At HELOC360, we understand that managing your HELOC repayment can be challenging. Many homeowners struggle to find the best strategy to pay off their home equity line of credit efficiently.

This guide will provide you with practical tips and effective methods to strategically repay your HELOC. We’ll explore various approaches to help you balance your HELOC obligations with other financial goals, potentially saving you money in the long run.

Understanding Your HELOC Terms

Variable Interest Rates and Their Impact

Home Equity Lines of Credit (HELOCs) typically come with variable interest rates, which can significantly affect your repayment strategy. These rates often tie to the prime rate, fluctuating based on economic conditions. As of April 30, 2025, the national average HELOC interest rate is 7.95%, according to Bankrate’s latest survey of the nation’s largest home equity lenders.

Draw Period vs. Repayment Period

HELOCs structure into two distinct phases:

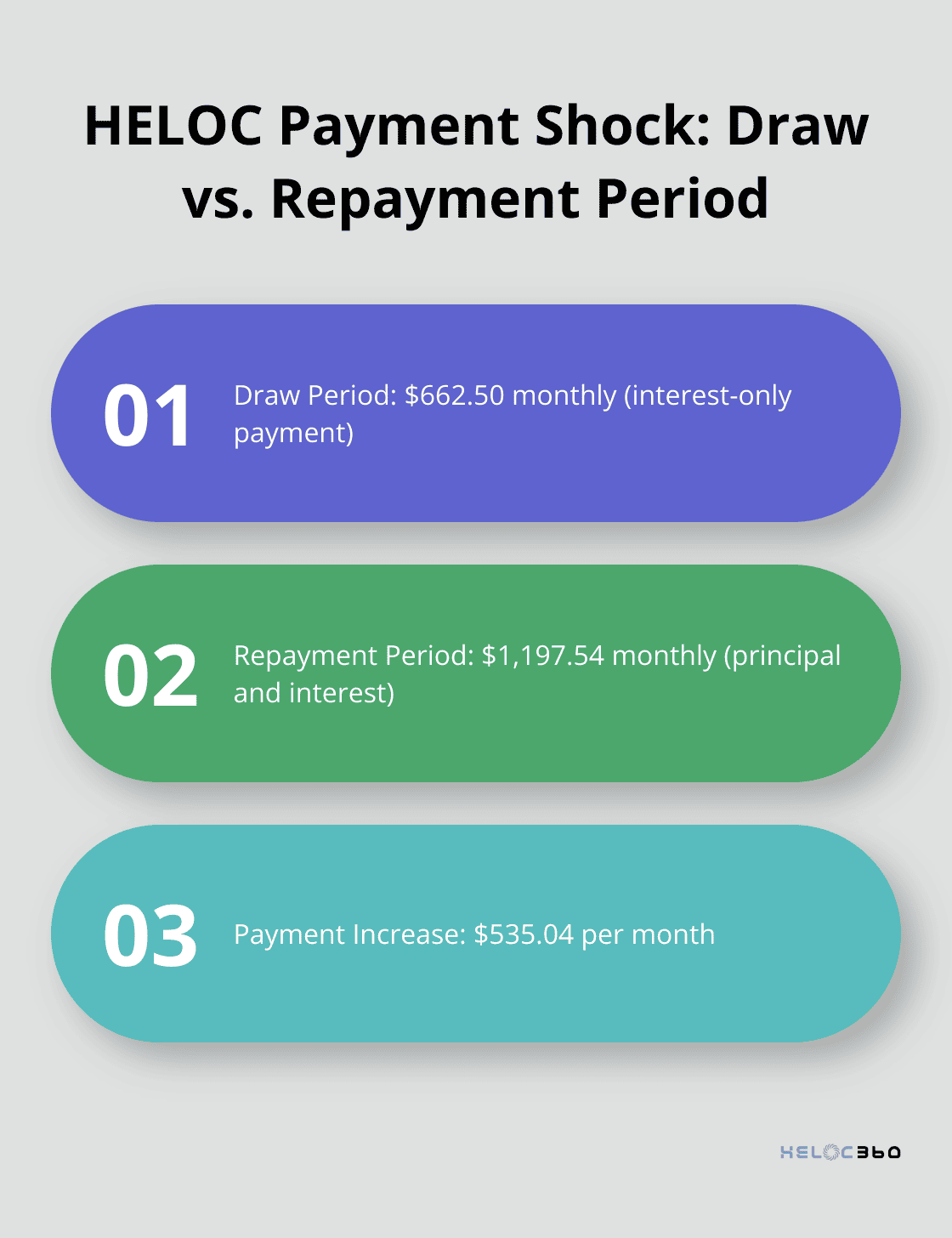

- Draw Period: This phase usually lasts 5 to 10 years. During this time, you can borrow against your credit line. Many HELOCs only require interest payments in this period, which can seem attractive but may lead to a payment shock when the repayment period begins.

- Repayment Period: This phase typically spans 10 to 20 years. You can no longer draw funds and must repay both principal and interest. This shift often results in significantly higher monthly payments.

For example, if you borrowed $100,000 at 7.95% interest during a 10-year draw period, your monthly payment could jump from $662.50 (interest-only) to $1,197.54 (principal and interest) when the 15-year repayment period starts.

Minimum Payment Requirements

Most HELOCs have minimum payment requirements, which vary depending on your lender and agreement terms. During the draw period, these minimums often consist of interest-only payments. While this keeps your monthly obligations low, it doesn’t reduce your principal balance.

In the repayment period, minimum payments typically include both principal and interest. These payments calculate to fully amortize your loan over the repayment term. It’s important to note that paying only the minimum can result in substantial interest charges over time.

To illustrate, consider a $150,000 HELOC with a 10-year draw period and a 15-year repayment period at 7.95% interest. If you only make minimum payments, you could end up paying a significant amount in interest over the life of the loan. This underscores the importance of understanding your HELOC terms and developing a strategic repayment plan.

Understanding these terms forms the foundation for effective HELOC management. With this knowledge, you can now explore various strategies to repay your HELOC efficiently and save money in the long run.

How to Repay Your HELOC Faster

At HELOC360, we often see homeowners who want to pay off their HELOCs more quickly. Accelerating your HELOC repayment can save you thousands in interest and free up your home equity sooner. Here are some effective strategies to consider:

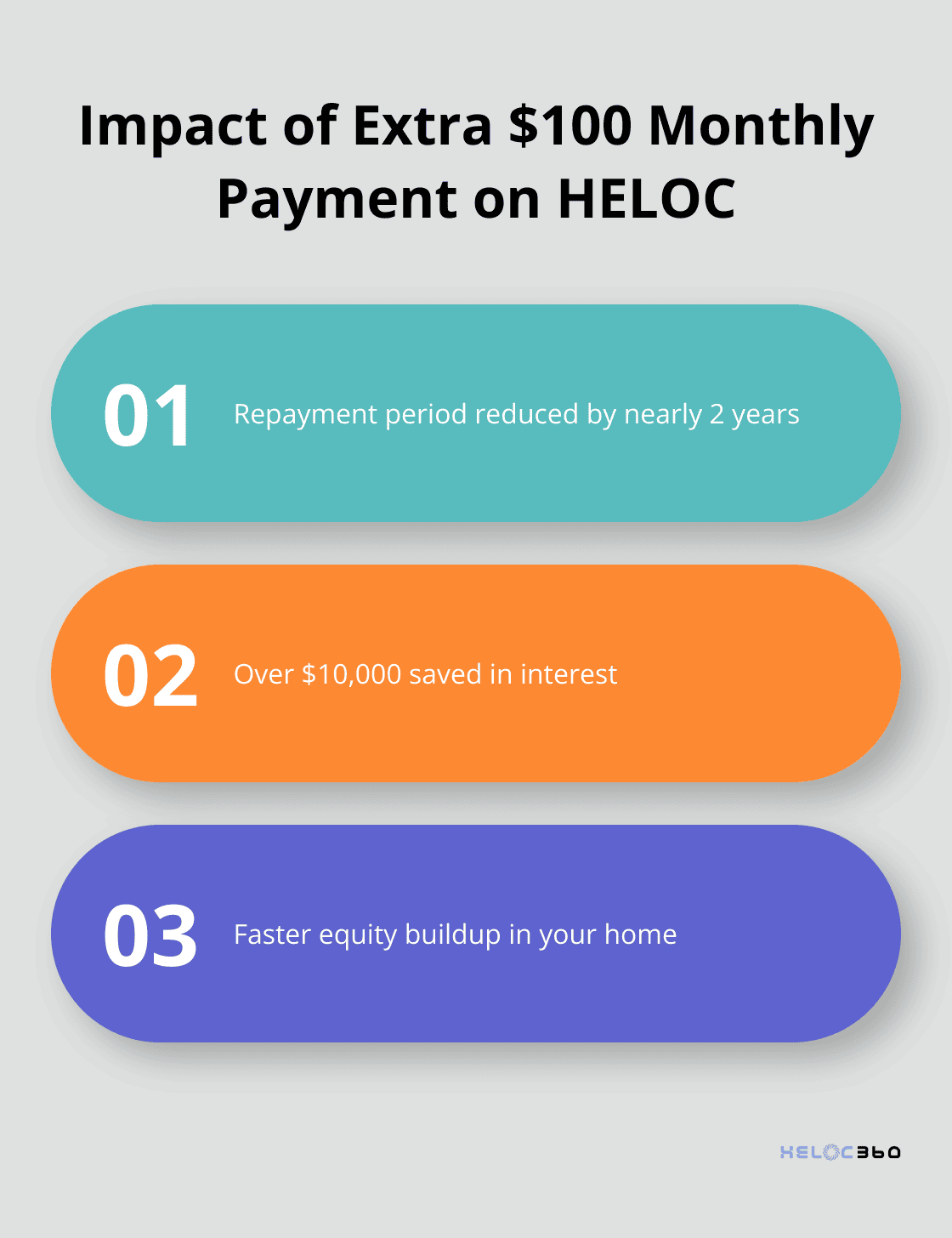

Pay More Than the Minimum

One of the simplest ways to speed up your HELOC repayment is to pay more than the minimum required amount. Even small additional payments can make a big difference over time. For example, if you have a $100,000 HELOC at 7.95% interest with a 15-year repayment term, paying an extra $100 per month could shave off nearly two years from your repayment period and save you over $10,000 in interest.

Make Principal-Only Payments

During the draw period, many HELOCs only require interest payments. However, making principal-only payments can significantly reduce your balance. Check with your lender to ensure extra payments go towards the principal. Some lenders may require you to specify that an additional payment should apply to the principal.

Explore Refinancing Options

Refinancing your HELOC can be a smart move, especially if interest rates have dropped since you opened your line of credit. According to a recent report, HELOC rates have fallen substantially from the highs reached at the beginning of 2024. This could translate to substantial savings over the life of your loan.

Another refinancing option is to convert your variable-rate HELOC to a fixed-rate home equity loan. This can provide more predictable payments and protection against future rate increases. However, factor in any closing costs associated with refinancing.

Use Windfalls Strategically

Tax refunds, work bonuses, or other unexpected windfalls present excellent opportunities to make a dent in your HELOC balance. A study by the National Association of Home Builders found that homeowners who applied at least 50% of their annual bonus to their HELOC repayment reduced their loan term by an average of 3.5 years.

Set Up Automatic Payments

Automating your HELOC payments ensures you never miss a due date and can help you stick to a more aggressive repayment plan. Many lenders offer discounts for setting up automatic payments. For instance, Bank of America offers a 0.25% rate discount for enrolling in auto pay from a Bank of America checking or savings account.

Implementing these strategies can help you repay your HELOC faster (potentially saving you thousands in interest and freeing up your home equity sooner). However, it’s important to balance aggressive HELOC repayment with other financial priorities. In the next section, we’ll explore how to strike this balance effectively and manage your HELOC repayment alongside other financial goals.

Balancing Your HELOC and Financial Goals

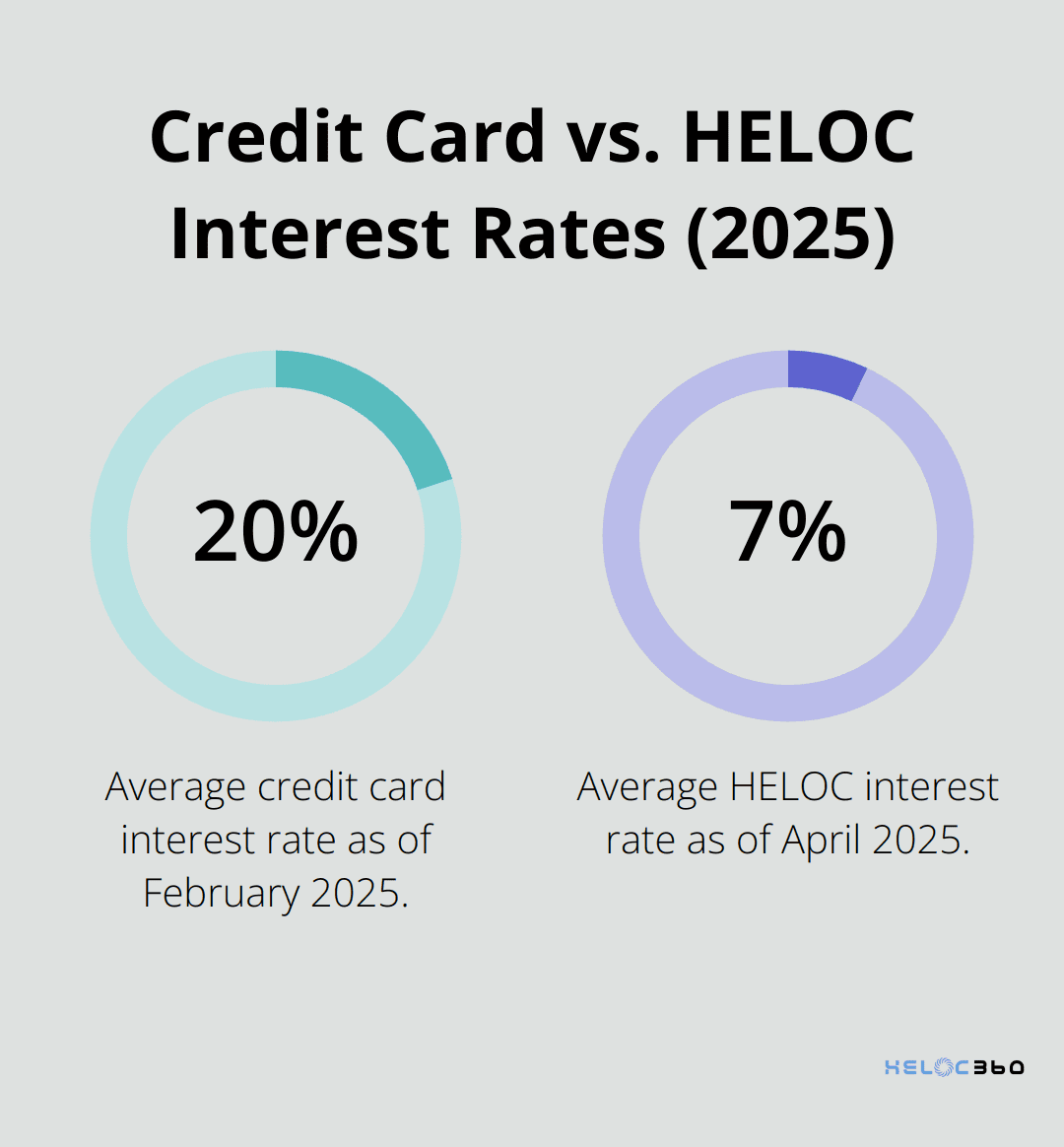

Prioritize High-Interest Debt

When managing your HELOC repayment, you should focus on high-interest debt first. Credit card debt often carries much higher interest rates than HELOCs. The Federal Reserve reported an average credit card interest rate of 20.92% as of February 2025, significantly higher than the average HELOC rate of 7.95%.

Consider using the debt avalanche method to tackle your debts. This approach involves paying off your highest-interest debt first while making minimum payments on other debts. Once you pay off the highest-interest debt, move to the next highest. This strategy can save you substantial money in interest over time.

Establish an Emergency Fund

An emergency fund serves as your financial safety net. Financial experts typically recommend saving 3-6 months of living expenses. However, if you aggressively repay your HELOC, you might consider a smaller emergency fund of 1-3 months’ expenses.

For example, if your monthly expenses total $4,000, try to save between $4,000 to $12,000 for emergencies. After reaching this goal, you can allocate more funds towards your HELOC repayment.

Maintain Retirement Savings

Don’t pause retirement contributions to focus solely on HELOC repayment. Time plays a critical role in retirement savings due to compound interest. Fidelity Investments states that a 25-year-old who invests $5,500 annually could have $1,035,000 by age 65 (assuming a 7% annual return). Starting at 35 with the same contributions would result in only $505,000.

If your employer offers a 401(k) match, contribute at least enough to get the full match. This essentially provides free money that you shouldn’t ignore. After securing the match, you can allocate additional funds to your HELOC repayment.

Evaluate Tax Implications

The tax implications of your HELOC can affect your repayment strategy. As of 2025, HELOC interest remains tax-deductible if you used the funds to buy, build, or substantially improve your home. However, the Tax Cuts and Jobs Act of 2017 significantly altered the rules for deducting home equity loan interest.

Consult with a tax professional to understand how your HELOC repayment strategy might affect your tax situation. In some cases, keeping your HELOC and investing elsewhere might prove more beneficial, especially if you fall into a higher tax bracket.

Your financial situation and goals may change over time, so review and adjust your strategy periodically. What works best for you will depend on your unique financial situation, goals, and risk tolerance.

Final Thoughts

Strategic HELOC repayment empowers homeowners to manage their finances and maximize home equity benefits. You can reduce interest costs and shorten your repayment period by paying more than the minimum, making principal-only payments, and using windfalls strategically. It’s important to consider refinancing options when market conditions favor such moves.

Your personal financial situation, goals, and risk tolerance should guide your HELOC repayment strategy. Efficient HELOC management frees up home equity faster, potentially saves thousands in interest, and creates more financial flexibility for your future. This approach allows you to leverage your home’s value as a powerful financial tool while maintaining a solid financial foundation.

HELOC360 offers tailored solutions and expert guidance to help you make informed decisions about your HELOC repayment and overall financial strategy. Your HELOC is more than just a loan – it’s a financial instrument that (when managed strategically) can open doors to new opportunities and help you achieve your long-term financial goals.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.