Choosing between a HELOC and a personal loan can be a tough decision for homeowners looking to borrow money. At HELOC360, we understand the importance of making an informed choice when it comes to your financial future.

In this post, we’ll compare HELOCs vs personal loans, examining their key features, benefits, and potential drawbacks. Our goal is to help you determine which option might be the best fit for your unique financial situation.

What Is a HELOC?

Definition and Basics

A Home Equity Line of Credit (HELOC) is a financial tool that allows homeowners to access their home’s equity. It functions as a revolving credit line secured by your home, offering flexibility and potentially lower interest rates compared to other borrowing options.

Mechanics of HELOCs

When you open a HELOC, you borrow against the equity you’ve built in your home. The amount you can borrow typically ranges from 60% to 85% of your home’s appraised value, minus your outstanding mortgage balance.

Draw and Repayment Periods

HELOCs operate in two distinct phases: the draw period and the repayment period. The draw period often lasts 10 years, during which you can borrow from your credit line as needed. You’ll typically only pay interest on the amount you’ve borrowed. After the draw period ends, you enter the repayment phase, where you can no longer borrow and must repay both principal and interest.

Interest Rates and Terms

HELOC interest rates are generally variable, tied to the prime rate plus a margin. As of March 12, 2025, the current average HELOC interest rate in the 10 largest U.S. markets is 8.04 percent. These rates can fluctuate based on market conditions and your creditworthiness.

Some lenders offer fixed-rate options for a portion of your HELOC balance, providing stability in your repayment plan. This can benefit borrowers who worry about potential rate increases in the future.

Costs and Considerations

While HELOCs often come with lower interest rates than personal loans or credit cards, it’s important to factor in additional costs. These may include appraisal fees, application fees, and annual maintenance fees. Some lenders waive these fees, so it’s worth shopping around to find the best deal.

Your home secures the HELOC, so failing to repay could put your property at risk of foreclosure. This makes it essential to borrow responsibly and have a solid repayment plan in place.

Many homeowners use HELOCs to fund home improvements, consolidate high-interest debt, or cover large expenses like education costs. The key is to understand how HELOCs work and use them strategically to meet your financial goals.

Now that we’ve covered the basics of HELOCs, let’s explore another popular borrowing option: personal loans.

What Are Personal Loans?

Definition and Structure

Personal loans provide a lump sum of money that borrowers repay in fixed monthly installments over a set term. Unlike HELOCs, these loans don’t require tapping into home equity. They typically range from $1,000 to $50,000, with some lenders offering up to $100,000 for qualified borrowers.

Repayment Terms

The repayment period for personal loans usually spans 1 to 7 years. Borrowers make fixed monthly payments that include both principal and interest. This structure allows for easy budgeting and predictable repayment schedules.

Secured vs. Unsecured

Most personal loans are unsecured, which means they don’t require collateral. This feature reduces risk for borrowers but often results in higher interest rates compared to secured loans (like HELOCs). Some lenders offer secured personal loans, which may provide lower rates but put the collateral at risk.

Common Uses

People use personal loans for various purposes:

- Debt consolidation

- Home improvements

- Large purchases

The flexibility of personal loans makes them suitable for a wide range of financial needs. However, it’s important to borrow only what you need and can afford to repay.

Interest Rates and Fees

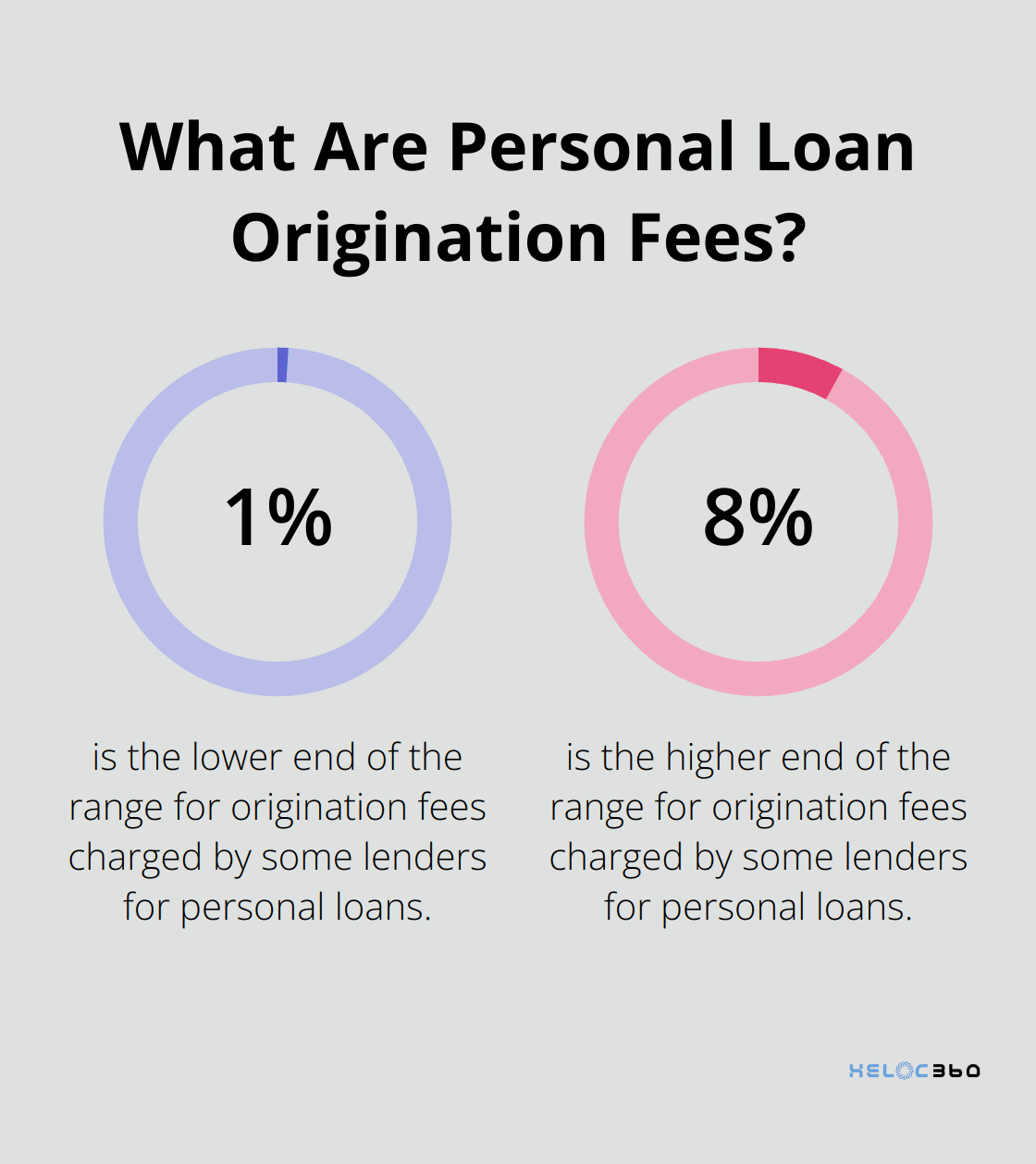

Interest rates for personal loans are typically fixed, providing consistent monthly payments throughout the loan term. Your credit score significantly influences your interest rate. As of February 2025, borrowers with excellent credit (720-850) might secure rates between 10.73% and 12.50%, while those with fair credit (630-689) could see rates around 17.80% to 19.90%.

Some lenders charge origination fees (ranging from 1% to 8% of the loan amount). It’s essential to factor in these fees when comparing the total cost of different loan options.

Application Process

Many lenders offer prequalification, which allows you to check potential rates without impacting your credit score. This feature can help when comparing offers from multiple lenders. The actual application process often involves submitting financial documents and undergoing a credit check.

Personal loans offer quick funding and fixed rates, but they often come with higher interest rates and shorter repayment terms compared to HELOCs. Your choice between these options should align with your long-term financial strategy and borrowing needs. In the next section, we’ll compare HELOCs and personal loans to help you make an informed decision.

HELOC vs Personal Loan: Which Is Right for You?

Credit Requirements and Approval Odds

HELOCs typically require higher credit scores than personal loans. A personal loan, on the other hand, could be a better option for one-time expenses or if you don’t have sufficient home equity.

Loan Amounts and Borrowing Limits

HELOCs often provide access to larger amounts of money. The borrowing limit is typically 60-85% of your home’s value minus your mortgage balance. For a home worth $400,000 with a $200,000 mortgage, you might qualify for a HELOC up to $140,000 (assuming an 85% limit).

Personal loans usually cap out at $100,000, with many lenders offering maximums of $50,000 or less. The exact amount you can borrow depends on your income, credit score, and existing debts.

Tax Implications and Potential Savings

HELOCs may offer tax advantages that personal loans don’t. Interest paid on a HELOC may be tax-deductible, depending on how the funds are used and other factors. It’s important to consult with a tax professional to understand the specific implications for your situation.

Personal loan interest isn’t tax-deductible, regardless of how you use the funds. This difference can make HELOCs more cost-effective for home-related expenses.

Flexibility in Fund Usage

Both HELOCs and personal loans offer flexibility, but in different ways. With a HELOC, you can draw funds as needed during the draw period (typically 10 years). This feature is ideal for ongoing projects or uncertain expenses. You only pay interest on the amount you’ve borrowed, not the entire credit line.

Personal loans provide a lump sum upfront, which can benefit one-time expenses or debt consolidation. However, if you need additional funds later, you’ll have to apply for a new loan.

Risk Factors: Secured vs Unsecured Debt

The biggest difference between HELOCs and personal loans lies in the security of the debt. HELOCs use your home as collateral, which means defaulting could result in severe consequences, including potential legal action by the lender.

Personal loans are typically unsecured, meaning there’s no collateral at stake. While this reduces the risk to your assets, it usually results in higher interest rates. Lenders compensate for the increased risk by charging more.

Consider your financial stability and comfort level with risk when choosing between these options. If you’re confident in your ability to repay and want to leverage your home’s equity for the best rates, a HELOC might be the way to go. If you prefer not to put your home on the line or don’t have sufficient equity, a personal loan could be the better choice.

Final Thoughts

Your choice between a HELOC and a personal loan depends on your financial situation, goals, and risk tolerance. HELOCs offer lower interest rates and potential tax benefits, while personal loans provide quick funding and fixed rates. Your credit score, home equity, and comfort with variable rates will influence your decision in the HELOC vs personal loan debate.

Both options come with responsibilities, so you must have a solid repayment plan. HELOCs put your home on the line, while personal loans often have higher interest rates and shorter repayment terms. The right choice will align with your long-term financial strategy and borrowing needs.

At HELOC360, we understand the complexity of these financial decisions. We’ve developed a platform to help homeowners make informed choices about their home equity. Our goal is to provide you with the tools and knowledge you need to leverage your home’s value effectively and achieve your financial aspirations.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.