Are you confused about HELOC fixed-rate options? You’re not alone. Many homeowners struggle to understand the differences between fixed-rate and variable-rate HELOCs.

At HELOC360, we’re here to clear up the confusion. In this post, we’ll break down fixed-rate HELOC options, compare them to variable-rate alternatives, and help you decide which choice might be right for your financial goals.

What Are Fixed-Rate HELOCs?

Definition and Mechanics

Fixed-rate HELOCs give you predictable repayments that you won’t get with a variable rate loan. Unlike traditional variable-rate HELOCs, fixed-rate options offer a stable interest rate for a set period (typically 5 to 30 years).

When you choose a fixed-rate HELOC, you lock in an interest rate for a portion of your credit line. This results in consistent monthly payments, which simplifies budgeting and shields you from potential interest rate increases.

Advantages of Fixed-Rate Options

Fixed-rate HELOCs excel in long-term planning scenarios. They prove invaluable when you finance a major home renovation or consolidate high-interest debt, as you know exactly what you’ll pay each month.

Some lenders offer additional flexibility. For example, U.S. Bank allows up to three active locks on your HELOC at one time, enhancing your debt management options.

Potential Drawbacks

While fixed-rate HELOCs offer stability, they often come with higher initial interest rates compared to variable-rate alternatives. Some lenders also charge conversion fees when you switch from variable to fixed rates.

It’s important to note that if market rates drop significantly after you’ve locked in a fixed rate, you might miss potential savings.

Lender Policies and Options

Lender policies for fixed-rate HELOCs vary widely. Some institutions offer fixed-rate terms ranging from 5 to 30 years, allowing customization based on borrower needs. Others impose minimum amounts for locking in fixed rates.

It’s common for lenders to limit the frequency of rate locks. Some restrict borrowers to a maximum of two fixed-rate conversions per year. These policies aim to balance flexibility with the lender’s risk management needs.

Making an Informed Decision

Your choice between a fixed-rate and variable-rate HELOC depends on your financial goals and risk tolerance. If you value predictability and plan to borrow a significant amount for an extended period, a fixed-rate HELOC might suit your needs.

As we move forward, let’s compare fixed-rate and variable-rate HELOCs to give you a clearer picture of how these options stack up against each other.

Fixed vs Variable HELOCs: A Comprehensive Comparison

Interest Rate Dynamics

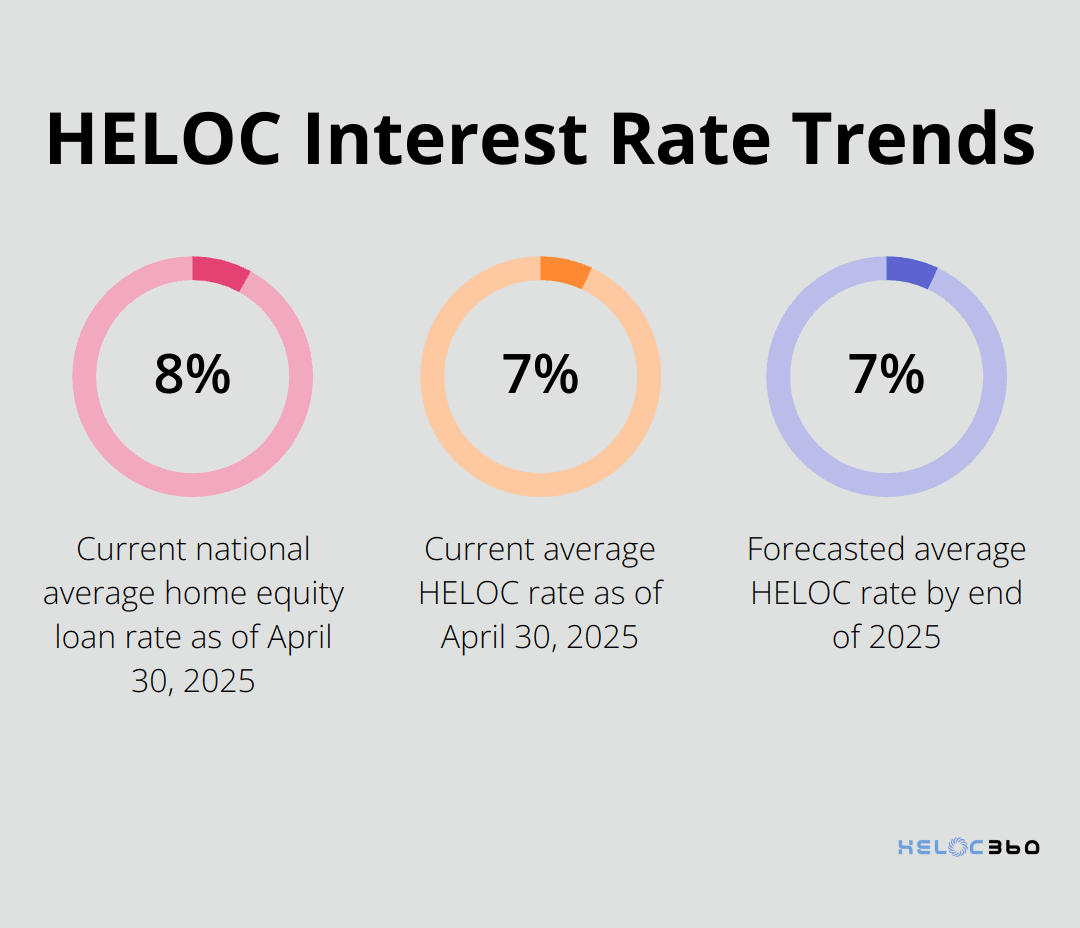

Fixed-rate HELOCs typically start with higher interest rates than their variable-rate counterparts. As of April 30, 2025, the national average home equity loan interest rate is 8.36%, according to Bankrate’s latest survey. However, fixed-rate options often exceed this average.

Variable-rate HELOCs usually offer lower initial rates but carry the risk of rate increases over time. These rates often tie to the prime rate, which can fluctuate based on economic conditions.

Repayment Structures

Fixed-rate HELOCs provide consistent monthly payments throughout the loan term. This predictability can significantly advantage budgeting and long-term financial planning.

Variable-rate HELOCs typically have two phases: a draw period and a repayment period. During the draw period (typically lasting up to 10 years), you’re usually only required to pay interest on what you borrow. Once the repayment period begins, you’ll pay both principal and interest, potentially leading to payment shock if rates have increased.

Long-Term Cost Implications

The long-term costs of fixed-rate and variable-rate HELOCs can vary significantly depending on market conditions and your borrowing habits.

Fixed-rate options provide certainty in total borrowing costs. You’ll know exactly how much you’ll pay over the life of the loan, which can advantage you in rising rate environments.

Variable-rate HELOCs may result in lower overall costs if interest rates remain stable or decrease. However, they carry the risk of becoming more expensive if rates rise substantially.

Greg McBride forecasts HELOCs to average 7.25 percent – a low not seen since 2022 – by the end of 2025. This prediction suggests that variable-rate options might become more attractive in the near future.

Risk Tolerance and Financial Goals

When deciding between fixed and variable rates, consider your risk tolerance and financial goals. If you value predictability and borrow a large sum for a specific purpose, a fixed-rate HELOC might suit you better. If you feel comfortable with some uncertainty and want to take advantage of potentially lower rates, a variable-rate HELOC could fit your needs.

The right choice depends on your individual circumstances. Some homeowners prefer the stability of fixed rates, while others opt for the potential savings of variable rates. Your decision should align with your long-term financial strategy and comfort level with interest rate fluctuations.

Market Trends and Future Outlook

Current market trends play a significant role in the fixed vs. variable HELOC decision. With interest rates showing signs of potential decrease (as indicated by McBride’s prediction), variable-rate HELOCs might become increasingly attractive. However, economic conditions can change rapidly, and what seems like a good deal today might not hold true in the future.

Experts recommend staying informed about market trends and economic forecasts when considering HELOC options. This knowledge will help you make a more informed decision about whether to lock in a fixed rate or take advantage of potentially lower variable rates.

As you weigh these factors, you might wonder about specific scenarios where one option clearly outperforms the other. Let’s explore situations where fixed-rate HELOCs make particular sense and how they align with various financial goals.

When to Choose a Fixed-Rate HELOC

Large, One-Time Expenses

Fixed-rate HELOCs excel for substantial, one-time costs. Home renovations stand out as a prime example. If you plan a major kitchen remodel or add a new wing to your house, a fixed-rate HELOC provides the funds you need with predictable monthly payments.

A $50,000 home improvement project becomes more manageable with a fixed-rate HELOC. You can budget precisely for the next 5, 10, or even 15 years. This predictability proves invaluable when managing large-scale projects.

Debt Consolidation Strategies

A fixed-rate HELOC serves as a powerful tool for consolidating high-interest debt. Consider a scenario with $30,000 in credit card debt at an average interest rate of 18%. Using a fixed-rate HELOC with an interest rate of 7.95% could save thousands in interest over the loan’s life.

The fixed rate ensures your debt consolidation strategy remains effective even if market rates increase. This stability proves crucial for long-term financial planning and debt elimination.

Risk-Averse Borrowers

Your personal risk tolerance plays a significant role in choosing between fixed and variable rates. If you value financial predictability and prefer knowing your exact monthly payments, a fixed-rate HELOC aligns well with your preferences.

This option particularly suits individuals on a fixed income or with a tight monthly budget. The consistency of fixed-rate payments can prevent financial stress and help you avoid potential payment shocks that could occur with variable rates.

Fixed-rate HELOCs typically start with higher interest rates but protect you from future rate increases. As of April 30, 2025, the average HELOC rate stands at 7.95% (according to Bankrate). If you lock in a rate close to this average, you shield yourself from significant future rate hikes.

Long-Term Financial Planning

Fixed-rate HELOCs provide a stable foundation for long-term financial planning. When you know exactly how much you’ll pay each month for the duration of your loan, you can more accurately forecast your financial future.

This predictability allows you to plan for other financial goals, such as retirement savings or college funds for your children. You won’t need to worry about adjusting your budget due to fluctuating interest rates, which can derail even the most carefully laid financial plans.

Market Uncertainty

In times of economic volatility or when interest rates show an upward trend, fixed-rate HELOCs offer a safe harbor. They provide protection against potential market swings that could increase your borrowing costs.

While you might start with a slightly higher rate compared to variable options, you gain peace of mind knowing your rate won’t increase, regardless of what happens in the broader economy. This certainty can prove particularly valuable during periods of inflation or economic instability.

Final Thoughts

Fixed-rate HELOCs offer stable and predictable borrowing options for homeowners who want to leverage their home equity. These financial tools provide consistent monthly payments, making them ideal for large one-time expenses, debt consolidation, and long-term financial planning. However, your personal financial situation will determine if a HELOC fixed rate option is right for you.

Consider your risk tolerance, financial goals, and current market conditions when you make this decision. If you value stability and have a specific purpose for the funds, a fixed-rate HELOC might align well with your needs. On the other hand, if you feel comfortable with some uncertainty and want to take advantage of potentially lower initial rates, a variable-rate HELOC could suit you better.

HELOC360 simplifies the process of home equity borrowing. We offer expert guidance and connect you with lenders that match your unique requirements. Our platform provides tailored solutions to help you achieve your financial aspirations (whether you’re planning a major renovation, consolidating debt, or seeking financial flexibility).

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.