Property investors often juggle multiple loans to maximize their real estate portfolios. HELOC subordination is a powerful tool that can help investors unlock additional borrowing power and flexibility.

At HELOC360, we’ve seen firsthand how mastering this strategy can lead to significant advantages in the competitive world of property investment. This guide will walk you through the ins and outs of HELOC subordination, its benefits, and how to navigate the process effectively.

What Is HELOC Subordination?

Definition and Mechanics

Mortgage subordination is the process of reorganizing the priority of existing mortgages on a property when a new mortgage is taken out. This process allows investors to access additional financing while maintaining their existing loans.

When you obtain a HELOC, it usually occupies the second position behind your primary mortgage. However, if you want to refinance your first mortgage or secure a new loan, the lender will typically require their loan to take first position. This is where subordination comes into play. The HELOC lender agrees to move their loan to a lower priority, allowing the new loan to take precedence.

Impact on Property Investors

HELOC subordination can significantly benefit property investors. It enables them to leverage their existing equity without closing their HELOC. This means they can keep their line of credit open for future opportunities or emergencies while still accessing new financing.

Consider this example: An investor with a $200,000 primary mortgage and a $100,000 HELOC wants to refinance their first mortgage to a $250,000 loan to take advantage of lower interest rates. Without subordination, they’d have to pay off and close the HELOC. With subordination, they can keep the HELOC open and still benefit from the refinance.

Common Scenarios for Subordination

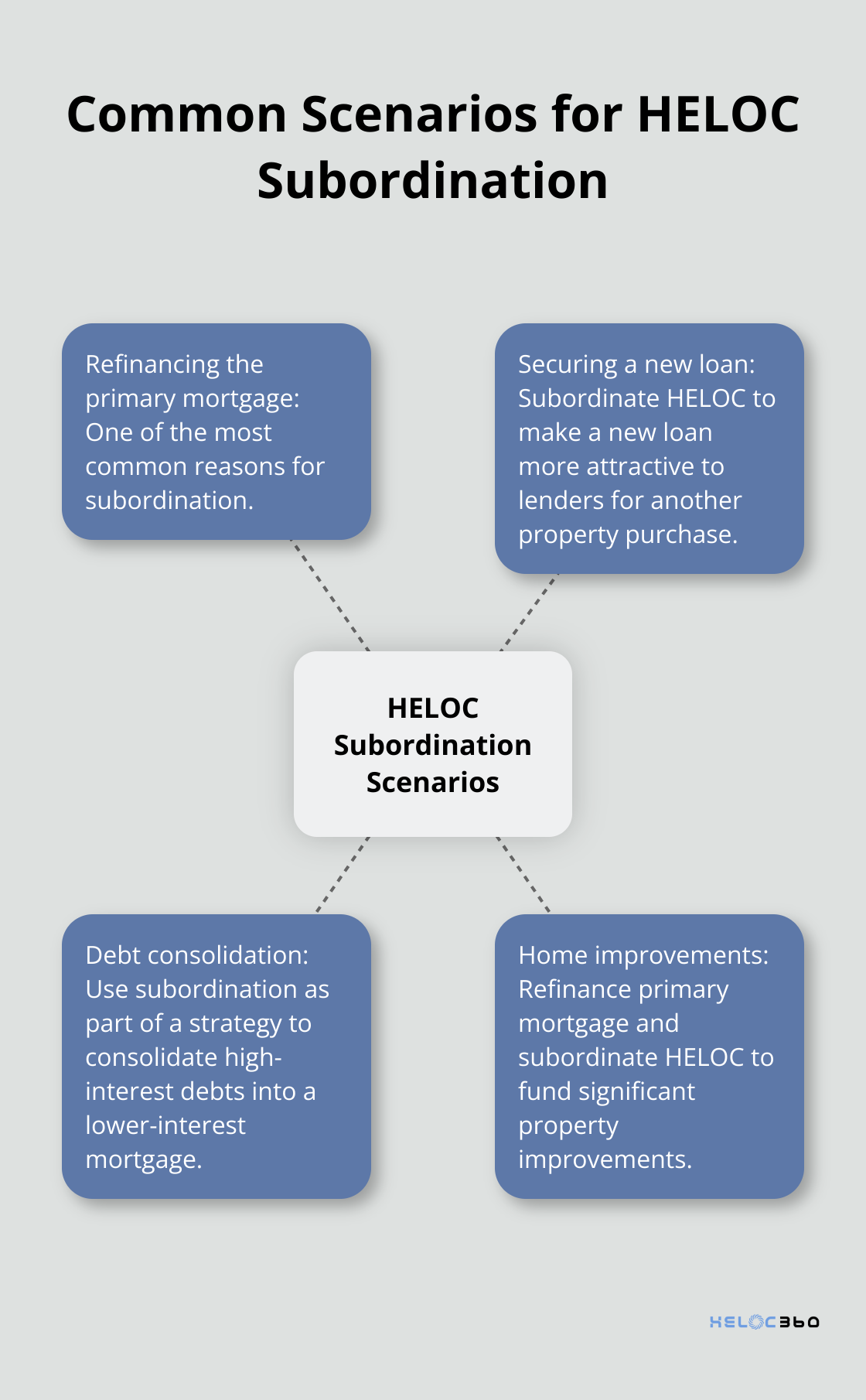

Property investors might need to pursue HELOC subordination in several scenarios:

- Refinancing the primary mortgage: This is one of the most common reasons for subordination.

- Securing a new loan: If an investor wants to obtain a new loan for another property purchase, they might need to subordinate their HELOC to make the new loan more attractive to lenders.

- Debt consolidation: Some investors use subordination as part of a strategy to consolidate high-interest debts into a lower-interest mortgage.

- Home improvements: If an investor wants to make significant improvements to a property but needs more funds than their HELOC provides, they might refinance their primary mortgage and subordinate the HELOC.

Lender Considerations

Lenders evaluate several factors when considering a subordination request:

- Loan-to-Value Ratio (LTV): The combined LTV of all loans on the property is a key consideration.

- Credit Score: A strong credit history increases the likelihood of approval.

- Payment History: Consistent, on-time payments on existing loans are viewed favorably.

- Property Value: Recent appraisals or assessments may be required to confirm the property’s current value.

Understanding these factors can help investors prepare a strong case for subordination. The next section will explore the specific benefits that HELOC subordination offers to property investors, providing insights into why this strategy has become increasingly popular in real estate investment circles.

Why HELOC Subordination Is a Game-Changer for Investors

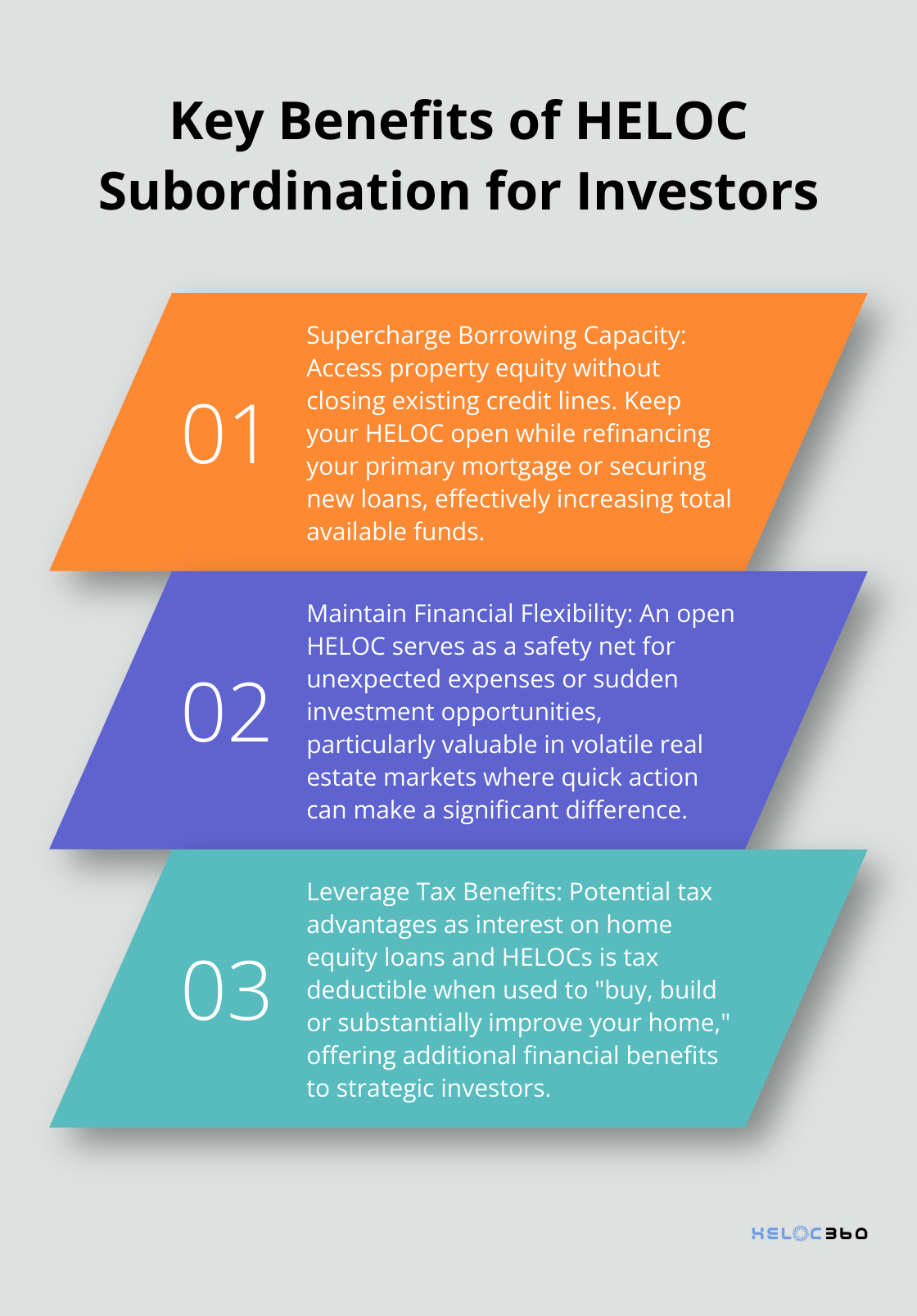

Supercharging Your Borrowing Capacity

HELOC subordination empowers property investors to optimize their real estate portfolios. This strategy allows investors to access their property’s equity without closing existing credit lines. You can keep your HELOC open while refinancing your primary mortgage or securing new loans. For instance, an investor with a $300,000 property, a $200,000 primary mortgage, and a $50,000 HELOC could refinance to a $250,000 primary mortgage without losing access to their HELOC. This strategy effectively increases their total available funds from $250,000 to $300,000.

Streamlining Multi-Property Management

The management of multiple properties often requires the juggling of various financial obligations. HELOC subordination offers the flexibility to allocate funds where they’re needed most. You can use your HELOC for quick renovations on one property while using a new primary mortgage to finance a major upgrade on another. This agility proves invaluable in fast-moving markets where opportunities arise quickly.

Optimizing Your Interest Rates

HELOC subordination opens up possibilities for securing better interest rates on your primary mortgage. A 2024 report by the Mortgage Bankers Association revealed that DBRS, Inc. (Morningstar DBRS) finalized its provisional credit ratings on Mortgage-Backed Notes, Series 2024-HE2 issued by FIGRE Trust.

Leveraging Tax Benefits

HELOC subordination can potentially offer tax advantages (although it’s essential to consult with a tax professional). Interest on home equity loans and HELOCs is tax deductible as long as you use the funds to “buy, build or substantially improve your home,” providing an additional financial benefit to investors who strategically use their subordinated HELOCs.

Maintaining Financial Flexibility

One of the most significant advantages of HELOC subordination is the preservation of financial flexibility. An open HELOC serves as a safety net for unexpected expenses or sudden investment opportunities. This proves particularly valuable in volatile real estate markets where quick action can make the difference between a profitable deal and a missed opportunity.

HELOC subordination transcends a mere financial maneuver; it represents a strategic approach to property investment that can significantly enhance your portfolio’s performance. The next section will guide you through the practical steps of navigating the HELOC subordination process, ensuring you can implement this powerful strategy effectively.

How to Navigate HELOC Subordination

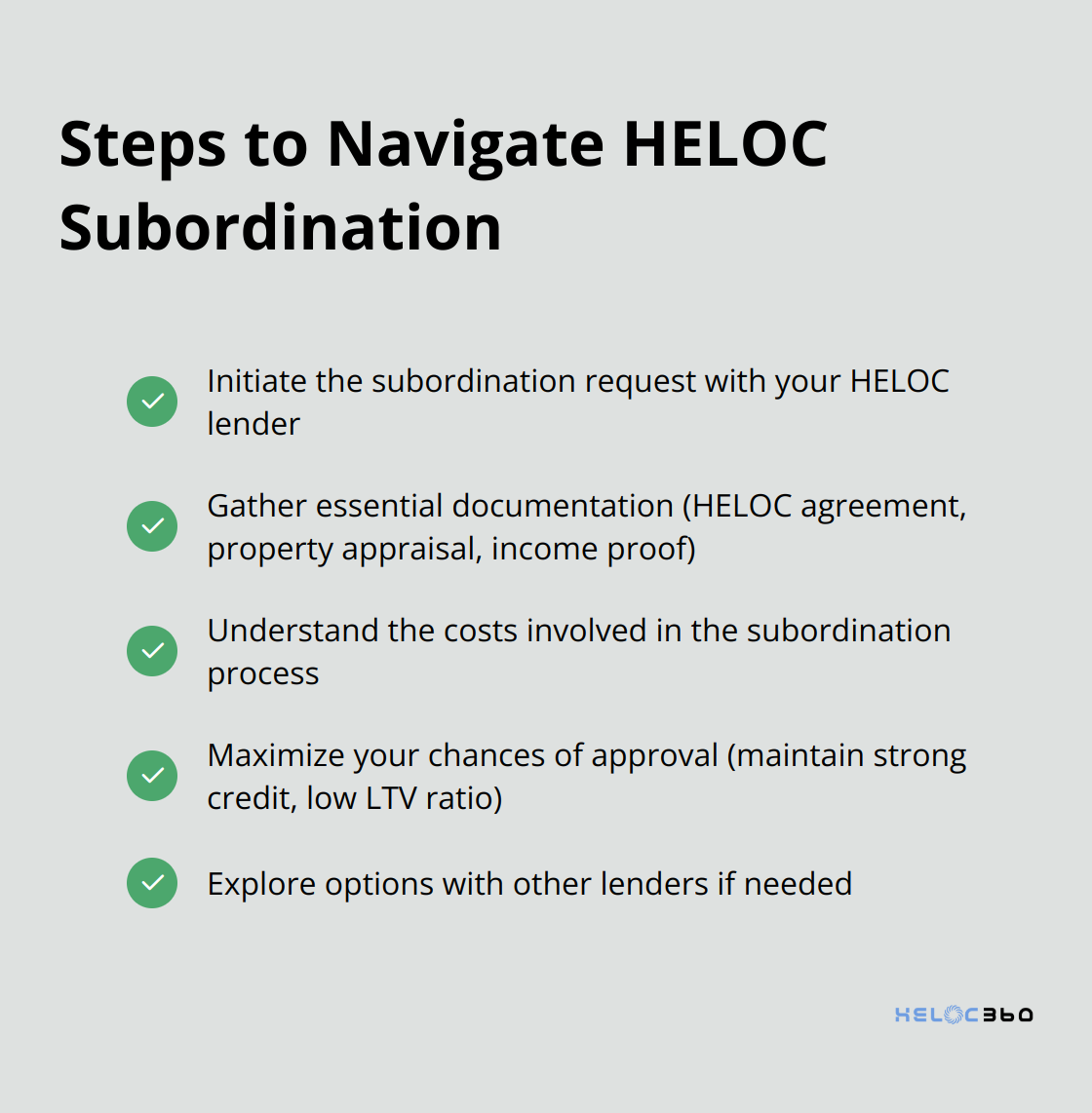

Initiate the Subordination Request

The first step involves contacting your HELOC lender to inform them of your subordination intention. You must provide details about the new loan you seek, including the loan amount and purpose. Most lenders have a specific subordination department or team that handles these requests.

Start this process early. A subordination agreement may be created when a homeowner pursues a home equity line of credit (HELOC) or another form of secured financing.

Gather Essential Documentation

To speed up the process, prepare these documents in advance:

- A copy of your current HELOC agreement

- Recent property appraisal (usually within the last 6 months)

- Proof of income and employment

- Bank statements for the last 2-3 months

- A preliminary HUD-1 or Closing Disclosure from the new lender

Some lenders might require additional documentation. For instance, if you use the subordination for a refinance, you’ll likely need to provide a copy of the new loan application and terms.

Understand the Costs

Subordination comes with a price tag. Lenders typically charge a fee for processing these requests. You might incur additional costs for a new appraisal or title search.

Maximize Your Chances of Approval

To increase the likelihood of your subordination request approval:

- Maintain a strong credit score.

- Keep your loan-to-value ratio low. Most lenders prefer a combined LTV of 80% or less after subordination.

- Demonstrate consistent income. Lenders want to see that you can manage the payments on all your loans.

- Be transparent about your plans. Clearly explain how the subordination fits into your overall investment strategy.

Each lender has its own criteria for approving subordination requests. Some might show more flexibility than others. If your current HELOC lender hesitates, consider exploring options with other lenders. HELOC360 can connect you with lenders who specialize in working with property investors and understand the importance of HELOC underwriting in your investment strategy.

Final Thoughts

HELOC subordination empowers property investors to unlock additional borrowing power and optimize their real estate portfolios. This powerful tool allows investors to leverage existing equity without closing credit lines, creating financial flexibility in a dynamic market. Investors who master HELOC subordination can adapt to changing conditions, pursue new ventures, and make strategic improvements to their properties.

HELOC360 simplifies the subordination process for property investors. We provide the knowledge and connections needed to make informed decisions about home equity. Our platform connects investors with specialized lenders who understand the unique needs of real estate professionals.

Explore tailored HELOC solutions that align with your investment goals. HELOC subordination can enhance your portfolio’s performance and take your property investments to new heights. Contact HELOC360 today to learn how we can help you harness the full potential of your home equity.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.