At HELOC360, we often encounter questions about HELOC bankruptcy. Many homeowners wonder if filing for bankruptcy can eliminate their HELOC debt.

The answer isn’t straightforward and depends on various factors, including the type of bankruptcy filed and the equity in your home.

This post will explore how different bankruptcy chapters treat HELOC debt and what it means for homeowners facing financial difficulties.

What Are HELOCs and How Do They Work in Bankruptcy?

Understanding HELOCs

A Home Equity Line of Credit (HELOC) functions as a revolving credit line secured by your home’s equity. It operates similarly to a credit card, allowing you to borrow up to a set limit, repay, and borrow again. HELOCs typically have two phases:

- Draw period (usually 10 years): You can borrow and make interest-only payments.

- Repayment period: You pay back principal and interest.

As of July 23, 2025, the national average HELOC interest rate is 8.26% according to Bankrate’s latest survey.

Bankruptcy Types and Their Impact

When financial hardship strikes, some homeowners consider bankruptcy. The two main types are:

- Chapter 7 (“liquidation” bankruptcy): This type can eliminate unsecured debts quickly. However, it doesn’t automatically wipe out HELOC debt because it’s secured by your home.

- Chapter 13 (“reorganization” bankruptcy): This option allows you to keep your assets while repaying debts over 3-5 years. It offers more flexibility in handling HELOC debt.

HELOCs in Bankruptcy Proceedings

In both bankruptcy types, your HELOC is treated as a secured debt. This means the lender has a legal claim (lien) on your property. Even if the bankruptcy discharges your personal liability for the debt, the lien remains.

Keeping Your Home and HELOC

If you want to keep your home in Chapter 7, you’ll need to continue paying your HELOC. In Chapter 13, you might include HELOC arrears in your repayment plan.

A key factor is your home’s value. If it’s worth less than your first mortgage, you might “strip off” the HELOC in Chapter 13, treating it as unsecured debt. This could potentially lead to partial or full discharge of the HELOC balance.

The Complexity of HELOC Bankruptcy

The process of managing HELOC debt through bankruptcy is complex, and outcomes vary widely based on individual circumstances. Factors such as home value, equity, and the specific terms of your HELOC all play a role in determining the best course of action.

As we move forward, we’ll explore how Chapter 7 bankruptcy specifically treats HELOC debt and what this means for homeowners facing financial difficulties.

How Chapter 7 Bankruptcy Affects Your HELOC

The Secured Nature of HELOCs in Chapter 7

Chapter 7 bankruptcy doesn’t erase your HELOC. As a secured debt, it receives different treatment from unsecured debts like credit cards or personal loans. While Chapter 7 bankruptcy can eliminate personal liability on a second mortgage or HELOC, it cannot strip the lien from the property. The lender maintains a legal claim on your property, even if the bankruptcy discharges your personal liability for the debt. This security interest survives bankruptcy, which forces homeowners to make important decisions.

Keep or Surrender: Your Main Options

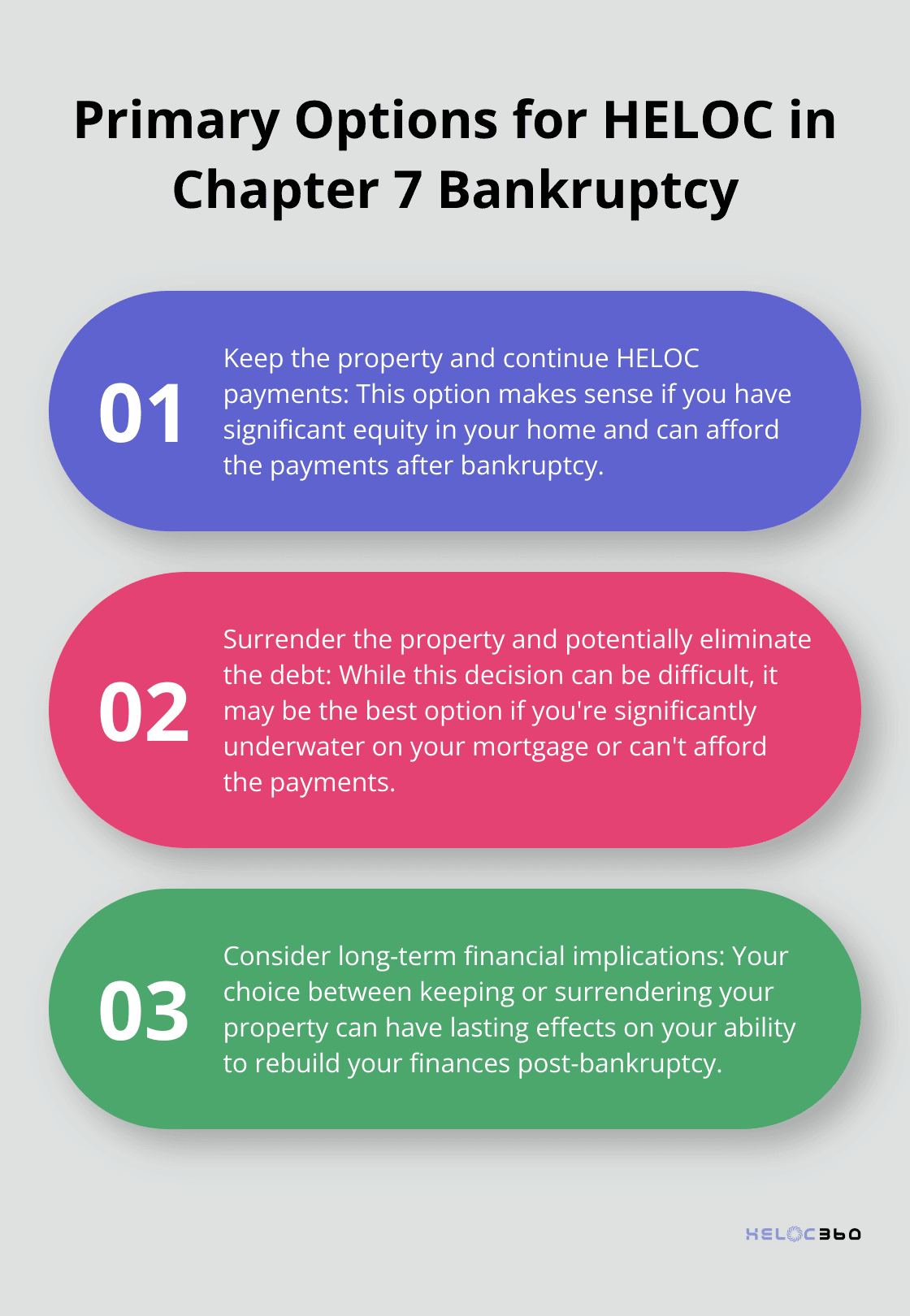

Chapter 7 typically presents two primary options for dealing with your HELOC:

- Keep the property and continue HELOC payments

- Surrender the property and potentially eliminate the debt

Keeping your home requires you to continue payments on both your primary mortgage and HELOC. This option makes sense if you have significant equity in your home and can afford the payments after bankruptcy.

Surrendering the property means giving up your home to the lender. While this decision can be difficult, it may be the best option if you’re significantly underwater on your mortgage or can’t afford the payments.

The Reality of Lien Stripping in Chapter 7

Many people believe lien stripping (the process of removing a junior lien like a HELOC) is possible in Chapter 7 bankruptcy. However, this option is primarily reserved for Chapter 13 cases. The U.S. Supreme Court has ruled against allowing debtors to “strip down” liens to the judicially determined value of the collateral in Chapter 7 cases.

Financial Implications of Your Decision

Your choice between keeping or surrendering your property can have long-lasting financial effects. If you keep the property, you’ll need to reaffirm the debt, which means you’ll remain personally liable for it even after bankruptcy. This could impact your ability to rebuild your finances post-bankruptcy.

If you surrender the property, you may face a deficiency judgment if the sale of your home doesn’t cover the full amount owed on your HELOC and primary mortgage. However, in many cases, the bankruptcy can discharge this deficiency.

Navigating the Complexities

The process of managing HELOC debt through Chapter 7 bankruptcy is complex. Outcomes vary widely based on individual circumstances. Factors such as home value, equity, and the specific terms of your HELOC all play a role in determining the best course of action.

While Chapter 7 bankruptcy can provide relief from overwhelming debt, it’s important to understand its effects on secured debts like HELOCs. In most cases, a creditor’s lien survives Chapter 7 bankruptcy, allowing the creditor to take the property after the bankruptcy case closes. As we move forward, we’ll explore how Chapter 13 bankruptcy treats HELOC debt differently, offering additional options for homeowners facing financial difficulties.

How Chapter 13 Bankruptcy Handles HELOC Debt

Restructuring Your HELOC in Chapter 13

Chapter 13 bankruptcy, or reorganization bankruptcy, allows you to keep your property while reorganizing debts into a manageable repayment plan. This type of bankruptcy offers more flexibility for homeowners with HELOC debt compared to Chapter 7. It allows you to restructure your debts and potentially save your home, even if you’re behind on payments.

In a Chapter 13 bankruptcy, you propose a repayment plan to catch up on missed payments over three to five years. This plan can include your HELOC debt, giving you time to get back on track without losing your home.

The Power of Lien Stripping

One of the most powerful tools in Chapter 13 bankruptcy is lien stripping. This process can turn your HELOC from a secured debt into an unsecured one if your home’s value has dropped below the balance of your first mortgage.

For example, if your home is worth $200,000, your first mortgage balance is $220,000, and you have a $50,000 HELOC, the court may strip the HELOC lien. This means you might only have to pay a small portion of the HELOC debt in your repayment plan.

Impact on Monthly Payments and Overall Debt

Chapter 13 bankruptcy can significantly reduce your monthly payments and overall debt burden. By including your HELOC in the repayment plan, you spread the payments over a longer period, making them more manageable.

For instance, if you owed $30,000 on your HELOC and struggled with $500 monthly payments, your Chapter 13 plan might reduce this to $200 per month over five years. This could make the difference between keeping and losing your home.

Moreover, any remaining HELOC balance at the end of your repayment plan may be discharged, potentially saving you thousands of dollars.

Unsecured Debt Treatment in Chapter 13

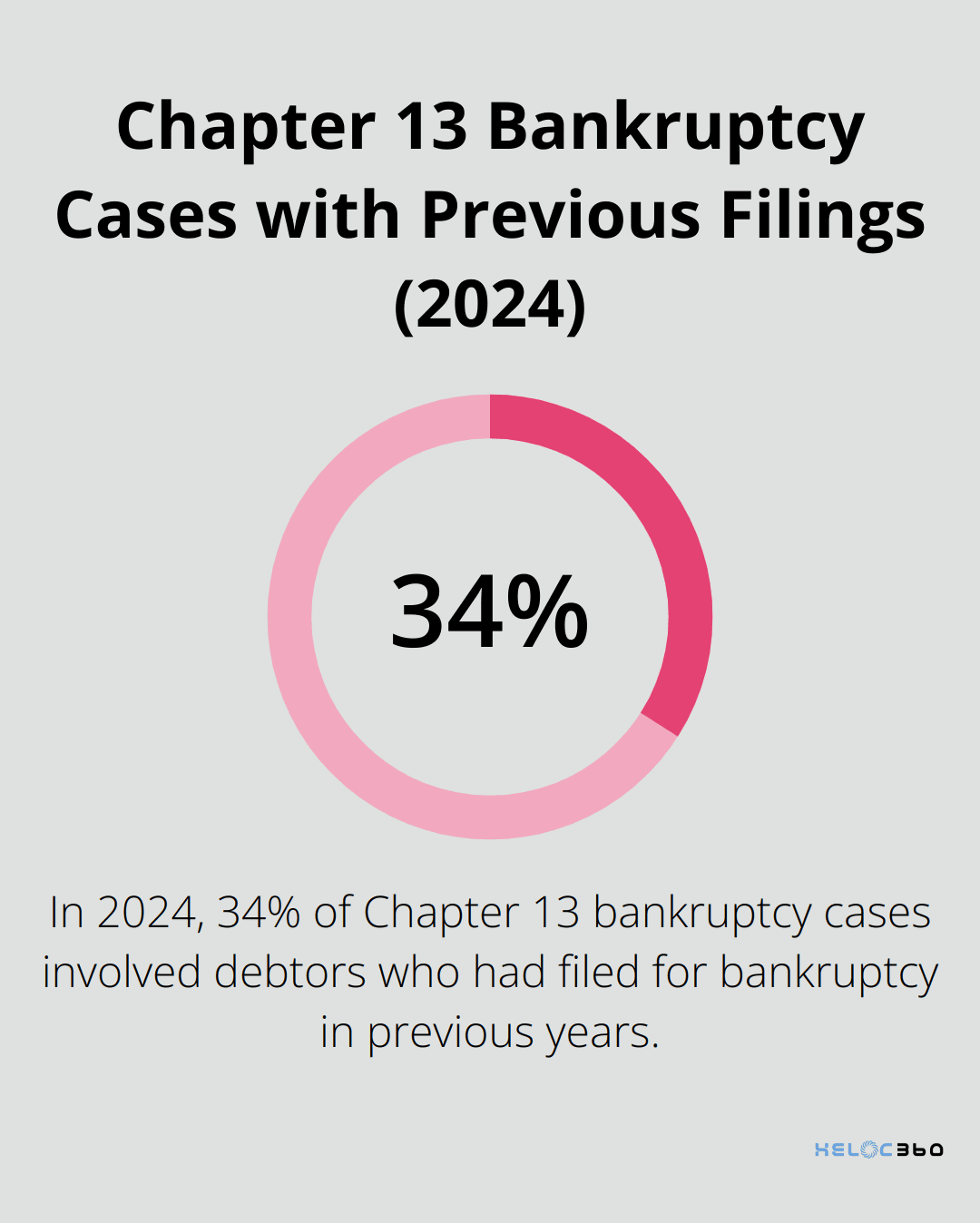

The U.S. Bankruptcy Court reported that in 2024, in 34 percent of the 192,789 chapter 13 cases filed, debtors stated that they had filed a bankruptcy petition during the previous years.

This treatment of unsecured debt (which your HELOC may become) can provide substantial relief. It’s important to note that the exact percentage you’ll pay depends on various factors, including your income, expenses, and the value of your non-exempt assets.

Navigating the Chapter 13 Process

The Chapter 13 process involves several steps, including filing a petition, attending a meeting of creditors, and getting your repayment plan approved by the court. Throughout this process, you’ll need to provide detailed financial information and adhere to the terms of your repayment plan.

While Chapter 13 can be complex, it offers unique benefits for homeowners with HELOC debt. It provides a structured way to catch up on payments, potentially strip liens, and reduce overall debt burden. However, it’s essential to consult with a qualified bankruptcy attorney to understand how these provisions might apply to your specific situation.

Final Thoughts

HELOC bankruptcy involves complex decisions that require expert guidance. The treatment of HELOC debt differs significantly between Chapter 7 and Chapter 13 bankruptcy, with Chapter 13 offering more flexibility. Homeowners should explore all alternatives before considering bankruptcy, as it can have long-lasting consequences on credit and financial stability.

A qualified bankruptcy attorney can provide personalized advice based on your specific financial situation. Every financial situation is unique, and the best solution varies for each homeowner. Proactive action and understanding your options will help secure your financial future and protect your home.

For those who want to leverage their home equity responsibly, HELOC360 offers comprehensive solutions tailored to your financial goals. Our platform connects you with lenders that fit your needs, helping you make informed decisions about using your home’s equity. Act now to take control of your financial future and protect your most valuable asset.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.