Real estate investing can be a powerful way to build wealth, but finding the right financing is often a challenge. Enter the Home Equity Line of Credit (HELOC) – a flexible funding option that’s gaining traction among savvy investors.

At HELOC360, we’ve seen firsthand how HELOC investing can unlock new opportunities in the real estate market. This guide will show you how to leverage your home equity to fund property purchases, renovations, and more, while managing the risks involved.

What Is a HELOC and How Can It Boost Your Real Estate Investments?

Understanding HELOCs

A Home Equity Line of Credit (HELOC) is a powerful financial tool that can supercharge your real estate investing strategy. HELOCs work similarly to how credit cards work. Your HELOC provider will set a credit limit, which usually is based on how much equity you have in your home.

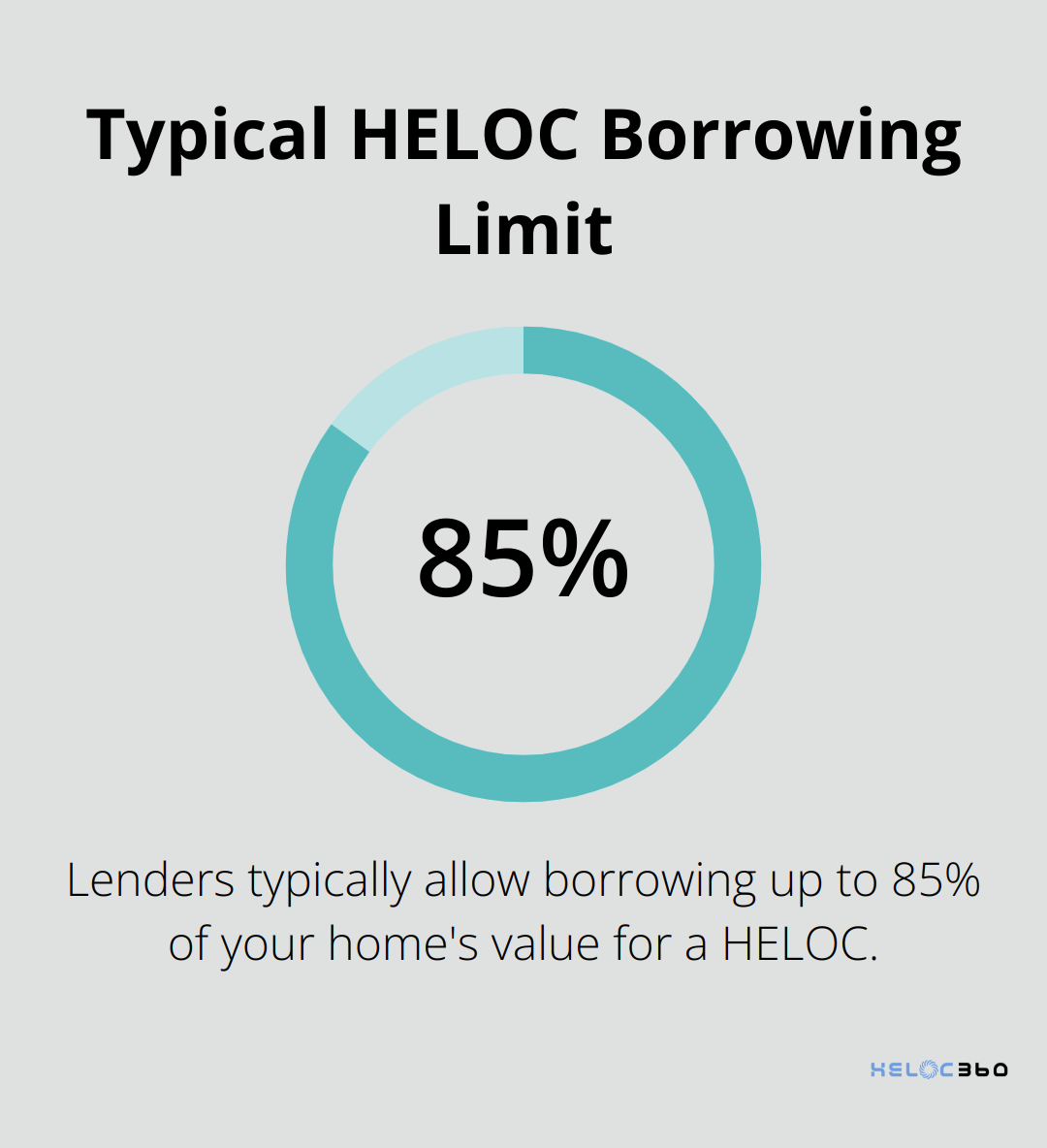

Lenders typically allow you to borrow up to 80-85% of your home’s value, minus your outstanding mortgage balance. For instance, if your home is worth $500,000 and you owe $300,000 on your mortgage, you might access a HELOC of up to $125,000 (assuming an 85% loan-to-value ratio).

HELOCs usually have two phases:

- Draw period (5-10 years): You can borrow funds as needed and typically only pay interest on the amount drawn.

- Repayment period: You pay back both principal and interest.

Benefits for Real Estate Investors

Using a HELOC for real estate investing offers significant advantages:

- Flexibility: Use funds for various investment strategies (e.g., property purchases, renovations).

- Quick access to cash: Seize time-sensitive investment opportunities.

- Lower interest rates: According to Bankrate, as of August 20, 2025, the national average HELOC interest rate is 8.12%.

Investment Strategies with HELOCs

HELOCs enable diverse real estate investment approaches:

- Property purchases: Use your HELOC as a down payment on new investment properties.

- Renovations: Fund improvements to increase existing property values.

- Bridge financing: Cover short-term gaps in funding for real estate deals.

Risks and Considerations

While HELOCs can transform your real estate investing, they come with risks:

- Collateral: Your home serves as collateral. Defaulting on payments could result in property loss.

- Variable interest rates: Current rates might increase, potentially impacting investment returns.

- Economic factors: The Federal Reserve’s actions can significantly influence HELOC rates.

To mitigate these risks, create a solid investment plan and ensure reliable income streams to meet your HELOC obligations. Stay informed about economic trends and their potential impact on interest rates.

Many investors successfully leverage HELOCs to grow their real estate portfolios. However, thorough research and careful planning are essential. Consider consulting with a financial advisor to ensure a HELOC aligns with your investment goals and risk tolerance.

The strategic use of a HELOC can unlock lucrative real estate opportunities, but it requires diligence and a clear understanding of the associated risks. In the next section, we’ll explore specific strategies for using a HELOC in real estate investing, helping you maximize the potential of this versatile financial tool.

Maximizing Your HELOC for Real Estate Success

The Fix and Flip Strategy

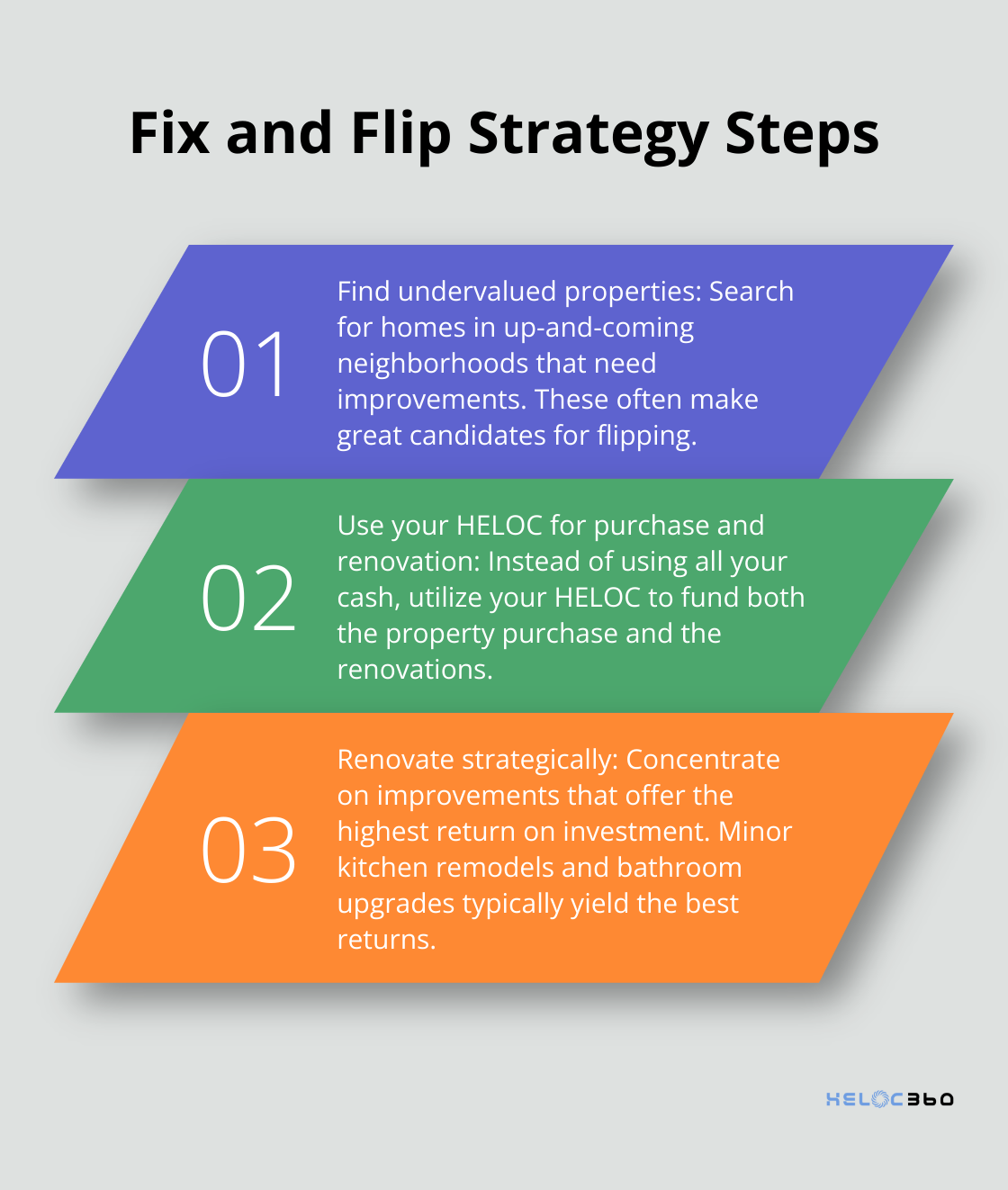

One popular way to use a HELOC in real estate is the fix and flip approach. This strategy involves purchasing a property below market value, renovating it, and selling it for a profit.

Here’s how you can make it work:

- Find undervalued properties: Search for homes in up-and-coming neighborhoods that need improvements. These often make great candidates for flipping.

- Use your HELOC for purchase and renovation: Instead of using all your cash, utilize your HELOC to fund both the property purchase and the renovations.

- Renovate strategically: Concentrate on improvements that offer the highest return on investment. Minor kitchen remodels and bathroom upgrades typically yield the best returns (according to recent industry reports).

- Sell quickly: Successful flipping requires minimizing holding costs. Buyers could repay only interest on the HELOC during the renovations and then pay off the loan’s balance when they sell the renovated home.

Expanding Your Rental Portfolio

Another effective strategy involves using your HELOC to grow your rental property portfolio. Here’s how:

- Use HELOC funds for down payments: Instead of saving for years, use your HELOC to make down payments on multiple rental properties.

- Look for cash-flowing properties: Ensure the rental income will cover your HELOC payments plus all other expenses.

- Refinance strategically: Once you’ve built equity in your rental properties, consider refinancing to pay off your HELOC and potentially acquire more properties.

Boosting Property Values Through Improvements

Sometimes, the best investment is right under your nose. Use your HELOC to fund improvements that significantly increase your property’s value:

- Focus on high-ROI upgrades: Consider improvements that can significantly increase your property’s value and rental potential.

- Consider adding living space: Finishing a basement or adding a bedroom can dramatically increase your property’s value and rental potential.

- Improve curb appeal: Don’t underestimate the power of a well-landscaped yard and a fresh coat of paint. These relatively inexpensive upgrades can significantly boost your property’s perceived value.

The key to success with any of these strategies is careful planning and execution. Always run the numbers, factor in all costs (including HELOC interest), and have a clear exit strategy before starting your investment journey.

In the next section, we’ll explore best practices for managing your HELOC effectively while pursuing these real estate investment strategies.

How to Manage Your HELOC Effectively for Real Estate Investments

Create a Comprehensive Investment Strategy

Start with a detailed business plan that outlines your investment goals, target properties, and financial projections. Include specific metrics such as expected cash flow, return on investment (ROI), and timeline for each project. For house flipping, try to achieve a minimum 20% ROI after accounting for all costs (including HELOC interest).

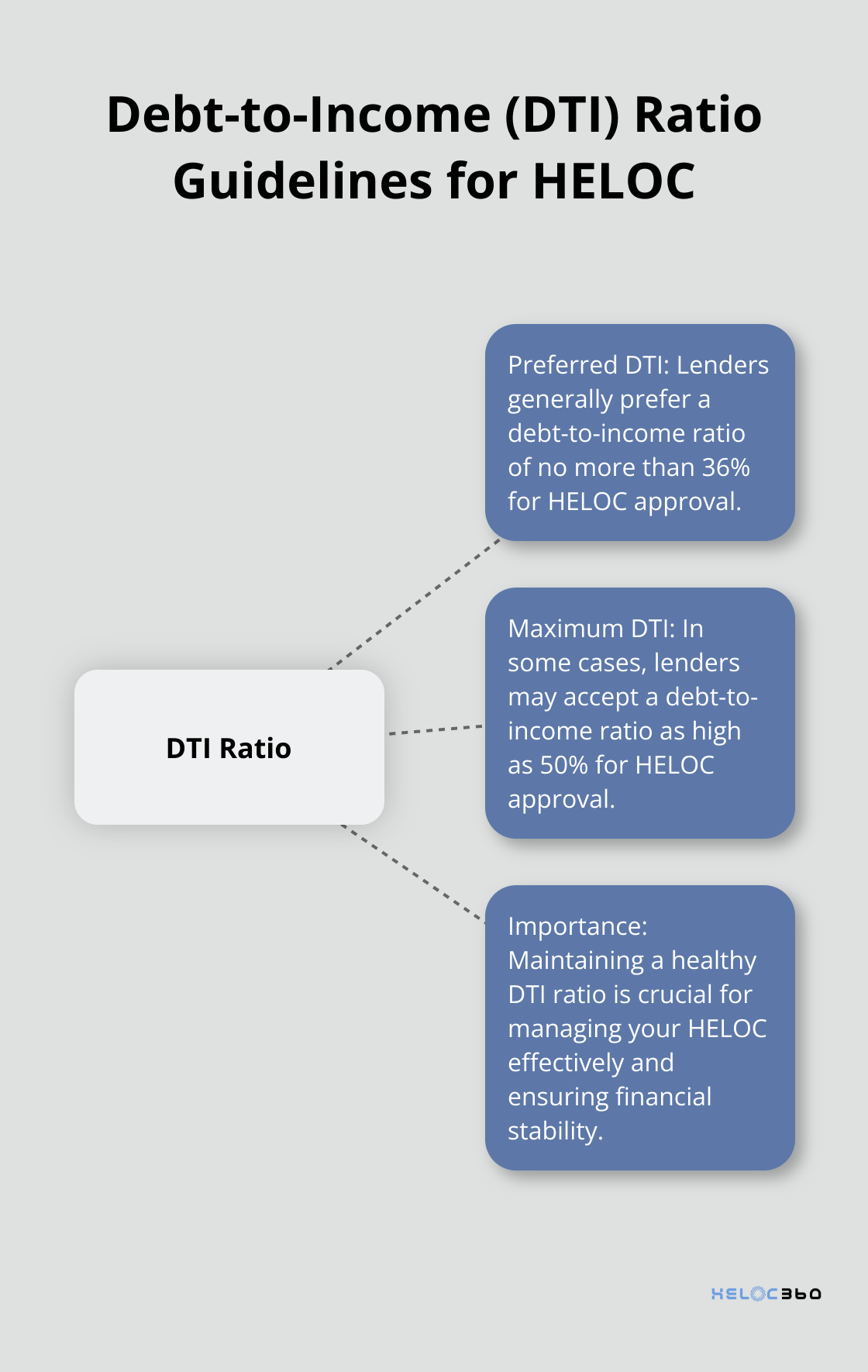

Monitor Your Debt-to-Income Ratio

Lenders generally prefer a debt-to-income (DTI) ratio of no more than 36%, but the cutoff can sometimes be as high as 50%. To maintain a healthy DTI, consider the BRRRR method (Buy, Rehab, Rent, Refinance, Repeat). With this strategy, you use a cash-out refinance on your investment property to purchase another distressed property to flip and rent out.

Track Market Trends

Real estate markets can change rapidly, affecting both property values and HELOC interest rates. Subscribe to local real estate newsletters, attend industry events, and network with other investors to stay ahead of market shifts. Tools like Zillow’s Home Value Index (ZHVI) are designed to capture the value of a typical property across the nation or the neighborhood, not just the homes that sold.

Review your HELOC terms regularly and compare them with current market rates. If you find better options, consider refinancing your HELOC or explore alternatives like cash-out refinancing.

Plan Multiple Exit Strategies

For each investment, prepare multiple exit strategies. If you renovate a property for resale, your primary strategy might involve selling within six months. However, also prepare a backup plan, such as renting the property if the market softens. Always factor in worst-case scenarios (e.g., market downturn or unexpected repairs) and ensure you have sufficient reserves to cover HELOC payments.

Consult with Financial Advisors

If you’re unsure about any aspect of using a HELOC for real estate investing, don’t hesitate to consult with financial advisors. They can provide personalized advice based on your specific financial situation and investment goals.

Final Thoughts

HELOCs offer real estate investors flexibility, lower interest rates, and quick access to funds. HELOC investing allows you to use your home’s equity without selling, giving you an edge in the competitive real estate market. However, responsible borrowing and risk management are essential when using a HELOC for real estate investments.

Creating a comprehensive strategy, maintaining a healthy debt-to-income ratio, and staying informed about market trends will help you succeed with HELOC investing. Your home serves as collateral, and variable interest rates can affect your investment returns, so you must understand these factors and plan to mitigate potential risks. Multiple exit strategies for each investment will prepare you for market shifts or unexpected expenses.

HELOC360 provides tailored solutions to help you maximize your home equity for real estate investments. Their platform simplifies the process and connects you with suitable lenders (while offering expert guidance). HELOC investing can transform your investment strategy, helping you build wealth and achieve your financial goals in the dynamic world of real estate.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.