Facing foreclosure can be a homeowner’s worst nightmare. The threat of losing your home and the devastating impact on your financial future can be overwhelming.

At HELOC360, we understand the stress this situation brings. That’s why we’re exploring how a HELOC foreclosure prevention strategy can be a lifeline for homeowners struggling to keep up with mortgage payments.

Understanding Foreclosure and Its Consequences

What is Foreclosure?

Foreclosure is a legal process where a lender takes possession of a property when the homeowner fails to make mortgage payments. This harsh reality affects thousands of Americans each year. In 2022, foreclosure filings were up 115% from 2021, but down 34% from 2019, highlighting the ongoing concern for homeowners.

The Credit Score Fallout

When foreclosure occurs, it deals a severe blow to your credit score. Foreclosure and its alternatives will cause your credit scores to drop-the amount depends on your credit history and other factors. This decrease can remain on your credit report for up to seven years, making it difficult to secure loans, credit cards, or even rent an apartment in the future.

Financial Repercussions Beyond Credit

The financial impact of foreclosure extends far beyond your credit score. You may face deficiency judgments, where you remain responsible for the difference between what the lender recovers from selling your home and what you owe on the mortgage. This can result in wage garnishment or seizure of other assets.

The Emotional Toll

Foreclosure isn’t just a financial crisis; it’s an emotional one too. The stress of potentially losing your home can cause anxiety, depression, and even physical health problems. Studies have concluded that foreclosure had adverse effects on health or mental health, with the majority of research supporting this finding.

Exploring Alternatives

The consequences of foreclosure are severe, but homeowners have options to avoid this outcome. One such option is a Home Equity Line of Credit (HELOC). A HELOC allows homeowners to borrow against their home’s equity, providing a potential lifeline during financial hardships. This strategy can help homeowners catch up on mortgage payments and regain financial stability.

How a HELOC Can Prevent Foreclosure

Understanding HELOC Basics

A Home Equity Line of Credit (HELOC) serves as a powerful tool for homeowners who face the threat of foreclosure. This flexible financing option allows you to access your home’s equity, providing a financial lifeline when you need it most.

A HELOC is a revolving line of credit secured by your home’s equity. Unlike a traditional loan, you can borrow and repay funds as needed, up to your credit limit. The interest rates typically fall below those of credit cards or personal loans, making it an attractive option for homeowners in financial distress.

Catching Up on Mortgage Payments

When you fall behind on mortgage payments, a HELOC can provide the cash needed to bring your account current. For example, if you’re three months behind on a $1,500 monthly mortgage payment, you could use $4,500 from your HELOC to catch up. This immediate action can stop the foreclosure process and give you time to stabilize your finances.

Advantages of HELOC Over Other Options

HELOCs offer several advantages over other financing options when facing foreclosure:

- Lower interest rates: HELOCs typically have lower interest rates compared to credit cards or personal loans. According to forecasts by McBride, HELOC rates are expected to continue falling in 2025, with the average HELOC rate projected to reach 7.25 percent by the end of the year, a low not seen since 2022.

- Flexible repayment: You only pay interest on the amount you borrow, not the entire credit line. This flexibility allows you to manage your debt more effectively.

- Potential tax benefits: In some cases, the interest paid on a HELOC may be tax-deductible (consult with a tax professional for specific advice).

- Home preservation: Using a HELOC to catch up on mortgage payments allows you to take active steps to keep your home and avoid the devastating consequences of foreclosure.

Cautious Approach to HELOC Strategy

While a HELOC can effectively prevent foreclosure, you must approach this strategy with caution. You need a solid plan to repay both your mortgage and HELOC to avoid further financial strain. If you consider this option, platforms like HELOC360 can connect you with lenders and provide expert guidance tailored to your situation.

The next step involves implementing a HELOC strategy to avoid foreclosure. This process requires careful assessment of your financial situation and a clear understanding of the steps involved in applying for and managing a HELOC.

How to Implement a HELOC Strategy

Assess Your Financial Situation

The first step in implementing a HELOC strategy requires a comprehensive review of your financial situation. Analyze your income, expenses, and outstanding debts. Create a detailed budget that accounts for all your monthly expenses, including your mortgage payment, utilities, groceries, and other essential costs.

A study by the Federal Reserve highlights that 63 percent of all adults in 2022 said they would have covered a $400 expense exclusively using cash, savings, or a credit card paid off at the next statement. This statistic underscores the importance of having a clear understanding of your financial standing before pursuing a HELOC.

Identify the root cause of your financial difficulties. Do you face a temporary setback due to job loss or unexpected medical expenses? Or does your financial strain result from long-term issues that require more substantial changes to your spending habits?

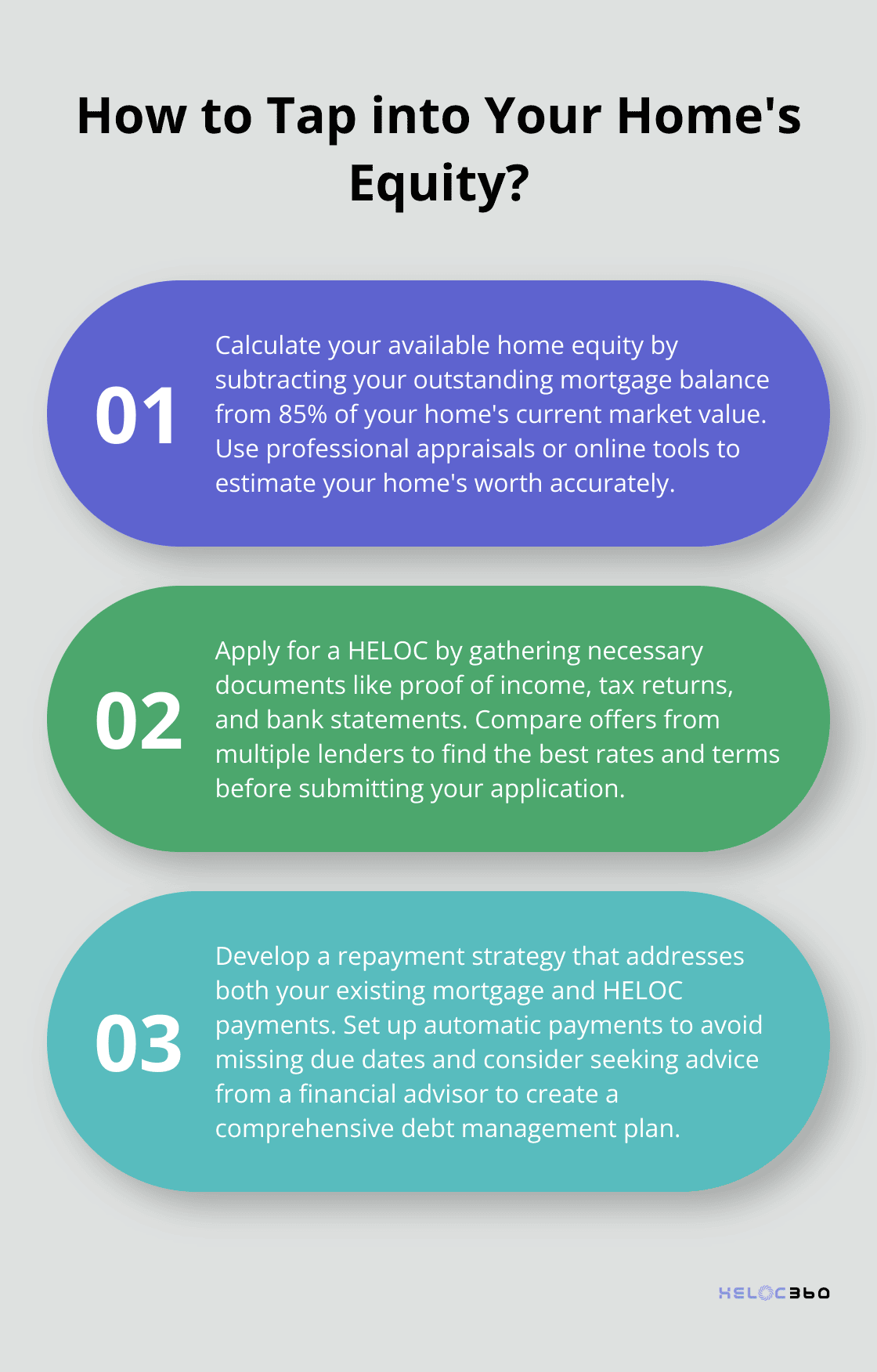

Calculate Your Available Home Equity

Your home equity equals the difference between your home’s current market value and the outstanding balance on your mortgage. To calculate your available equity, you need to determine your home’s current value. Professional appraisals provide the most accurate valuation, but online tools and recent sales of comparable properties in your area can give you a rough estimate.

Most lenders allow you to borrow up to 85 percent of your home’s value, minus your outstanding mortgage balance. For example, if your home is worth $300,000 and you owe $200,000 on your mortgage, your total available equity would be $55,000 (assuming an 85% loan-to-value ratio).

Apply for a HELOC

Once you’ve assessed your finances and calculated your available equity, apply for a HELOC. This process typically involves the following steps:

- Gather necessary documents: These usually include proof of income, tax returns, bank statements, and information about your existing mortgage and other debts.

- Shop around for lenders: Compare offers from multiple lenders to find the best rates and terms.

- Submit your application: Provide all required information and documentation to your chosen lender.

- Property appraisal: The lender will likely require an appraisal to confirm your home’s value.

- Underwriting and approval: The lender will review your application and make a decision.

- Closing: If approved, you’ll need to sign final documents to complete the process.

Develop a Repayment Strategy

A key aspect of using a HELOC to avoid foreclosure involves having a solid repayment plan. This plan should address both your existing mortgage payments and the HELOC repayment.

Start by allocating the HELOC funds to bring your mortgage current. Then, create a budget that allows you to make regular payments on both your mortgage and HELOC. Consider setting up automatic payments to ensure you don’t miss any due dates.

If your financial difficulties are temporary, focus on making minimum payments until your situation improves. For long-term financial challenges, seek advice from a financial advisor or credit counselor to develop a comprehensive debt management strategy.

While a HELOC can provide immediate relief from foreclosure, address the underlying financial issues to prevent future problems. Stay committed to your repayment plan to use a HELOC as an effective tool to avoid foreclosure and regain financial stability.

Final Thoughts

A HELOC foreclosure prevention strategy empowers homeowners to overcome financial difficulties. This approach allows access to home equity funds, which can help catch up on mortgage payments and avoid foreclosure consequences. HELOCs offer flexibility and typically lower interest rates compared to other financing options.

Swift action proves essential when facing financial challenges. Early addressing of potential mortgage payment issues opens up more options and reduces foreclosure risk. We at HELOC360 simplify the process of navigating home equity solutions, connecting you with lenders that match your specific needs.

A HELOC provides immediate relief, but addressing root causes of financial difficulties remains important. Developing a solid repayment plan and seeking advice from financial professionals ensures long-term financial health. HELOC360 helps transform your home’s equity into a lifeline, supporting you to overcome financial challenges and secure your home’s future.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.