Home Equity Lines of Credit (HELOCs) can be powerful financial tools, but they come with important limitations.

At HELOC360, we believe it’s crucial to understand these constraints before making any commitments.

This post will explore HELOC limitations, including borrowing limits, interest rate fluctuations, and the risks of using your home as collateral.

How Much Can You Borrow with a HELOC?

The Loan-to-Value Ratio: Your Home’s Worth Matters

When you consider a Home Equity Line of Credit (HELOC), your borrowing capacity depends on several key factors. The loan-to-value (LTV) ratio is a critical metric that lenders use to determine your HELOC limit. Most lenders allow you to borrow up to 85% of your home’s value, minus your mortgage balance.

For example, if your home is worth $300,000 and you have a $200,000 mortgage balance, your maximum HELOC could be around $55,000 (85% of $300,000 minus $200,000).

Credit Score: Your Financial Report Card

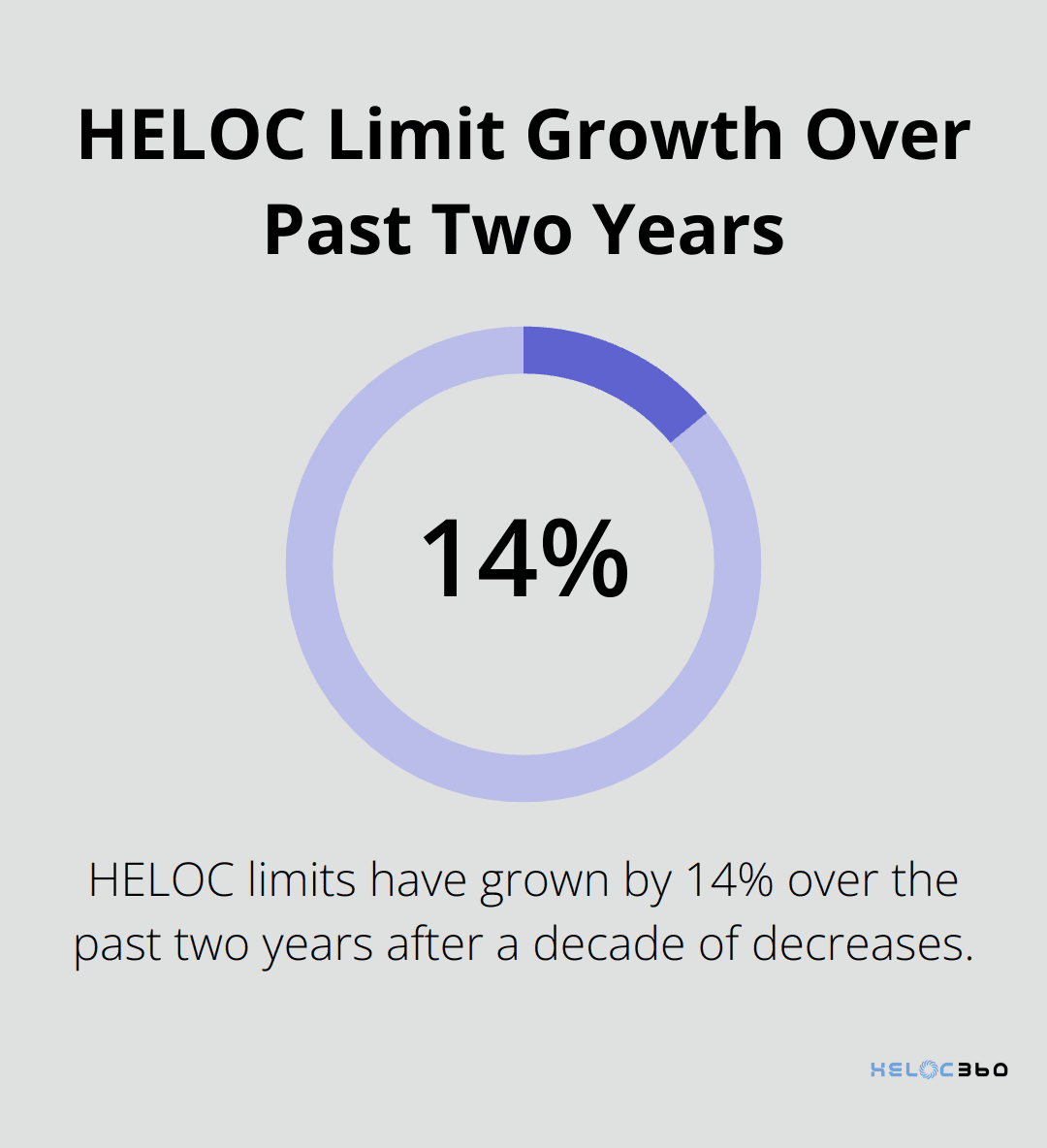

Your credit score significantly impacts not just approval, but also your borrowing capacity. Limits on home equity lines of credit (HELOC) grew by $30 billion, and have grown by 14% over the past two years after ten years of decreases. Try to achieve a score of at least 700 to maximize your borrowing potential.

Income and Debt-to-Income Ratio: Proving You Can Pay

Lenders want assurance that you can handle additional debt. Your income and debt-to-income (DTI) ratio play a crucial role here. HELOC requirements typically include a good to excellent credit score, usually 620 or higher, and sufficient equity, meaning you must own 15% to 20% of your home’s equity.

For instance, if you earn $6,000 monthly and have $2,000 in debt payments, your DTI is 33% (2000 / 6000). This puts you in a favorable position for a higher HELOC limit.

The Impact of Market Conditions

Market conditions can affect HELOC limits. During economic downturns, lenders may tighten their criteria. The COVID-19 pandemic, for instance, saw many lenders reduce HELOC limits (or stop offering them altogether). Stay informed about current market trends when you apply.

Understanding these factors helps set realistic expectations for your HELOC borrowing capacity. Borrow as little or as much as you need, up to your approved credit limit.

As we move forward, let’s explore how interest rate fluctuations can impact your HELOC and what strategies you can employ to manage this risk effectively.

How Interest Rates Impact Your HELOC

Variable vs. Fixed Rate HELOCs

Most HELOCs offer variable interest rates, which change over time based on market conditions. These rates typically link to the prime rate, which the Federal Reserve’s monetary policy influences. When the prime rate rises, your HELOC rate could increase, affecting your monthly payments.

Fixed-rate HELOCs, though less common, provide more predictability. Your interest rate remains constant throughout the loan’s life, offering stability in monthly payments. However, these often start with higher initial rates compared to variable-rate options.

The Real Impact on Your Wallet

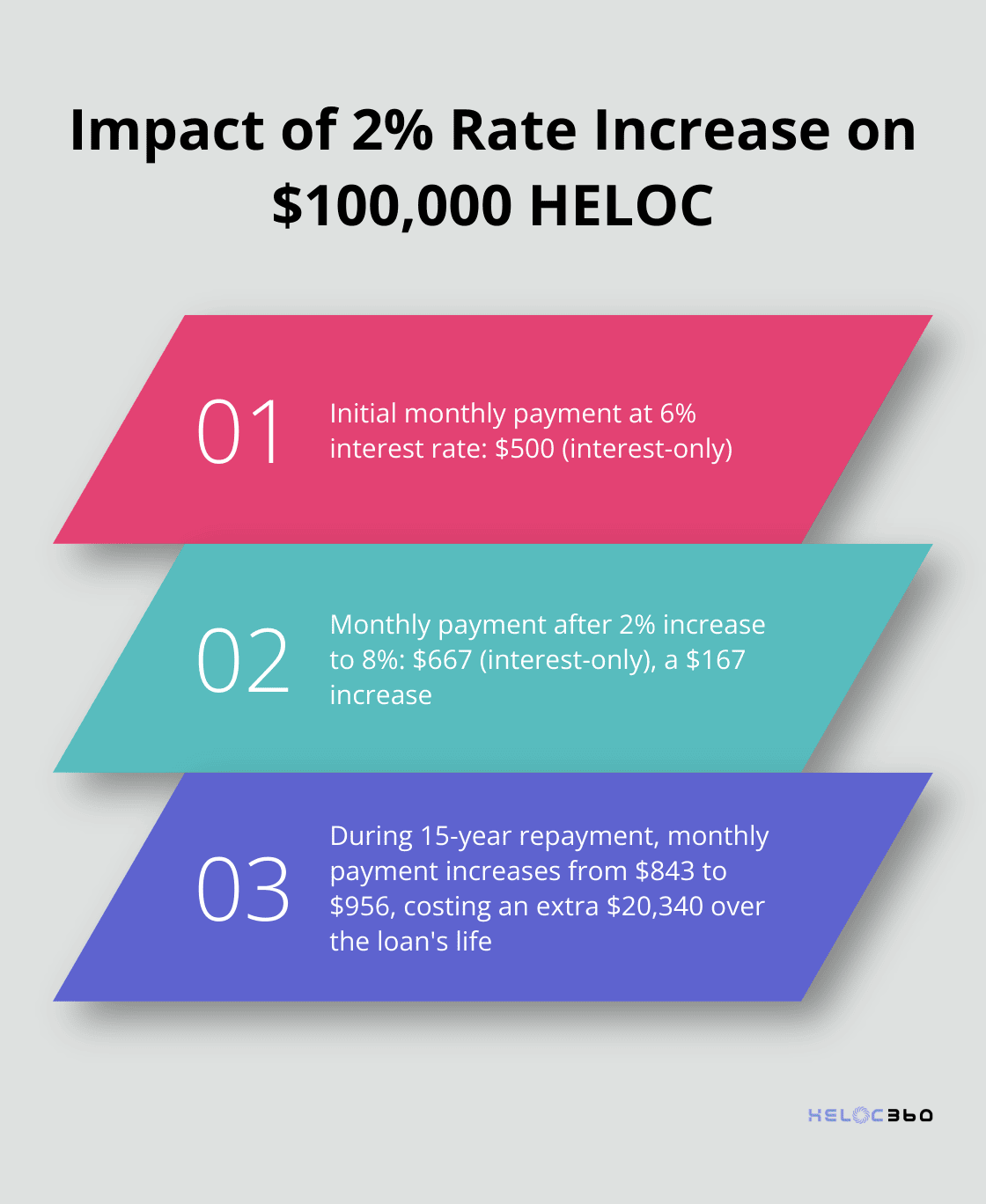

Let’s break down how rate changes affect your payments. Consider a $100,000 HELOC with an initial rate of 6%. Your monthly interest-only payment would be about $500. If the rate increases to 8%, your payment jumps to $667 – a $167 increase per month.

The impact becomes even more significant during the repayment phase when you pay both principal and interest. On a 15-year repayment term, a 2% rate increase could raise your monthly payment from $843 to $956, costing you an extra $20,340 over the loan’s life.

Strategies to Manage Interest Rate Risk

- Rate Caps: Many HELOCs offer rate caps, which limit how much your rate can increase over the loan’s life. Ask potential lenders about their cap structures.

- Convert to Fixed-Rate: Some lenders allow you to convert all or part of your variable-rate balance to a fixed rate. This can provide stability if you anticipate rising rates.

- Pay More Than the Minimum: During the draw period, try to pay more than just the interest. This reduces your principal and lessens the impact of potential rate increases.

- Use Your HELOC Strategically: Consider using your HELOC for short-term expenses that you can pay off quickly, minimizing your exposure to rate fluctuations.

- Stay Informed: Keep an eye on economic indicators and Federal Reserve announcements. These can give you a heads-up on potential rate changes.

Understanding interest rates forms just one piece of the HELOC puzzle. As we move forward, let’s explore another critical aspect: the potential risks of using your home as security for a HELOC.

What Are the Risks of Using Your Home as Collateral?

The Threat of Foreclosure

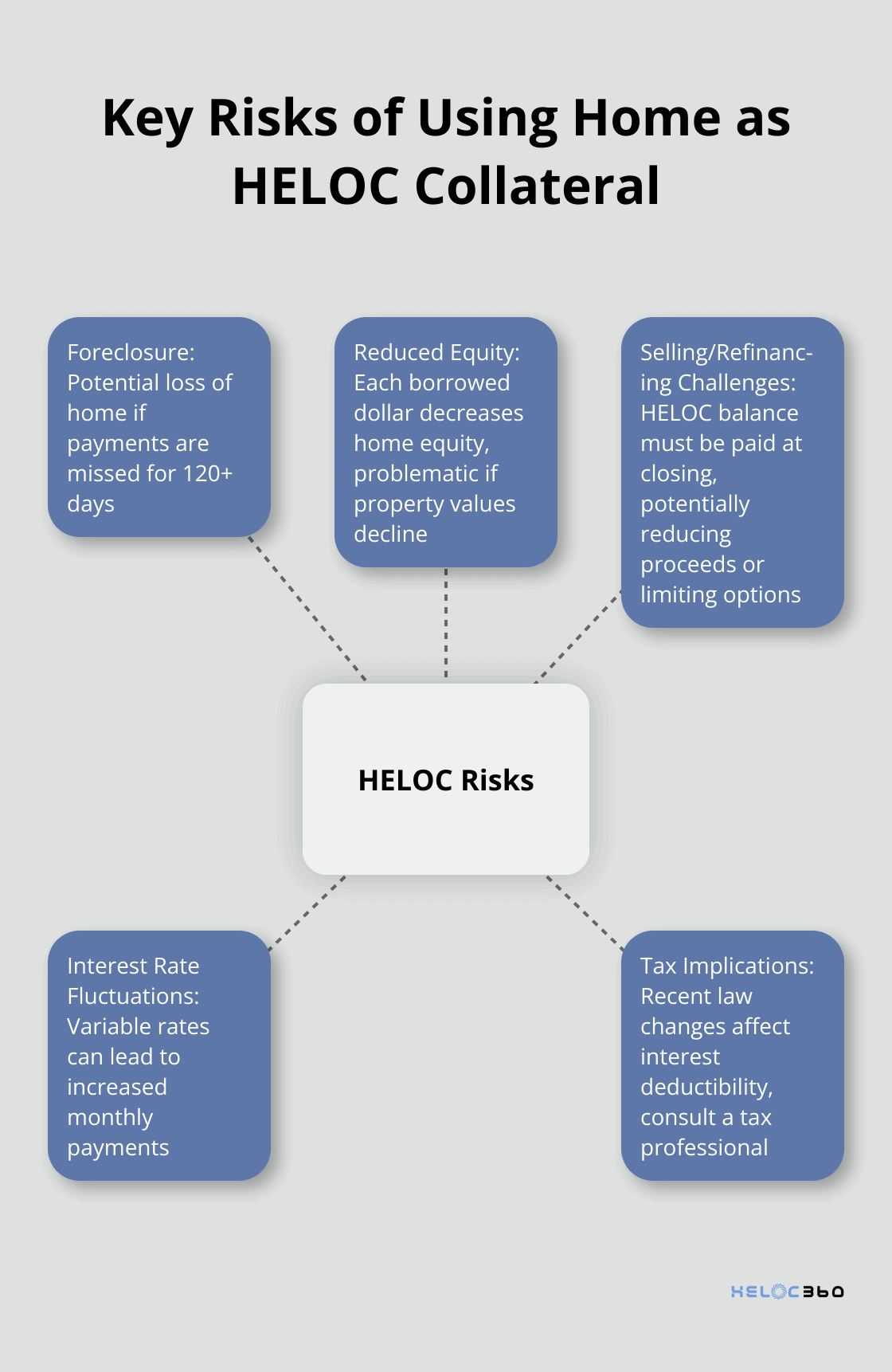

Using your home as collateral for a HELOC carries significant risks. The most severe consequence is the possibility of foreclosure if you fail to repay the loan. Generally, the legal foreclosure process can’t start until you are at least 120 days behind on your mortgage. This means you could lose your home if you fall behind on your HELOC payments.

To reduce this risk:

- Build an emergency fund that covers 3-6 months of expenses.

- Look into payment protection insurance.

- Contact your lender promptly if you anticipate payment difficulties.

Reduction of Home Equity

Each dollar you borrow against your home decreases your equity. This becomes particularly problematic if property values decline. During the 2008 housing crisis, many homeowners found themselves underwater on their mortgages due to falling home values and high loan balances.

To safeguard your equity:

- Borrow conservatively (keep your total loan-to-value ratio below 80%).

- Use HELOC funds for value-adding home improvements when possible.

- Make extra payments to build equity faster.

Challenges in Selling or Refinancing

A HELOC can complicate matters if you decide to sell your home or refinance your primary mortgage. You’ll need to pay off the HELOC balance at closing, which could reduce your proceeds from a sale or limit your refinancing options.

To maintain flexibility:

- Keep your HELOC balance low relative to your home’s value.

- Choose a HELOC with no prepayment penalties.

- Plan ahead if you’re considering selling or refinancing in the near future.

Market Fluctuations and Interest Rate Risk

HELOCs often come with variable interest rates, which can fluctuate based on market conditions. HELOC interest rates can change significantly over time, potentially affecting your monthly payments and budget.

To manage this risk:

- Understand how your HELOC’s interest rate is calculated.

- Consider converting a portion of your HELOC to a fixed-rate loan if your lender offers this option.

- Budget for potential rate increases to ensure you can handle higher payments.

Tax Implications

While interest on HELOCs used for home improvements may be tax-deductible, recent tax law changes have affected this benefit. The IRS provides guidance on HELOC interest deductibility. It’s important to consult with a tax professional to understand how a HELOC might affect your tax situation.

These risks shouldn’t necessarily deter you from considering a HELOC. With careful planning and responsible borrowing, a HELOC can be a valuable financial tool. Platforms like HELOC360 can help you navigate these challenges and find a solution that aligns with your financial goals while minimizing risks.

Final Thoughts

HELOC limitations include borrowing constraints based on your home’s value, credit score, and income. Interest rate fluctuations can significantly impact your payments, and using your home as collateral carries inherent risks such as potential foreclosure and reduced equity. You should carefully consider your financial situation, long-term goals, and ability to manage potential risks before you commit to a HELOC.

HELOCs offer flexibility and potentially lower interest rates compared to other forms of credit, but they also come with responsibilities that require careful consideration. You should evaluate your borrowing needs, assess your comfort with variable interest rates, and create a solid plan for repayment. These steps will help you make an informed decision about whether a HELOC aligns with your financial objectives.

We at HELOC360 can help you navigate the complexities of HELOCs and make the most of your home equity while minimizing risks. Our platform provides guidance and connects you with lenders that match your unique needs. You can unlock the full potential of your home’s value and work towards your financial aspirations with confidence.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.