- ***PAID ADVERTISEMENT**

- ACHIEVE LOANS – HOME EQUITY EXPERTISE

- FLEXIBLE FINANCING SOLUTIONS

- PERSONALIZED SUPPORT

- RECOMMENDED FICO SCORE: 640+

- COMPETITIVE RATES STREAMLINED APPLICATION PROCESS

HELOC closing costs can catch many homeowners off guard. While the benefits of a Home Equity Line of Credit are well-known, the associated fees often lurk in the fine print.

At HELOC360, we believe in transparency and want to help you navigate these hidden expenses. This post will shed light on the less obvious costs and provide strategies to minimize them.

- Approval in 5 minutes. Funding in as few as 5 days

- Borrow $20K-$400K

- Consolidate debt or finance home projects

- Fastest way to turn home equity into cash

- 100% online application

Common HELOC Closing Costs: What You Need to Know

When you apply for a Home Equity Line of Credit (HELOC), understanding the common closing costs is essential. These fees can significantly impact your total borrowing cost, so awareness helps you make informed decisions.

Appraisal Fees: Valuing Your Home

Lenders require an up-to-date valuation of your property to determine your borrowing limit. Appraisal fees typically range from $300 to $450, though they can go as high as $800. Some lenders use automated valuation models, which can be cheaper but may not capture recent home improvements.

Title Search and Insurance: Lender Protection

Title search and insurance fees often surprise borrowers. A title search ensures there are no liens or claims against your property. Title insurance protects the lender if title issues arise later.

Application and Origination Fees: Starting Your HELOC

Application fees cover the cost of processing your HELOC request. Origination fees compensate the lender for setting up the HELOC. Some lenders combine these into a single fee, so you should ask for a breakdown of charges.

Annual Maintenance Fees: Ongoing Expenses

Annual maintenance fees cover the cost of managing your HELOC account. While not technically a closing cost, they’re an important consideration when calculating the long-term expense of your HELOC. Some lenders may charge an annual fee up to $75, which may be waived for certain banking customers.

Credit Report Fees: Assessing Your Creditworthiness

Lenders will pull your credit report to evaluate your financial history. This fee is often passed on to you as part of the closing costs.

Borrowers who thoroughly understand these common closing costs are better equipped to negotiate with lenders and find cost-effective HELOC options. Always request a detailed list of fees and compare offers from multiple lenders. As you explore these costs, you’ll also want to be aware of some lesser-known fees that can catch you off guard if you’re not prepared.

What Are the Hidden Costs of HELOCs?

When you consider a Home Equity Line of Credit (HELOC), you must look beyond the common closing costs. Many homeowners don’t anticipate lesser-known fees that can significantly impact the overall cost of borrowing. Let’s explore these hidden expenses and how they might affect your HELOC experience.

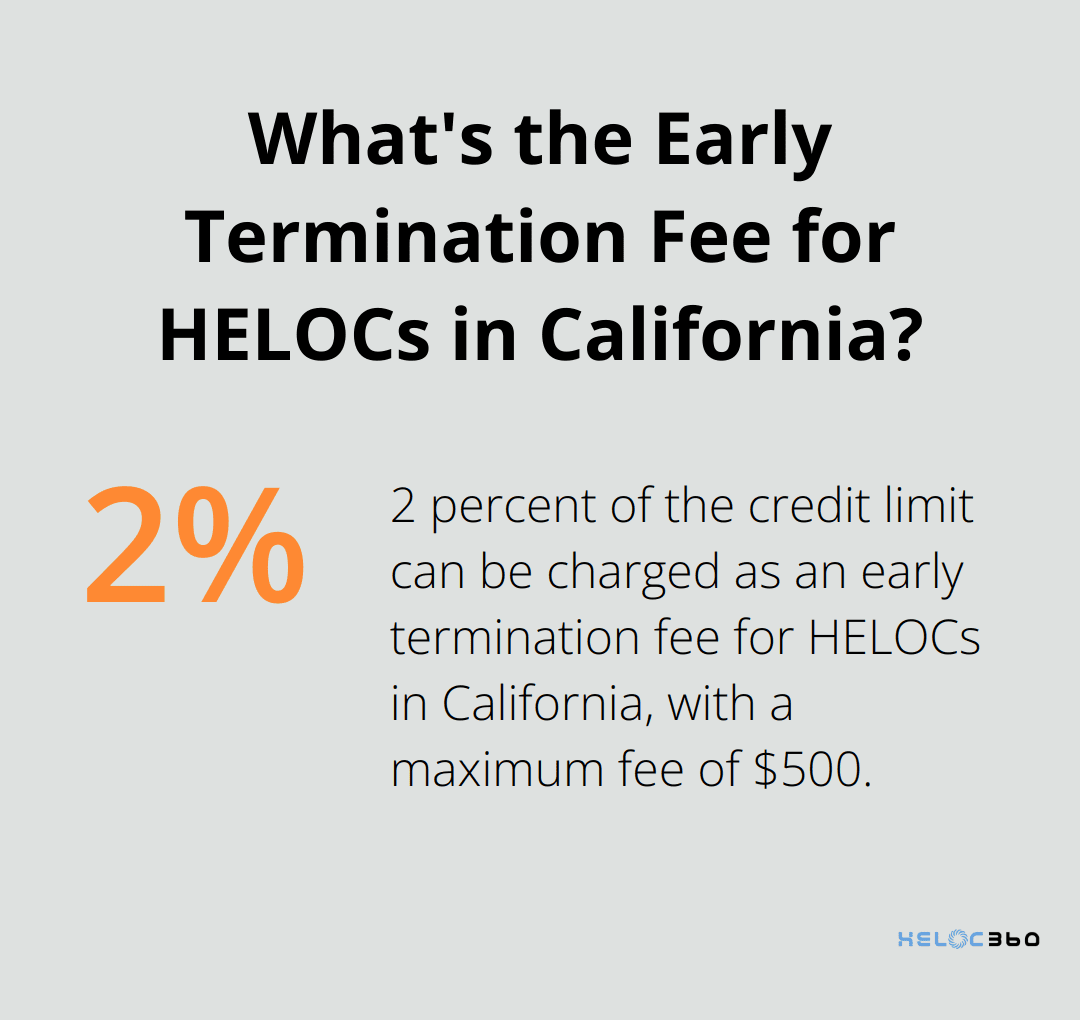

Early Termination Fees: The Price of Flexibility

HELOCs often come with a draw period of 5 to 10 years, followed by a repayment period. If you decide to close your HELOC before this period ends, you might face early termination fees. These fees can vary by state. For example, in California, the early termination fee can be 2 percent of the credit limit with a maximum fee of $500.

Inactivity Fees: Use It or Lose It

Some lenders impose inactivity fees if you don’t use your HELOC for a certain period, typically a year or more. These fees can add up over time and eat into your potential savings. To avoid these charges, you can make small, periodic draws on your HELOC or negotiate with your lender to waive this fee.

Minimum Draw Requirements: Forced Borrowing

Many HELOCs come with minimum draw requirements. These requirements can include factors such as the amount of equity you have in your home, your credit score and history, your debt-to-income (DTI) ratio, and your income history. It’s important to clarify these requirements with potential lenders and consider how they align with your financial needs.

Rate Lock Fees: Stability at a Cost

While HELOCs typically offer variable interest rates, some lenders allow you to lock in a fixed rate on a portion of your balance. However, this service often comes with a fee. These fees can add up quickly if you frequently switch between variable and fixed rates.

Understanding these hidden costs is essential for making an informed decision about a HELOC. You should always read the fine print and ask lenders detailed questions about potential fees. The lowest advertised interest rate doesn’t always translate to the most cost-effective HELOC when all fees are considered. Now that you’re aware of these hidden costs, let’s explore strategies to minimize HELOC closing costs and find the best deal for your financial situation.

How to Cut HELOC Closing Costs

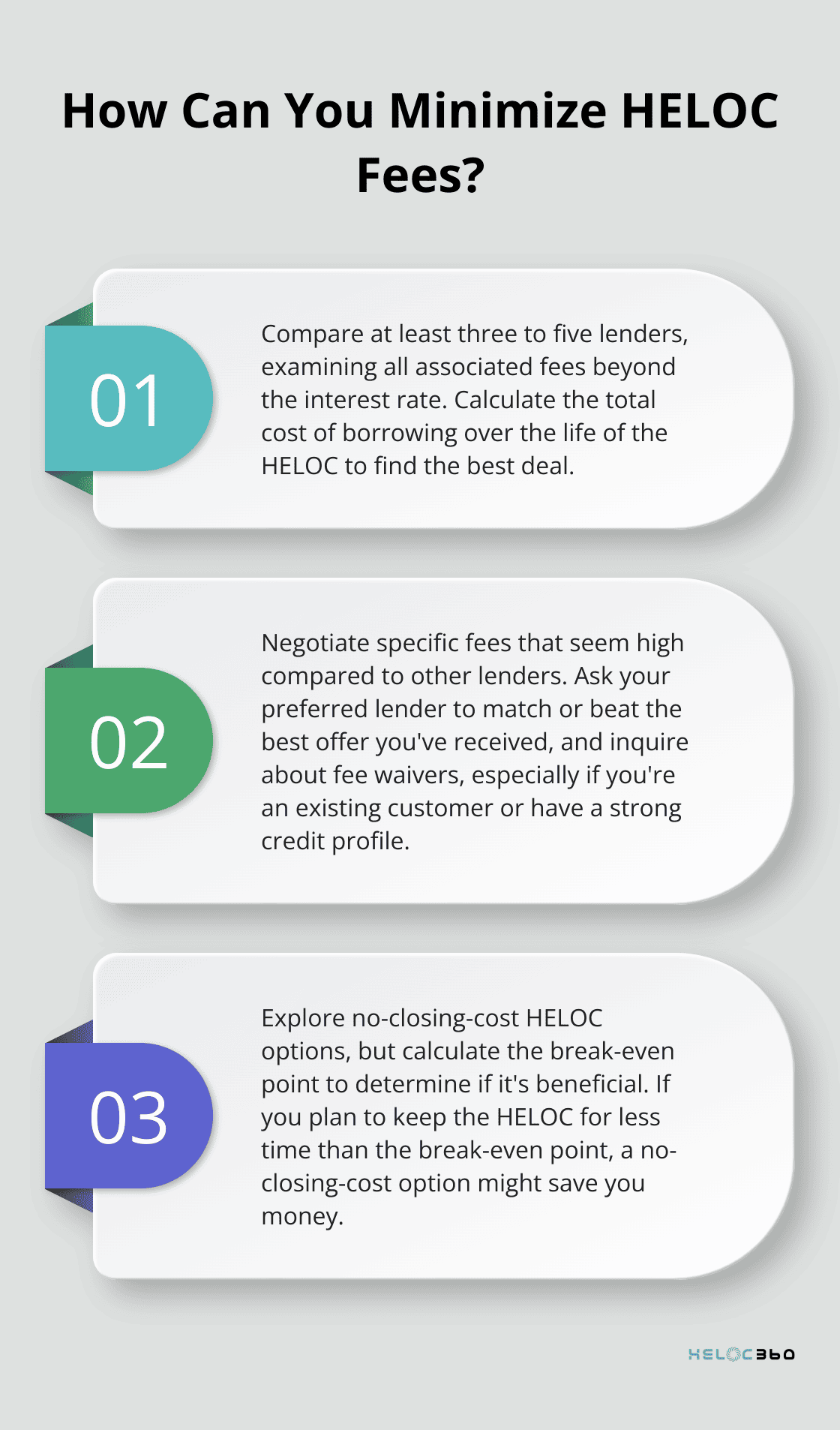

Compare Multiple Lenders

The first step to reduce HELOC closing costs is to shop around. Different lenders offer varying fee structures and interest rates. According to Freddie Mac research, the payoff for mortgage applicants who comparison shop doubled in 2022.

Research at least three to five lenders. Look beyond the interest rate and examine all associated fees. Some lenders may offer lower interest rates but compensate with higher closing costs. Others might have higher rates but lower fees. Calculate the total cost of borrowing over the life of the HELOC to find the best deal.

Master the Art of Negotiation

After you identify potential lenders, negotiate. Many borrowers don’t realize that closing costs are often negotiable. Ask your preferred lender to match or beat the best offer you’ve received from other institutions.

Focus on specific fees that seem high compared to other lenders. For example, if one lender charges a $500 application fee while others charge $250, ask them to justify the difference or lower their fee.

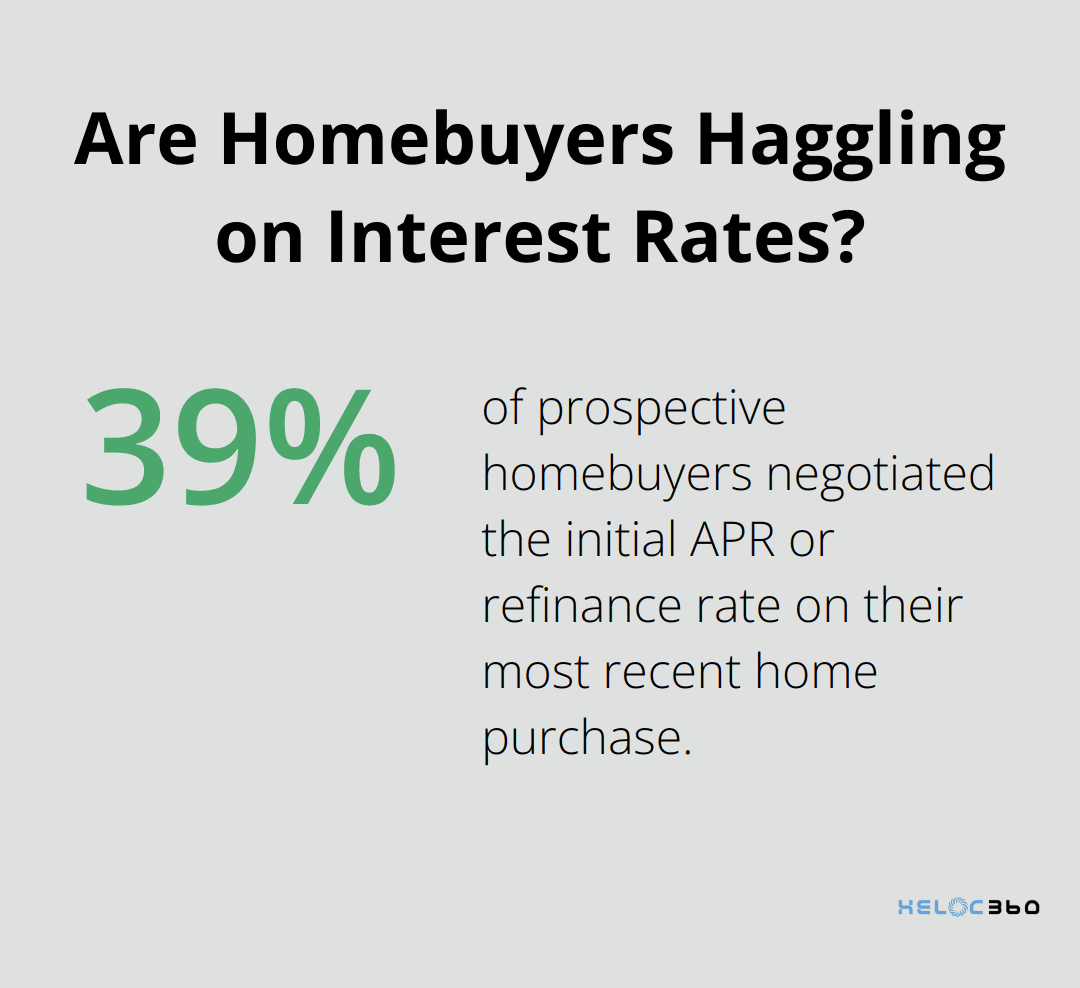

Some lenders may waive certain fees altogether, especially if you’re an existing customer or have a strong credit profile. A LendingTree survey found that just 39% of prospective homebuyers negotiated the initial APR or refinance rate on their most recent home purchase, despite the high success rate.

Explore No-Closing-Cost Options

Some lenders offer no-closing-cost HELOCs. It’s important to understand how these work. Typically, the lender rolls the closing costs into the loan amount or charges a higher interest rate to offset the waived fees.

For example, a lender might offer a HELOC with a 5% interest rate and $3,000 in closing costs, or a no-closing-cost option with a 5.5% rate. If you plan to borrow a large amount or keep the HELOC open for many years, the higher interest rate could end up costing more than paying the closing costs upfront.

Calculate the break-even point (the time it takes for the accumulated higher interest to exceed the closing costs you would have paid). If you plan to keep the HELOC for less time than the break-even point, a no-closing-cost option might save you money. Most HELOCs require closing costs, which are often a bit lower than the costs of closing a primary mortgage.

Consider Your Long-Term Financial Goals

While reducing closing costs is important, ensure you’re getting a HELOC that aligns with your financial goals and borrowing needs. Take the time to understand all aspects of the HELOC offers you’re considering, and don’t hesitate to ask questions. A thorough research and negotiation process can help you secure a HELOC that not only minimizes upfront costs but also provides long-term financial benefits.

Final Thoughts

HELOC closing costs can significantly impact the true cost of borrowing against your home equity. These expenses vary between lenders, making it essential to look beyond advertised interest rates and examine all associated fees. You can potentially save thousands of dollars over the life of your HELOC through careful comparison and negotiation with lenders.

We at HELOC360 prioritize transparency in the lending process. Our platform helps homeowners navigate the complexities of home equity borrowing, providing comprehensive information about HELOC options (including detailed breakdowns of closing costs and fees). You can compare offers from multiple lenders, ensuring you find the most cost-effective solution for your financial needs.

The key to securing a favorable HELOC lies in thorough research and careful consideration of all costs involved. HELOC360 offers tools to help you make an informed decision that aligns with your long-term financial goals. Your home’s equity is a valuable asset – use it wisely and cost-effectively.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.