At HELOC360, we understand that choosing the right financing option can be challenging.

When it comes to borrowing money, two popular choices often come up: HELOCs and personal loans.

This HELOC comparison will help you understand the key differences between these two financial products.

We’ll explore their features, benefits, and drawbacks to help you make an informed decision that suits your unique needs.

What Is a HELOC?

Definition and Key Features

A Home Equity Line of Credit (HELOC) is a financial tool that allows homeowners to access their home’s equity. It functions as a revolving credit line secured by your home, offering flexibility and potentially lower interest rates compared to other borrowing options.

How HELOCs Work

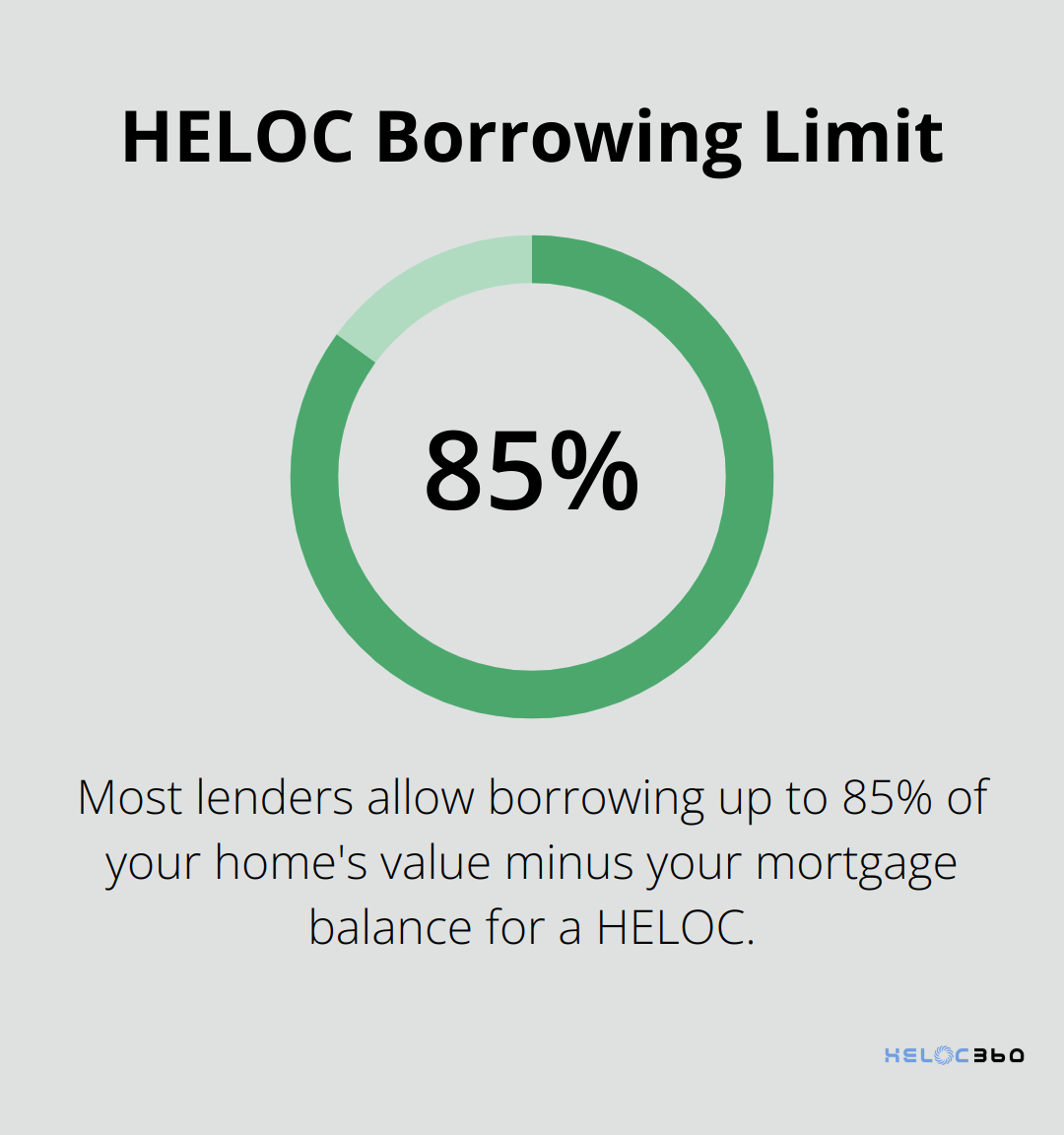

When you open a HELOC, lenders determine your credit limit based on your home’s value and outstanding mortgage balance. Most lenders allow borrowing up to 85% of your home’s value minus your mortgage balance. For instance, if your home is worth $300,000 and you owe $200,000 on your mortgage, you might qualify for a HELOC of up to $55,000 (85% of $300,000 = $255,000, minus $200,000).

HELOCs operate in two distinct phases:

- Draw Period: This phase typically lasts 5-10 years. During this time, you can borrow from your credit line as needed, often only making interest payments.

- Repayment Period: Once the draw period ends, you can no longer borrow and must repay both principal and interest.

HELOC Interest Rates and Terms

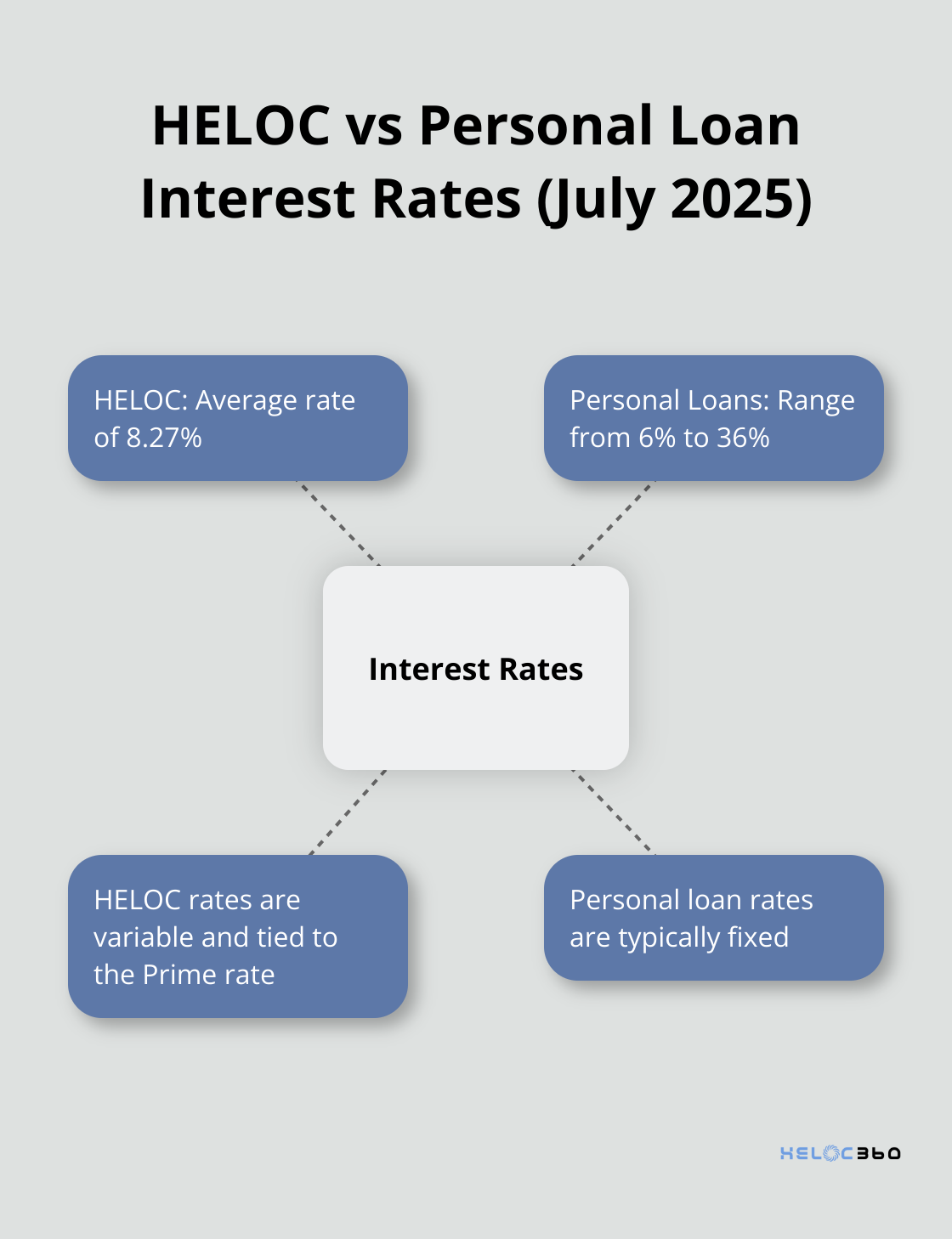

HELOC interest rates are usually variable, tied to a benchmark like the prime rate. As of July 2, 2025, the national average HELOC interest rate is 8.27%, according to Bankrate’s latest survey of the nation’s largest home equity lenders. These rates can fluctuate based on market conditions and your creditworthiness.

The repayment period for HELOCs often extends 15-20 years, resulting in lower monthly payments. However, you may pay more in interest over time due to this longer term.

Key Considerations

While HELOCs offer attractive features, they come with risks. Your home serves as collateral, which means you could lose it if you default on payments. Additionally, the variable interest rate can lead to payment fluctuations, potentially straining your budget if rates rise significantly. As experts note, “A variable-rate HELOC can be risky, especially if you have a high debt-to-income ratio”.

HELOCs excel when used for home improvements or other investments that potentially increase your property value. They’re less suitable for short-term expenses or debt that doesn’t contribute to your long-term financial health.

Exploring Personal Loans

Now that we’ve explored HELOCs, let’s turn our attention to personal loans. These financial products offer a different set of features and benefits that might better suit your needs depending on your financial situation and goals.

What Are Personal Loans?

Types of Personal Loans

Personal loans offer a versatile financing option without using your home as collateral. These loans provide a lump sum that you repay in fixed monthly installments over a set period.

Two main types of personal loans exist: secured and unsecured. Secured loans require collateral (such as a car or savings account), while unsecured loans don’t. Most personal loans are unsecured, which makes them accessible to a wider range of borrowers.

Some lenders offer specialized personal loans for specific purposes (like debt consolidation or home improvements). These loans might come with slightly better terms if used for their intended purpose.

Interest Rates and Repayment Terms

As of July 2025, personal loan interest rates typically range from 6% to 36% (depending on your credit score, income, and other factors). Consumer credit increased at a seasonally adjusted annual rate of 4.3 percent, with revolving credit increasing at an annual rate of 7 percent.

Repayment terms for personal loans typically range from two to seven years. Shorter terms often come with lower interest rates but higher monthly payments. Longer terms can make your monthly payments more manageable but may result in paying more interest over time.

Advantages of Personal Loans

Personal loans offer several benefits:

- Quick access to funds (often within a few days of approval)

- Fixed interest rates and predictable monthly payments (which make budgeting easier)

- No collateral required for unsecured loans

- Flexibility in use (you can use the funds for various purposes)

Potential Drawbacks

While personal loans have advantages, they also come with some potential downsides:

- Higher interest rates compared to HELOCs

- Shorter repayment periods (which can lead to higher monthly payments)

- Possible origination fees (which can add to the overall cost of the loan)

- Stricter eligibility requirements for those with lower credit scores

Comparing Personal Loans to Other Options

Personal loans serve as a viable alternative to HELOCs for those who prefer not to use their home as collateral or need a fixed amount for a one-time expense. However, if you’re a homeowner with significant equity, a HELOC might offer lower interest rates and more flexible borrowing options.

As we move forward, let’s examine how personal loans stack up against HELOCs in more detail, helping you determine which option aligns best with your financial needs and goals.

HELOC vs Personal Loan: Key Differences to Consider

Interest Rates and Fees

HELOCs typically offer lower interest rates compared to personal loans. As of July 2025, the average HELOC rate stands at 8.27%, while personal loan rates range from 6% to 36%. HELOC rates are directly tied to the Prime rate, so when the Prime rate rises or falls, your interest rate and monthly payment can change, too. Personal loans usually come with fixed rates, providing more predictable monthly payments.

HELOCs often involve closing costs similar to those of a mortgage (2% to 5% of the loan amount). Personal loans may have origination fees (typically 1% to 8% of the loan amount). Some lenders offer no-fee options for both products, so it’s worth shopping around to find the best deal.

Borrowing Limits and Flexibility

HELOCs allow you to borrow up to 85% of your home’s value minus your outstanding mortgage balance. This can result in significantly higher borrowing limits compared to personal loans. For example, if your home is worth $300,000 and you owe $200,000 on your mortgage, you could potentially access up to $55,000 through a HELOC.

Personal loans typically have lower borrowing limits, usually ranging from $1,000 to $50,000 (though some lenders offer up to $100,000 for qualified borrowers). Personal loans provide a lump sum upfront, while HELOCs allow you to draw funds as needed during the draw period, offering more flexibility.

Collateral and Risk

A key difference between these options is collateral. HELOCs use your home as collateral, which means you risk foreclosure if you default on payments. This added risk is why HELOCs often offer lower interest rates. Personal loans, especially unsecured ones, don’t require collateral, making them less risky for borrowers but potentially more expensive due to higher interest rates.

If you don’t want to put your home on the line or don’t have sufficient home equity, a personal loan might be the better choice. However, if you’re confident in your ability to repay and want to leverage your home’s value for a lower rate, a HELOC could be advantageous.

Impact on Credit Score

Both HELOCs and personal loans can affect your credit score, but in slightly different ways. Opening either type of account will result in a hard inquiry on your credit report, which may temporarily lower your score by a few points.

With a HELOC, your credit utilization ratio (the amount of available credit you’re using) can fluctuate as you draw and repay funds, potentially causing your credit score to vary. Personal loans, being installment loans, don’t affect your credit utilization ratio in the same way. Instead, they can help diversify your credit mix, which may positively impact your score.

Making timely payments is essential for maintaining or improving your credit score, regardless of which option you choose. Late payments on either type of loan can significantly damage your credit.

Tax Implications

HELOCs may offer a tax advantage that personal loans don’t. If you use HELOC funds for substantial home improvements, the interest you pay might be tax-deductible. However, the Tax Cuts and Jobs Act of 2017 limited this benefit, so consult a tax professional to understand how it applies to your situation.

Personal loan interest is generally not tax-deductible, regardless of how you use the funds. This is an important consideration if you plan to use the money for home improvements and want to maximize potential tax benefits.

Final Thoughts

Your choice between a HELOC and a personal loan depends on your financial situation and goals. HELOCs offer lower interest rates and higher borrowing limits, ideal for homeowners with significant equity who need flexible access to funds. Personal loans provide quick access to funds without risking your home, with fixed interest rates and predictable monthly payments.

Consider factors such as your credit score, home equity, financial stability, and the purpose of the loan when making your decision. Interest rates, borrowing limits, and repayment terms can vary significantly between lenders, so it’s important to compare offers before deciding. A thorough HELOC comparison can help you understand the nuances of different products and find the best fit for your needs.

We at HELOC360 understand that navigating these financial decisions can be complex. Our platform provides expert guidance and connects you with lenders that match your unique needs. Visit HELOC360 to explore your options and make an informed decision about leveraging your home’s value for your financial goals.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.