Are you considering a Home Equity Line of Credit (HELOC) but unsure if it’s the right move for your financial future? At HELOC360, we understand the importance of aligning financial decisions with your long-term goals.

This guide will walk you through the process of HELOC evaluation, helping you determine if this flexible borrowing option fits your unique financial situation.

What Is a HELOC and How Can It Benefit You?

The Basics of HELOCs

A Home Equity Line of Credit (HELOC) is a powerful financial tool that allows homeowners to access their home’s equity. It functions like a credit card, but uses your home as collateral. Lenders approve you for a maximum credit line to use for large expenses, based on your home’s value and your outstanding mortgage balance.

HELOCs typically have two phases:

- Draw period (usually 10 years): You can borrow as needed and only pay interest on what you use.

- Repayment period (usually 20 years): You pay back both principal and interest.

HELOCs vs. Other Loan Types

HELOCs stand out from other loans in several ways:

- Lower interest rates: Because they’re secured by your home, HELOCs often offer more competitive rates than personal loans or credit cards.

- Flexibility: Unlike home equity loans that provide a lump sum upfront, HELOCs allow you to borrow only what you need, when you need it. This flexibility can potentially save you money on interest.

Common Uses for HELOCs

HELOCs are versatile financial tools with numerous practical applications:

- Home improvements: Many homeowners use HELOCs to fund renovations, which can increase property value.

- Debt consolidation: HELOCs can help consolidate high-interest debt, potentially saving thousands in interest payments.

- Education expenses: Some families use HELOCs to fund college tuition or other educational costs.

- Business funding: Entrepreneurs might tap into their home equity to start or expand a business.

The Importance of Responsible Borrowing

While HELOCs offer numerous benefits, it’s essential to borrow responsibly. The New York Fed reports that 4.3 percent of outstanding debt was in some stage of delinquency in 2022. This statistic underscores the importance of having a solid repayment plan before borrowing.

Your home is on the line with a HELOC, so it’s vital to use this financial tool wisely. Always consider your financial goals and repayment capacity before taking out a HELOC.

Evaluating Your Financial Situation

Before you decide if a HELOC is right for you, it’s crucial to assess your current financial situation. This evaluation will help you determine if a HELOC aligns with your financial goals. Let’s explore how to conduct this assessment in the next section.

How Healthy Is Your Financial Situation?

Assess Your Debt and Income

Start with a calculation of your debt-to-income ratio (DTI). This figure is essential for lenders and your financial planning. To calculate your estimated DTI ratio, simply enter your current income and payments.

Most lenders prefer a DTI under 43% for HELOC approval. If your DTI exceeds this, consider debt reduction before applying for a HELOC.

Next, examine your income stability. Self-employed individuals or those with variable income should gather at least two years of tax returns to demonstrate consistent earnings. Lenders want to see your ability to handle potential HELOC payments on top of existing obligations.

Determine Your Home Equity

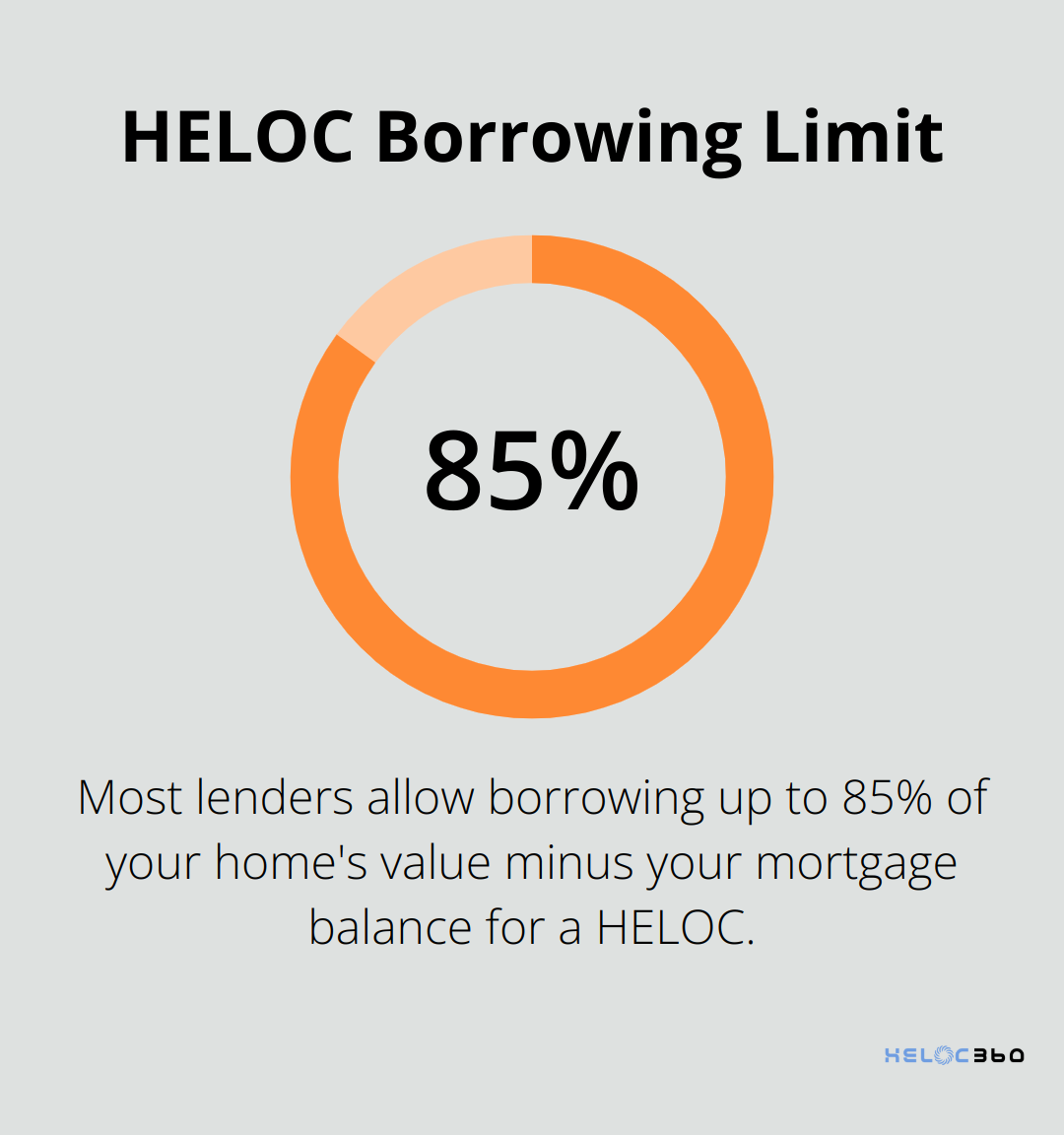

Your home equity is the difference between your home’s current market value and your mortgage balance. For example, if your home is worth $300,000 and you owe $200,000 on your mortgage, you have $100,000 in equity.

Most lenders allow borrowing up to 85% of your home’s value minus your mortgage balance. In our example, that’s $55,000 (85% of $300,000 = $255,000, minus $200,000 mortgage).

To obtain an accurate home value, consider a professional appraisal or use online estimation tools (keeping in mind that these tools may not account for recent improvements or local market conditions).

Set Clear Financial Goals

Think about your reasons for wanting a HELOC and how it fits into your broader financial picture. Are you planning to renovate your kitchen to increase your home’s value? Or are you looking to consolidate high-interest credit card debt?

Short-term goals might include debt consolidation or funding a child’s education. Long-term goals could involve building a rental property portfolio or preparing for retirement.

Make your goals SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. This approach will help you use your HELOC effectively and avoid treating your home equity like an ATM.

Consider the Risks

While HELOCs offer flexibility, they also come with risks. Your home serves as collateral, so it’s vital to have a solid repayment plan. If you’re unsure about managing a HELOC, speak with a financial advisor who can provide personalized guidance based on your unique situation.

A thorough assessment of your financial health and alignment of a HELOC with your goals will equip you to make an informed decision about this financial tool. Now that you’ve evaluated your financial situation, let’s explore the advantages and potential drawbacks of using a HELOC in the next section.

Is a HELOC Right for You? Weighing the Pros and Cons

Flexibility in Borrowing and Repayment

HELOCs offer unmatched flexibility. You can draw funds as needed during the draw period (typically 10 years) and only pay interest on the amount you use. This feature makes HELOCs ideal for ongoing projects or expenses with uncertain costs.

However, this flexibility can lead to overspending if not managed carefully. Without a structured repayment plan, you might end up with a large balance at the end of the draw period, facing significantly higher payments during the repayment phase.

Interest Rates: Potential Savings and Risks

One of the most attractive features of HELOCs is their potentially lower interest rates compared to other forms of borrowing. As of July 2025, the national average HELOC interest rate is 8.27%, according to Bankrate’s latest survey of the nation’s largest home equity lenders.

But there’s a catch: HELOC rates are typically variable, which means they can fluctuate based on market conditions. While you might start with a low rate, it could increase over time, potentially impacting your ability to repay the loan.

Collateral Considerations: Your Home at Stake

Using your home as collateral is a double-edged sword. It allows HELOCs to offer lower interest rates, but it also means your home is at risk if you can’t repay the loan.

Tax Implications: A Potential Benefit

Interest paid on a HELOC may be tax-deductible if the funds are used for home improvements. However, tax laws can change, and what’s deductible today might not be tomorrow. Always consult with a tax professional to understand the current implications for your situation.

Real-World Applications

HELOCs can be transformative when used strategically. Some homeowners use a HELOC to fund home improvements, which can potentially increase their home’s value and provide a good return on investment.

However, challenges can arise for those who don’t fully understand the risks. A thorough evaluation of your financial situation and goals is essential before deciding if a HELOC is right for you.

Final Thoughts

A HELOC evaluation requires careful consideration of your financial situation and goals. You must assess your debt-to-income ratio, available home equity, and long-term financial strategy before deciding if a HELOC fits your needs. HELOCs offer flexibility and potentially lower interest rates, but they also come with risks such as variable rates and using your home as collateral.

If you determine a HELOC aligns with your financial objectives, the next step involves finding the best terms and rates. HELOC360 can simplify this process, providing tools and information for confident decision-making about your home equity. Our platform connects you with lenders that match your unique financial situation and goals.

We at HELOC360 strive to help you unlock your home’s full potential. Our expert guidance and tailored solutions support you in using your home as a powerful financial asset (whether for home improvements, debt consolidation, or seeking financial flexibility). Take the time to evaluate your options carefully and set yourself up for long-term financial success.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.