HELOC interest rates today are a hot topic for homeowners looking to tap into their home equity.

At HELOC360, we’re committed to providing you with the most up-to-date information on these rates and how they compare to other loan options.

This post will explore current HELOC rate trends, compare them to alternative borrowing methods, and offer strategies to help you secure the best possible rate.

What Are Today’s HELOC Interest Rates?

Current HELOC Rate Overview

As of August 13, 2025, the average HELOC rate stands at 8.12%, according to Bankrate’s latest survey of the nation’s largest home equity lenders. This rate shows the current market conditions for home equity lines of credit.

Recent HELOC Rate Trends

HELOC rates have shown fluctuations over the past month. While specific historical data isn’t available, it’s important to note that rates can change frequently based on various economic factors.

The current rates have led to changes in HELOC inquiries. However, individual rates can vary significantly based on factors like credit score, loan-to-value ratio, and specific lender terms.

Key Factors Influencing HELOC Rates

Several elements impact today’s HELOC rates:

- Federal Reserve Policy: The Fed’s interest rate decisions directly affect HELOC rates. Current HELOC borrowers can expect their interest rate and payments to adjust within a month or two after a Fed rate change.

- Economic Indicators: Inflation rates and overall economic health play vital roles. Recent economic data can contribute to rate trends.

- Housing Market Conditions: Home values in many areas can affect available equity, making HELOCs an attractive option for both lenders and borrowers.

Regional Variations in HELOC Rates

HELOC rates can vary by region. However, as of August 13, 2025, the national average HELOC interest rate is 8.12%, according to Bankrate’s survey of the nation’s largest home equity lenders.

When you shop for a HELOC, don’t focus solely on national averages. Look at rates specific to your area for a more accurate picture. (This approach will help you find the best deal possible.)

The Importance of Timing

While current rates reflect today’s market conditions, they may differ from historic lows seen in recent years. This fact underscores the importance of carefully considering your financial goals and exploring all options before committing to a HELOC.

As we move forward, let’s examine how these HELOC rates stack up against other loan options available to homeowners.

How HELOC Rates Compare to Other Loan Options

HELOC vs. Home Equity Loan Rates

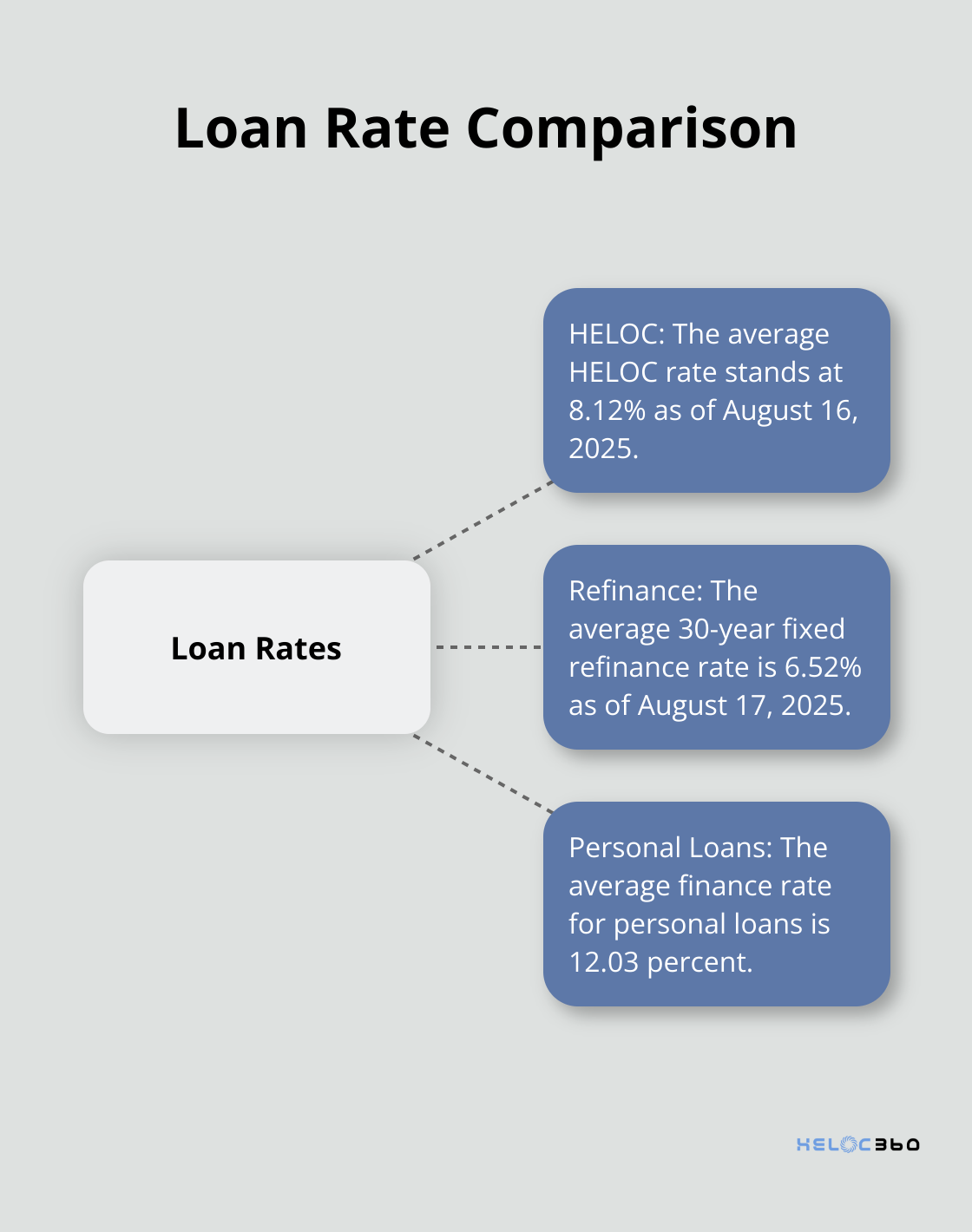

As of August 16, 2025, the average HELOC rate stands at 8.12%. It’s important to note that this average can include introductory rates that may only last for six months or one year. After that, your interest rate may change.

HELOCs offer more flexibility. You draw funds as needed and pay interest only on what you borrow. Home equity loans provide a lump sum with fixed payments, which can benefit those who prefer predictable monthly costs.

HELOC vs. Mortgage Refinance Rates

Mortgage refinance rates typically fall below HELOC rates. The average 30-year fixed refinance rate is 6.52% as of August 17, 2025. However, refinancing replaces your entire mortgage, which might not suit you if you’ve already secured a low rate on your existing mortgage.

HELOCs allow you to access your home equity without altering your primary mortgage. This can prove advantageous if your current mortgage rate undercuts today’s refinance rates (a common scenario for many homeowners).

HELOC vs. Personal Loan Rates

Personal loan rates usually exceed HELOC rates. According to recent data, the average finance rate for personal loans offered by commercial banks is 12.03 percent. However, personal loans don’t require collateral, which some borrowers prefer.

HELOCs often boast lower rates because they use your home as security. This security also means your property faces risk if you default on payments. (Always assess your ability to repay before choosing any loan option.)

Factors Beyond Interest Rates

When you compare these loan types, look beyond just the interest rates. Consider these key factors:

- Loan terms

- Fees (including closing costs and annual fees)

- Your specific financial situation

- Your long-term financial goals

The Role of Credit Scores

Your credit score significantly influences the rates you’ll receive for any loan type. For HELOCs, a score of 720 or higher typically secures the best rates. (Improving your credit score can lead to substantial savings over the life of your loan.)

As you weigh these options, remember that the best choice depends on your unique financial situation and goals. The next section will explore strategies to help you secure the most favorable HELOC rate possible.

How to Secure the Best HELOC Rate

Improve Your Credit Score

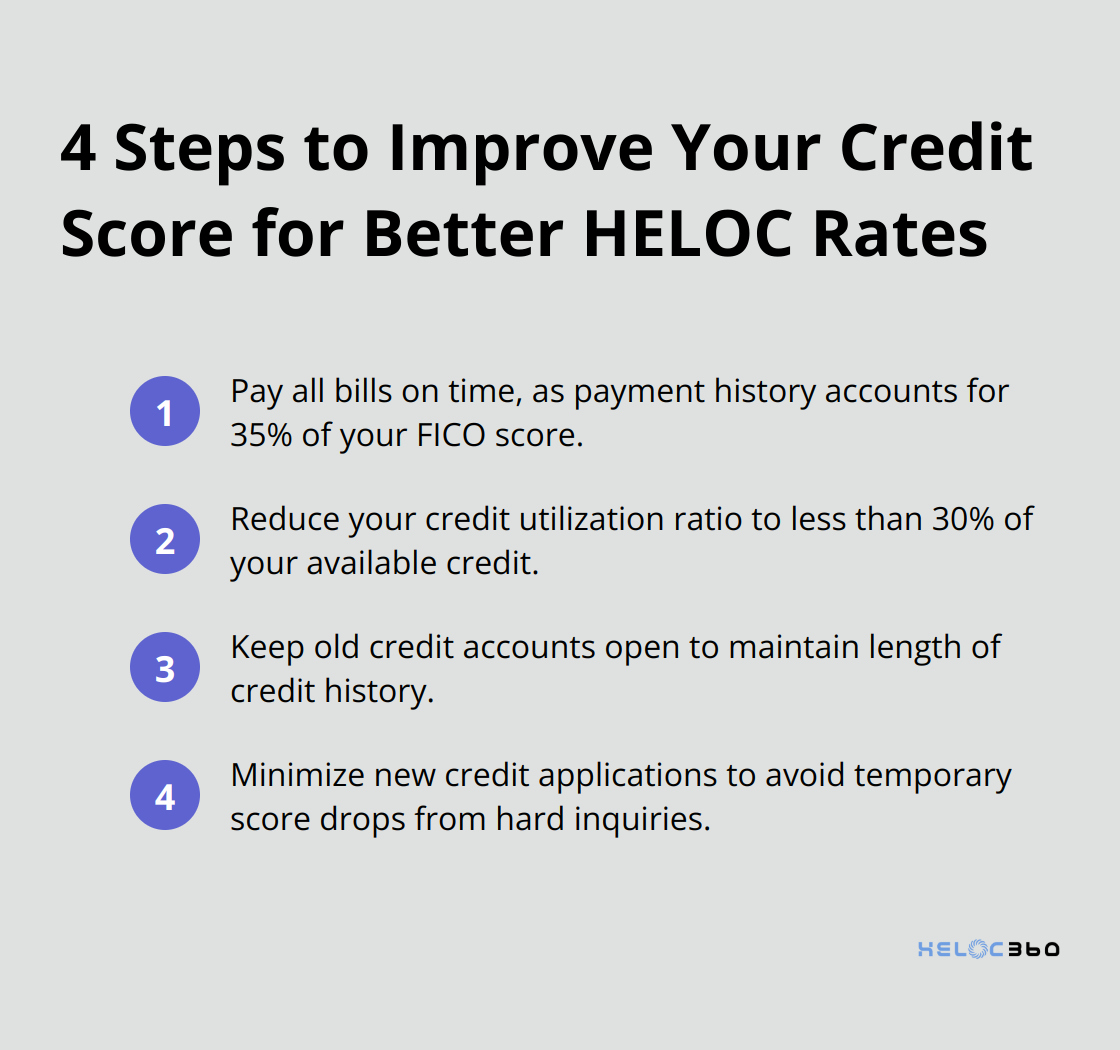

Your credit score significantly influences your HELOC rate. To secure the most advantageous borrowing conditions, such as qualifying for the best rates, you will want to aim to raise your credit score to the 700+ range. To enhance your score:

Boost Your Home Equity

Lenders view higher equity as lower risk, often resulting in better rates. To increase your equity:

- Make extra mortgage payments. Even small additional amounts can accumulate over time.

- Complete value-adding home improvements. Focus on projects with high ROI, such as kitchen or bathroom updates.

- Allow time for your home’s value to appreciate. However, be aware that a serious dip in home values can cause lenders to lower your credit line or freeze it, preventing you from withdrawing more funds.

Compare Offers and Negotiate

Don’t accept the first offer you receive. According to Freddie Mac research, the payoff for mortgage applicants who comparison shop doubled in 2022.

- Compare offers from at least three lenders. Examine both national banks and local credit unions.

- Look beyond the interest rate. Consider fees, closing costs, and draw period length.

- Use competing offers as leverage. Some lenders might match or beat a competitor’s rate.

Consider the Entire Loan Package

The lowest rate doesn’t always equal the best deal. Evaluate the entire loan package, including fees and terms, to ensure you’re getting the most value. (This approach will help you make a more informed decision.)

Seek Expert Guidance

Navigating HELOC rates and terms can be complex. Consider consulting with financial advisors or using platforms that connect you with multiple lenders. These resources can simplify the process and help you find a rate that aligns with your financial goals.

Final Thoughts

HELOC interest rates today present a complex landscape for homeowners. The national average rate of 8.12% as of August 13, 2025, reflects a market influenced by economic factors and regional variations. Potential borrowers must weigh the unique advantages of HELOCs against alternatives like mortgage refinancing to make informed decisions.

Improving credit scores, increasing home equity, and comparing multiple offers can lead to better HELOC terms. A comprehensive evaluation of loan packages, beyond just interest rates, often results in significant long-term savings. (This approach helps homeowners secure the most favorable conditions for their financial situation.)

HELOC360 simplifies the process of navigating HELOC interest rates and terms. Our platform connects you with lenders that match your specific needs, enabling you to make informed decisions about using your home’s equity. We strive to help you achieve your financial goals, whether funding renovations, consolidating debt, or creating financial flexibility.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.