Thinking about applying for a Home Equity Line of Credit (HELOC)? You might be surprised by some of the criteria lenders use to evaluate applicants.

At HELOC360, we’ve seen many homeowners caught off guard by unexpected HELOC requirements. While credit scores and income are well-known factors, there are several lesser-known qualifications that can make or break your application.

Let’s explore these surprising HELOC criteria and help you better understand your eligibility.

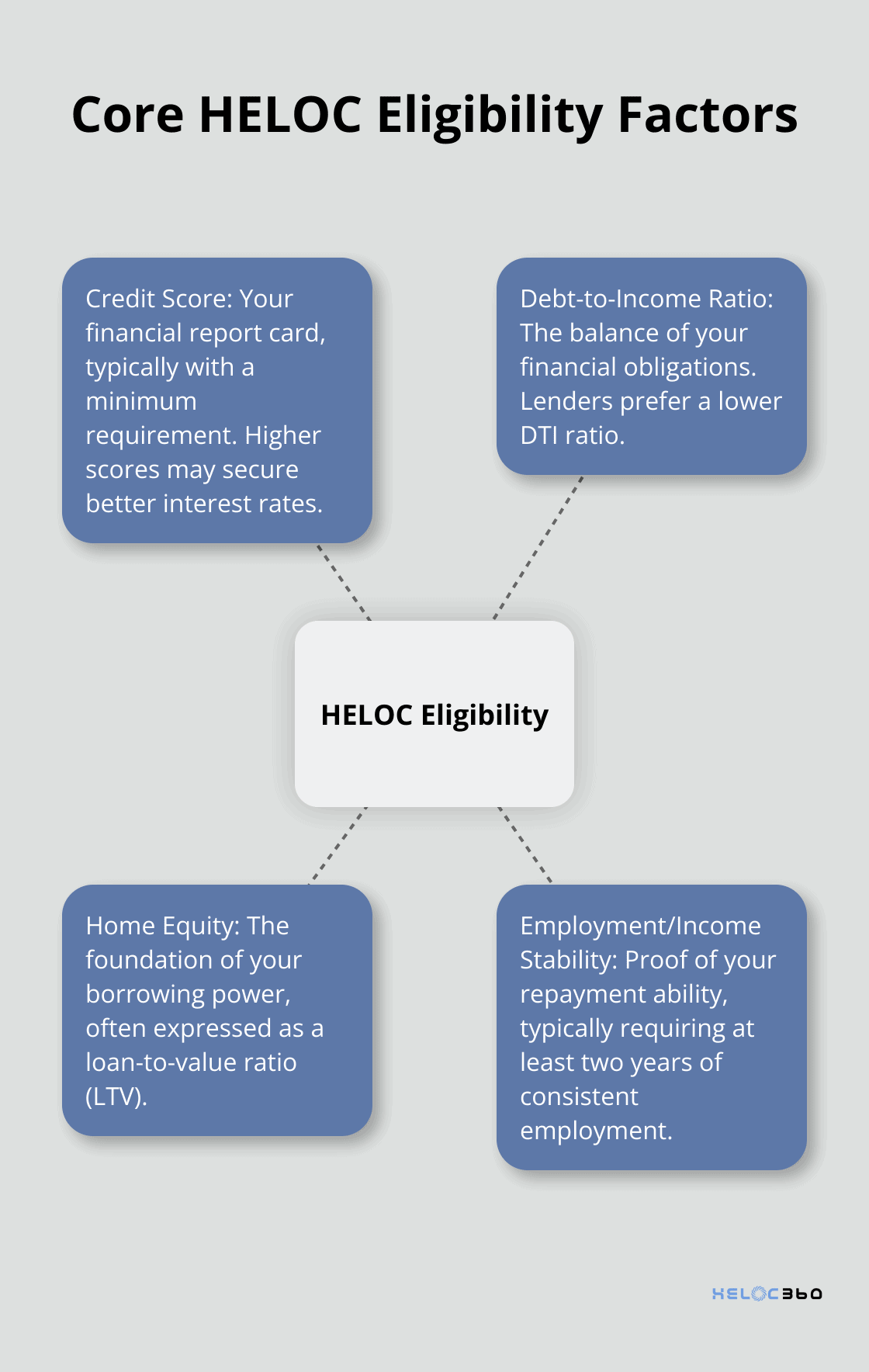

Core HELOC Eligibility Factors: What You Need to Know

When you apply for a Home Equity Line of Credit (HELOC), lenders evaluate several key factors to determine your eligibility. These core criteria can significantly impact your approval chances and the terms you’re offered.

Credit Score: Your Financial Report Card

Your credit score acts as a gateway to HELOC approval. Lenders typically have a minimum credit score requirement, while a higher score may help you secure better interest rates. If your score falls below the lender’s minimum requirement, improve it before applying. Pay down existing debts and ensure timely bill payments to boost your creditworthiness.

Debt-to-Income Ratio: The Balance of Your Financial Obligations

Lenders typically prefer a lower debt-to-income (DTI) ratio. Your debt-to-income ratio is calculated by adding up all your monthly debt payments and dividing them by your gross monthly income. A high DTI? Consider paying off some debts or increasing your income before you apply for a HELOC.

Home Equity: The Foundation of Your Borrowing Power

Most lenders require a certain amount of equity in your home. This is often expressed as a loan-to-value ratio (LTV). Calculate your LTV by dividing your current mortgage balance by your home’s appraised value. For example, if your home is worth $200,000 and you owe $140,000 on your mortgage, your LTV is 70%. More equity often leads to higher borrowing potential and better terms.

Employment and Income Stability: Proving Your Repayment Ability

Lenders want to see a stable income and employment history. Most require at least two years of consistent employment in the same field. Self-employed? You’ll typically need to provide two years of tax returns to verify your income. Lenders will also examine your debt-to-income ratio to ensure you have sufficient income to cover your existing debts plus the potential HELOC payments.

These core eligibility factors form the foundation of your HELOC application. Many applicants express surprise at how these factors interact and impact their eligibility. As you prepare for your HELOC application, focus on these key areas to increase your approval chances and potentially secure better terms.

Now that you understand the core eligibility factors, let’s explore some unexpected HELOC qualifications that might catch you off guard.

Hidden HELOC Hurdles: Unexpected Qualifications You Should Know

Property Type Restrictions

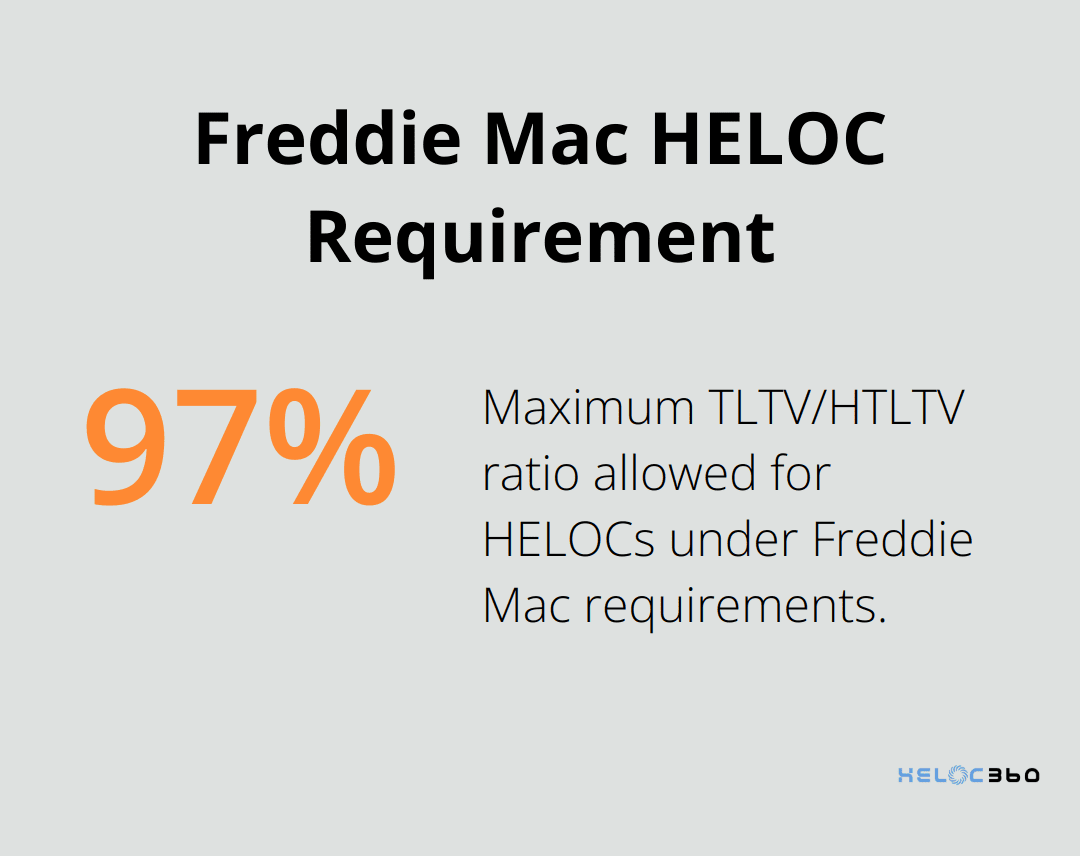

Not all properties qualify equally for HELOCs. Secondary financing that meets Freddie Mac requirements is allowed, including HELOCs, with a TLTV/HTLTV ratio less than or equal to 97%. Single-family homes often sail through, but condominiums, cooperatives, and manufactured homes face additional hurdles. Some lenders refuse HELOCs on these property types, while others demand higher credit scores or lower loan-to-value ratios.

Owners of unique properties (e.g., multi-unit buildings or homes on leased land) should brace for extra scrutiny. These properties challenge appraisers and may increase risk for lenders. Research lenders who specialize in your property type to boost your approval odds.

Occupancy and Usage Requirements

Your property’s intended use impacts HELOC eligibility significantly. Lenders favor primary residences as lower-risk options. Second homes or investment properties attract stricter requirements and potentially higher interest rates.

For primary residences, lenders often require occupancy for a specific number of days annually (typically around 180). If you split time between multiple homes, ensure you meet the primary residence occupancy requirements.

Flood Zones and Insurance Considerations

Location plays a pivotal role in HELOC approval, especially regarding flood risks. Properties in designated flood zones usually require proof of flood insurance. This additional requirement can increase your overall costs and affect debt-to-income ratio calculations.

High-risk flood zones or a history of frequent flooding can make it more difficult to secure a mortgage. Even properties outside high-risk flood zones may need flood certification. This process assesses the property’s flood risk and can influence your HELOC terms. Budget for flood certification costs (typically $15 to $25).

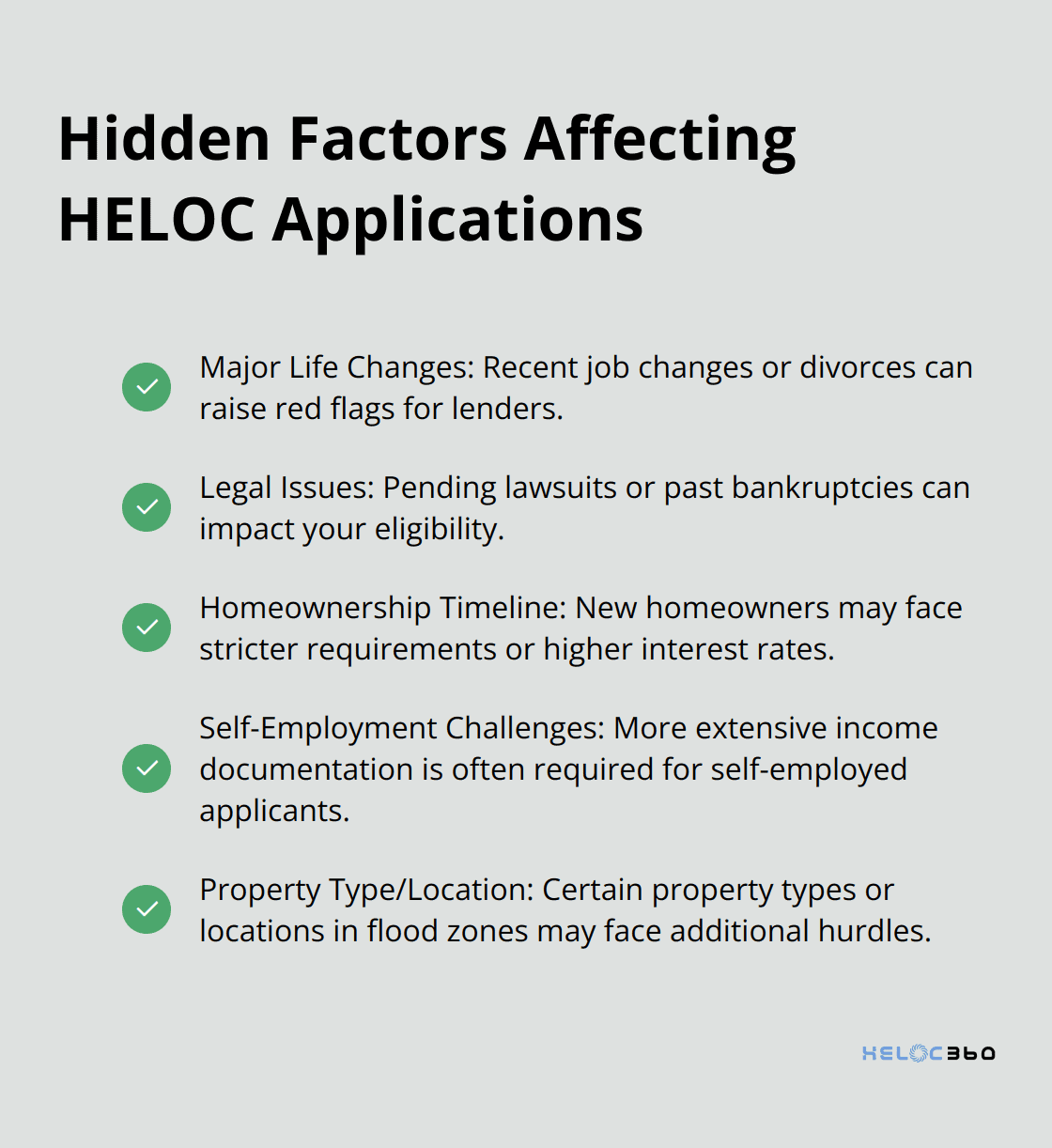

Recent Major Life Events

Significant life changes can affect your HELOC application. Recent job changes, divorces, or major purchases might raise red flags for lenders. They want to see stability in your financial situation. If you’ve experienced a major life event recently, prepare to explain how it impacts your financial stability.

Self-Employment Income Verification

Self-employed applicants face unique challenges when applying for HELOCs. Lenders often require more extensive income documentation, including two years of tax returns and profit and loss statements. Some lenders may also ask for business bank statements or a letter from your accountant. Prepare these documents in advance to streamline your application process.

However, it’s worth noting that some home equity loans allow you to qualify without traditional income verification, which could be beneficial for self-employed individuals.

These unexpected qualifications can catch HELOC applicants off guard. As you move forward with your application, keep these factors in mind and prepare accordingly. The next section will explore additional lesser-known factors that could influence your HELOC approval.

Hidden Factors That Can Make or Break Your HELOC Application

The Impact of Major Life Changes

Lenders scrutinize recent significant life events when evaluating HELOC applications. A job change, even if it’s a promotion, can raise red flags. Lenders typically prefer to see at least two years of stable employment. If you’ve switched careers or become self-employed recently, you might face additional hurdles.

Divorce or separation can also complicate your HELOC application. These events often lead to financial instability and changes in property ownership, which lenders view as risky. If you’ve recently gone through a divorce, prepare to provide additional documentation about your financial situation and property ownership.

Legal Issues and Their Financial Implications

Pending legal issues can severely impact your HELOC eligibility. Lenders view ongoing lawsuits (especially those involving financial disputes) as potential risks. These legal battles could result in judgments against you, affecting your ability to repay the HELOC.

Even resolved legal issues can influence your application. For instance, a past bankruptcy can remain on your credit report for up to 10 years, potentially lowering your credit score and making lenders wary. If you have any legal concerns, address them openly with your lender and provide documentation showing resolution or progress.

The Homeownership Timeline Factor

While different institutions may have varying factors, usually the HELOC rate will be based off your line amount, credit score, lien position and state taxes. Most lenders consider these factors when evaluating HELOC applications.

If you’re a new homeowner, you might face stricter requirements or higher interest rates. Some lenders may even require a waiting period before you can apply for a HELOC. To improve your chances, try to build equity quickly through extra mortgage payments or home improvements that increase your property’s value.

Self-Employment Income Verification Challenges

Self-employed applicants often encounter unique challenges when applying for HELOCs. Unlike traditionally employed borrowers, who can easily use pay stubs for income verification, you’ll have to submit more comprehensive documentation. Prepare these documents in advance to streamline your application process.

Property Type and Location Considerations

Not all properties qualify equally for HELOCs. Single-family homes often sail through, but condominiums, cooperatives, and manufactured homes face additional hurdles. Some lenders refuse HELOCs on these property types, while others demand higher credit scores or lower loan-to-value ratios.

Location also plays a pivotal role, especially regarding flood risks. Properties in designated flood zones usually require proof of flood insurance. This additional requirement can increase your overall costs and affect debt-to-income ratio calculations.

To maximize your chances of approval and make the most of your HELOC, it’s crucial to understand your HELOC’s terms, including draw and repayment periods. Effective HELOC management starts with a robust repayment plan.

Final Thoughts

HELOC criteria encompass more than just credit scores and debt-to-income ratios. Property type restrictions, occupancy requirements, flood zone considerations, and major life events all play significant roles in determining eligibility. Understanding these factors empowers homeowners to present stronger applications and potentially negotiate better terms. Assessing your financial situation, including less obvious factors, is a critical step before applying for a HELOC.

Lenders may have different HELOC criteria, so comparing offers is advisable. At HELOC360, we help homeowners navigate the complexities of home equity borrowing with tailored solutions and expert guidance. Our platform aims to make it easier for you to unlock your home’s full potential and achieve your financial goals.

Your home’s equity is a powerful financial tool that can open doors to new opportunities. Knowledge about both common and surprising HELOC criteria will help you make informed decisions about leveraging your home equity. This understanding is a significant step towards financial empowerment and greater financial flexibility.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.