When it comes to HELOCs, understanding all associated costs is vital. HELOC origination fees can significantly impact your overall expenses.

At HELOC360, we’ve seen how these fees can catch homeowners off guard. This post will break down what you need to know about HELOC origination fees and how to manage them effectively.

What Are HELOC Origination Fees?

Definition and Purpose

HELOC origination fees are upfront charges lenders impose when you open a home equity line of credit. These fees cover the costs of processing your application, underwriting, and setting up the credit line. Lenders use these fees to offset their administrative expenses, which include costs for credit checks, property appraisals, and document preparation. Some lenders also view these fees as compensation for the risk they take by extending credit.

Fee Structures and Ranges

HELOC origination fees can vary widely among lenders. For example, some lenders may charge an origination fee of up to 4.99% of the initial draw. This amount is usually added to your loan balance, which increases your debt and the interest you’ll pay over time.

Impact on Overall HELOC Costs

Origination fees can significantly affect your total HELOC expenses. When shopping for a HELOC, it’s important to look beyond just the interest rate. A lender offering a lower rate but charging a high origination fee might end up being more expensive overall. Try to compare these total costs across multiple lenders to ensure you get the most cost-effective option for your needs.

Variations Among Lenders

Not all lenders charge origination fees the same way. Some may offer to waive the fee in exchange for a higher interest rate. Others might roll the fee into your loan balance. Some lenders have moved to no-fee structures, while others still charge origination fees.

The Importance of Comparison

Given the variations in fee structures and their impact on overall costs, it’s essential to compare offers from multiple lenders. This comparison should include not only the origination fees but also interest rates, other closing costs, and any potential ongoing fees (such as annual maintenance fees). By taking a comprehensive view of the costs, you can make a more informed decision about which HELOC offer provides the best value for your specific financial situation.

As we move forward, let’s explore the typical HELOC origination fee structures in more detail, including the factors that influence these fees and how they can vary across different lenders and market conditions.

How HELOC Origination Fees Vary

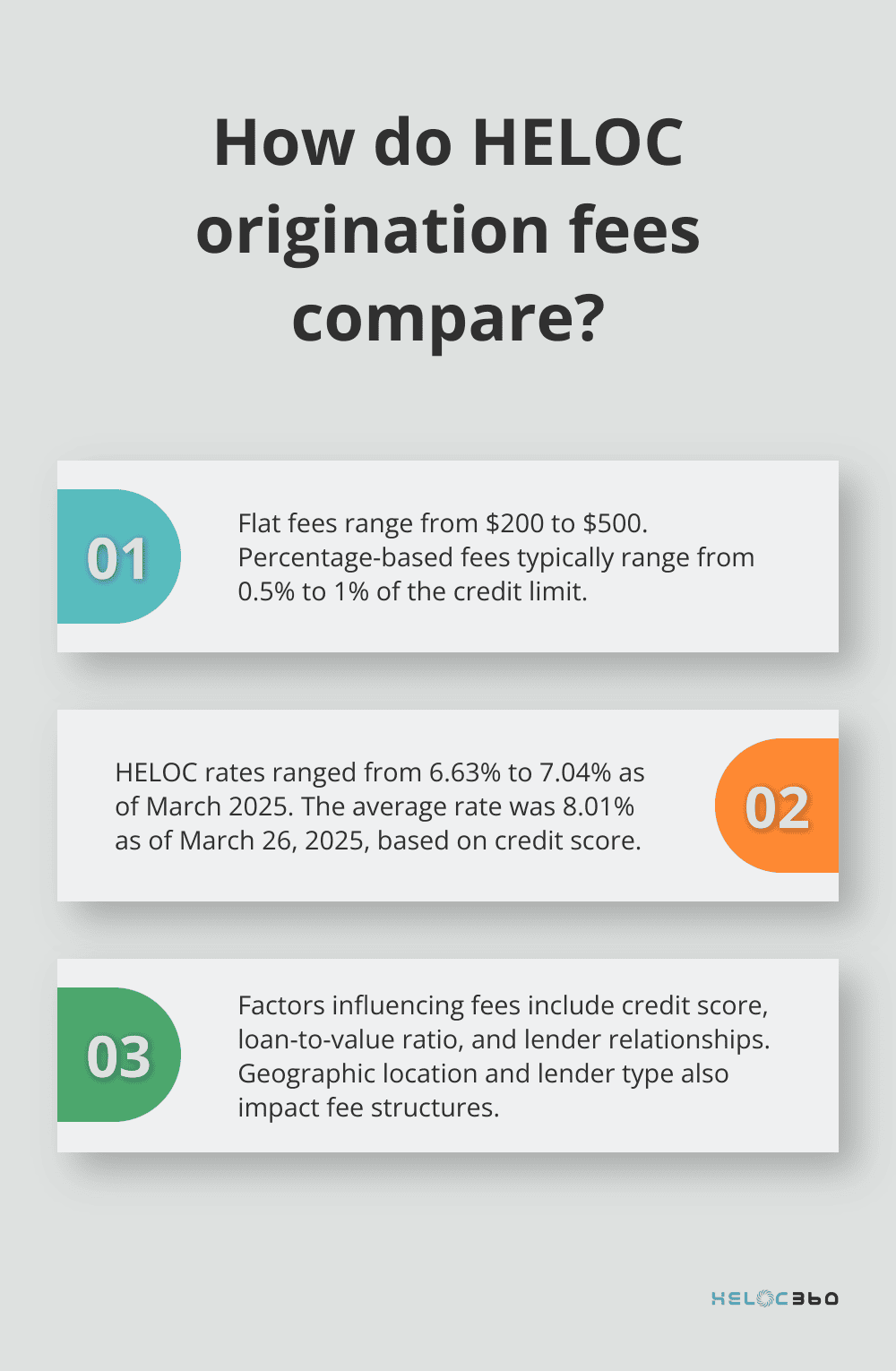

Flat Fees vs. Percentage-Based Fees

HELOC origination fees take different forms among lenders. Some charge a flat fee, typically $200 to $500. This benefits larger loan amounts as the fee remains constant. For example, a $500 flat fee on a $250,000 HELOC represents just 0.2% of the loan amount.

Other lenders use percentage-based fees, usually 0.5% to 1% of the credit limit. This structure advantages smaller loans but can cost more for larger ones. A 1% fee on a $250,000 HELOC amounts to $2,500, significantly higher than the flat fee example.

Current Market Averages

As of March 2025, HELOC rates have ranged from a low of 6.63% to a high of 7.04%. This figure fluctuates based on market conditions and individual lender policies. In competitive markets (like California or New York), some lenders offer lower fees to attract borrowers.

Some online lenders now offer no-fee HELOCs to gain market share. While attractive, these offers often come with higher interest rates or other costs that offset the lack of an origination fee.

Factors Influencing Fee Amounts

Several factors impact the origination fee you’ll encounter:

- Credit Score: HELOC rates can vary based on credit score, with the average rate falling to 8.01% as of March 26, 2025.

- Loan-to-Value Ratio: A lower LTV ratio often results in more favorable terms, including potentially lower origination fees.

- Relationship with the Lender: Existing customers may receive discounts on origination fees. Bank of America, for instance, offers reduced fees for their Preferred Rewards members.

- Geographic Location: Fees vary by state due to different regulations and market conditions. Texas, for example, has stricter HELOC regulations, which can lead to higher fees.

- Lender Type: Traditional banks often charge higher fees compared to credit unions or online lenders. A 2024 study by the National Credit Union Administration emphasized the importance of credit unions identifying and managing concentration risk.

Homeowners who compare multiple offers and negotiate with lenders often secure more favorable fee structures. It’s not uncommon for savvy borrowers to save hundreds or even thousands of dollars in origination fees by shopping around and leveraging competing offers.

The variation in HELOC origination fees highlights the importance of thorough research and comparison. As we move forward, we’ll explore effective strategies to minimize these fees and secure the most advantageous HELOC terms for your financial situation.

How to Reduce HELOC Origination Fees

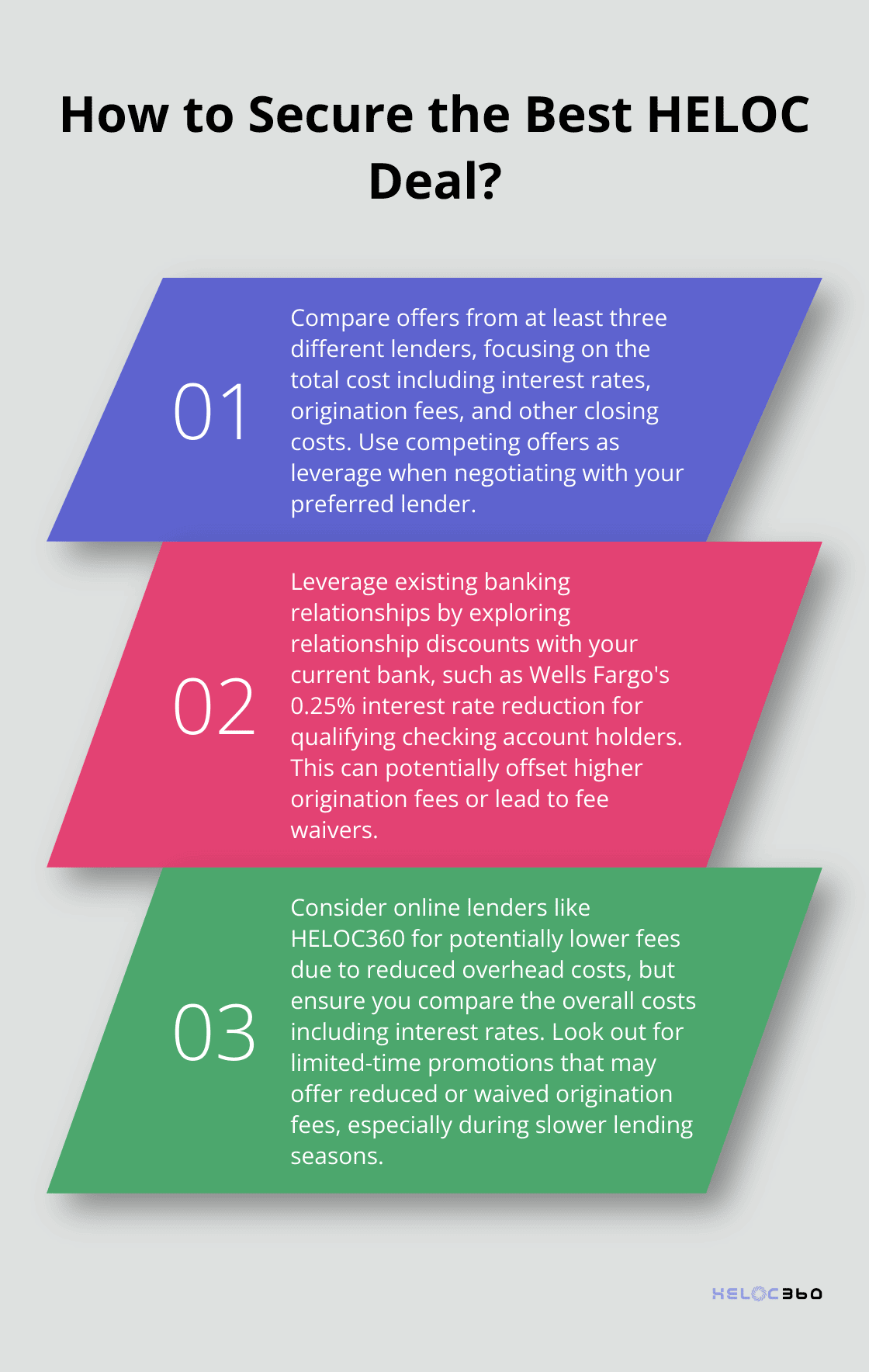

Leverage Existing Banking Relationships

Many banks offer discounts on HELOC origination fees for existing customers. Wells Fargo provides relationship discounts that can lower your interest rate by 0.25% if you have a qualifying checking account. Their rates range from 6.99% to 24.49% Annual Percentage Rate (APR), which includes this relationship discount. This rate reduction can offset higher origination fees or potentially lead to fee waivers.

Compare Multiple Lenders

Don’t settle for the first offer you receive. Use this information to your advantage by getting quotes from at least three different lenders.

Negotiate with Confidence

Lenders often have flexibility in their fee structures. A survey by LendingTree found that just 39% of prospective homebuyers negotiated the initial APR or refinance rate on their most recent home purchase, despite the high success rate. When you negotiate, prepare with competing offers and highlight your strong credit history or substantial home equity.

Consider Online Lenders

Online lenders often have lower overhead costs, which can translate to lower fees for borrowers. For example, some online lenders offer HELOCs with no origination fees and a streamlined application process. However, always compare the overall costs (including interest rates) to ensure you get the best deal. HELOC360 stands out as a top choice among online platforms, offering tailored solutions and expert guidance.

Look for Limited-Time Promotions

Banks frequently run promotions to attract new customers. These can include reduced or waived origination fees, especially during slower lending seasons. Keep an eye out for these offers, but make sure to read the fine print as they may come with other conditions.

Final Thoughts

HELOC origination fees significantly impact the overall cost of your home equity line of credit. These fees, which range from flat rates to percentage-based charges, cover the lender’s expenses for application processing and credit line setup. You must evaluate HELOC offers beyond just the interest rate, as the fee structure and other costs can substantially affect your total borrowing expenses.

Negotiation with lenders and leveraging existing banking relationships often lead to reduced or waived HELOC origination fees. You should not hesitate to ask about fee waivers or discounts, especially if you have a strong credit history or substantial home equity. Promotional offers may provide more favorable terms, so keep an eye out for these opportunities.

At HELOC360, we understand the complexities of navigating HELOC costs (including origination fees). Our platform simplifies the process, provides expert guidance, and connects you with lenders offering terms tailored to your financial goals. We help you unlock your home equity’s full potential while ensuring you understand all aspects of your HELOC.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.