Thinking about getting a Home Equity Line of Credit (HELOC)? It’s a big decision that requires careful consideration and preparation.

At HELOC360, we’ve seen many homeowners rush into HELOCs without fully understanding what they’re getting into. That’s why we’ve created this comprehensive HELOC preparation checklist to help you assess your readiness and make an informed decision.

Let’s walk through the essential steps you need to take before applying for a HELOC.

Understanding the Basics of a HELOC

What Is a HELOC?

A home equity line of credit, or HELOC, is a loan that allows you to borrow against your home’s equity. It functions as a revolving credit line, similar to a credit card, but uses your home as collateral.

How HELOCs Work

When you receive HELOC approval, the lender assigns a credit limit based on your home’s value and outstanding mortgage balance. You can withdraw funds from this credit line during the “draw period” (typically 5-10 years). During this phase, you often only pay interest on the borrowed amount.

After the draw period ends, the repayment phase begins. You can no longer borrow from the line of credit and must repay both principal and interest. This phase usually lasts 10-20 years.

HELOC vs. Home Equity Loan

While both utilize your home’s equity, they operate differently. A home equity loan provides a lump sum upfront with fixed payments, whereas a HELOC offers flexibility to borrow as needed with variable rates. HELOCs are rising while home equity loans remain steady as the Federal Reserve leaves interest rates unchanged.

Common Uses for HELOCs

HELOCs serve various financial purposes:

- Home improvements: HELOCs are commonly used to fund renovations.

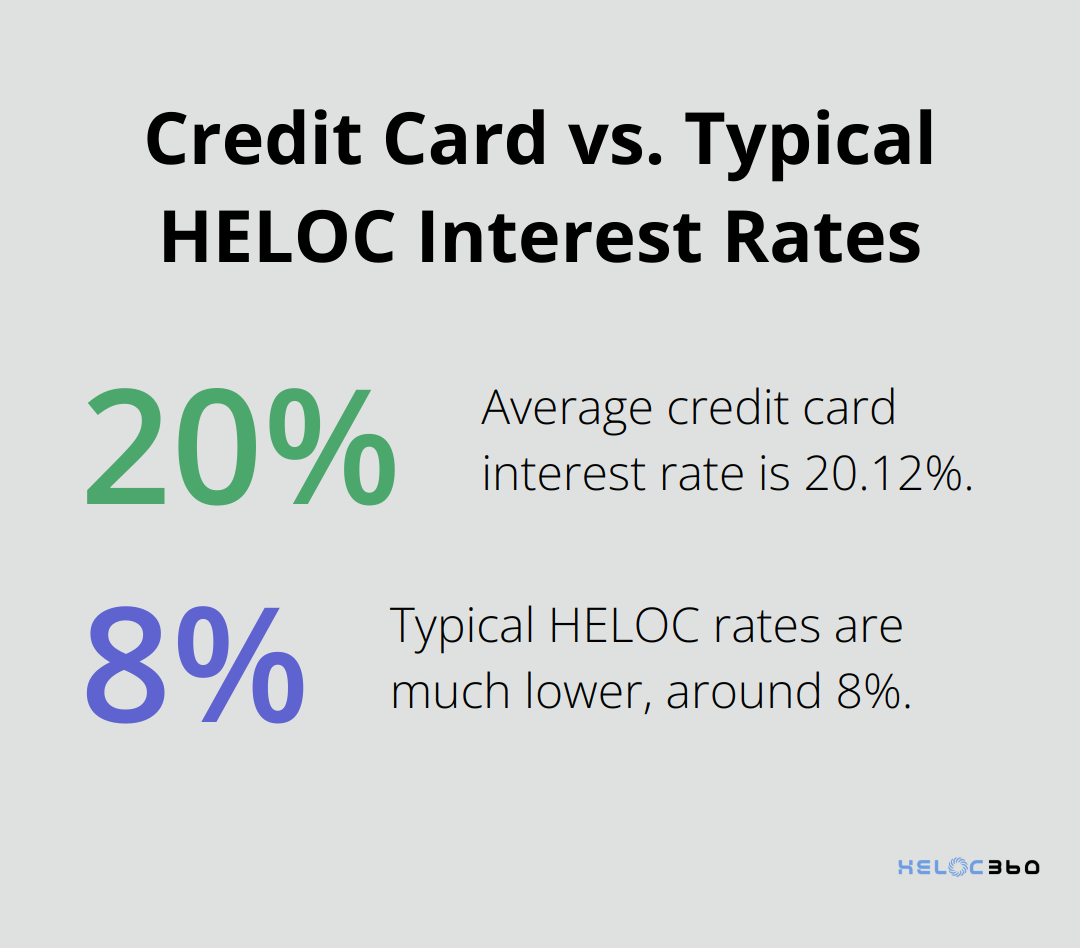

- Debt consolidation: With average credit card interest rates at 20.12 percent, using a lower-rate HELOC to pay off high-interest debt can result in significant savings.

- Education expenses: As college costs continue to rise, HELOCs offer an alternative to high-interest student loans.

- Emergency fund: HELOCs provide a safety net for unexpected expenses without depleting savings.

HELOCs can serve as powerful financial tools when used wisely. However, they come with risks, including potential home loss if you default on payments. Your long-term financial goals and repayment ability should guide your decision to pursue a HELOC.

Now that you understand the basics of HELOCs, let’s move on to assessing your financial readiness for this type of credit line.

Are You Financially Ready for a HELOC?

Before you apply for a Home Equity Line of Credit (HELOC), you must assess your financial readiness. This step ensures you’re not just eligible for a HELOC, but also prepared to manage it responsibly.

Evaluate Your Credit Score

Your credit score significantly influences HELOC approval and interest rates. Lenders typically have a minimum credit score requirement, while a higher score may help you secure better interest rates. Understanding why your credit score matters for a HELOC is crucial before applying.

To boost your credit score:

- Pay all bills on time

- Reduce credit card balances

- Avoid opening new credit accounts

Understand Your Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is another critical factor lenders consider. This ratio compares your monthly debt payments to your gross monthly income. Most lenders prefer a DTI of 43% or lower for HELOC approval.

To calculate your DTI:

- Sum up all monthly debt payments

- Divide by your gross monthly income

- Multiply by 100 for a percentage

If your DTI is high, focus on paying down existing debts before applying for a HELOC.

Calculate Your Home Equity

Your available home equity determines how much you can borrow through a HELOC. Most lenders allow you to borrow up to 85% of your home’s value minus your outstanding mortgage balance.

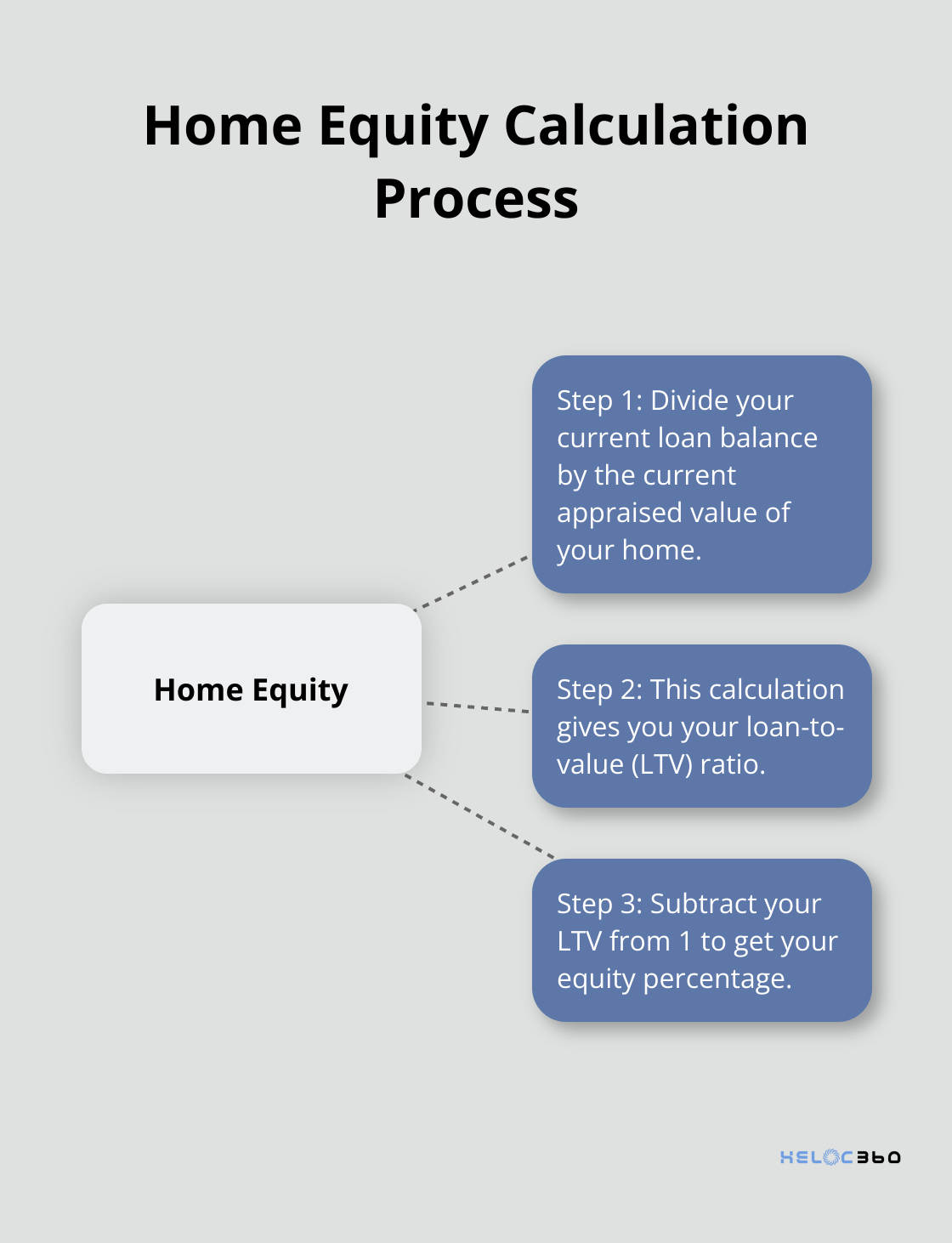

- Divide your current loan balance by the current appraised value of your home

- This gives you your loan-to-value (LTV) ratio

- Subtract your LTV from 1 to get your equity percentage

For example, if your home is worth $200,000 and you owe $140,000 on your mortgage, your LTV would be 0.70 or 70%, meaning you have 30% equity.

Align with Your Financial Goals

A HELOC should fit into your broader financial strategy. Consider how it aligns with both short-term needs and long-term goals. HELOCs can serve as a strategic tool for cash flow management. The ability to draw funds as needed allows homeowners to address short-term cash needs while working towards long-term financial objectives.

Evaluate the purpose of the HELOC carefully. Using it for value-adding home improvements or debt consolidation can be smart financial moves. However, using it for discretionary spending might not be the best choice.

Lastly, consider your income stability and future financial obligations. Are you confident in your ability to make payments over the long term, even if interest rates rise or your income changes?

Now that you’ve assessed your financial readiness, it’s time to move on to the practical steps of preparing for a HELOC application. Let’s explore the essential items you’ll need to gather and the key factors to consider in our HELOC Preparation Checklist.

Your HELOC Preparation Roadmap

Compile Your Financial Dossier

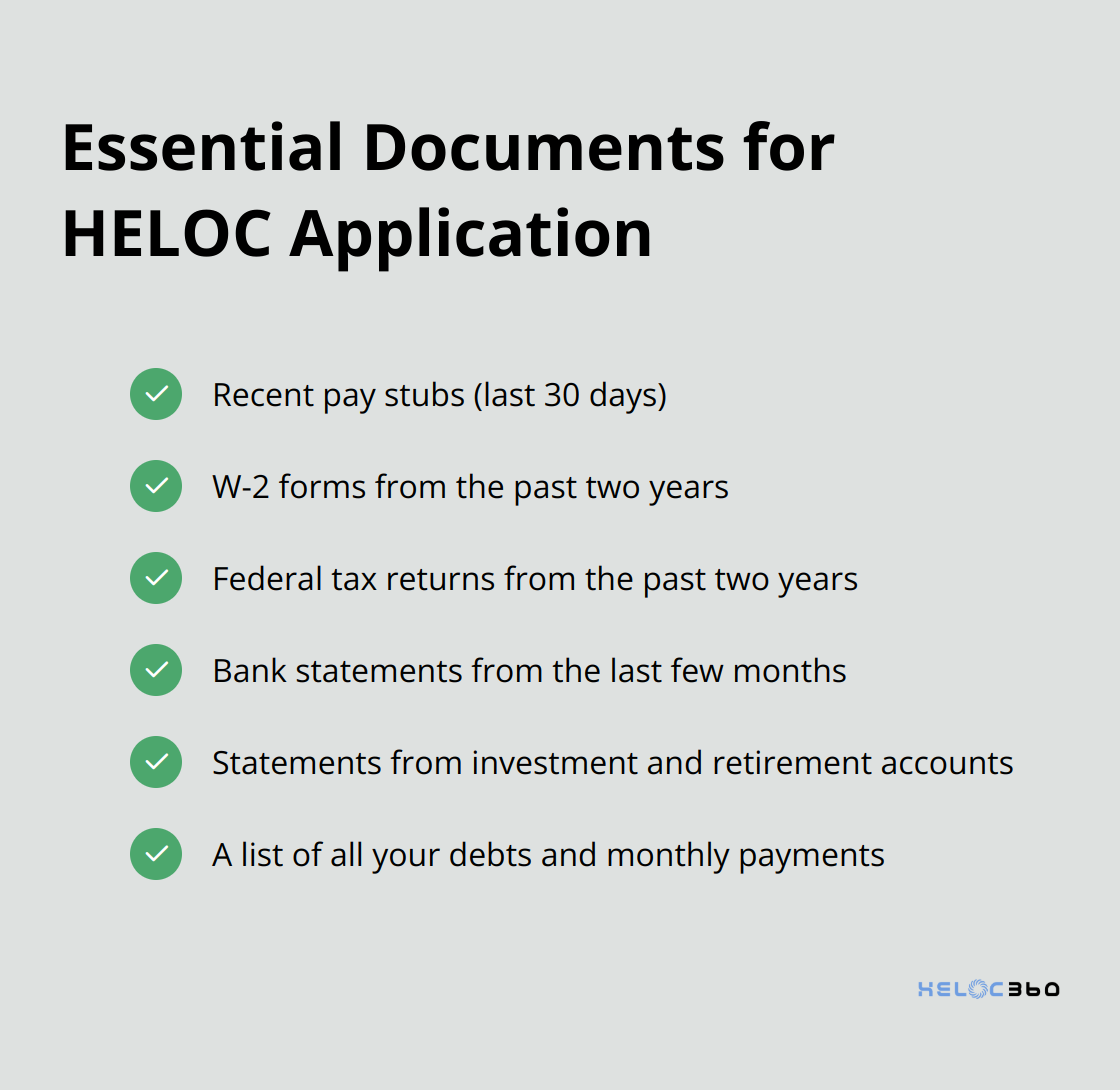

Start by gathering all necessary financial documents. This typically includes:

Having these documents ready will streamline the application process and demonstrate your financial responsibility to potential lenders.

Scout the HELOC Landscape

Take time to research and compare different HELOC offerings. Look beyond just interest rates. Pay attention to:

- Annual fees

- Closing costs

- Minimum draw requirements

- Repayment terms

HELOCs bumped up a bit this week, while home equity loans remained flat.

Decode HELOC Terms and Conditions

Understanding the fine print is essential. Pay special attention to:

- Draw period length

- Repayment period terms

- Prepayment penalties

- Rate caps and floors

It helps to explore and understand your options when borrowing against the equity in your home. You can find more information from the Consumer Financial Protection Bureau.

Strategize for Rate Fluctuations

HELOCs typically come with variable interest rates. Plan for potential rate changes by:

- Calculating your payments under different rate scenarios

- Setting aside a buffer in your budget for higher payments

- Considering a HELOC with a fixed-rate option for some or all of your balance

Rates are expected to continue declining in 2025, especially those on HELOCs.

Seek Expert Guidance

Navigating the HELOC landscape can be complex. Consider consulting with financial advisors or using platforms (like HELOC360) that offer expert guidance and lender comparisons. These resources can help you make informed decisions aligned with your financial goals.

Final Thoughts

HELOC preparation requires careful consideration and thorough planning. You must understand the basics of HELOCs, assess your financial readiness, and follow a comprehensive preparation checklist. This process involves more than document gathering; it demands an evaluation of your financial health, understanding of your home’s equity, and alignment with long-term financial goals.

HELOCs serve as powerful financial tools when used wisely. They provide flexibility for home improvements, debt consolidation, or creating a financial safety net. However, you must approach them with a clear strategy and full awareness of the responsibilities they entail.

At HELOC360, we aim to simplify the HELOC process and provide expert guidance. Our platform connects you with lenders that fit your unique needs (empowering you to make informed decisions). You can confidently approach your HELOC journey and unlock the full potential of your home equity with thorough preparation and the right resources.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.