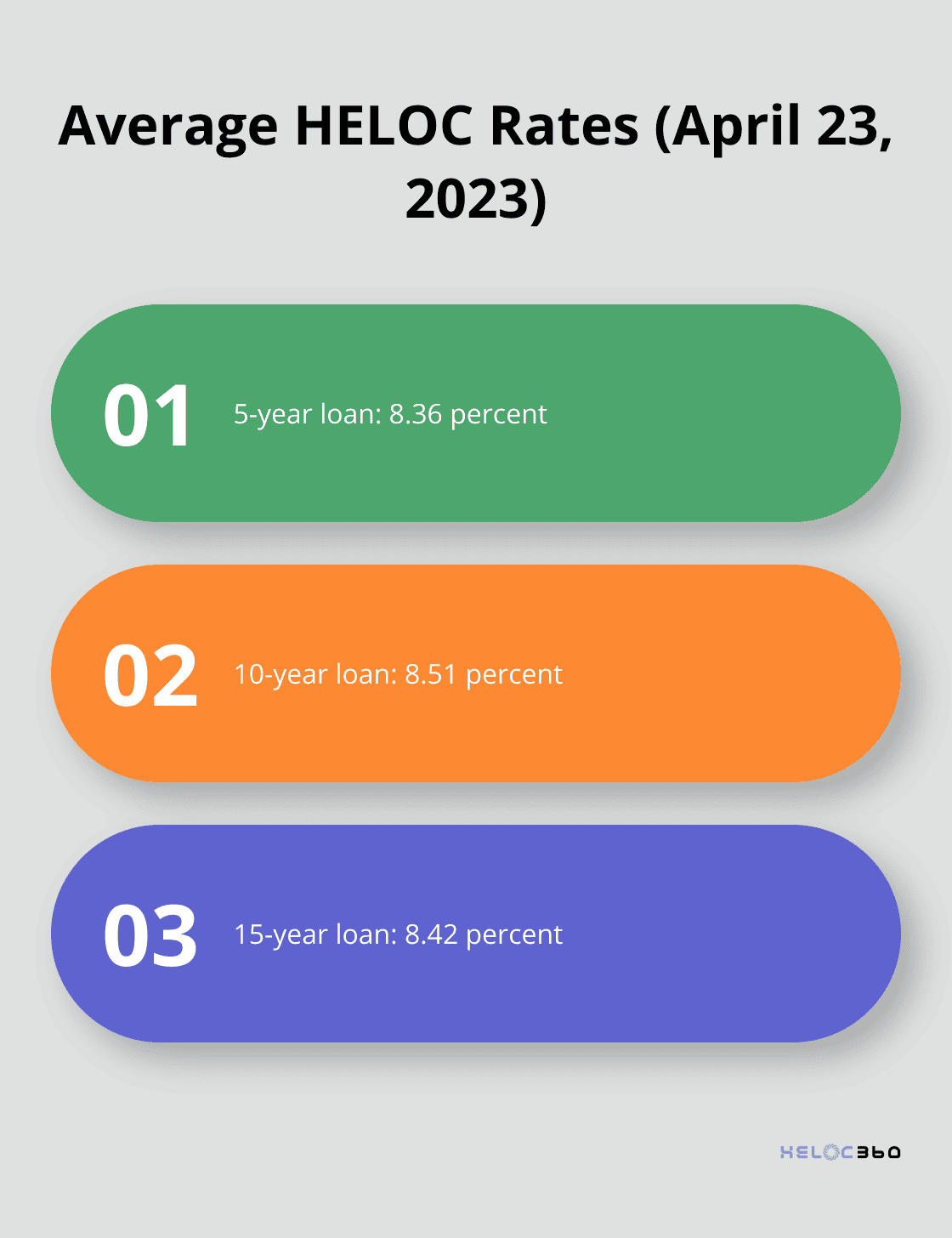

HELOCs also boast lower interest rates compared to credit cards or personal loans. As of April 23, 2023, the average rates for 5-, 10-, and 15-year $30,000 loans were 8.36 percent, 8.51 percent and 8.42 percent, respectively, according to Bankrate’s survey.

Potential Tax Benefits and Savings

HELOCs may offer tax advantages. If you use the funds for home improvements, you might qualify for interest deductions. (Always consult a tax professional for personalized advice.)

For homeowners with high-interest debt, HELOCs can lead to substantial savings. Consider this scenario: You carry $20,000 in credit card debt at 22% APR. Switching to a HELOC at a lower rate could save you thousands in interest over time.

Risks and Considerations

While HELOCs offer numerous benefits, they come with risks. Your home serves as collateral, which means defaulting on payments could lead to severe consequences. Your lender may have the right to take legal action. Additionally, variable interest rates can cause your payments to fluctuate over time.

As you weigh the pros and cons of a HELOC, it’s essential to understand if you’re an ideal candidate. Let’s explore the key factors that make someone a prime HELOC candidate in the next section.

Are You the Perfect HELOC Candidate?

Equity: Your Home’s Hidden Treasure

The cornerstone of HELOC eligibility is substantial home equity. Most lenders require you to maintain a minimum of 20 percent equity, although some allow 15 percent. For instance, if your home is worth $300,000 and you owe $200,000 on your mortgage, you have $100,000 or 33% equity. This puts you in a strong position for a HELOC.

To calculate your equity, subtract your current mortgage balance from your home’s current market value. Online tools and recent comparable sales in your area can help estimate your home’s value. For a more accurate assessment, consider a professional appraisal.

Credit Score: Your Financial Report Card

Your credit score plays a crucial role in HELOC approval and interest rates. While some lenders may approve scores as low as 620, the higher your credit score is, the more likely you are to qualify for the best available interest rates and loan options.

To boost your score before applying:

- Pay down credit card balances

- Make all payments on time

- Avoid opening new credit accounts

- Check your credit report for errors and dispute any inaccuracies

Income Stability: Proving You Can Pay

Lenders want to see a stable income and employment history. Most prefer at least two years in your current job or field. They’ll typically look at your debt-to-income (DTI) ratio, which should ideally be below 43%. To calculate your DTI, add up your monthly debt payments, divide that number by your pre-tax monthly income, and multiply by 100.

For example, if your monthly debts total $2,000 and your gross monthly income is $6,000, your DTI is 33% (2,000 / 6,000 = 0.33). This would be considered favorable by most lenders.

Clear Financial Goals: Know Your ‘Why’

Having a clear purpose for your HELOC funds isn’t just about satisfying lenders-it’s about making smart financial decisions. Common uses include:

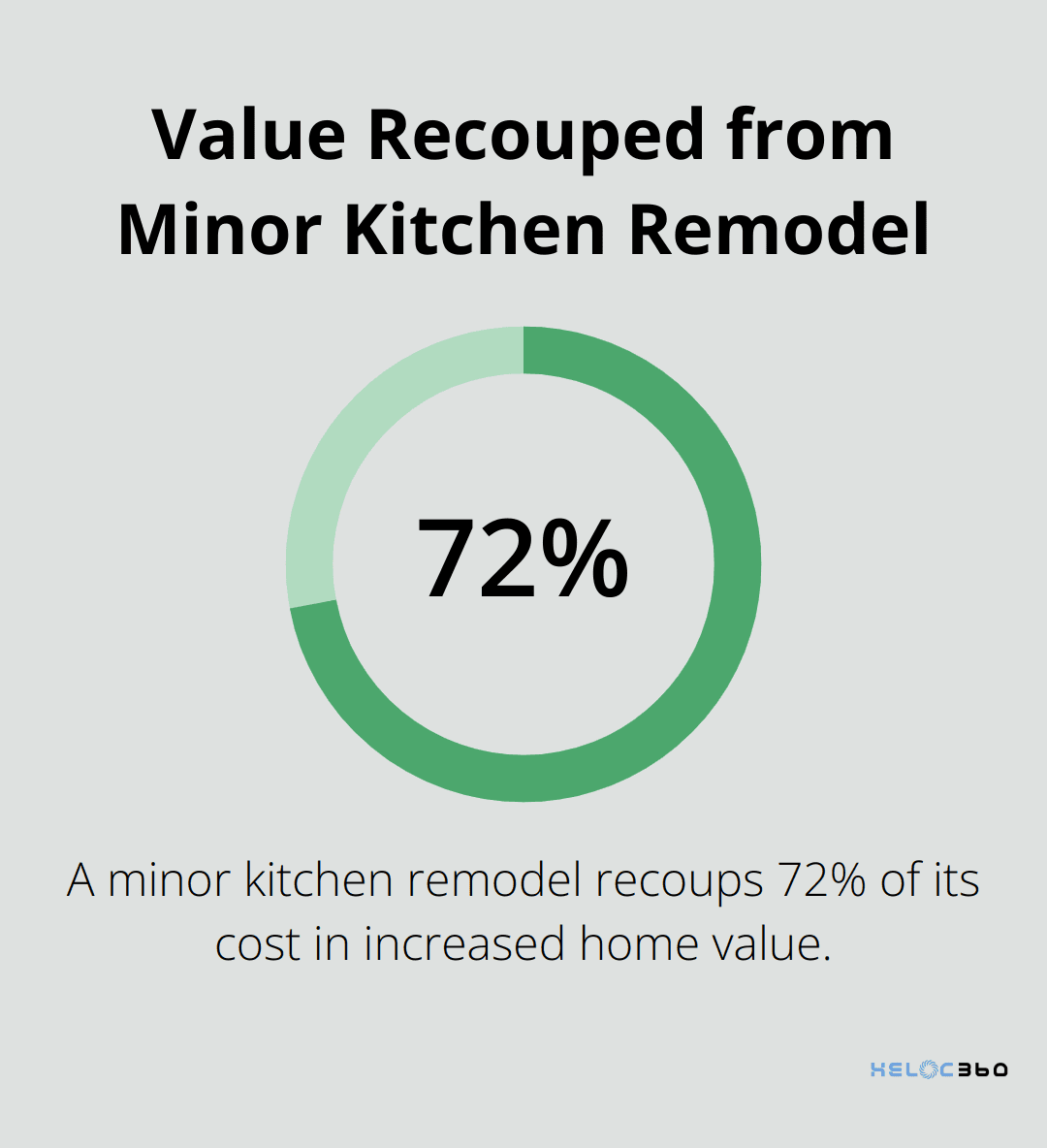

- Home improvements: A minor kitchen remodel can recoup about 72% of its cost in increased home value (Remodeling Magazine’s 2022 Cost vs. Value Report).

- Debt consolidation: If you’re paying high interest on credit cards (average APR of 20.68% as of April 2023, according to CreditCards.com), a HELOC could save you thousands in interest.

- Education expenses: With average private college tuition at $39,400 per year (College Board, 2022-2023), a HELOC can be a lower-interest alternative to student loans.

- Emergency fund: A HELOC can serve as a backup for unexpected expenses, although it’s not the ideal primary solution.

Using your HELOC wisely is key to maximizing its benefits and minimizing risks. The next section will explore situations where a HELOC might not be the best financial move, helping you make an informed decision about leveraging your home equity.

When Is a HELOC Not Right for You?

Insufficient Home Equity

A Home Equity Line of Credit (HELOC) requires at least 15-20% equity in your home. Recent home purchases or property value declines might leave you short of this requirement. For instance, a $300,000 home with a $270,000 mortgage balance equals only 10% equity, which falls below most lenders’ thresholds.

Financial Instability

HELOCs pose risks if your income fluctuates or your job security wavers. The Bureau of Labor Statistics reported that the unemployment rate changed little at 4.2 percent in March 2025. Job loss doesn’t exempt you from HELOC payments, potentially jeopardizing your home ownership.

High Debt-to-Income Ratio

Lenders favor a debt-to-income (DTI) ratio under 43%. Higher ratios may result in HELOC disqualification or unfavorable terms. A $5,000 monthly income with $2,500 in monthly debts yields a 50% DTI, suggesting potential difficulty managing additional debt.

Short-Term Homeownership Plans

HELOCs might not suit those planning to sell soon. With typical draw periods of 5-10 years and repayment periods of 10-20 years, selling before the term ends requires full balance repayment. This could complicate your home sale or reduce profits.

Tendency to Overspend

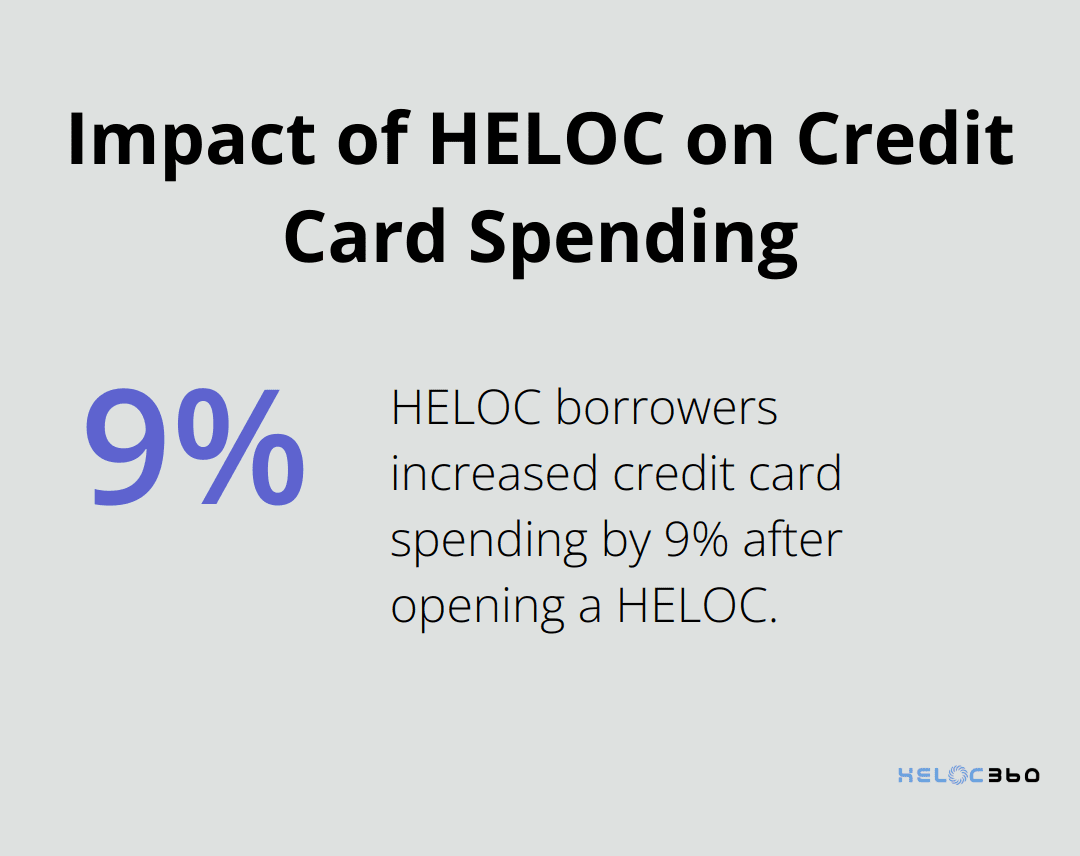

The revolving credit nature of HELOCs can tempt those who struggle with financial discipline. A Federal Reserve Bank of Philadelphia study found HELOC borrowers increased credit card spending by 9% after opening a HELOC. Easy fund access could spell trouble for those prone to overspending.

Better Alternatives Available

Other financial products might better fit your needs in some cases. Home equity loans offer fixed interest rates and predictable payments for one-time expenses. These loans provide a lump sum, which suits specific financial goals more appropriately than a revolving credit line.

Final Thoughts

HELOC eligibility depends on various factors, including home equity, credit score, and income stability. You must evaluate your financial situation and long-term plans to determine if a HELOC suits your needs. A HELOC can provide financial flexibility, but it also carries risks that you should carefully consider.

HELOC360 simplifies the process of exploring home equity options. We connect you with lenders that match your specific needs and financial goals. Our platform provides the knowledge and tools to make informed decisions about leveraging your home’s equity.

If you want to explore your HELOC options, HELOC360 can help you determine if it’s the right financial move for you. Our expert guidance and tailored solutions empower you to unlock the full potential of your home’s value. We turn your home equity into a gateway for new financial opportunities.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.