- ***PAID ADVERTISEMENT**

- ACHIEVE LOANS – HOME EQUITY EXPERTISE

- FLEXIBLE FINANCING SOLUTIONS

- PERSONALIZED SUPPORT

- RECOMMENDED FICO SCORE: 640+

- COMPETITIVE RATES STREAMLINED APPLICATION PROCESS

Planning your HELOC repayment can be challenging, but it’s essential for managing your finances effectively. A HELOC repayment calculator is a powerful tool that can help you understand your loan obligations and make informed decisions.

At HELOC360, we’ve created this guide to help you navigate the complexities of HELOC repayment and make the most of our calculator. Let’s explore how you can use this tool to plan your payments and optimize your financial strategy.

- Approval in 5 minutes. Funding in as few as 5 days

- Borrow $20K-$400K

- Consolidate debt or finance home projects

- Fastest way to turn home equity into cash

- 100% online application

How HELOC Repayment Works

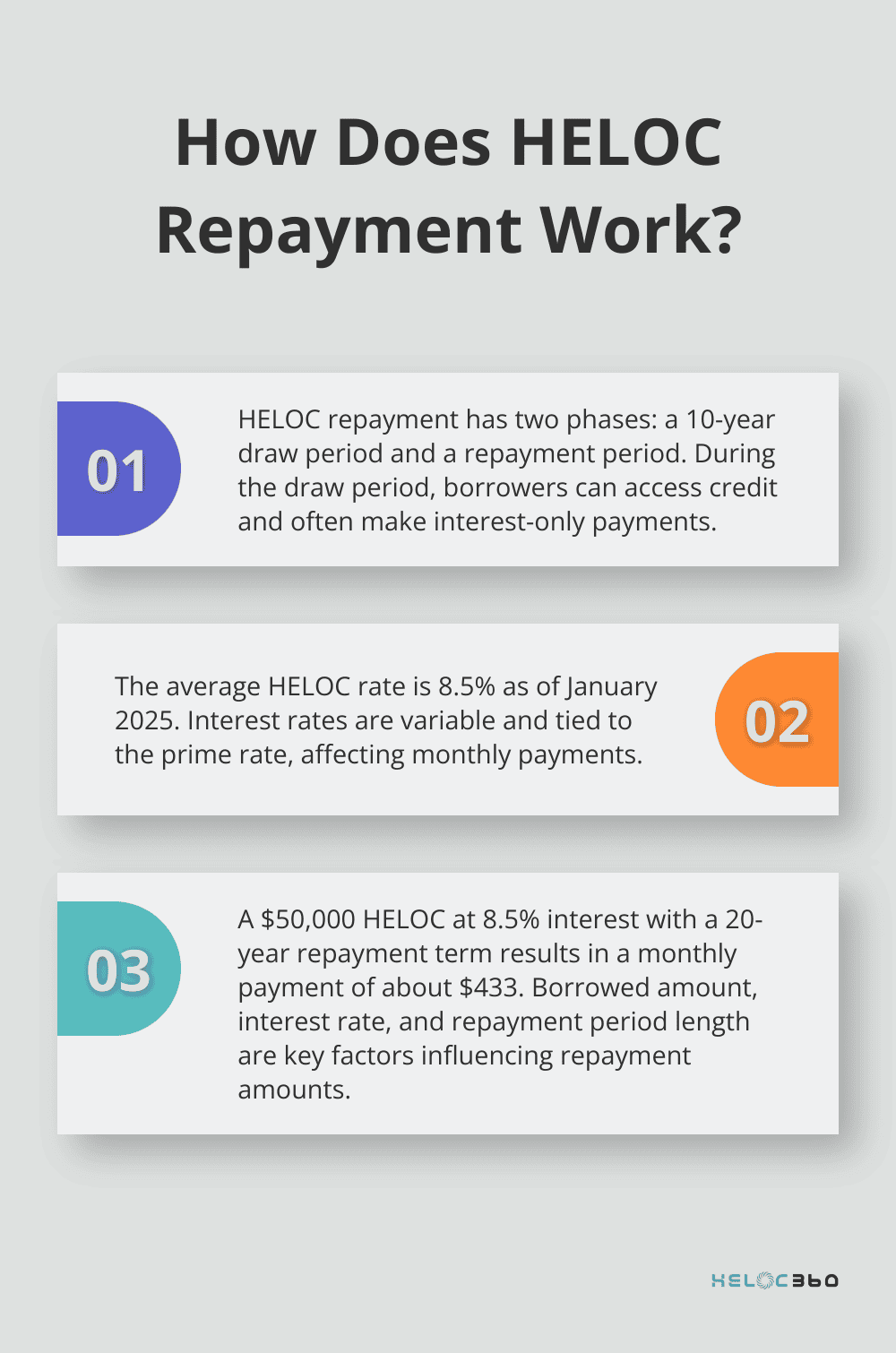

The Two Phases of HELOC Repayment

HELOC repayment consists of two main phases: the draw period and the repayment period. During the draw period (typically 10 years), borrowers can access their credit line as needed and often make interest-only payments. The repayment phase follows, where borrowing stops and repayment of both principal and interest begins.

Interest Rates and Their Impact

Interest rates significantly affect HELOC repayment. Most HELOCs feature variable rates tied to the prime rate. As of January 2025, the average HELOC rate stands at 8.5%. This variability means monthly payments can change based on market conditions. Borrowers should prepare for potential rate increases to avoid financial stress.

Key Factors Influencing Repayment Amounts

Several elements determine your HELOC repayment amount:

- Borrowed amount

- Interest rate

- Repayment period length

For instance, a $50,000 loan at 8.5% interest with a 20-year repayment term results in a monthly payment of approximately $433. However, this amount can fluctuate if interest rates change or if additional draws occur during the draw period.

The Importance of Payment Planning

Planning HELOC payments extends beyond meeting monthly obligations; it optimizes your financial health. Understanding your repayment structure enables informed decisions about borrowing amounts and timing. For example, if you need $30,000 for home renovation, you might draw that amount early in your term to maximize the interest-only payment period.

Effective planning also allows exploration of strategies like extra payments during the draw period to reduce the principal balance. This approach can lower overall interest costs and smooth the transition to the repayment period.

Strategies for Effective HELOC Management

To manage your HELOC effectively:

- Monitor interest rate trends

- Create a budget that accounts for potential payment increases

- Consider making principal payments during the draw period

- Explore refinancing options if better terms become available

These strategies can help you maintain control over your HELOC and maximize its benefits. As we move forward, we’ll explore how to use a HELOC repayment calculator to put these strategies into action and create a personalized repayment plan.

How to Calculate Your HELOC Payments

Gather Your HELOC Details

Before you start, collect these key pieces of information:

- Your current HELOC balance

- The interest rate on your HELOC

- The length of your repayment period

- Any additional fees associated with your HELOC

These details ensure you get the most accurate results from the calculator.

Input Your Information

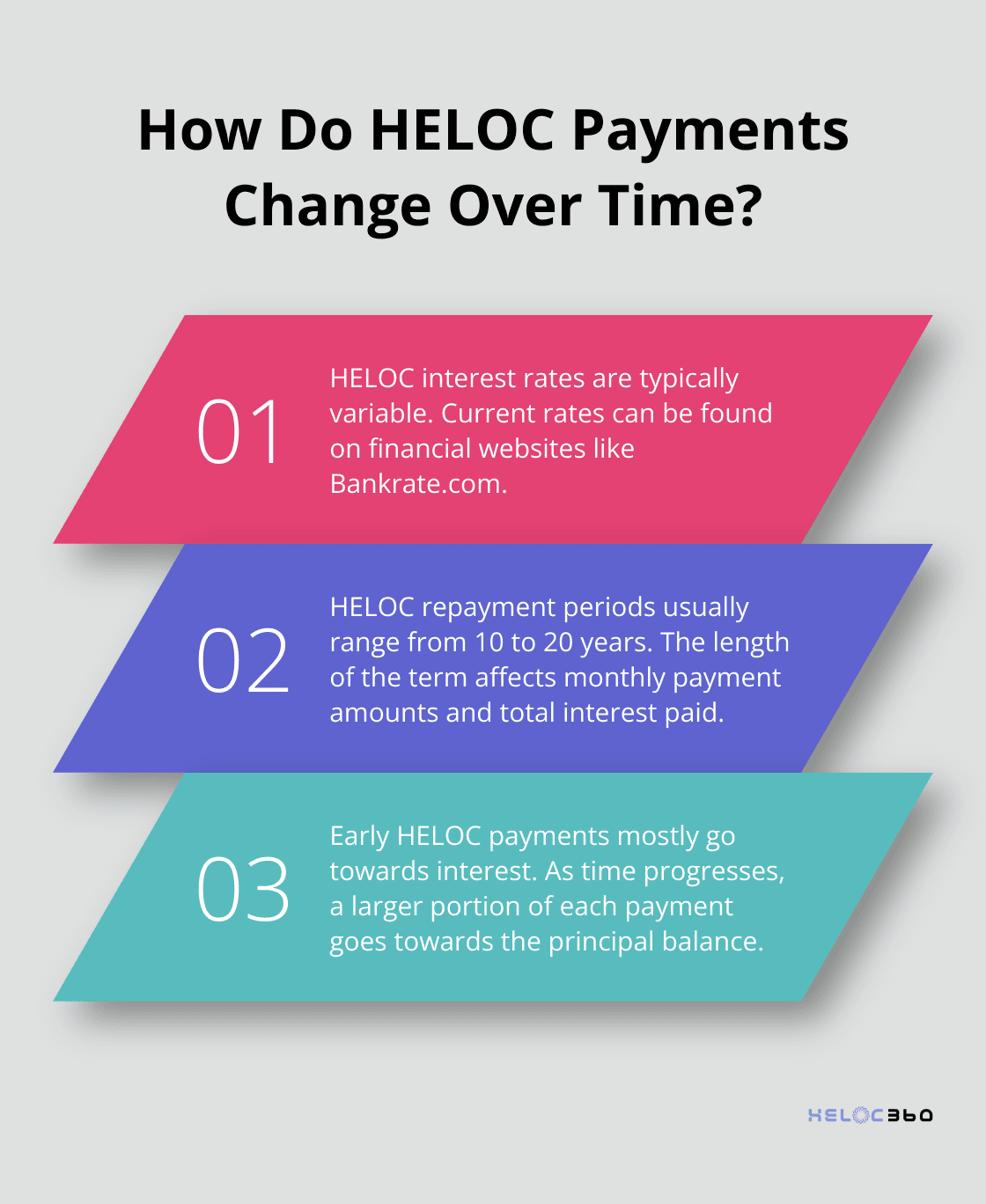

Once you have your HELOC details, enter them into the calculator. Start with your current balance (the amount you’ve borrowed from your HELOC). Next, input your interest rate. HELOCs typically have variable rates, so use the most current rate provided by your lender.

Then, enter the length of your repayment period (usually between 10 to 20 years, depending on your HELOC terms). Lastly, include any additional fees, such as annual maintenance fees, to get a comprehensive view of your costs.

Interpret Your Results

After you input your information, the calculator will generate your estimated monthly payments. This figure represents what you need to budget for each month to repay your HELOC within the specified term.

The calculator will also show the total amount you’ll pay over the life of the loan, including interest. This can be eye-opening, as it illustrates the true cost of borrowing.

Pay attention to the amortization schedule provided. This breakdown shows how much of each payment goes towards principal and interest over time. In the early years, a larger portion of your payment goes towards interest. As time progresses, this balance shifts, with more going towards principal.

Explore Different Scenarios

One of the most valuable features of a HELOC repayment calculator is the ability to explore different scenarios. Try adjusting your repayment period to see how it affects your monthly payments and total interest paid. A shorter term will increase your monthly payments but reduce the overall interest you’ll pay.

You can also use the calculator to see the impact of making extra payments. Input different additional payment amounts to see how they could shorten your loan term and reduce total interest.

Plan for Rate Changes

Given the variable nature of HELOC rates, use the calculator to prepare for potential rate increases. Try inputting higher interest rates to see how they would affect your payments. This exercise can help you budget for worst-case scenarios and avoid financial stress if rates rise.

For example, if your current rate is 7.25%, calculate your payments with a higher rate. This will give you a buffer in your budget and help you decide if you need to consider refinancing options.

A HELOC repayment calculator empowers you to make informed decisions about your home equity borrowing. Understanding your repayment obligations and exploring different scenarios allows you to create a solid financial plan that aligns with your goals and budget. The more you use this tool, the better equipped you’ll be to manage your HELOC effectively. Now that you know how to calculate your HELOC payments, let’s explore some strategies for effective HELOC repayment in the next section.

Maximizing Your HELOC Repayment Strategy

The Power of Extra Payments

Extra payments towards your HELOC can significantly reduce the total interest you’ll pay over time. Even small, consistent additional payments can make a big difference. For a $100,000 HELOC at 7% interest with a 20-year repayment term, adding just $100 extra per month could save you over $15,000 in interest and shorten your repayment period by nearly 4 years.

To maximize the impact of extra payments, allocate any windfalls (such as tax refunds or work bonuses) directly to your HELOC balance. This strategy is particularly effective during the draw period when you might only need to make interest payments. Reducing your principal early will decrease the base amount on which interest is calculated, potentially saving thousands over the life of your loan.

Exploring Refinancing Options

As market conditions change, refinancing your HELOC might become an attractive option. Monitor interest rate trends and your credit score. If rates drop significantly or your credit improves, you might qualify for better terms that could lower your monthly payments or reduce your overall interest costs.

One refinancing strategy to consider is converting your HELOC to a fixed-rate loan option. This can protect you from future rate increases and provide more predictable payments. Some HELOCs come with a fixed-rate loan option, allowing you to convert all or part of the balance of your line of credit into a fixed-rate loan.

Before refinancing, carefully weigh the costs against the potential savings. Closing costs for a new loan typically range from 2% to 5% of the loan amount. Use repayment calculators to compare your current loan with refinancing options to ensure the move makes financial sense for your situation.

Smart Budgeting for HELOC Success

Consistent HELOC payments are essential for maintaining your financial health and avoiding potential pitfalls. Create a dedicated budget category for your HELOC payments and treat them as a non-negotiable expense, like your mortgage or utilities.

One effective budgeting technique is the 50/30/20 rule, which splits your monthly income among three main categories: needs, wants and savings. This approach can help you prioritize your HELOC payments alongside other financial goals.

To buffer against potential rate increases, try budgeting for payments slightly higher than your current obligation. For example, if your monthly payment is $500, budget for $550. This approach not only prepares you for possible rate hikes but also accelerates your repayment if rates remain stable.

Leveraging Technology for Payment Management

Technology can help you stay on track with your HELOC repayment. Many banks offer automatic payment options for HELOCs. Setting up auto-pay can help you avoid missed payments and late fees, which can negatively impact your credit score and potentially increase your interest rate.

Use budgeting apps or spreadsheets to track your HELOC payments and monitor your progress over time. These tools can provide valuable insights into your repayment strategy and help you identify areas where you can make improvements.

Final Thoughts

A HELOC repayment calculator serves as an essential tool for homeowners who navigate home equity borrowing. This calculator provides clear insights into repayment obligations and allows users to explore various scenarios. It helps borrowers understand the impact of extra payments and prepare for potential rate changes, which improves HELOC management.

We at HELOC360 strive to provide homeowners with resources to maximize their home equity. Our comprehensive platform offers calculators and a full suite of tools to help unlock the potential of your home’s value. HELOC360 connects you with suitable lenders and assists in exploring HELOC options to turn your home equity into a powerful financial asset.

Responsible HELOC management requires regular monitoring of loan terms and staying informed about market conditions. You should adjust your strategy as needed to ensure your HELOC works for you. With proper planning and the right tools (such as a HELOC repayment calculator), you can navigate your HELOC repayment with confidence and achieve your financial goals.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.