Variable HELOC rates can be a powerful financial tool, but they come with their own set of challenges.

At HELOC360, we’ve seen how understanding these rates can make a significant difference in your borrowing strategy.

This guide will equip you with the knowledge and tactics to navigate HELOC variable rates effectively, helping you make informed decisions about your home equity line of credit.

What Are Variable HELOC Rates?

The Basics of Variable HELOC Rates

Variable HELOC rates form a key component of Home Equity Lines of Credit that significantly impact your borrowing experience. Unlike fixed rates, which remain constant throughout the loan term, variable rates fluctuate based on market conditions and other factors.

The Anatomy of Variable HELOC Rates

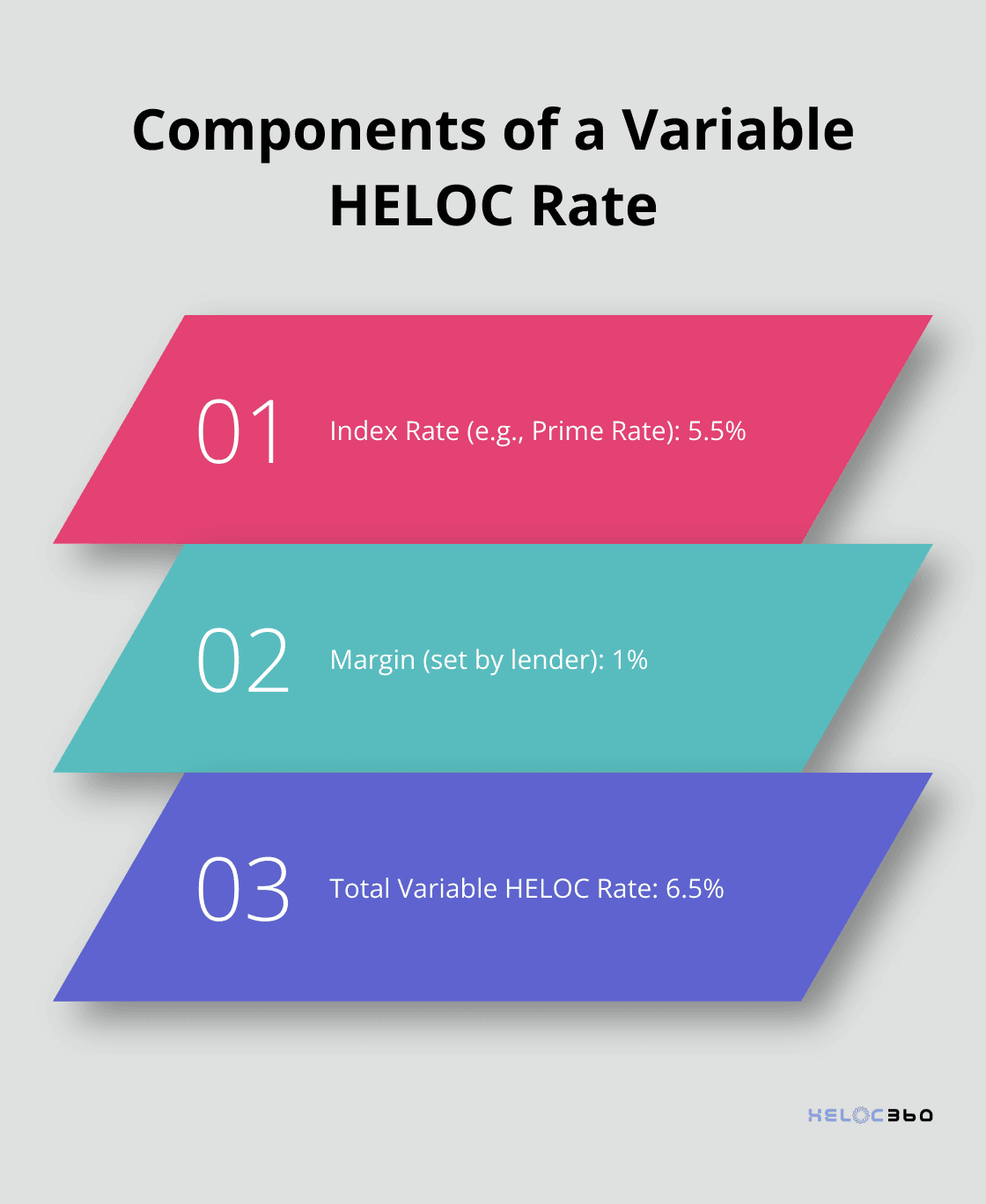

Variable HELOC rates typically consist of two components: an index rate and a margin. The index rate (often the Prime Rate published in the Wall Street Journal) moves up or down based on broader economic conditions. The margin, set by the lender, remains constant throughout the loan term. These components combine to determine your overall interest rate.

For instance, if the Prime Rate is 5.5% and your lender’s margin is 1%, your HELOC rate would be 6.5%. Should the Prime Rate increase to 6%, your new rate would become 7%, affecting your monthly payments.

Market Forces Shaping Variable Rates

Several factors can cause your variable HELOC rate to change. The Federal Reserve’s interest rate decisions influence what you pay for variable-rate home equity lines of credit (HELOCs) and new home equity loans.

Economic indicators such as inflation, employment rates, and GDP growth also influence variable rates. For example, during periods of high inflation, the Fed might raise rates to cool down the economy, leading to higher HELOC rates.

Rate Change Frequency and Timing

Lenders don’t adjust rates daily. Most HELOCs have specific terms regarding how often rates can change (typically monthly or quarterly). Some lenders may offer rate caps, stipulating how much your rate can increase each time, as well as a maximum rate cap annually and over the life of the loan.

Preparing for Rate Fluctuations

Understanding these mechanics and influences can help you make more informed decisions about your HELOC and better prepare for potential rate changes. While variable rates offer the potential for lower initial rates, they also come with the risk of higher costs if rates rise significantly over time.

As we move forward, let’s explore the advantages and disadvantages of variable HELOC rates, which will provide you with a comprehensive view of this financial tool.

Are Variable HELOC Rates Right for You?

The Appeal of Lower Initial Rates

Variable HELOC rates often start lower than fixed-rate options, which attracts homeowners seeking immediate savings. Home equity loan interest rates are down compared to a year ago, largely thanks to the Federal Reserve’s late-2024 rate cuts. This difference can result in substantial savings, especially for large borrowing amounts.

However, it’s important to look beyond the initial rate. While the upfront savings tempt many, the long-term implications of rate fluctuations require careful consideration. Homeowners should project their financial situation over the entire loan term, not just the first few years.

Flexibility: Advantages and Risks

One of the most appealing aspects of variable HELOC rates is the flexibility they offer. Borrowers can access funds as needed during the draw period typically lasting 10 years and only pay interest on the amount used. This feature makes HELOCs ideal for ongoing projects or as a financial safety net.

Yet, this flexibility comes with responsibility. Some homeowners overextend themselves, lured by the initial low rates and easy access to funds. It’s essential to maintain discipline and have a clear repayment strategy, regardless of how tempting it might be to tap into your home equity for non-essential expenses.

The Reality of Rate Increases

The primary risk of variable HELOC rates lies in potential rate hikes. Over the past decade, periods of significant rate increases occurred. For instance, between 2016 and 2019, average consumer loan interest rates for major types of debt increased.

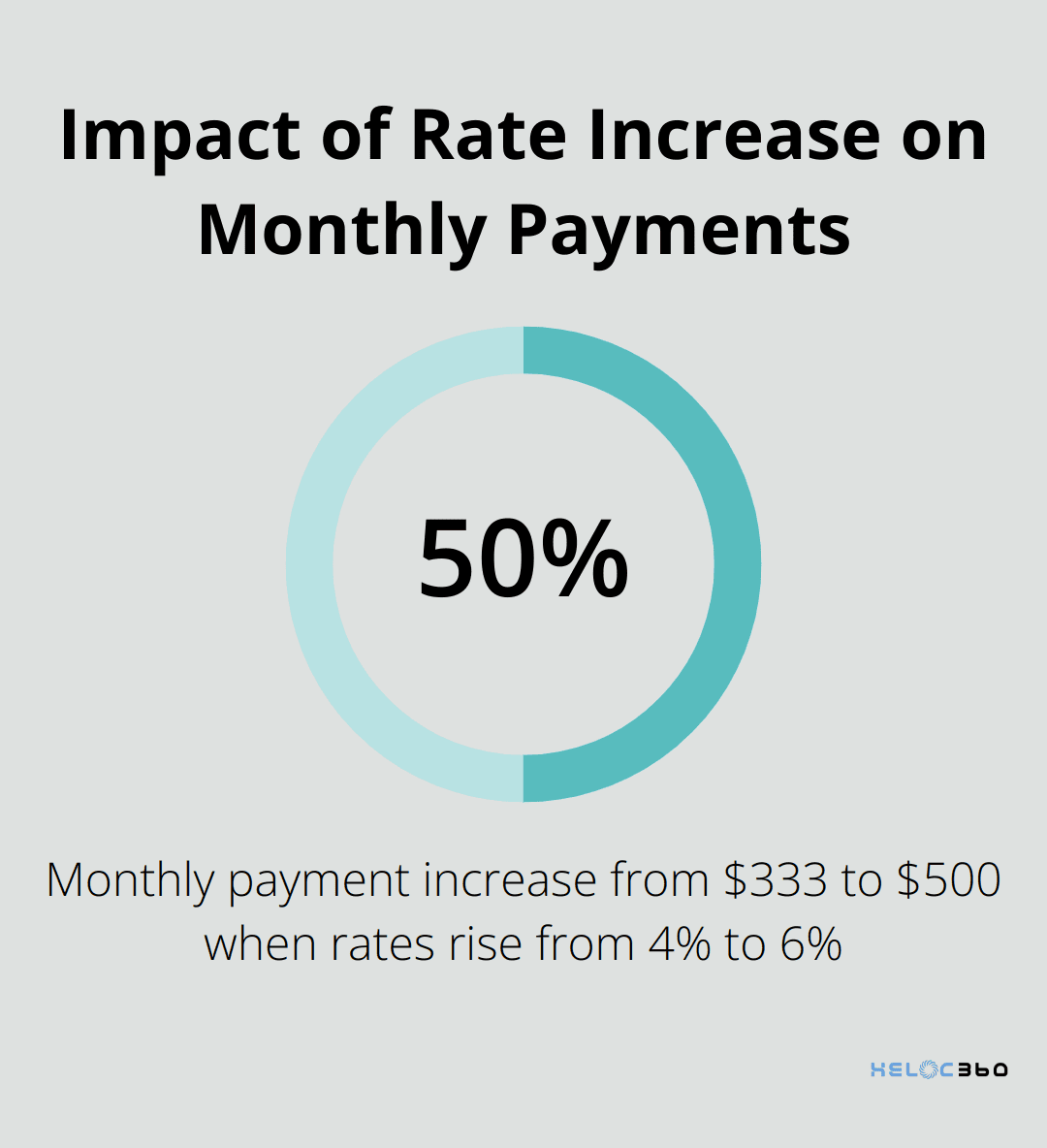

Such increases can dramatically affect monthly payments and overall loan costs. A $100,000 HELOC with an initial rate of 4% could see monthly interest-only payments jump from $333 to $500 if rates increase to 6%. This scenario underscores the importance of stress-testing your budget for potential rate hikes before committing to a variable HELOC.

Weighing the Pros and Cons

Variable HELOC rates offer potential savings and flexibility, but they require vigilant management and a solid financial foundation. Homeowners must carefully consider their financial goals, risk tolerance, and ability to handle potential rate increases before choosing a variable HELOC.

As we move forward, let’s explore effective strategies for managing variable HELOC rates, which will equip you with the tools to navigate this financial instrument successfully.

How to Master Variable HELOC Rates

Monitor Market Trends

Understanding economic indicators helps anticipate potential rate changes. The Offered Certificates are complex financial instruments and may not be suitable investments for you. You should not purchase Offered Certificates without fully understanding their risks and potential impacts on your financial situation.

To stay informed, check financial news sources and the Federal Reserve’s website for updates on economic outlooks and monetary policy decisions. The Bureau of Labor Statistics releases monthly reports on inflation and employment, which can signal future rate movements.

Use Technology for Rate Tracking

Many financial institutions and third-party apps offer rate alert services. Set up notifications for Prime Rate changes or specific HELOC rate thresholds. This approach ensures prompt information about significant shifts that could affect your borrowing costs.

Some lenders provide online portals to monitor your HELOC rate and balance. Check if your lender offers such tools and use them to track your rate changes over time.

Create a Financial Buffer

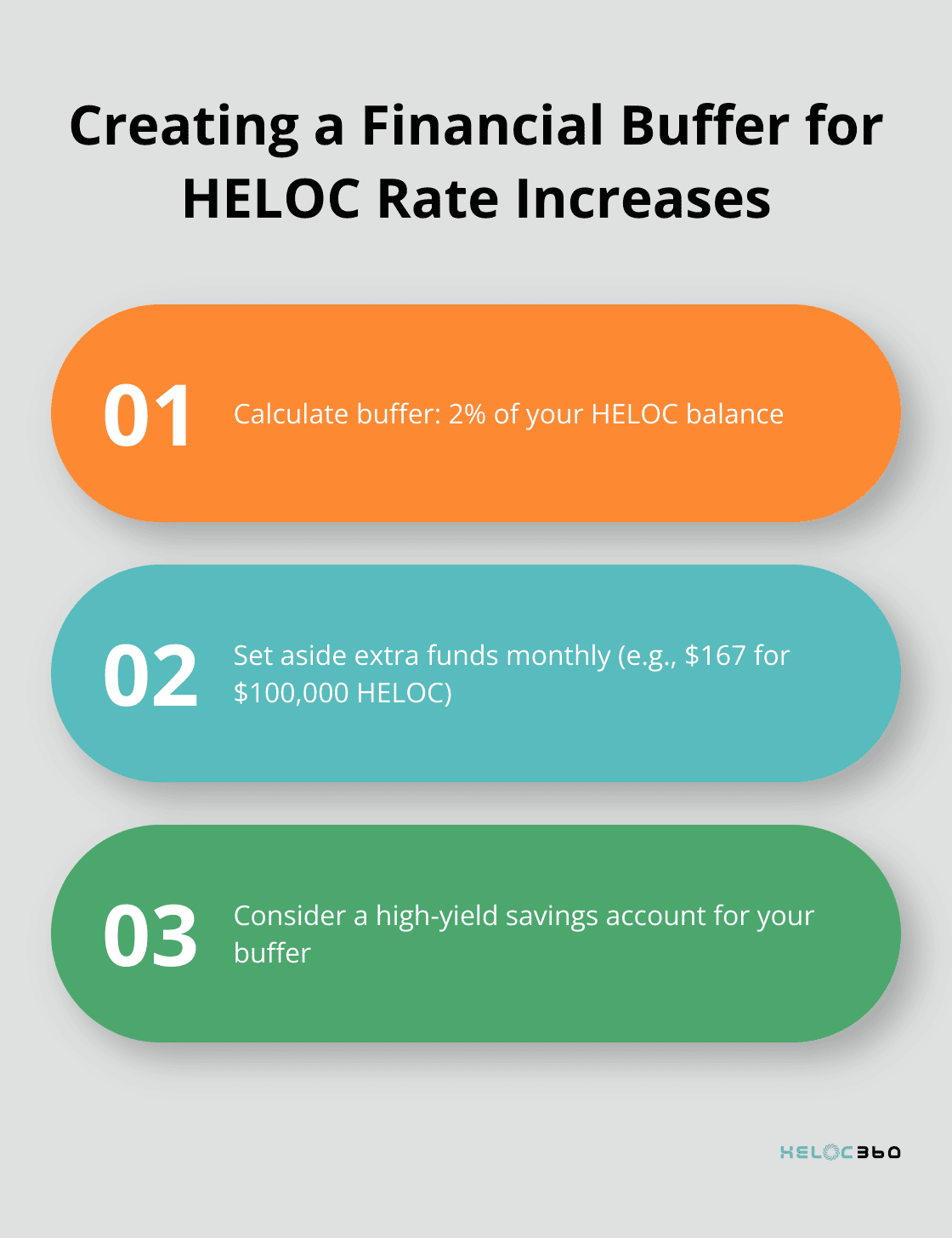

Establish a buffer in your budget to manage potential rate increases. A good rule of thumb: set aside enough to cover a 2% rate hike on your current balance. For a $100,000 HELOC, this means budgeting an extra $167 per month to cover a potential increase from 5% to 7%.

Consider opening a high-yield savings account specifically for this buffer. As of May 2025, some online banks offer savings rates above 4%, allowing your buffer to grow while it’s not needed.

Explore Rate Protection Options

A HELOC fixed-rate option is a home equity loan and home equity line of credit hybrid, and it has its own quirks, benefits, and drawbacks. This feature can provide stability if you anticipate rising rates or want to secure a portion of your debt at a favorable rate.

When shopping for a HELOC, prioritize lenders that offer these protective features. While HELOC360 doesn’t directly provide loans, it can connect you with lenders offering robust rate protection options tailored to your needs.

Final Thoughts

Variable HELOC rates offer potential benefits like lower initial costs and borrowing flexibility, but they also come with the risk of future increases. You must assess your financial situation, risk tolerance, and long-term goals before you commit to a variable-rate HELOC. The attractiveness of lower initial rates should not overshadow the potential for rate fluctuations over the entire loan term.

We at HELOC360 understand the complexities of HELOC variable rates. Our platform empowers homeowners with the knowledge and tools needed to make informed decisions about their home equity. We connect you with lenders that offer competitive rates and flexible terms, helping you find the right HELOC solution for your unique needs.

HELOC360 simplifies the process of exploring and comparing HELOC options. We ensure you have access to the information and resources necessary to navigate variable rates effectively. From rate structures to strategies for rate management, our comprehensive approach supports you throughout your HELOC journey (without making any specific claims about our company).

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.