Home equity lines of credit (HELOCs) can be a powerful financial tool for homeowners. However, the terminology surrounding these loans can be confusing.

At HELOC360, we believe that understanding HELOC terms is essential for making informed decisions about your home’s equity. This guide will break down the most important HELOC terms every homeowner should know.

What Is a HELOC?

Definition and Basics

A Home Equity Line of Credit (HELOC) is a financial product that allows homeowners to borrow against the equity they’ve built in their property. Unlike a traditional loan, a HELOC provides a revolving line of credit (similar to a credit card), but with the added security of your home as collateral.

How HELOCs Work

When you apply for a HELOC, lenders typically allow you to borrow up to 80-85% of your home’s value, minus the amount you still owe on your mortgage. For example, if your home is worth $300,000 and you owe $200,000 on your mortgage, you might be eligible for a HELOC of up to $55,000 (85% of $300,000 = $255,000, minus $200,000 = $55,000).

HELOC vs. Home Equity Loan

While both HELOCs and home equity loans tap into your home’s equity, they function differently:

- A home equity loan provides a lump sum upfront with fixed monthly payments.

- A HELOC offers flexibility in borrowing and repayment.

With a HELOC, you only pay interest on the amount you actually borrow, not the entire credit line. This can result in significant savings compared to a home equity loan if you don’t need the full amount immediately.

Key Features of HELOCs

HELOCs come with unique features that set them apart from other financial products:

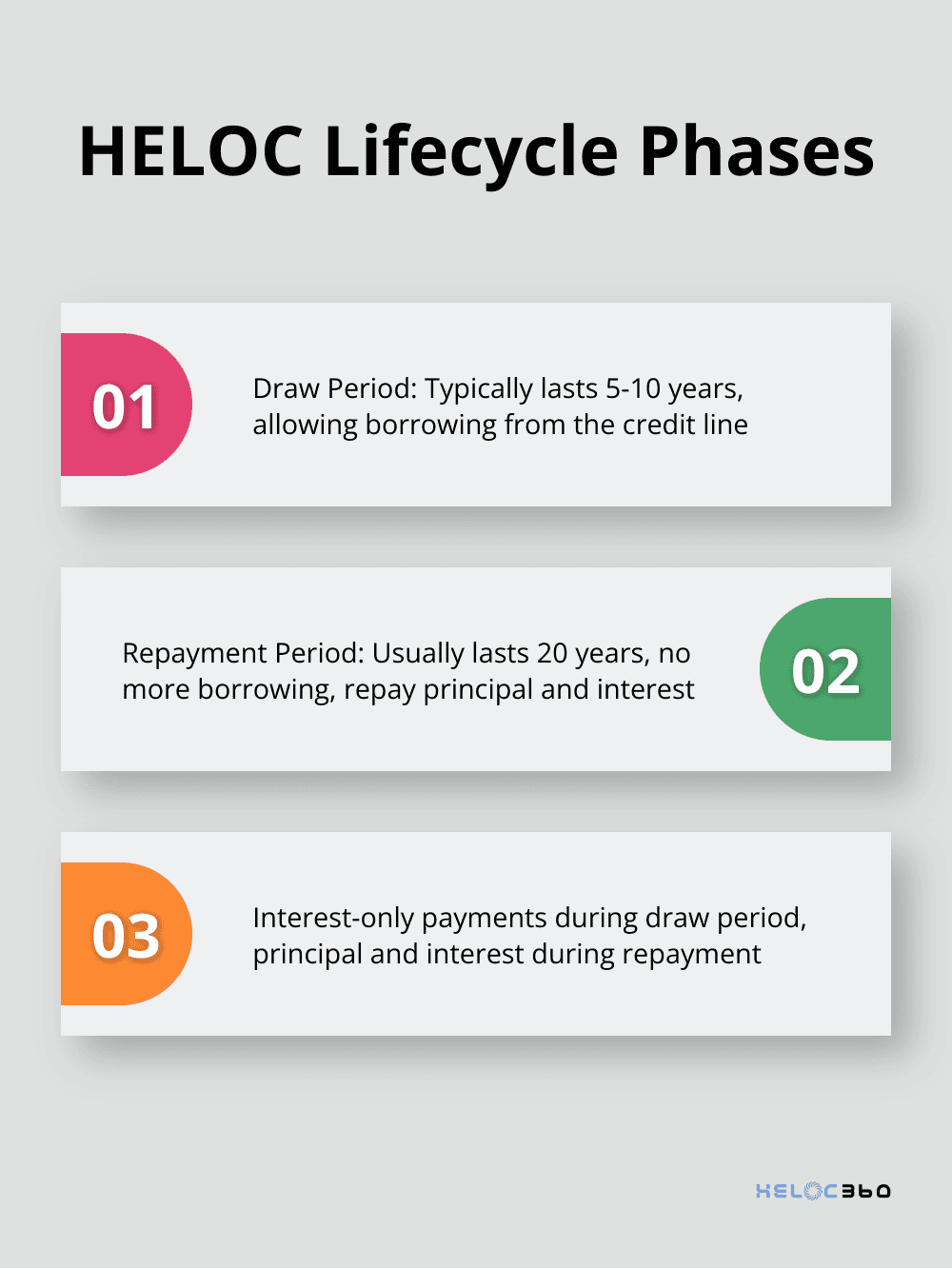

- Draw Period: This phase typically lasts up to 10 years. During this time, you’re usually only required to pay interest on what you borrow.

- Repayment Period: After the draw period ends, the repayment period begins (usually lasting 10-20 years). You can no longer borrow funds and must repay both principal and interest.

- Variable Interest Rates: Most HELOCs have variable interest rates, which can fluctuate based on market conditions. According to recent data from Bankrate, the national average HELOC interest rate is 8.02%, as of April 16, 2025. However, some lenders offer fixed-rate options for more predictable payments.

Importance of Understanding HELOC Terms

Understanding these features is essential before committing to a HELOC. Many platforms (such as HELOC360) provide detailed information and expert guidance to help you make an informed decision about whether a HELOC aligns with your financial goals.

As we move forward, let’s explore the essential HELOC terms every homeowner should know to navigate this financial tool effectively.

Key HELOC Terms Every Homeowner Should Know

Draw Period and Repayment Period

A HELOC’s lifecycle consists of two main phases: the draw period and the repayment period. The draw period typically lasts 5 to 10 years. During this time, homeowners can borrow from their credit line as needed. Most lenders only require interest payments on the borrowed amount during this phase.

The repayment period begins after the draw period ends. This phase usually lasts 20 years. Borrowers can no longer access funds from the credit line and must repay both the principal and interest on their outstanding balance. Monthly payments often increase during this period, so it’s important to plan ahead.

Variable Interest Rates and APR

Most HELOCs feature variable interest rates that fluctuate based on market conditions. These rates are directly tied to the Prime rate, so when the Prime rate rises or falls, your interest rate and monthly payment can change, too.

The Annual Percentage Rate (APR) represents the yearly cost of borrowing, including interest and fees. Comparing APRs proves essential when shopping for HELOCs, as they offer a comprehensive view of the total cost.

Some lenders offer rate caps to limit interest rate increases over time. For example, a HELOC might have a lifetime cap of 18%, ensuring your rate never exceeds this percentage, regardless of market conditions.

Credit Limit and Available Credit

Your HELOC’s credit limit represents the maximum amount you can borrow. Lenders typically base this limit on your home’s value, outstanding mortgage balance, and creditworthiness. The available credit is the unused portion of your credit limit.

For instance, if you have a $100,000 HELOC and you’ve borrowed $30,000, your available credit would be $70,000. Regular monitoring of your available credit ensures you have funds when needed.

Loan-to-Value Ratio (LTV)

The Loan-to-Value ratio plays a key role in determining your HELOC’s credit limit. An LTV ratio is calculated by dividing the amount borrowed by the appraised value of the property, expressed as a percentage. Most lenders cap the combined LTV at 80-85%.

Consider this example: If your home is worth $400,000 and you owe $250,000 on your mortgage, a lender with an 85% LTV limit might offer you a HELOC of up to $90,000 ($400,000 x 85% = $340,000 – $250,000 = $90,000).

Understanding these terms empowers homeowners to make informed decisions about HELOCs. However, the terms discussed so far only scratch the surface. Let’s explore some important clauses and conditions found in HELOC agreements that can significantly impact your borrowing experience.

What’s Hidden in HELOC Fine Print?

Prepayment Penalties: A Costly Surprise

Some HELOC agreements include prepayment penalties. These fees apply if you pay off your HELOC balance early or close the account before a specified time. For instance, if you close a HELOC before three years has elapsed, you may pay a 3 percent penalty or you could be charged a 5 percent penalty.

To avoid unexpected costs, ask your lender about prepayment penalties upfront. Try to negotiate their removal or reduction. Alternatively, seek lenders who don’t impose these fees.

The True Cost: Annual Fees and Closing Costs

HELOCs often come with annual fees and closing costs that add up over time. Annual fees typically range from $50 to $100, while closing costs typically range from 2% to 5% of the loan amount, but some lenders may reduce or waive them altogether.

Some lenders offer no-closing-cost HELOCs, but exercise caution. These often come with higher interest rates, which could cost you more in the long run. Always calculate the total cost over the life of the HELOC, including fees and interest, to make an informed decision.

Minimum Draw Requirements: Use It or Lose It

Many HELOCs have minimum draw requirements. These obligations require you to borrow a certain amount within a specified timeframe. For instance, a lender might require you to draw at least $10,000 within the first 30 days of opening the HELOC. If you fail to meet this requirement, you could face fees or even account closure.

If you don’t plan to use a large amount of your HELOC immediately, look for lenders with low or no minimum draw requirements. This flexibility allows you to access funds as needed without unnecessary borrowing.

Right of Rescission: Your Financial Safety Net

The right of rescission is a federal law that gives you three business days to cancel a HELOC agreement without penalty after signing. This cooling-off period proves valuable if you have second thoughts or discover unfavorable terms you missed initially.

To exercise this right, you must notify the lender in writing within the three-day window. The clock starts ticking from the moment you sign the agreement, receive the Truth in Lending disclosure, and receive two copies of the right to cancel notice.

Understanding these clauses and conditions is essential for making an informed decision about a HELOC. The flexibility of a HELOC can be attractive, but you must weigh the potential costs and obligations carefully. A thorough review of the agreement and pointed questions about these terms will help ensure that a HELOC aligns with your financial goals and helps you avoid costly surprises down the road.

Final Thoughts

Understanding HELOC terms empowers homeowners to make informed decisions about their home’s equity. HELOC360 simplifies the process, providing homeowners with knowledge and resources to navigate HELOC terminology confidently. Our platform helps you compare offers from various lenders and find solutions that align with your financial goals.

HELOCs offer flexibility and potentially lower interest rates compared to other forms of borrowing. You can use a HELOC for home improvements, debt consolidation, or creating financial flexibility. HELOC360 helps you unlock the full potential of your home’s equity, making it easier to achieve your financial aspirations.

The financial landscape changes constantly, so staying informed about HELOC terms and conditions is important. With the right knowledge and support, you can harness the power of your home equity to create a brighter financial future. HELOC360 is here to guide you through every step of the process.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.