Are you an entrepreneur with big dreams but limited capital? A Home Equity Line of Credit (HELOC) might be the key to unlocking your business potential.

At HELOC360, we’ve seen many aspiring business owners leverage their home equity to fuel their entrepreneurial ambitions. This flexible funding option can provide the capital you need to start, grow, or expand your business.

In this post, we’ll explore how a HELOC for business purposes can work for you, along with the advantages and risks to consider.

How Can a HELOC Power Your Business?

Unleashing Your Home’s Hidden Potential

A Home Equity Line of Credit (HELOC) is a second mortgage that uses your home as collateral to let you borrow up to a certain amount over a set period. This financial instrument serves as a powerful tool for entrepreneurs seeking to fund their business ventures, providing a flexible source of capital for various business purposes.

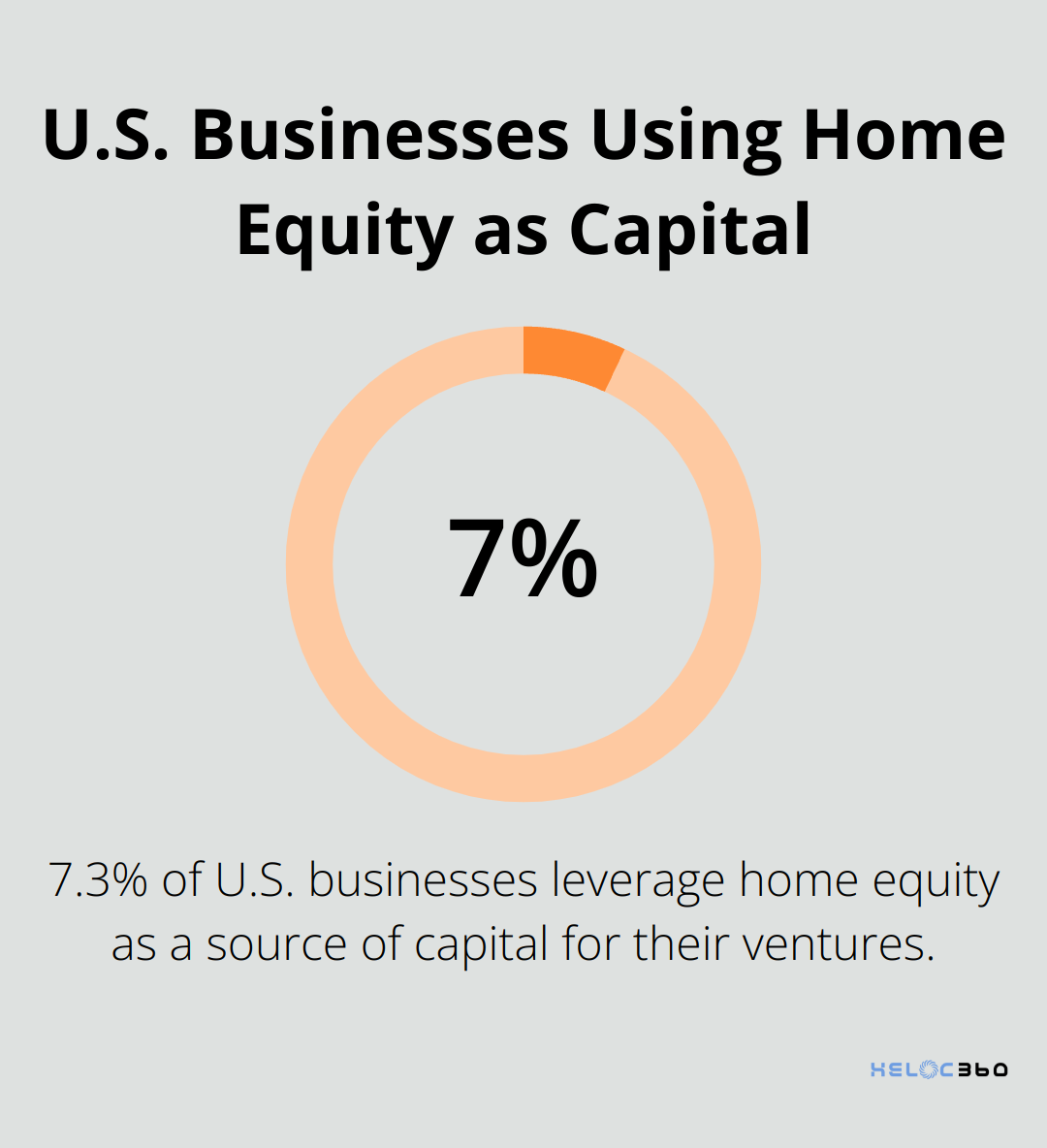

The U.S. Census Bureau reports that 7.3% of U.S. businesses use home equity as capital, highlighting a growing trend among entrepreneurs who turn to their homes as a funding source. This approach proves particularly advantageous for those who might face challenges in securing traditional business loans, especially during the early stages of their venture.

Flexibility: A Key Advantage

One of the most significant benefits of using a HELOC for business capital lies in its flexibility. Unlike traditional business loans that provide a lump sum, a HELOC allows you to draw funds as needed (up to your approved credit limit). This flexibility proves crucial for managing cash flow, particularly in businesses with seasonal fluctuations.

Cost-Effective Financing Options

HELOCs typically offer lower interest rates compared to other forms of business financing. This difference can translate to substantial savings over time, allowing you to reinvest more money back into your business.

HELOC vs. Traditional Business Loans

While traditional business loans have their place, HELOCs offer several distinct advantages:

- Simpler application process: HELOCs often require less paperwork and time to process.

- No business plan required: Unlike many business loans, HELOCs typically don’t demand extensive financial projections.

- Faster access to funds: Once approved, you can access your HELOC funds quickly and easily.

However, it’s important to note that using a HELOC for business purposes comes with risks. The variable interest rates of HELOCs can fluctuate, potentially increasing your costs over time. Moreover, since your home serves as collateral, you face the risk of foreclosure if you’re unable to repay the loan.

Navigating the HELOC Landscape

To make the most of a HELOC for your business, you need to understand your options and connect with lenders that best fit your unique situation. This is where platforms like HELOC360 come into play, offering guidance and resources to help you navigate the HELOC landscape effectively.

As you consider a HELOC to fuel your entrepreneurial dreams, it’s essential to explore strategies for maximizing the benefits of a HELOC in your business operations. Let’s examine some practical ways to put your HELOC to work for your business.

How Can You Maximize Your HELOC for Business Growth?

Smart Inventory Management to Jumpstart Your Business

A Home Equity Line of Credit (HELOC) can revolutionize your inventory management strategy. Use your HELOC to take advantage of bulk discounts and maintain optimal stock levels. The National Retail Federation predicts that retailers will use AI to streamline operations, optimize inventory, and accelerate product design based on consumer preferences and trends in 2025. This approach allows you to meet customer demand without tying up all your cash, potentially boosting your bottom line while maintaining reserves for other business needs.

Smooth Out Cash Flow Fluctuations

Many businesses face seasonal fluctuations or irregular income streams. A HELOC can act as a financial buffer during lean periods. For example, a landscaping business might use a HELOC to cover payroll and equipment costs during winter months (when income typically drops). This strategy allows the business to retain skilled workers and prepare for the busy spring season without financial strain.

Invest in Growth-Driving Equipment

Upgrading your equipment or technology can significantly boost your business’s productivity and competitiveness. The flexibility of a HELOC makes it an excellent tool for these strategic purchases. The Equipment Leasing and Finance Association reported that the equipment finance industry saw new business volume increase 6.3% in 2022. You could experience similar improvements in your business operations by using your HELOC for strategic equipment purchases.

Create a Clear Plan for HELOC Usage

When you consider using your HELOC for business purposes, it’s important to have a clear plan for how the funds will generate returns. This approach ensures you use your home equity strategically to fuel sustainable business growth. Try to outline specific goals and expected outcomes for each use of your HELOC funds.

Seek Professional Advice

While a HELOC can be a powerful tool for business funding, it’s crucial to use it wisely. Always consider the potential risks and establish a solid repayment plan. If you’re unsure about how to best leverage your HELOC for your business, seek advice from financial professionals. They can provide personalized guidance based on your specific business needs and financial situation.

As you explore these strategies for maximizing your HELOC, it’s equally important to understand the potential risks and considerations associated with using home equity for business purposes. Let’s examine these factors to ensure you make informed decisions about leveraging your HELOC for entrepreneurial success. Using a HELOC to start a business can offer lower interest rates compared to other types of loans and flexible borrowing options.

What Are the Risks of Using a HELOC for Your Business?

The Challenge of Variable Interest Rates

Home Equity Lines of Credit (HELOCs) typically come with variable interest rates, which can fluctuate based on market conditions. The latest data from the Federal Reserve indicates that the average personal loan rate is 11.66% and the average credit card rate is 21.37% APR. However, these rates can change, potentially increasing your monthly payments.

To address this risk, you should set aside a portion of your business income to cover potential rate increases. Some financial advisors recommend budgeting for a 2-3% rate increase to prepare for market fluctuations.

Navigating Personal and Business Finance Boundaries

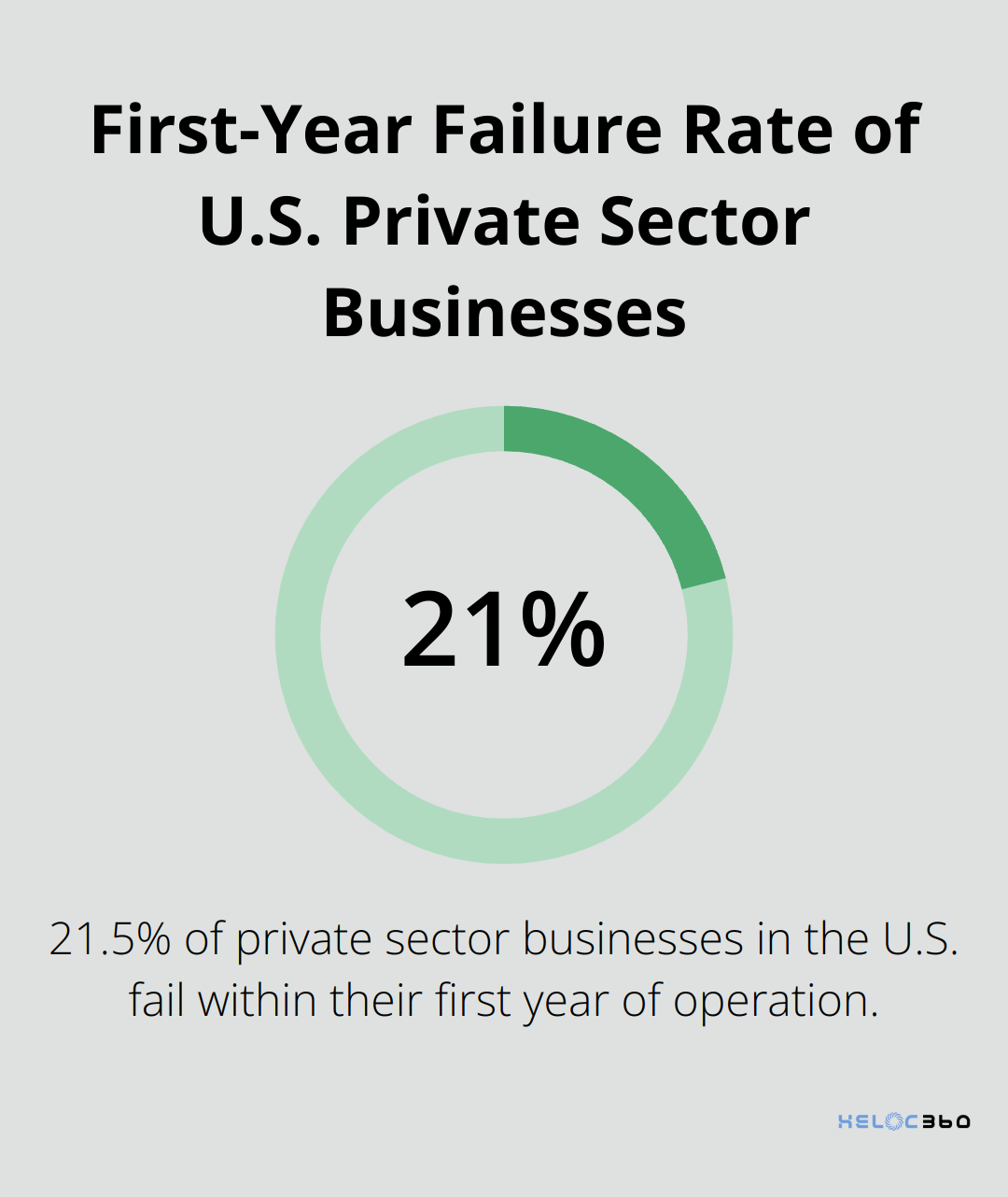

Using a HELOC for your business means putting your personal assets at stake. If your business encounters difficulties, you could risk losing your home. According to recent statistics, 21.5% of private sector businesses in the U.S. fail in the first year.

To protect yourself, you need to maintain a clear separation between personal and business finances. Set up a dedicated business account for HELOC funds and keep meticulous records of how you use the money. This approach not only helps with tax purposes but also provides a clear picture of your business’s financial health.

The Importance of a Comprehensive Business Plan

A well-crafted business plan is essential when you use a HELOC for your venture. Scientific research shows that companies with written business plans grow 30% faster, making it a crucial tool for long-term success.

Your business plan should include:

- Realistic financial projections

- A clear repayment strategy for your HELOC

- Contingency plans for market downturns or unexpected challenges

You should consider working with a business advisor or financial planner to refine your strategy. Many local Small Business Development Centers offer free or low-cost consulting services to help entrepreneurs develop robust business plans.

Assessing Market Volatility

Market conditions can significantly impact your business’s success and your ability to repay your HELOC. Economic downturns, changes in consumer behavior, or industry-specific challenges can all affect your revenue streams.

To mitigate this risk, you should diversify your business offerings (if possible) and stay informed about market trends. Regular market analysis and adaptability in your business strategy can help you navigate uncertain times more effectively.

Understanding the Long-term Commitment

Taking out a HELOC for your business is a long-term financial commitment. The typical HELOC has a draw period of 5-10 years, followed by a repayment period of 10-20 years. This extended timeline means you’ll need to consider how your business might evolve over the coming decades.

You should create a long-term financial plan that accounts for both your business growth projections and your HELOC repayment obligations. This foresight can help you avoid financial strain in the future and ensure that your use of home equity aligns with your overall business goals.

Final Thoughts

A HELOC can fuel your entrepreneurial dreams by providing flexible funding for your business. You will gain access to lower interest rates compared to traditional business loans and credit cards. However, you must plan carefully and assess the risks and rewards of using your home equity for business purposes.

A solid business plan and repayment strategy are essential for HELOC business success. You should stay informed about market trends and seek professional advice to make smart decisions. HELOC360 offers expert guidance and connects you with lenders that match your unique needs and goals.

You can unlock your home’s full potential and turn it into a springboard for your business ambitions. Explore your options with HELOC360 to transform your entrepreneurial vision into reality. A HELOC can become a valuable asset in your business journey with strategic use and careful planning.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.