At HELOC360, we often get asked about using home equity lines of credit for investment purposes. HELOC investing has become increasingly popular among homeowners looking to leverage their property’s value.

This strategy can offer unique opportunities, but it also comes with significant risks. In this post, we’ll explore the potential benefits and drawbacks of using a HELOC for investments, helping you make an informed decision about this financial approach.

What Are the Risks and Rewards of HELOC Investing?

Understanding HELOC Basics

A Home Equity Line of Credit (HELOC) allows homeowners to borrow against their property’s equity. While HELOCs traditionally fund home improvements or debt consolidation, investors now consider them for various investment purposes. This shift opens new opportunities but introduces significant risks that require careful evaluation.

HELOCs typically offer lower interest rates compared to personal loans or credit cards. This makes them an attractive option for accessing funds. However, your home serves as collateral for a HELOC, which means defaulting on payments could put your property at risk.

The Investment Potential of HELOCs

Using a HELOC for investments can become a powerful strategy when executed correctly. Real estate investors might use HELOC funds to purchase additional properties or finance renovations on existing ones. The potential returns from these investments could exceed the HELOC’s interest rate, creating a profitable scenario.

Stock market investments represent another avenue some consider with HELOC funds. However, this approach carries higher risks due to market volatility. Financial experts generally recommend that investment returns should exceed 10% to justify using HELOC funds in the stock market, considering the interest payments and potential risks involved.

Assessing the Risks

The primary risk of using a HELOC for investments lies in the possibility of losing both your investment and your home equity if things go wrong. Market downturns or poor investment choices could leave you with debt that exceeds the value of your investment, while still obligating you to repay the HELOC.

Moreover, HELOC interest rates often vary, tied to the prime rate. This means your borrowing costs could increase over time, potentially reducing your investment returns. The Federal Reserve’s decisions on interest rates directly impact HELOC costs, adding another layer of uncertainty to this strategy.

Mitigating Risks in HELOC Investing

To mitigate risks associated with HELOC investing, consider these strategies:

- Diversify your investments to spread risk

- Maintain a cash reserve for HELOC payments

- Monitor market conditions and adjust your strategy accordingly

- Consult with financial advisors to create a solid investment plan

The Importance of Financial Assessment

Before considering HELOC investments, thoroughly assess your financial situation and risk tolerance. It’s essential to have a solid repayment plan and avoid over-leveraging your home equity. Preserving your home’s equity should remain a priority in any financial strategy involving HELOCs.

As we move forward, let’s explore specific investment options you can consider with HELOC funds, each with its own set of potential benefits and risks.

Where Can You Invest HELOC Funds?

Real Estate Investments

Real estate remains a popular choice for HELOC investors. Rental properties provide steady income streams, while fix-and-flip projects offer potential for quick profits. Most experts anticipate continued growth in home equity through 2025, albeit at a more modest pace than in recent years. This appreciation trend makes real estate an attractive option for many investors.

Real estate investments require significant capital and ongoing management. Investors must account for property taxes, maintenance costs, and potential vacancies. The 1% rule (monthly rent equals at least 1% of the purchase price) helps quickly assess potential rental properties.

Stock Market Investments

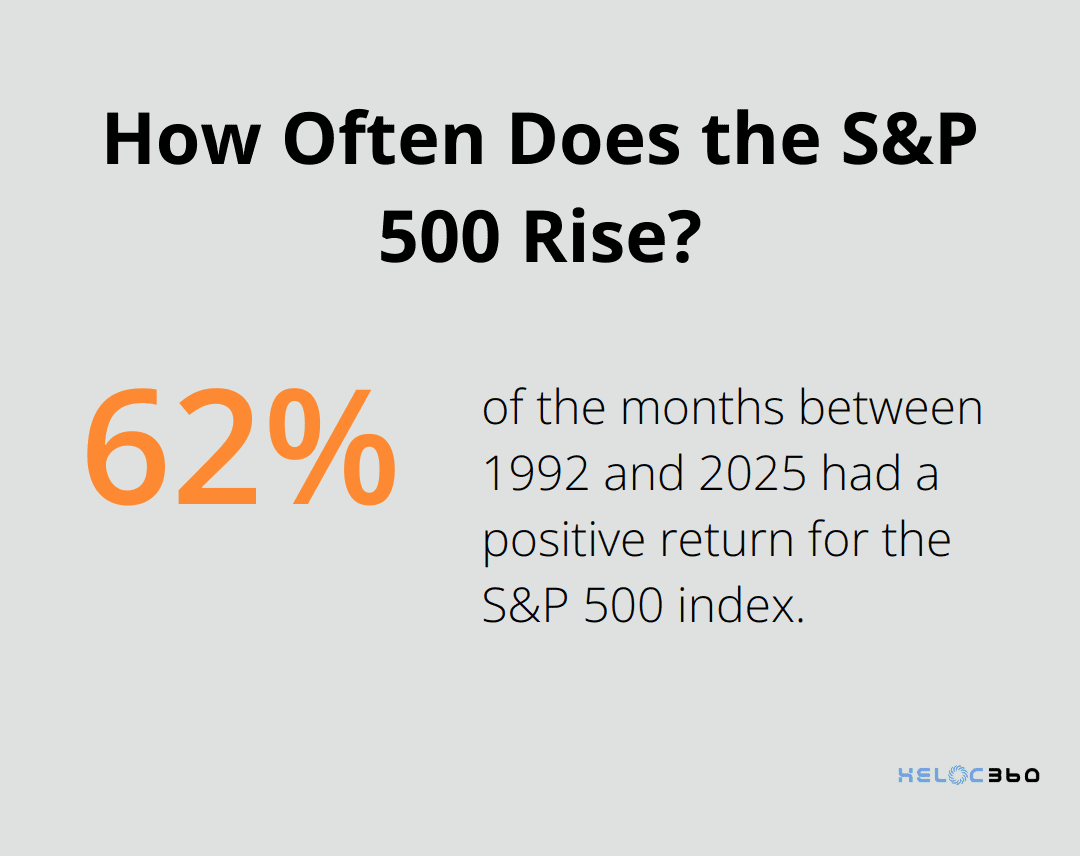

The stock market offers liquidity and potential for high returns. The S&P 500 index had a positive return during 247 of the 396 months (62%) between 1992 and 2025. However, short-term volatility can be significant.

When investing HELOC funds in stocks, diversification reduces risk. Low-cost index funds or ETFs that track broad market indices provide exposure to a wide range of companies, minimizing risk compared to individual stock picking.

Business Ventures and Startups

Using HELOC funds to start or expand a business can yield substantial returns, but it carries risks. Survival rates for new business establishments vary from year to year due to several factors, including the business cycle, industry, and location.

Before investing in a business, develop a comprehensive business plan. SCORE, a network of volunteer business mentors supported by the U.S. Small Business Administration, offers free guidance to increase success chances.

Alternative Investments

Alternative investments like cryptocurrencies, peer-to-peer lending, or art offer high potential returns but come with significant risks. For example, Bitcoin’s value increased by over 150% in 2024 but also experienced a 30% drop within a single month.

For alternative investments, limit exposure to a small portion of your portfolio (typically no more than 5-10%). Research any alternative investment thoroughly and understand its unique risks before committing HELOC funds.

Regardless of the investment option, a solid strategy and risk management plan are essential. The next section will explore key considerations to keep in mind before using a HELOC for investments, helping you make informed decisions about leveraging your home equity.

How to Evaluate HELOC Investment Risks

Assess Your Financial Health

Start with an examination of your current financial status. Calculate your estimated DTI ratio by entering your current income and payments. Review your credit score, as it significantly impacts HELOC interest rates. A FICO score of 740 or higher typically qualifies for the best HELOC rates (according to Experian).

Next, evaluate your cash flow. Make sure you have enough income to cover potential HELOC payments, even if your investments underperform. Financial advisors often suggest you maintain a six-month emergency fund before you consider HELOC investments.

Develop a Robust Investment Strategy

A solid investment strategy is essential when you use borrowed funds. Diversification works by spreading your investments across and within different asset classes to mitigate investment risk and decrease market volatility.

Consider your investment timeline. Short-term investments using HELOC funds carry more risk due to market fluctuations. Longer-term strategies allow more time to weather market ups and downs.

Understand Tax Implications

The Tax Cuts and Jobs Act of 2017 changed the rules for HELOC interest deductions. Deducting home equity loan interest can save you money on your tax bill, but you have to understand the rules under the TCJA of 2017. Consult a tax professional to understand how your specific investment plans might affect your tax situation.

Compare HELOC Rates and Investment Returns

HELOC rates typically range from 6% to 10% (depending on your credit score and market conditions). To justify using a HELOC for investments, your expected returns should exceed this rate by a significant margin to account for risk.

For context, the S&P 500 has historically returned an average of about 10% annually, but with significant year-to-year variations. Real estate investments often target returns of 8-12% or higher, depending on the strategy and local market conditions.

Past performance doesn’t guarantee future results. Always factor in potential market downturns when you project investment returns.

Seek Professional Advice

Financial advisors can provide valuable insights into the risks and potential rewards of using a HELOC for investments. They can help you create a personalized strategy that aligns with your financial goals and risk tolerance.

Try to find an advisor with experience in HELOC investing. They can offer guidance on how to structure your investments to maximize potential returns while minimizing risks.

Final Thoughts

HELOC investing offers homeowners a unique opportunity to leverage their property’s equity for potential financial growth. This strategy comes with significant risks that require careful consideration, including the possibility of losing both your investment and home equity if things go wrong. Successful HELOC investing demands thorough financial assessment, a robust investment strategy, and a clear understanding of the associated risks.

The decision to use your home’s equity for investments should be made after careful consideration and with the guidance of financial professionals. Tax implications, HELOC rates, and potential investment returns are critical factors to evaluate before proceeding with this strategy. Your home is more than just an investment-it’s your sanctuary, and any decision to use its equity should be approached with caution.

At HELOC360, we understand the complexities of HELOC investing and strive to help homeowners make informed decisions. Our platform offers solutions and expert guidance to ensure you have the knowledge and resources needed to navigate this financial strategy effectively (while safeguarding your most valuable asset). HELOC investing can open doors to new financial opportunities when approached with proper planning and risk management.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.