Are you leaving money on the table when it comes to your HELOC? Many homeowners are unaware of the potential tax benefits associated with their Home Equity Line of Credit.

At HELOC360, we’ve seen countless clients miss out on valuable HELOC write-offs simply because they didn’t know they existed. This guide will unveil hidden deductions that could significantly reduce your tax burden and put more money back in your pocket.

Understanding HELOC Tax Deductions

Qualifying Expenses for Tax Deductions

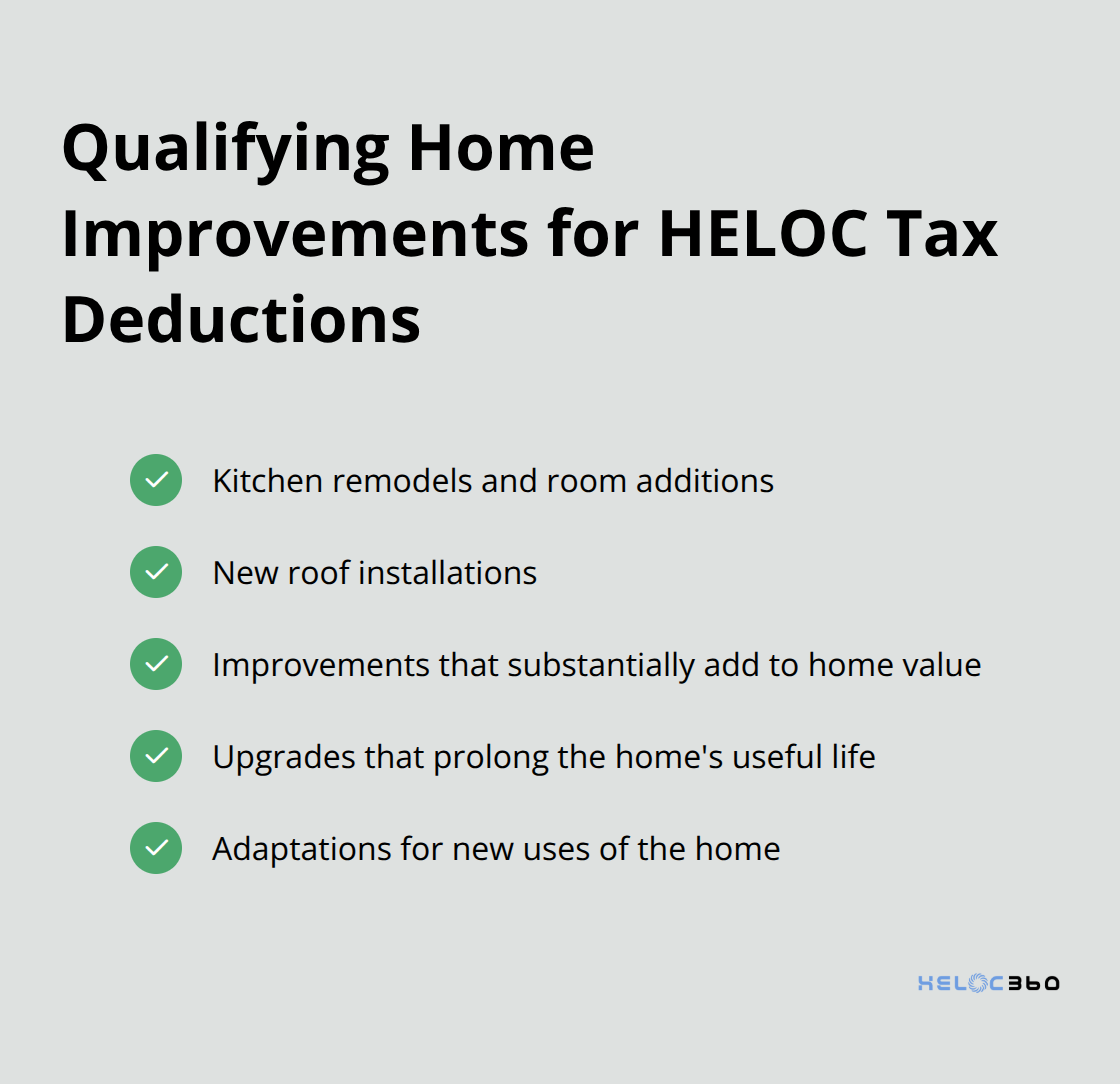

The Tax Cuts and Jobs Act of 2017 reshaped HELOC interest deductions. You can now only deduct interest if you use the funds to buy, build, or substantially improve your home. Home improvements that increase your property’s value, extend its life, or adapt it for new uses qualify for deductions. Examples include kitchen remodels, room additions, and new roofs. However, simple repairs (like fixing a leaky faucet) don’t make the cut. The IRS maintains strict guidelines on this distinction.

The Importance of Proper Documentation

Meticulous record-keeping is essential for HELOC expenses. Save all receipts, contracts, and before-and-after photos of improvements. Without proper documentation, you risk losing deductions if audited. Create a separate bank account for your HELOC funds to simplify expense tracking during tax season. This small step can save you hours of frustration later.

Recent Changes in Tax Laws

Current rules for HELOC deductions will expire in 2025. After this date, tax laws may change, potentially affecting HELOC interest deductions. However, don’t bank on this change – tax laws evolve rapidly. For now, focus on maximizing your deductions under current law. If you plan to use a HELOC for non-home improvement purposes, consider alternatives like personal loans that might offer better rates.

Navigating Complex Tax Laws

Tax laws surrounding HELOCs can be intricate. While we strive to provide accurate information, always consult a tax professional for advice tailored to your situation. They can help you navigate the nuances and ensure you’re not missing any potential deductions.

Maximizing Your HELOC Deductions

To make the most of your HELOC tax benefits, consider these strategies:

- Plan your home improvements carefully (ensure they qualify for deductions)

- Keep detailed records of all HELOC-funded projects

- Consult with a tax professional before making major financial decisions

- Stay informed about potential changes in tax laws

As we move forward, let’s explore specific home improvement deductions that can significantly impact your tax savings.

What Home Improvements Qualify for HELOC Tax Deductions?

Understanding IRS Guidelines

The IRS sets specific rules for home improvements that qualify for HELOC tax deductions. These improvements must “substantially add to the value of your home, prolong its useful life, or adapt it to new uses.” This definition opens up numerous possibilities for homeowners.

Eligible Home Improvement Projects

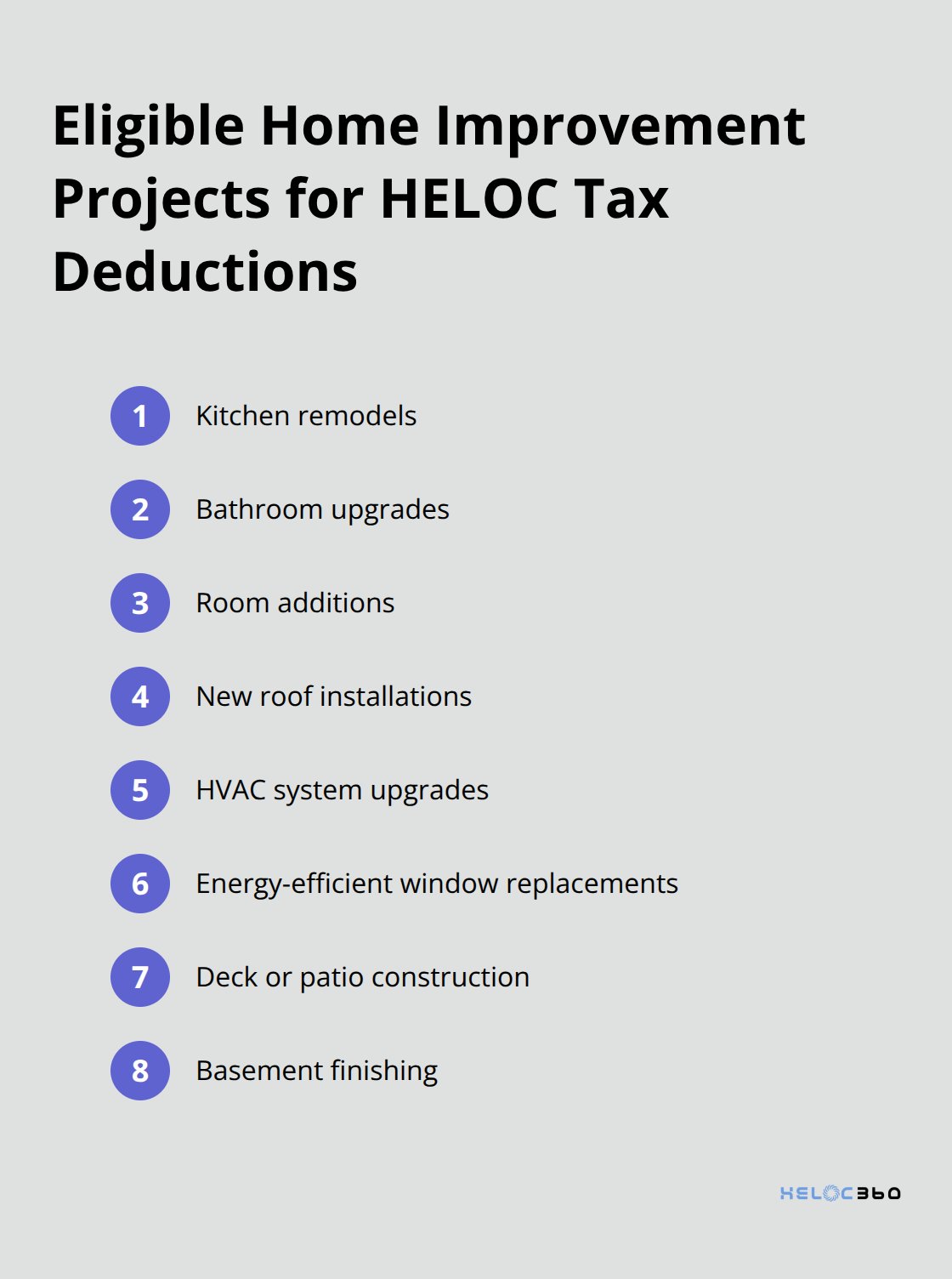

Major renovations often meet the IRS criteria. Examples include:

- Kitchen remodels

- Bathroom upgrades

- Room additions

- New roof installations

- HVAC system upgrades

- Energy-efficient window replacements

- Deck or patio construction

- Basement finishing

It’s important to note that routine maintenance and repairs (such as painting walls or fixing leaky faucets) do not qualify for these deductions.

How to Calculate Renovation Deductions

The calculation of deductions requires precision. You can only deduct the interest paid on the portion of your HELOC used for qualifying home improvements. For instance, if you borrow $50,000 and use $30,000 for a kitchen remodel, you can only deduct the interest on that $30,000.

To ensure accurate calculations:

- Maintain detailed records of all project-related expenses.

- Monitor the amount of HELOC funds used specifically for the project.

- Preserve all receipts, invoices, and contracts.

- Take before and after photos to document the improvements.

These records prove invaluable during tax season and essential in case of an audit.

Strategies to Maximize Tax Benefits

To optimize your HELOC tax deductions, consider combining several smaller projects into one larger renovation. This approach can help you reach the threshold for substantial improvements more easily.

Timing also plays a key role. If you plan a major renovation, try to use your HELOC funds before the tax year ends to maximize your deductions for that period.

Don’t overlook energy-efficient upgrades. These improvements not only qualify for HELOC interest deductions but may also be eligible for additional tax credits.

The Importance of Professional Guidance

While these guidelines provide a solid foundation, tax laws can be complex and subject to change. Always consult with a qualified tax professional to ensure you maximize your HELOC tax deductions while staying compliant with current regulations.

As we move forward, let’s explore how HELOC funds can be used for business purposes and the potential tax implications that come with this strategy.

Leveraging HELOC for Business Growth

Powering Business with Home Equity

Entrepreneurs and small business owners can use a HELOC as a potent tool to fuel business growth. Many clients successfully invest their home equity in their businesses. However, understanding the tax implications and record-keeping requirements is vital when using HELOC funds for business purposes.

Tax Deductions for Business-Related HELOC Interest

Interest on home equity loans and lines of credit are deductible only if the borrowed funds are used to buy, build, or substantially improve the taxpayer’s home. This can substantially reduce your tax burden, making a HELOC an attractive option for business financing. However, the rules require careful navigation.

To qualify for these deductions, you must use the HELOC funds directly for business expenses (e.g., purchasing inventory, buying equipment, or funding marketing campaigns). The key lies in maintaining a clear separation between personal and business use of the funds.

Meticulous Record-Keeping Requirements

When you use HELOC funds for your business, impeccable record-keeping becomes non-negotiable. The IRS scrutinizes these deductions closely, so you need to justify every dollar claimed.

We recommend creating a separate bank account for your HELOC funds used for business purposes. This helps maintain clear and organized financial records. This simplifies expense tracking and interest deduction calculations. Keep all receipts, invoices, and bank statements related to these transactions. Digital record-keeping tools can prove invaluable for organizing this information.

Strategies to Maximize Business-Related HELOC Deductions

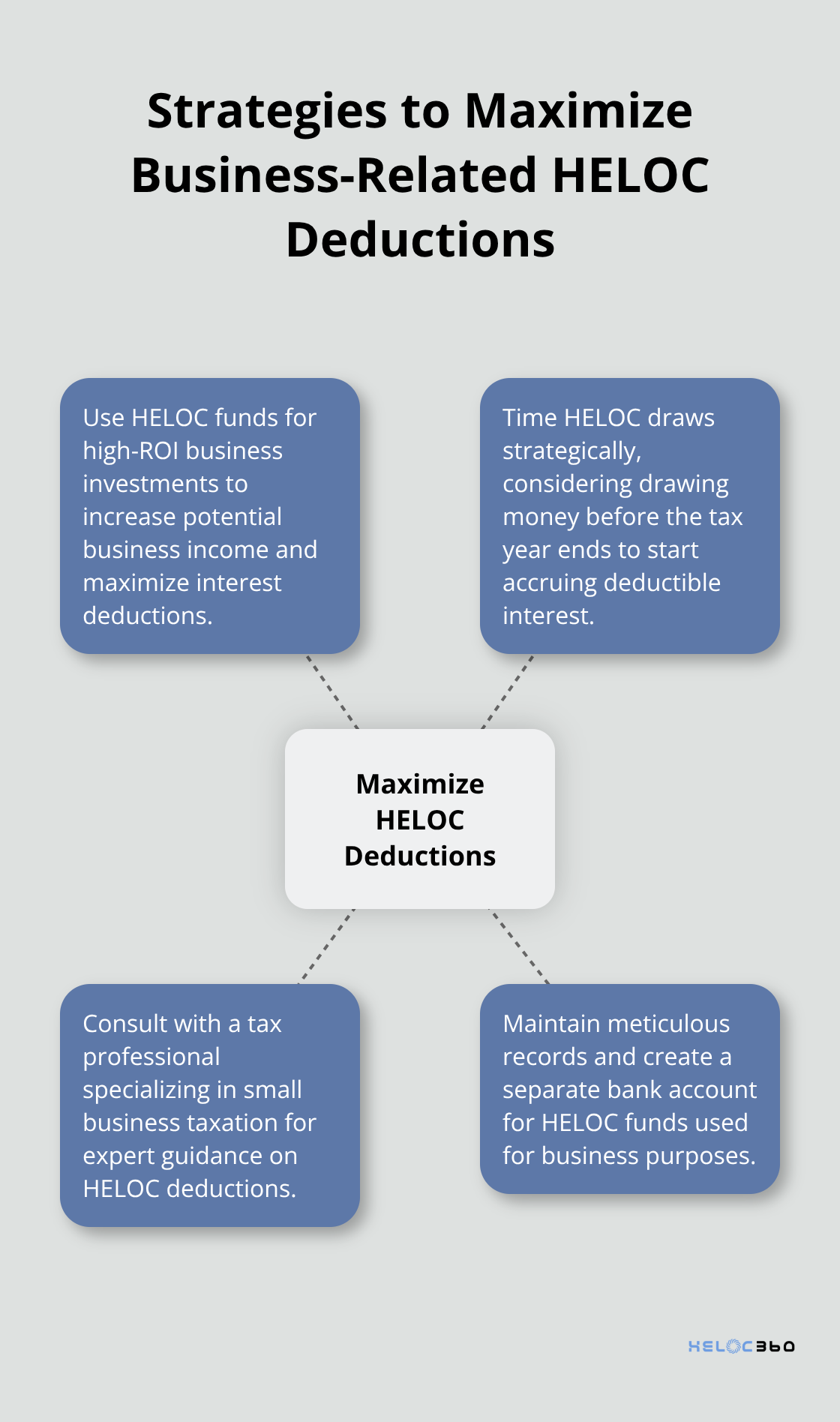

To optimize your tax benefits, consider these strategies:

- Use HELOC funds for high-ROI business investments. This not only potentially increases your business income but also maximizes your interest deductions.

- Time your HELOC draws strategically. If you anticipate needing funds for a major business expense in the coming year, consider drawing the money before the tax year ends to start accruing deductible interest.

- Consult with a tax professional who specializes in small business taxation. They can help you navigate the complexities of HELOC deductions and ensure you maximize your benefits while staying compliant with tax laws.

A HELOC can serve as a valuable tool for business growth, but it also puts your home at risk if you default on payments. Always approach this strategy with caution and a solid business plan.

Final Thoughts

HELOC write-offs can significantly reduce your tax burden, but they require careful planning and record-keeping. You must understand what qualifies for deductions, maintain meticulous records, and stay informed about tax law changes. A qualified tax professional can provide personalized advice based on your specific situation and help you navigate the complexities of HELOC tax benefits.

Your home’s equity is a powerful financial tool that can open doors to new opportunities. When you use it wisely, you can make your home work harder for you and achieve your financial goals. Strategic planning of expenses, focusing on substantial home improvements, and maintaining clear separation between personal and business expenses are key to maximizing HELOC-related tax benefits.

We at HELOC360 simplify the HELOC process and offer expert guidance to help you unlock the full potential of your home equity. Our platform connects you with lenders that fit your unique needs, whether you plan major renovations, consolidate debt, or seek financial flexibility. We provide comprehensive solutions tailored to your goals, so you can make the most of your HELOC.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.