Home Equity Lines of Credit (HELOCs) are popular financial tools, but they’re not always the best choice for everyone.

At HELOC360, we understand that exploring HELOC alternatives can be crucial for making informed financial decisions.

This blog post will guide you through various options, helping you find the best solution for your unique financial situation.

Understanding HELOCs: Benefits and Risks

What is a HELOC?

A Home Equity Line of Credit (HELOC) is a financial product that allows homeowners to borrow against their home’s equity. It functions like a credit card, providing a revolving line of credit that homeowners can access as needed.

How HELOCs Work

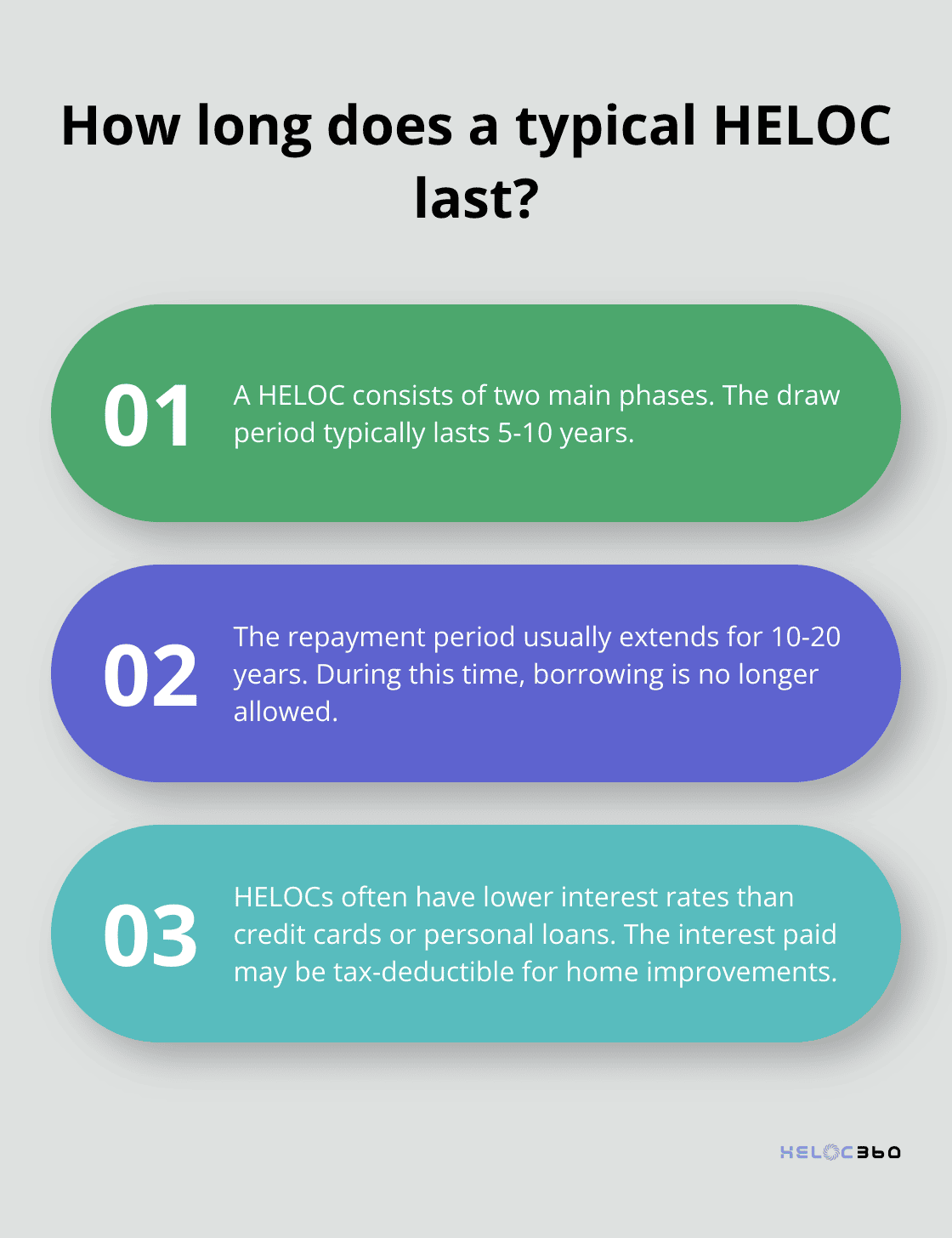

When you open a HELOC, the lender approves you for a maximum credit limit based on your home’s value and your outstanding mortgage balance. The HELOC has two main phases:

- Draw Period (typically 5-10 years): You can borrow funds up to your credit limit and pay interest only on the amount you’ve borrowed.

- Repayment Period (usually 10-20 years): You can no longer borrow from the credit line and must repay the outstanding balance.

Advantages of HELOCs

HELOCs offer several benefits:

- Lower Interest Rates: They often have lower rates compared to credit cards or personal loans because they’re secured by your home.

- Potential Tax Benefits: The interest you pay may be tax-deductible if used for home improvements (according to IRS guidelines).

- Flexibility: You can borrow as much or as little as you need (up to your credit limit), making HELOCs useful for ongoing expenses like home renovations or education costs.

Potential Risks and Drawbacks

Despite their advantages, HELOCs come with risks:

- Home Loss: The most significant risk is the possibility of losing your home if you can’t repay the loan, as your house serves as collateral.

- Variable Interest Rates: HELOC rates are typically variable, which means your payments can increase if rates rise, making budgeting challenging.

- Additional Fees: Some HELOCs have fees, including annual maintenance fees, which can add to the overall cost of borrowing.

- Overborrowing: The easy access to funds can lead to accumulating more debt than you can comfortably repay.

- Negative Equity: If your home’s value decreases, you might end up owing more than your home is worth (a situation known as being “underwater” on your mortgage).

While HELOCs can be powerful financial tools, they’re not suitable for everyone. It’s important to carefully consider your financial situation and goals before deciding if a HELOC is the right choice for you. In the next section, we’ll explore alternatives to HELOCs that might better suit your needs.

Cash-Out Refinance: A Powerful Alternative to HELOCs

Understanding Cash-Out Refinancing

Cash-out refinancing offers homeowners a robust alternative to HELOCs. This financial strategy replaces your existing mortgage with a new, larger loan, allowing you to pocket the difference in cash. For instance, if your home is worth $300,000 and you owe $200,000 on your mortgage, you could refinance for $250,000 and receive $50,000 in cash (minus closing costs).

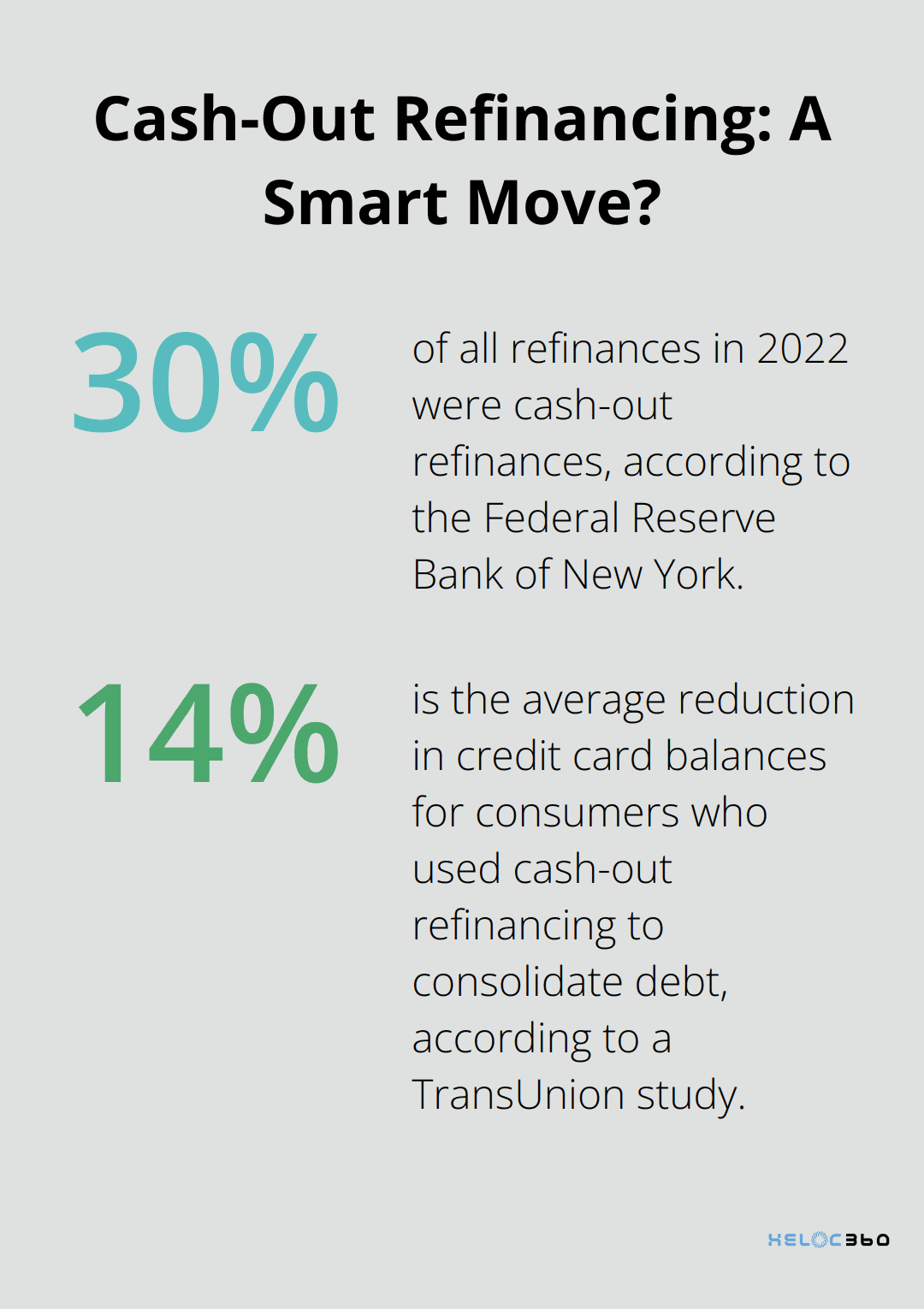

The Federal Reserve Bank of New York reports that cash-out refinances accounted for about 30% of all refinances in 2022, highlighting the growing popularity of this financial tool among homeowners.

Advantages Over HELOCs

Cash-out refinancing presents several benefits compared to HELOCs:

- Fixed Interest Rates: Unlike the variable rates of most HELOCs, cash-out refinances typically offer fixed rates, providing stability in monthly payments.

- Lower Interest Rates: As of Mar. 19, 2025, the current average HELOC interest rate in the 10 largest U.S. markets is 8.03 percent. This difference can lead to substantial savings over the loan’s lifetime.

- Potential Tax Benefits: The Tax Cuts and Jobs Act of 2017 limited mortgage interest deductions, but you may still deduct interest on up to $750,000 of qualified residence loans used to buy, build, or substantially improve your home.

Ideal Scenarios for Cash-Out Refinance

Cash-out refinancing proves particularly advantageous in certain situations:

- Major Home Renovations: If you plan significant home improvements, a cash-out refinance can provide the necessary funds while potentially increasing your home’s value. Americans spent $420 billion in 2020 on remodeling their homes.

- Debt Consolidation: Using the cash to pay off high-interest debt (such as credit cards or personal loans) can result in substantial interest savings. A TransUnion study found that consumers who used cash-out refinancing to consolidate debt saw an average 14% reduction in their credit card balances.

Considerations Before Refinancing

While cash-out refinancing offers numerous benefits, it’s essential to weigh the costs:

- Closing Costs: Refinancing typically involves closing costs ranging from 2% to 5% of the loan amount. Calculate whether the benefits outweigh these expenses over time.

- Loan Term: Extending your loan term might result in paying more interest over the life of the loan, despite a lower interest rate.

- Home Equity: Refinancing reduces your home equity, which could impact your financial flexibility in the future.

As you explore your options, consider how personal loans and home equity loans compare to cash-out refinancing and HELOCs. These alternatives might better suit your financial needs depending on your specific situation.

Personal Loans and Home Equity Loans: Exploring HELOC Alternatives

Understanding Personal Loans

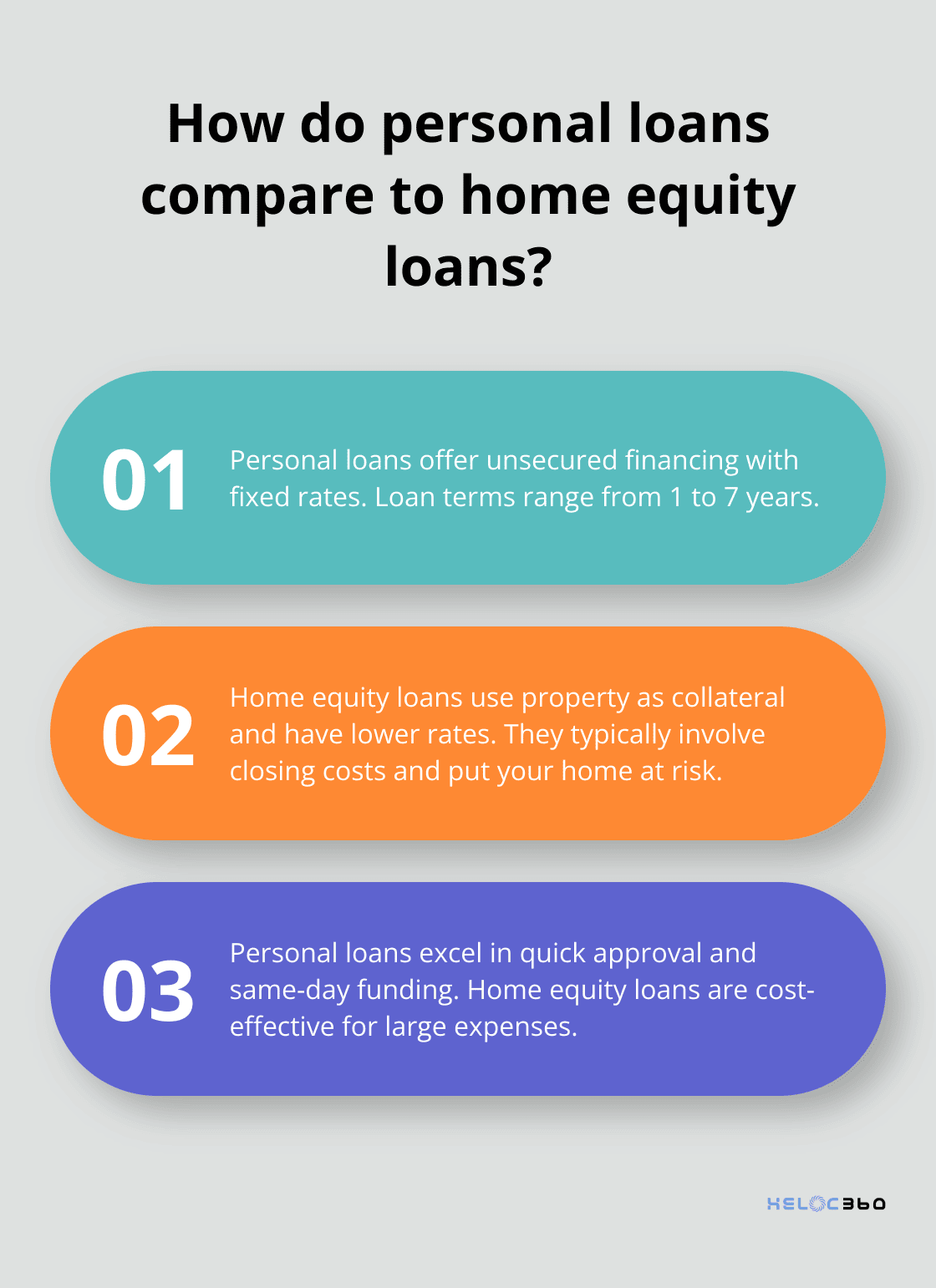

Personal loans offer unsecured financing without collateral. These loans feature fixed interest rates and repayment terms from one to seven years.

Personal loans excel in quick approval processes. Many lenders provide same-day or next-day funding, which suits urgent financial needs. They also don’t put your home at risk, as they’re not secured by your property.

However, personal loans often carry higher interest rates compared to secured loans like HELOCs or home equity loans. They also typically have lower borrowing limits.

Home Equity Loans: Leveraging Your Property’s Value

Home equity loans (sometimes called second mortgages) allow you to borrow against your home’s equity in a lump sum.

Home equity loans offer fixed interest rates, which result in predictable monthly payments. They also tend to have lower interest rates than personal loans, making them cost-effective for large expenses.

However, like HELOCs, home equity loans use your home as collateral, which puts it at risk if you default on payments. They also typically involve closing costs.

Comparing Your Options

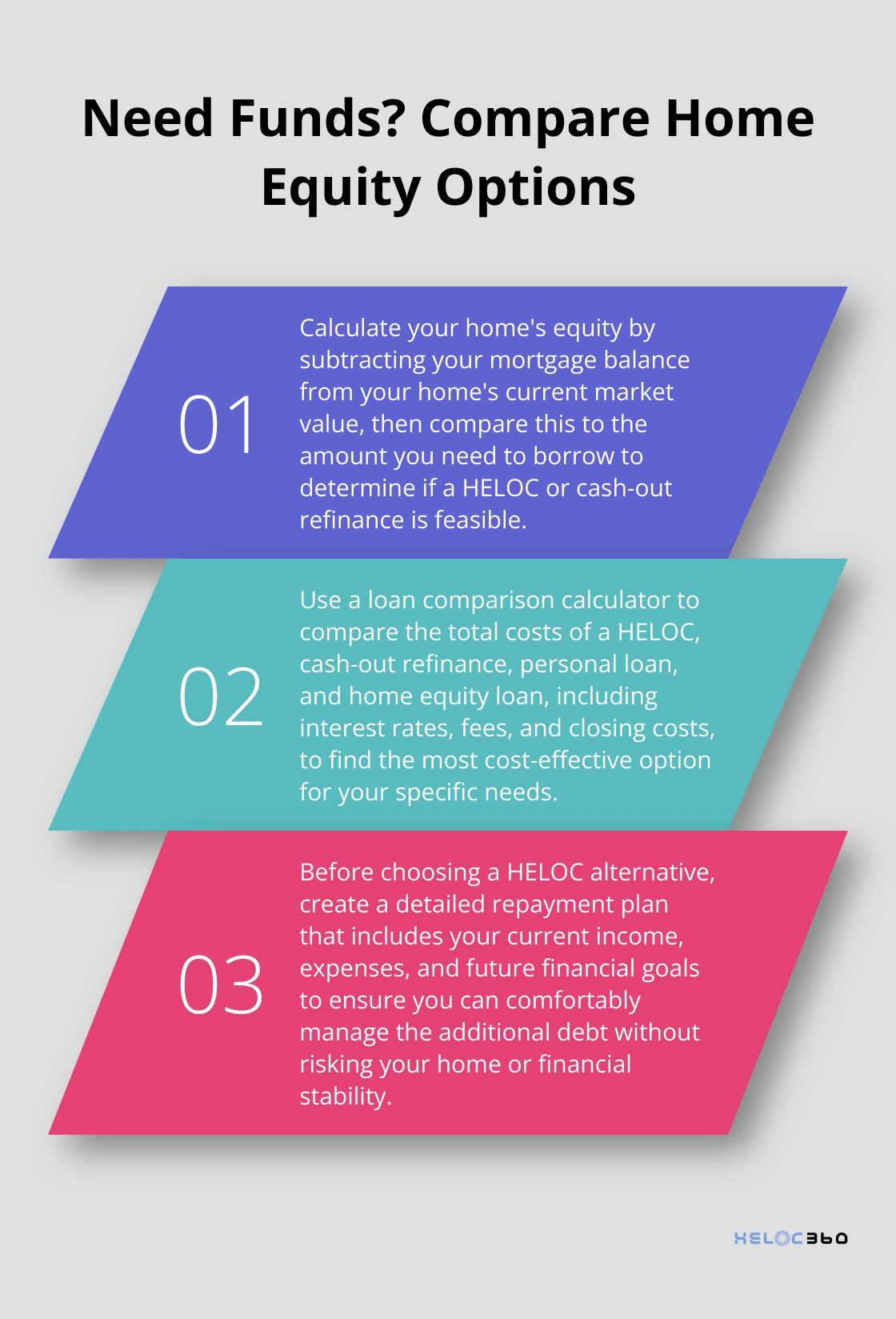

When you choose between personal loans, home equity loans, and HELOCs, consider your financial goals and circumstances:

- Personal loans suit short-term needs or situations where you lack significant home equity.

- Home equity loans offer lower interest rates for large, one-time expenses if you have substantial home equity.

- HELOCs provide more flexibility for ongoing expenses or if you want more control over your borrowing.

Factors to Consider

Several factors should influence your decision:

- Interest Rates: Compare the rates of each option (personal loans typically have the highest rates, while HELOCs and home equity loans offer lower rates).

- Loan Terms: Evaluate the repayment periods and how they align with your financial plans.

- Fees and Closing Costs: Factor in any additional expenses associated with each option.

- Risk Tolerance: Assess your comfort level with using your home as collateral.

Making the Right Choice

Your unique financial situation will determine the best option for you. For personalized guidance, consider using a platform like HELOC360, which can help you compare these alternatives and find the optimal solution based on your financial profile and goals.

Final Thoughts

Each HELOC alternative offers unique advantages and potential drawbacks. Cash-out refinancing provides fixed rates and lower interest costs, while personal loans offer quick access to funds without risking your home. Home equity loans present a lump sum with fixed rates, suitable for one-time large expenses.

Your individual situation will determine the best choice among these HELOC alternatives. You must assess your financial goals, comfort with using your home as collateral, and ability to manage repayments. Current market conditions, interest rates, and your credit score will also impact the terms you receive.

HELOC360 can simplify your decision-making process by providing personalized guidance and connecting you with suitable lenders. This platform helps you gain a comprehensive understanding of your options and make an informed choice that aligns with your financial aspirations. Your home’s equity is a powerful financial tool – use it wisely to achieve your goals.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.